Daily Global Market Summary - 6 August 2021

Most major US and European equity indices closed higher, while APAC mas mixed. US and benchmark European government bonds closed sharply lower. CDX-NA and European iTraxx were almost unchanged across IG and high yield. The US dollar closed higher, natural gas and copper were flat, and oil, gold, and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher except for Nasdaq -0.4%; Russell 2000 +0.5%, DJIA +0.4%, and S&P 500 +0.2%.

- 10yr US govt bonds closed +9bps/1.31% yield and 30yr bonds +9bps/1.95% yield, with both selling off 4bps shortly after the release of the better-than-expected US non-farm payroll report.

- CDX-NAIG closed -1bp/49bps and CDX-NAHY -2bps/286bps, which is

-1bp and -6bps week-over-week, respectively.

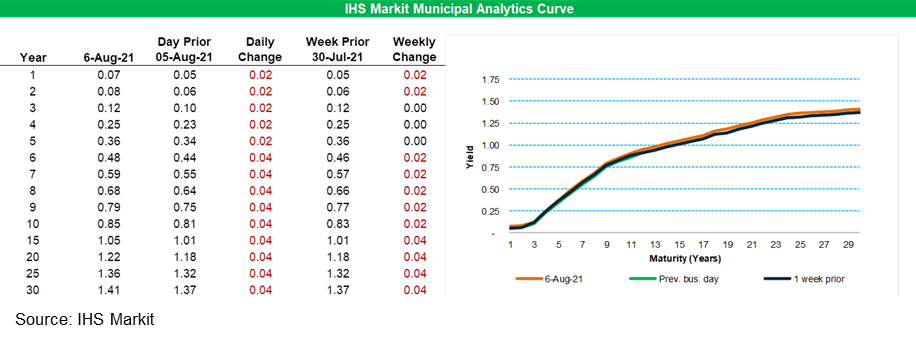

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC)

sold off 4bps for 6-year and longer paper, with that same part of

the curve 2-4bps weaker week-over-week.

- DXY US dollar index closed +0.6%/92.8.

- Gold closed -2.5%/$1,763 per troy oz, silver -3.8%/$24.33 per troy oz, and copper flat/$4.35 per pound.

- Crude oil closed -1.2%/$68.28 per barrel and natural gas closed 0%/$4.14 per mmbtu.

- US nonfarm payroll employment rose 943,000 in July following

gains over May and June that were revised higher by a cumulative

119,000. The unemployment rate declined 0.5 percentage point to

5.4%, as a sharp gain in civilian employment substantially outpaced

a moderate increase in the civilian labor force. (IHS Markit

Economists Ben

Herzon and Michael

Konidaris)

- The July employment report revealed that labor-market conditions were improving rapidly just prior to the intensification of the Delta outbreak. Whether conditions continue to improve apace will depend on how consumers, businesses, and government authorities react to the outbreak.

- Nearly two-thirds of the gain in total payrolls in July was in education services (public and private) and accommodations and food services, where payrolls expanded a combined 600,000.

- Payrolls have come a long way since spring 2020 but are still 5.7 million short of the pre-pandemic peak. Roughly one-half of this deficit is accounted for by leisure and hospitality (1.7 million short of full recovery) and education (public and private) and healthcare (1.4 million short of full recovery).

- Turning to some details in the report, the average (private) workweek was unchanged in July at 34.8 hours, remaining well above pre-pandemic norms. Still, the index of aggregate weekly hours remains below the pre-pandemic peak, even as real GDP has fully recovered. That is, the average private employee working now is working longer hours and is more productive than in February 2020.

- Average hourly earnings (AHE) rose 0.4% in July and are up 4.0% from July 2020. Over the last three months, AHE have risen at a 5.0% annual rate, up from 3.4% the three months prior. AHE in leisure and hospitality is leading the way, surging 16.6% (annual rate) over the last three months.

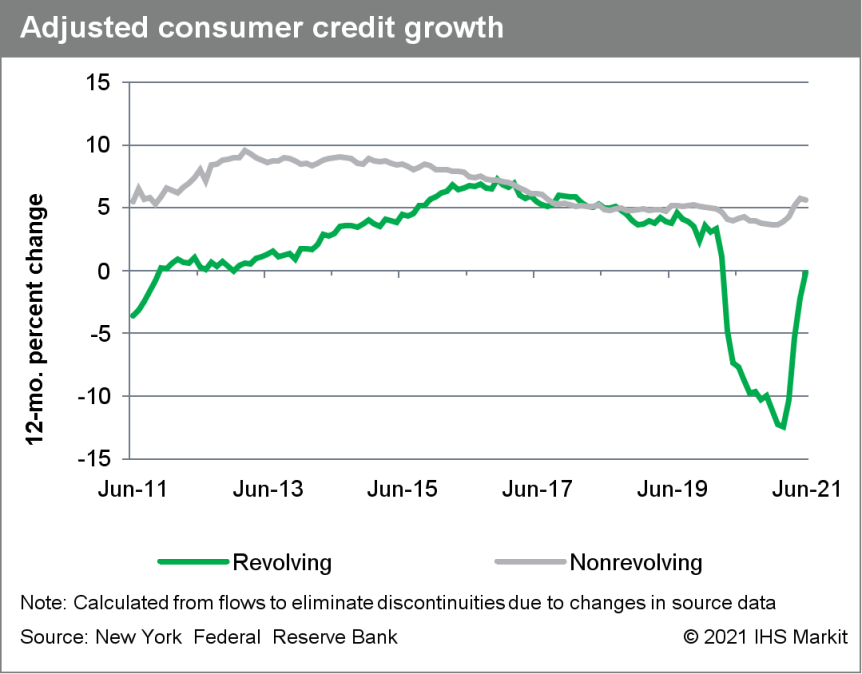

- US outstanding nonmortgage consumer credit rose $38 billion to

$4.32 trillion in June in one of the largest monthly increases on

record. (IHS Markit Economist David

Deull)

- The 12-month change in outstanding consumer credit was 4.2%, 0.4 percentage point higher than in May and approaching pre-pandemic rates of increase.

- Revolving credit rose $18 billion, an exceptionally large jump for a single month.

- Despite the increase, the level of outstanding revolving credit was 0.2% lower this June than last, as consumers largely held off on credit card usage during the pandemic.

- Nonrevolving debts, which include student and auto loans, continued to expand at a rapid clip. Nonrevolving consumer credit rose $20 billion in June and the 12-month change in nonrevolving debt was 5.5%, 0.2 percentage point beneath its May increase.

- The ratio of nonmortgage consumer credit to disposable personal income rose, as expected, increasing 0.3 percentage point to 24.1%.

- The floodgates for consumer credit card spending were opened in

June as the flow of stimulus checks was choked off while the waning

pandemic induced a fierce (albeit possibly brief) resurgence in

social activity and related expenses. July is likely to see more of

the same, although worries related to the Delta variant began to

mount.

- Ford has announced that it is offering voluntary buyouts to some of its US white-collar workforce, reports Automotive News. In a statement, the company said, "We have offered a voluntary separation program to eligible US salaried employees in select skill teams." Ford added that "this action is to further enable us to match our business priorities with the critical skills needed to turn around our automotive operations and deliver the Ford+ plan". A spokesperson also said that "staffing adjustments, including hiring and separations, are part of a multiyear process to align talent with our cycle and service plan and to turn around our automotive operations." (IHS Markit AutoIntelligence's Ian Fletcher)

- Ford and Bosch are teaming up with the US state of Michigan and real-estate developer Bedrock to launch a test site for emerging parking technology, called the Detroit smart parking lab. The lab will open in September and will allow companies to test parking-related mobility, logistics, and electric vehicle (EV) charging technologies. The car rental firm Enterprise will use the test site to examine how automated valet parking technology can apply to the quick turnaround (QTA) process, which involves rental vehicles being returned, cleaned, and refueled (including charging), before being staged for future rentals. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Autonomous truck startup TuSimple has posted its first quarterly financial results as a public company, according to a company statement. It has reported a net loss of USD116.5 million for the second quarter of 2021, compared with USD28.1 million in the same period of 2020. The expanded loss is attributable to a rise in expenses, mainly research and development (R&D) and general and administrative costs. TuSimple's revenue increased to USD1.5 million in the second quarter, up 463.5% year on year (y/y). The growth in revenue was due to increased commercial utilization of TuSimple's fleet and partner fleets. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Canada's Ivey Purchasing Managers' Index (PMI) plunged 15.5

points to 56.4 in July. The beginning shoots of a fourth wave

increase the downside risk to the forecast, but solid growth

momentum will support our forecast of a strong recovery in the

short term. (IHS Markit Economist Chul-Woo

Hong)

- Purchasing managers' spending activity continued its six-month expansion streak while the growth pace decelerated to the slowest pace since the beginning of 2021.

- Among four subindexes declining in the month, the biggest mover was the employment index, down 7.5 points to 62.1 after hitting a record-high level in the previous month. Partly reflecting the slowdown of the employment index, July's Labour Force Survey showed a relatively modest net job gain.

- The suppliers' deliveries index fell 6.8 points to 31.1, the lowest level since December 2020, showing worsening supply disruption mainly due to ongoing health restrictions, raw material shortages, and port congestion delays.

- Meanwhile, the inventories index went down 5.0 points to 60.4, with further investment in inventories. Given the ongoing severe supply disruption, purchasing managers put a big effort into mitigating the supplier delivery issue and possible further supply-chain pressure.

- The prices index moved the least, inching down 2.3 points to 77.1, which showed a continued substantial inflation pressure with strong commodity prices inflation.

- Canada's net employment gain was a bit stronger than expected

at 94,000. The unemployment rate was 7.5%, a tad higher than

projected. (IHS Markit Economist Arlene

Kish)

- Part-time positions advanced only 11,000 after June's boost. Full-time positions made a comeback with a hefty 83,000 jump.

- The labor force participation rate was unchanged at 65.2%.

- Private-sector employment was up substantially at 122,700 while public-sector jobs pulled back by 30,500.

- It looks like Canada is unavoidably in the early stages of a fourth COVID-19 wave, but there are no signals that suggest a reversal of job gains as provincial governments have not announced any significant scaling back of newly lifted pandemic restrictions. As such, employment should trend higher.

- The Central Bank of Brazil (Banco Central do Brasil: BCB) on 4

August increased the policy rate from 4.25% to 5.25% and announced

a similar move for its next meeting scheduled for 22 September. The

raise was in response to accelerating inflation that reached 8.3%

at the end of June; data for July's inflation will be available on

11 August. (IHS Markit Economist Rafael

Amiel)

- A major factor driving inflation has been the hike in electricity tariffs; Brazil is suffering from a severe drought, and hydroelectric power reservoirs are reaching very-low water levels. This has prompted authorities to increase electricity tariffs as the plants require a greater use of thermoelectric plants, making electricity more expensive. Higher global oil prices also contribute to domestic inflation.

- Another factor that is driving the overall Consumer Price Index (CPI) inflation higher is the fast increase in food prices; the drought explains, in part, this trend. Higher food prices are not an isolated event in Brazil; the United Nations' Food and Agriculture Organization (FAO) reports that global food prices jumped by 30.1% in July 2021, compared with a year earlier.

- The BCB targets inflation at 3.75 +/- 1.5 percentage points, and with inflation above target, it began to raise the policy rate in March when it was at 2.0%. This was the fourth time in as many meetings that the BCB has increased the rate, although the increases during the previous three meetings were by 75 basis points; the latest has been more aggressive with the 100-basis-point jump.

- The monetary authority assesses that the high inflation is temporary, but is too high to risk a dovish policy and intends to keep inflationary expectations well-anchored.

Europe/Middle East/Africa

- Most major European equity indices closed higher except for UK flat; Italy +1.3%, France +0.5%, Spain +0.5%, and Germany +0.1%.

- 10yr European govt bonds closed lower; UK +9bps, Germany +5bps, and Spain/Italy/France +4bps.

- iTraxx-Europe flat/46bps and iTraxx-Xover -2bps/232bps, which

is -1bp and -4bps week-over-week, respectively.

- Brent crude closed -0.8%/$70.70 per barrel.

- According to the UK Office for National Statistics (ONS), the

number of payrolled employees increased for the sixth consecutive

month, up by 197,000, or 0.7% month on month (m/m), in May to 28.5

million. Nevertheless, it remained 553,000 below the levels seen

before the COVID-19 virus pandemic. (IHS Markit Economist Raj

Badiani)

- Since February 2020, the largest falls in payrolled employment have been in the accommodation and food services sector, people aged under 25 years, and people living in London.

- The ONS reported that total UK employment (all aged 16 plus) increased by 113,000 quarter on quarter (q/q), or 0.3% q/q, to 32.5 million in the three months to April, compared with the three months to January.

- In annual terms, the number of employed people in the three months to April was 353,000, or 1.3%, lower compared with a year earlier.

- The number of unemployed people based on the Labour Force Survey (LFS) or the International Labour Organization (ILO) measure decreased by 90,000 in the three months to April, standing at 1.675 million.

- The BoE's Monetary Policy Committee (MPC) voted unanimously to

maintain the Bank Rate at 0.1% at its meeting that ended on 4

August. The MPC also voted unanimously to maintain the stock of

sterling non-financial investment-grade corporate bond purchases at

GBP20 billion (USD28 billion), financed by the issuance of central

bank reserves. (IHS Markit Economist Raj

Badiani)

- The MPC voted by a majority of 7-1 to continue with the BoE's existing program of UK government bond purchases, financed by the issuance of central bank reserves, maintaining the target for the stock of these government bond purchases at GBP875 billion to be achieved by end-2021.

- The dissenting voice was Michael Saunders, who wants to stop the current asset purchase program as soon as practical after the meeting. He argues that the existing policy stance is likely to deliver above-target inflation two and three years ahead, noting the prospect of a "larger and more persistent level of excess demand in the United Kingdom and higher than expected global cost pressures". In addition, he argues that inflation peaking at around 4% and a closed output gap could elevate medium-term inflation expectations.

- As of 4 August, the total stock of the Asset Purchase Facility (APF) was GBP845 billion. The BoE reported that GBP100 billion of the planned purchases of GBP150 billion of assets in 2021 had been completed.

- Sales of sugar sweetened beverages (SSBs) in the UK have

dropped 18% in volume terms after the UK's national Soft Drinks

Industry Levy (SDIL) was enacted in April 2018, according to new

findings published by the country's Institute of Labour Economics

(IZA). (IHS Markit Food and Agricultural Commodities' Vladimir

Pekic)

- The introduced levy was particularly steep, requiring the manufacturers of SSBs to typically pay GBP0.24 per liter of beverage, with the aim of substantially raising prices and motivating consumers to reduce their purchases of sugar-sweetened fizzy beverages.

- On the other hand, the SDIL also contains a provision that ensures that brands that reduced their sugar content below 5g/100ml would not be levied. Milk-based drinks or 100% fruit juices with no added sugar are not subject to the levy, even if they exceed the sugar content thresholds.

- The newly published empirical results suggest that the levy led to massive reductions in the calorie intake by UK consumers. Furthermore, most of these reductions were realized before the levy even went into effect.

- The study reveals that aggregate weekly consumption for the main UK soft drinks brands remained roughly stable at around 110 million liters from the pre-levy period (April 2015) till after the levy was enacted (April 2019). On the other hand, average weekly consumption in calorie terms fell by more than 5 billion calories to around 15 billion calories, in the same period.

- Seasonally and calendar-adjusted German industrial production

excluding construction declined by 1.0% month on month (m/m) in

June, following a cumulative net drop of 2.3% during January-May.

June's production level is thus 7% below its February 2020

pre-pandemic high. In addition, base effects curtailed the

year-on-year (y/y) rate from May's 19.7% to 6.7%. (IHS Markit

Economist Timo

Klein)

- Total production including construction (see table below for a breakdown of the recent history) posted an even larger decline of 1.3% m/m in June as construction fared even worse during the month (-2.6% m/m). Energy output fell 0.6% m/m, having declined by 2.9% m/m in May already.

- The split by type of good reveals large divergences. Investment goods output was once again the key depressing force, whereas intermediate goods corrected only moderately and consumer goods - greatly helped by the loosening of COVID-19-related restrictions since mid-May - posted their second sharp bounce in a row. This is also reflected in a breakdown by industrial branch, in which machinery and equipment (-6.6% m/m) stand out negatively, followed by chemicals/pharmaceuticals (-2.7%) and motor vehicles (-0.9%). This contrasts with a second consecutive strong increase for food/beverages/tobacco (6.0% m/m). In the case of motor vehicles, the ongoing shortage of computer chips has led to a downward trend since January, with car production thus now being 24% lower than in December 2020.

- Covestro reports net profit of €449 million ($530 million) for

the second quarter, beating analysts' consensus estimate of €433

million and reversing a loss of €52 million in the prior-year

period. Sales surged 83% year on year (YOY) to €3.9 billion with

core volumes rising 35%, and EBITDA soared to €817 million. (IHS

Markit Chemical Advisory)

- The resins and functional materials (RFM) business acquired from DSM earlier this year was consolidated into Covestro's results for the first time, contributing significantly to the 35% YOY volume increase, with about 10 percentage points attributable to initial consolidation of the business, it says.

- In the company's polyurethanes segment, core volumes rose 27.8% YOY with increases in all the main customer industries across all regions, it says. Sales more than doubled YOY to €1.84 billion, due mainly to higher average selling prices and total volumes sold, boosting margins and resulting in EBITDA of €452 million, reversing a loss of €24 million in the prior-year period.

- Core volumes also rose in the polycarbonates business, by 15.4%, compared with the same period last year due to growth in volumes sold to the automotive and transportation sectors in all regions. Higher total volumes and selling prices drove sales up by 56.6% YOY, to €1.01 billion from €648 million a year earlier. Substantially improved margins and growth in volumes caused EBITDA to almost triple, to €260 million.

- In Covestro's coatings, adhesives, and specialties segment, core volumes more than doubled YOY due almost entirely to the initial consolidation of the RFM business. This portfolio change, together with increased volumes and higher selling prices, resulted in sales and EBITDA more than doubling YOY to €926 million and €134 million, respectively.

- France's current-account deficit narrowed from EUR2.4 billion

(USD2.8 billion) in May to just EUR0.5 billion in June, according

to seasonally adjusted figures released by the Bank of France

(Banque de France). (IHS Markit Economist Diego

Iscaro)

- The deficit totaled EUR11.9 billion during the first half of the year, below a shortfall of EUR25.9 billion during the same period in 2020.

- The decline in the overall deficit in June resulted from a substantial widening of the surplus on the services account. The surplus rose from EUR1.9 billion to EUR3.3 billion, the highest since February 2018.

- Services were boosted by improving transport and travel balances, while receipts of other services such as professional services also increased in June.

- Exports of goods, which had risen by 0.8% month on month (m/m) in May, went up by 1.7% m/m in June. Meanwhile, merchandise imports increased by 0.7% m/m.

- Merchandise trade data released by the Customs Office, which uses a different methodology, show exports to other eurozone countries rising strongly in July, with exports to Asian countries also rebounding partially from their sharp decline in May.

- On the product side, exports of transport equipment, which had fallen by 13.9% m/m in May, rose by 7.0% m/m in June. The three-month moving average (mma) shows that exports of transport equipment in May were still 25.3% below their level during the three months to February 2020.

- Chipmaker Qualcomm Inc. has offered to purchase Swedish auto parts maker Veoneer Inc. for USD4.6 billion, reports Reuters. This is an 18.4% premium to a bid by Canada's Magna International Inc. that was accepted by Veoneer's board in July. Veoneer said that its board of directors would "evaluate the proposal from Qualcomm consistent with its legal duties and the terms of the Magna merger agreement". Veoneer, which was spun off from automotive safety equipment supplier Autoliv Inc. in 2018, is a developer of advanced driver assistance systems (ADAS). (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- Major APAC equity markets closed mixed; Australia +0.4%, Japan +0.3%, Hong Kong -0.1%, South Korea -0.2%, Mainland China -0.2%, and India -0.4%.

- According to a company filing with the Hong Kong Stock Exchange, Jiangxi Ganfeng LiEnergy Technology Co., a controlled subsidiary of Ganfeng Lithium, is planning to invest CNY3 billion (USD463 million) and CNY5.4 billion in separate battery projects. The former will be for the construction of a new-type lithium battery project with 5-GWh annual capacity in the High Tech Industrial Development Zone of Xinyu, Jiangxi. The latter will be invested to establish a new independent legal-entity project company to build a new-type lithium battery Science and Technology industrial park with annual capacity of 10 GWh and an Advanced Battery Research Institute project in Liangjiang New District, Chongqing. The Jiangxi project is expected to be completed and begin operations by October 2023, while the Chongqing project is expected to begin construction within three months from the date of signing the "Land delivery minutes". The scope of the project includes research and development (R&D), production, and sales of lithium-ion power batteries and fuel cells, as well as production and sales of supercapacitors, battery management systems, and wind and solar energy storage systems. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Plus's Level 4 autonomous heavy truck has completed a 20-mile stretch of China's Wufengshan highway in regular traffic conditions, reports Automotive News. The truck conducted lane changes and other maneuvers autonomously without a safety driver, teleoperator, or any other form of human intervention. (IHS Markit Automotive Mobility's Surabhi Rajpal)

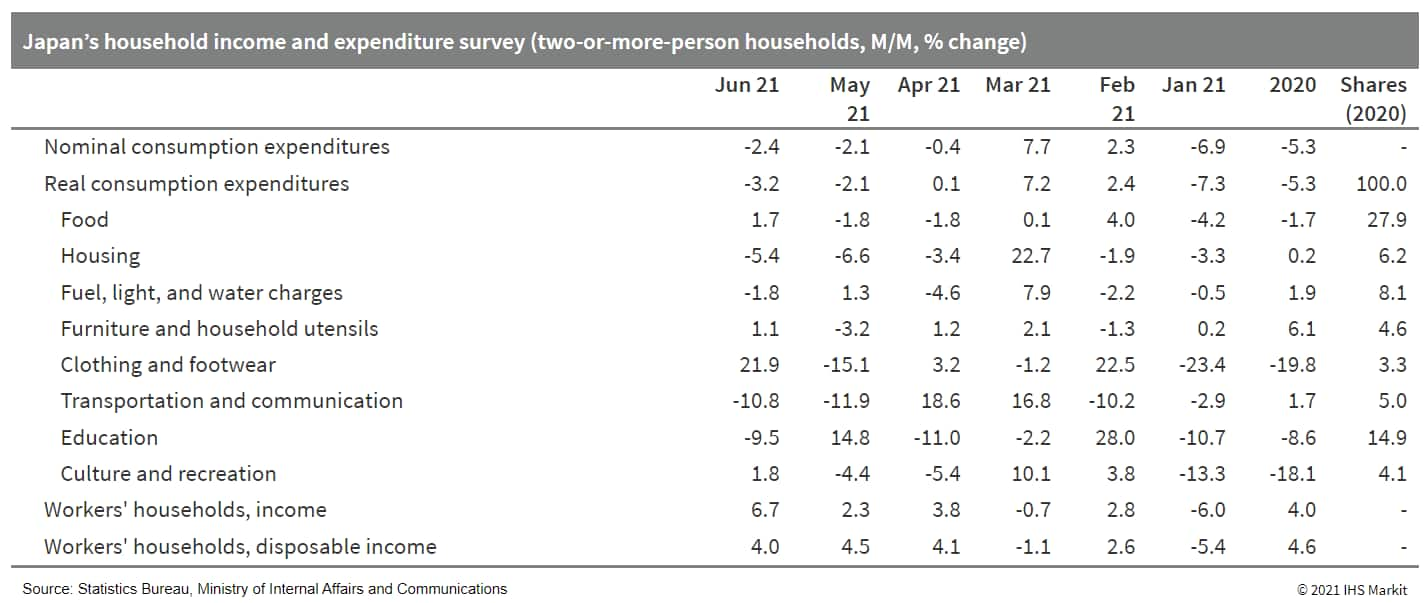

- Japan's real household expenditures fell by 3.2% month on month

(m/m) in June following a 2.1% m/m drop in May. The year-on-year

(y/y) figure also declined by 5.1% for the first drop in four

months. The major reasons behind the m/m decline were drops in

transportation and miscellaneous items, offsetting rebounds in

spending in clothing and footwear and some other items. The y/y

fall was due largely to decreases in spending for furniture,

household utensils, and autos, reflecting the dropout of the

effects of cash benefits a year ago, which led to a decline in

monthly real household income for workers' households of 11.5% y/y.

(IHS Markit Economist Harumi

Taguchi)

- Nominal monthly average cash earnings fell by 0.1% y/y in June. The first drop in five months reflected a 2.3% y/y decline in special earnings (mainly seasonal bonuses), offsetting increases in scheduled cash earnings as well as non-scheduled cash earnings in line with a rise in hours worked from a year earlier.

- Sluggish special earnings were due largely to declines in

life-related services, eating and drinking services, transportation

and postal services, and construction because of poor corporate

performance under persistent COVID-19 containment measures.

- The South Korean government has revealed a draft plan, including three road maps, to reach its target of achieving carbon neutrality by 2050, reports Dong A-ILBO. A final decision on the plan will be made later this year after receiving feedback from the industry, labor groups, civil society, and local governments. The Presidential Committee on 2050 Carbon Neutrality has unveiled several options, from the complete elimination of coal and gas from the energy mix, to reliance on thermal fuels. The plan seeks to boost production of electric and hydrogen vehicles, which accounted for a share of only 3.4% of the total number of vehicles in the country in 2020, to 97% by 2050. (IHS Markit AutoIntelligence's Isha Sharma)

- Supported by low numbers of COVID-19 infections in the first

two months of the quarter and base effects from a year earlier,

Indonesia's economy expanded at the fastest pace in 16 years during

the second quarter, rising by 7.07% year on year (y/y). Initial

data for July point to early negative effects of escalated COVID-19

containment measures on economic activity. (IHS Markit Economist Bree

Neff)

- Private consumption was stronger than expected, with the strongest recoveries being in transport and communication (up 10.6% y/y) and at restaurants and hotels (up 16.8% y/y), as consumers felt like they could get out a bit more as COVID-19 infections waned (averaging about 5,000 new cases per day between 1 April and 31 May, versus just shy of 40,000 cases in July). Spending picked up for other consumption categories as well, but not nearly as sharply, and in real, level terms private consumption spending was up just 0.1% from the second-quarter 2019 result, indicating the long path to recovery for households.

- To support the recovery in domestic demand, import growth surged in real terms, led by a 15.6% y/y surge in non-oil and gas goods imports. Based on nominal, monthly trade data, import growth was broad-based across the capital, consumer, and intermediate goods categories, although intermediate goods growth was the strongest and likely supported the manufacturing sector's 6.6% y/y expansion.

- Export performance was also stronger than expected, with oil and gas exports up 31.9% y/y in real terms and exports of non-oil and gas goods up 24.5% y/y in real terms, both supported by strong sustained external demand for a wide range of commodities (and the resulting high prices). Additionally, there has been limited disruption to export production for those commodities exported from provinces outside of Java even during June. Mining-sector output during the quarter was up 13.3% y/y for coal products and 18.1% y/y for iron ore products, offset by a continued contraction for oil and gas product output.

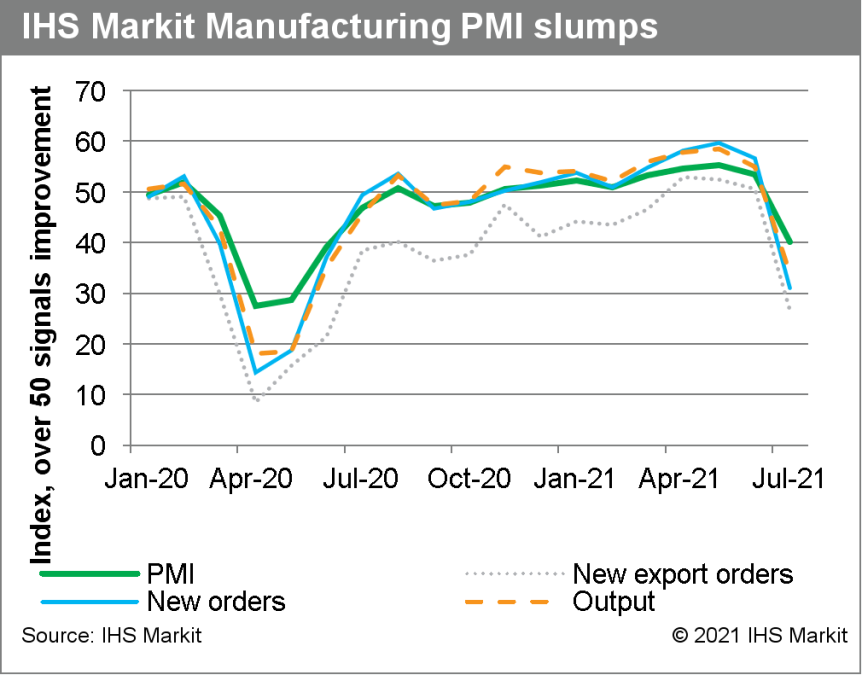

- The introduction of stricter COVID-19 containment measures,

particularly for Java and Bali, in July prompted the IHS Markit

Manufacturing Purchasing Managers' Index (PMI) for July to sink

into contractionary territory for the first time in nine months.

After several strong months of new orders and output (supporting

the manufacturing sector's expansion in the second quarter), both

indicators sank to their lowest levels since May 2020.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.