Daily Global Market Summary - 6 January 2022

Most major US, European, and APAC equity indices closed lower. US government bonds closed mixed with the curve flatter on the day and benchmark European bonds closed sharply lower. European iTraxx closed wider across IG and high yield, while CDX-NA was almost flat on the day. The US dollar and oil closed higher, while natural gas, gold, silver, and copper were lower on the day. All eyes will be on tomorrow's 8:30am ET US non-farm payroll report to determine if the arrival of the omicron variant had a material impact on December's employment numbers.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except Russell 2000 +0.6%; S&P 500 -0.1%, Nasdaq -0.1%, and DJIA -0.5%.

- 10yr US govt bonds closed +2bps/1.73% yield and 30yr bonds -1bp/2.09% yield.

- CDX-NAIG closed flat/52bps and CDX-NAHY flat/304bps.

- DXY US dollar index closed +0.2%/96.32.

- Gold closed -2.0%/$1,789 per troy oz, silver -4.2%/$22.19 per troy oz, and copper -1.3%/$4.36 per pound.

- Crude oil closed +2.1%/$79.46 per barrel and natural gas closed -1.1%/$3.67 per mmbtu.

- US manufacturers' orders rose 1.6% in November, while shipments

rose 0.7% and inventories rose 0.7%. The increase in orders in

November outpaced the consensus expectation. (IHS Markit Economists

Ben

Herzon and Lawrence Nelson)

- Orders and shipments of core capital goods (nondefense capital goods excluding aircraft) were little revised through November.

- Recent trends in core orders and shipments, including a long-running excess of orders over shipments, have led to rapid gains in unfilled orders for core capital goods. This will provide a boost to equipment spending and exports for some time, even if orders for core capital goods turn lower (as IHS Markit analysts assume).

- Supply constraints continue to restrain real expansion in manufacturing, even as demand remains elevated. The result has been surging prices.

- Over the 12 months ending in November, the producer price index (PPI) for the net output of the manufacturing sector rose 16.6%, outpacing increases in nominal orders (15.5%) and shipments (13.0%) over this period.

- Real orders and shipments are below levels from late 2020.

- Supply constraints, broadly, are expected to continue well into this year.

- Indeed, the current wave of new COVID-19 infections will only exacerbate global supply issues and will delay the return of spending patterns toward pre-COVID-19 norms: i.e., less spending on goods and more spending on services.

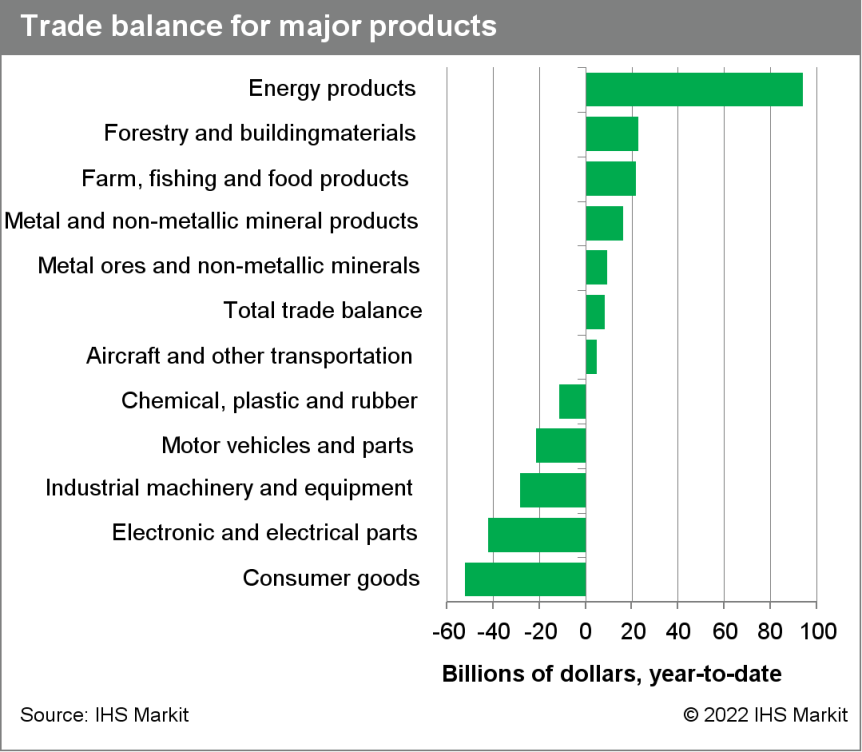

- November's US trade report indicates imports are flooding in

from everywhere. This report fleshes out last week's advance

international trade in goods report and adds details on trade in

services. The advance report showed the goods deficit, as measured

by the Census Bureau, widening by $14.6 billion to $97.8 billion.

This report shows (1) a $14.9-billion deficit expansion to $98.0

billion and (2) the services surplus jumping by $2.1 billion with

travel exports (tourists visiting the US) accounting for the

unexpectedly large increase. (IHS Markit Economist Patrick

Newport)

- The advance trade report raised several questions about November's import surge in goods: How much of the nearly 5% nominal increase was real and how much price changes? What was the petroleum/nonpetroleum breakdown? What is behind the blistering pace in consumer goods imports? What parts of the world are imports coming from? This report has answers.

- Real goods imports increased 4.0% in November; nominal imports grew 4.6%. Nonpetroleum imports climbed 4.2%; petroleum imports grew 1.6%.

- Real consumer goods imports have increased 10% since July. Contributing most to the flood are (1) apparel, textiles, nonwool or cotton, (2) pharmaceutical preparations, and (3) cell phones and other household goods not classified elsewhere.

- Container ships lined up outside the Los Angeles and Long Beach ports have come to symbolize the bottlenecks crippling supply chains. But imports are flooding in from all over the world. Year to date, goods imports were up 19% from both the European Union and Mexico, 32% from Canada, 17% from Pacific rim markets (16% from mainland China), 34% from South and Central America, 60% from Africa, and 22% in total.

- US seasonally adjusted initial claims for unemployment

insurance rose by 7,000 to 207,000 in the week ended 1 January. The

current level of claims is below the 2019 average (218,000) as

employers are trying to retain existing employees amid tight labor

markets; indeed, the layoffs and discharges rate is at a record

low. The not seasonally adjusted (NSA) tally of claims—at

315,469—is below the level of claims in the comparable week in

2019, when there were 335,294 claims. (IHS Markit Economist Akshat

Goel)

- Seasonally adjusted continuing claims (in regular state programs) rose by 36,000 to 1,754,000 in the week ended 25 December. The insured unemployment rate was unchanged at 1.3%.

- Ongoing claims for Pandemic Emergency Unemployment Compensation (PEUC) and Pandemic Unemployment Assistance (PUA) will no longer be published with this news release. There was a total of 255,142 claims under Pandemic Emergency Unemployment Compensation (PEUC) and Pandemic Unemployment Assistance (PUA) in the week ended 11 December—the last week data are available for. According to the Department of Labor, any ongoing claims under these programs represent claims for weeks of unemployment prior to the two programs' expiration on 6 September 2021.

- In the week ended 18 December, the unadjusted total of continuing claims for benefits in all programs fell by 199,869 to 1,722,352.

- US employers announced 19,052 planned layoffs in December,

according to Challenger, Gray & Christmas—up 28.1% from the

lowest monthly reading on record in November. The total for

December is down 75% from the December 2020 reading. (IHS Markit

Economist Juan

Turcios)

- Last year, employers announced plans to cut 321,970 jobs. This was the lowest annual total on record and 86% lower than the 2,222,249 job cuts announced over 2020 (Challenger began tracking job-cut announcements in January 1993).

- With job-cut announcements hovering near historic lows, job openings near all-time highs, and the quits rate at a record high, the labor market appears to be tight and tilted in the favor of workers.

- According to Andrew Challenger, senior VP of Challenger, Gray & Christmas, "Quits hit a new record in November with 4.5 million. Workers are leaving jobs in droves, particularly in-person jobs in Entertainment/Leisure, Health Care, and Transportation, according to the Department of Labor. This trend is likely to continue as we contend with the largest surge in COVID cases we've yet seen, spurred by Omicron."

- Last year, employers cited COVID-19 as a reason for 8,904 planned job cuts, with none citing COVID-19 as a reason in December. Since August, COVID-19 has been cited only a total of 954 times as a reason for planned job cuts despite the increase in cases that occurred first because of the Delta variant and the current wave of new infections brought on by the Omicron variant. Employers cited other reasons, including closing (69,648), restructuring (58,712), market conditions (54,160), and demand downturn (48,619) more frequently than COVID-19 as causes of job-cut announcements in 2021.

- In 2020, COVID-19 was the leading reason for announced job cuts, accounting for 1,109,656 announced job cuts. COVID-19 was the ninth-leading reason for job-cut announcements last year. Interestingly, vaccine refusal was the tenth-leading reason cited for job-cut announcements at a total of 7,634.

- Aerospace/defense announced 34,627 job cuts last year, the highest number of any industry. Rounding out the five sectors that reported the most job cuts last year are healthcare/products (31,997), services (28,650), telecommunications (25,543), and energy (21,537).

- In her January 5 State of the State address, New York Gov.

Kathy Hochul announced a $500 million investment in offshore wind

energy that she said will create thousands of good-paying green

jobs. "As we build out our wind-energy capacity, and continue our

transition to clean energy, our reliance on fossil fuels must be

phased out," said the governor in her prepared speech. "In

September, I announced two clean energy mega-projects to put us on

a path to achieve the ambitious goal of cutting 80% of New York

City's power plant emissions by 2030. New construction in the State

will be zero-emission by 2027, and we will build climate-friendly,

electric homes and promote electric cars, trucks, and buses." As

for the offshore wind initiative, the governor said: "With this

investment, New York will lead the nation on offshore wind

production, creating green jobs for New Yorkers, and powering our

clean energy future. I am proud to make New York a leader in

offshore wind and renewable energy. We must harness the potential

of offshore wind to fuel our economy forward and meet our ambitious

climate goals." Hochul's offshore wind plan will build on more than

6,800 direct high-paying jobs, a combined economic impact of $12.1

billion statewide, and more than 4.3 GW of energy, representing

half of New York's 2035 goal. The plan includes (IHS Markit

PointLogic's Barry Cassell):

- Invest $500 Million in Offshore Wind Infrastructure - New York will invest up to $500 million in the ports, manufacturing, and supply chain infrastructure needed to advance its offshore wind industry, leveraging private capital to deliver more than $2 billion in economic activity.

- Procure Enough New Offshore Wind Energy to Power at Least 1.5 Million Homes and Create At Least 2,000 New Jobs - The New York State Energy Research and Development Authority (NYSERDA) will launch its next offshore wind procurement in 2022, which is expected to result in at least 2 GW of new projects. NYSERDA will couple this procurement with the $500 million offshore wind infrastructure investment to obtain maximum leverage for New York.

- Initiate Planning for a Future Offshore Wind Transmission Network to Power 4 Million New York City Homes - To realize an offshore wind grid able to deliver at least 6 GW of offshore wind energy directly into New York City while minimizing onshore and ocean floor impacts, state agencies will conduct a New York State Cable Corridor Study to identify strategic offshore wind cable corridors and access key points of interconnection to the grid.

- Launch the Offshore Wind Master Plan 2.0 Deep Water - Building on New York's Offshore Wind Master Plan, NYSERDA will initiate a new Master Plan 2.0: Deep Water to unlock the next frontier of offshore wind development.

- Alongside these new actions, construction on the state's first offshore wind project, the South Fork Wind Farm, will begin in early 2022.

- Volvo Cars has announced that it plans to debut its unsupervised autonomous driving feature, now called Ride Pilot, on its next-generation electric vehicle (EV) in California, United States, pending necessary approvals. Volvo Cars is to deploy the system as an add-on subscription feature for its new electric sport utility vehicle (SUV), the name of which is to be announced later this year, once it has been approved for use on highways, according to the company statement. The software is being developed by Zenseact and Volvo, as well as by developers from Luminar. Mats Moberg, head of research and development at Volvo Cars, said, "We are proud to announce the planned US launch of our first truly unsupervised autonomous driving [AD] feature, as we look to set a new industry standard for autonomy without compromising safety. Having Zenseact's brand new AD software and Luminar's LiDAR standard in our new fully electric SUV is a game-changer for Volvo Cars, as well as for automotive safety and autonomous driving." Volvo is testing the system in Sweden and collecting data across Europe and the US. Testing of the system is set to begin in California in the middle of this year. After rolling out the system in California first, Volvo plans to introduce the system in other global markets. The EV is to be equipped with Luminar's LiDAR sensor as well as five radars, eight cameras, and 16 ultrasonic sensors as standard. (IHS Markit AutoIntelligence's Stephanie Brinley)

- At the CES 2022 show in Las Vegas (US), Peterbilt will showcase its first Model 579 equipped with Level 4 autonomous system Aurora Driver. According to a company statement, Aurora has added the new Model 579 to its heavy-duty test fleet, which is hauling freight for customers. Sterling Anderson, chief product officer and co-founder of Aurora, said, "Our partnership with PACCAR to co-develop self-driving Class 8 trucks builds on a deep technical foundation and years of collective expertise. The team is making progress as we prepare to launch Peterbilt's first autonomous trucks at scale. Together, we're building a product and business that will make our roads safer and our supply chains more efficient, and we're excited to share a glimpse into that future at CES." Aurora, which recently confirmed that it was going public through a merger with special-purpose acquisition company (SPAC) Reinvent, has developed an autonomous system called "Aurora Driver". Working with partners PACCAR and Volvo Group, it aims to launch its autonomous system in commercial service in heavy-duty trucks in late 2023 with robotaxis to follow a year later. In collaboration with PACCAR, it plans to launch a commercial pilot of autonomous trucks hauling goods for package delivery firm FedEx. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Towards the end of the month, Canada's British Columbia

experienced devastating floods, causing the Port of Vancouver to

suspend operations. Despite this, trade flows continued to advance

from strong performance in October. Supporting both sides of the

trade ledger was the rise in pharmaceutical and medicinal products

trade. The sharp uptick in vaccine imports is attributed to the

approval of vaccines for youths. Additionally, some vaccine

products were imported for labelling and packaging before being

exported within the same month. As a result, the broader consumer

goods category contributed over a percentage point to both monthly

export and import growth. (IHS Markit Economist Evan Andrade)

- Canada's nominal merchandise trade surplus widened for a fourth consecutive month to $3.1 billion. This was the widest surplus since September 2008.

- Exports increased 3.8% month on month (m/m) to $58.6 billion while imports rose 2.4% m/m to $55.4 billion.

- In volume terms, exports jumped to 2.8% m/m and imports edged up 0.7% m/m.

- Fourth-quarter export performance has been strong so far, but

the emergence of the Omicron variant is likely going to create some

turbulence in the coming months.

Europe/Middle East/Africa

- Most major European equity markets closed lower except for Spain flat; UK -0.9%, Germany -1.4%, France -1.7%, and Italy -1.8%.

- 10yr European govt bonds closed sharply lower; Germany/France +2bps, Italy +3bps, Spain +4bps, and UK +7bps.

- iTraxx-Europe closed +2bps/50bps and iTraxx-Xover +7bps/250bps.

- Brent crude closed +1.5%/$81.99 per barrel.

- Worley has been contracted by Drax Group to provide the FEED for the first two carbon capture units to be deployed at Drax's power station in North Yorkshire, United Kingdom. This was announced on 15 December 2021. This contract follows on from the pre-FEED phase of the project which was completed by Worley. The two units will utilize Drax's Bioenergy with Carbon Capture and Storage (BECCS) technology and are expected to capture approximately 8 million metric tons of carbon dioxide a year. (IHS Markit Upstream Costs and Technology's Jie Sheng Aw)

- The year-on-year (y/y) rate of increase in the eurozone

producer price index (PPI) rose by almost two percentage points in

November 2021 to 23.7%, a new record high and above the market

consensus expectation (of 22.9%, according to Reuters' survey).

(IHS Markit Economist Ken

Wattret)

- Having risen for 12 months straight, the PPI inflation rate is now 14 percentage points above its prior peak, set back in 2008.

- Soaring energy prices were again key to November's elevated PPI inflation rate. On a y/y basis, the energy sub-index rose by 66%, triple the previous record high, again set in 2008.

- In month-on-month (m/m) terms, the energy index rose by 3.5%, following an unprecedented 18.6% increase in October. Soaring gas prices in Europe have been driving the recent surge, with a further increase likely to have occurred in December.

- The eurozone PPI inflation rate excluding energy also rose to a new record high in November, of 9.8%, up by 0.8 percentage point from October. The prior historical peak, set in 2011, was 4.2%.

- Ireland has brought in a minimum price for alcoholic drinks of

10 cents per gram of alcohol in a bid to curb alcohol consumption,

especially binge drinking, as well as delay the moment young people

start drinking. (IHS Markit Food and Agricultural Policy's Sara

Lewis)

- The new minimum unit pricing (MUP) law that took effect on 4 January will mainly affect sales in off-licenses, shops and supermarkets, particularly hard discounters, such as Aldi, rather than pubs or restaurants.

- The law brings a hefty price hike for some products, for example retailers now have to charge €7.40 for the cheapest 750 milliliter (ml) bottle of wine (12.5% alcohol) which previously could be found for under €5. The same size bottle of 14% wine cannot be sold for less than €8.28.

- Retailers have to ask at least €20.71 for a bottle of 37.5% sprits and €23.75 for 43% spirits. A 500ml can of beer now retails for a minimum €1.70.

- One of the biggest price rises will apply to slabs containing 24 cans of beer or cider, which will more than double in price, from under €20 to around €40.

- "In Aldi, the cheap larger, Galahad, was sold as low as 75 cents a can but must now cost €1.57. An 11% alcohol bottle of wine will need to cost at least €6.50 while a stronger 13.5% wine will cost €7.89 minimum," newspaper The Irish Examiner reported.

- Iveco Group has announced that it has signed a new credit facility following its demerger from CNH Industrial. In a statement, the company said that it had signed a EUR1.9-billion (USD2.1-billion) syndicated facility with Banco Bilbao Vizcaya Argentaria, Barclays, BNP Paribas, BofA Securities, Citi, Deutsche Bank, Intesa Sanpaolo, Mediobanca Banca di Credito Finanziario, Mizuho Bank, Santander CIB, Société Générale, and Unicredit as bookrunners and mandated lead arrangers. The company added that the facility includes a EUR1.4-billion committed revolving credit facility with a five-year tenor, with two extension options of one year each. There is also a EUR500-million committed term facility with a 12-month tenor, extendable by the company for an additional 12 months. The announcement comes during the same week that Iveco Group has become an independent listed entity on the Milan stock exchange after the completion of its spin-off on 1 January. This is part of a long-running plan to demerge the 'On-Highway' operations of CNH Industrial, a move that was finally approved by shareholders and directors in late December 2021. (IHS Markit AutoIntelligence's Ian Fletcher)

- Denmark aims to reach fully fossil-fuel-free domestic aviation

by 2030 while making sure that consumers have a domestic "green"

aviation option by 2025. Danish Prime Minister Mette Frederiksen

made the government's pledge in her annual speech on New Year's

Day. The Nordic state aims to get on track to reach economy-wide

net-zero emissions by 2050. Denmark's government in 2019 agreed to

increase the pace of decarbonization, vowing to slash its 1990

emissions not by 40% but by 70% by 2030. (IHS Markit Net-Zero

Business Daily's Cristina Brooks)

- But greener flight requires developing aviation technologies, as currently planes are only allowed to operate on a 50% sustainable aviation fuel (SAF) and fossil fuel blend, according to BP.

- The prime minister noted that Denmark's private sector and universities, like Aalborg University, are working to develop greener technologies and fuels for planes.

- The first SAF made from biogas, CO2, and hydrogen can be produced in Denmark and the Nordic countries by 2025, according to a 2019 University of Southern Denmark study.

- Denmark's public grant agency is funding the Energy Cluster Denmark consortium to commercialize SAF made from biomass.

- Last May Denmark notched an SAF "first" through Shell joint venture DCC & Shell Aviation.

- The SAF was made from "sustainably sourced, renewable waste" to allow airline Alsie Express to fly between the Danish cities of Sønderborg and Copenhagen. It was supplied as part of 2020 SAF supply agreement between Shell and Finnish refiner Neste.

- For now, however, the prevailing practice to decarbonize aviation in Denmark is to use offsets, Shell said.

- Hala, a joint venture between Dubai's Roads and Transport Authority (RTA) and Careem, has partnered with Binary, an out-of-home (OOH) media technology company, to equip a group of taxis with an onboard entertainment system (OES), reports Zawya. The OES will provide informational and entertainment content (including geo-targeted video advertisements and special offers) to users. Ahmed Bahrozyan, CEO of the Public Transport Agency at the RTA, said, "We aim to focus our strategic partnership and collaboration with Hala on providing an engaging experience to all our customers through innovative technologies and connected services and by delivering a uniquely entertaining taxi-ride experience. The new initiative, in prospect, is configured to take taxi users on an integrated journey around our modern city and to explore the narrative of its enriched culture." Currently, only 250 vehicles in the RTA's fleet come with the interactive, 10-inch-display tablets. In future, the RTA's entire fleet is expected to feature the Binary OES. The RTA has endorsed a long-term plan for public transport in Dubai to have zero emissions by 2050. In April 2021, the RTA also partnered with the World Economic Forum (WEF) to promote autonomous vehicle (AV) technology. (IHS Markit AutoIntelligence's Tarun Thakur)

Asia-Pacific

- Most major APAC equity indices closed lower except for Hong Kong +0.7%; Mainland China -0.3%, India -1.0%, South Korea -1.1%, Australia -2.7%, and Japan -2.9%.

- The Chinese city of Guangzhou has opened its first Level 4 autonomous bus line for operations, reports Pandaily. The bus line, which officially commenced operations on 1 January, is 'Nansha 23' with a total route length of 8.5 kilometers. The bus is deployed with two 64-line LiDARs, 12 high-definition cameras, USB ports, and slow brake buttons, as well as professional-level safety personnel to enhance safety. Passengers can use the slow brake button to gently stop the vehicle in an emergency. They can also use the smart bus voice robot control system, 'Xiaoyu', to control the lights and air conditioning. Passengers aged 18 years old and above can make reservations to hail a free ride on the automated bus. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- BYD's vehicle production in Xi'an had returned to near-normal levels by 3 January, reports Jiemian, citing a BYD spokesperson. BYD's operations in Xi'an were affected by the recent outbreak of the COVID-19 virus, but the automaker has not provided details of the volume losses caused by its production suspension. The automaker's two plants in Xi'an mainly produce the Qin Plus, Qin Pro, and Song Pro. The city has been placed under lockdown since 23 December 2021 by the local authorities after the number of home-grown COVID-19 cases began to surge in mid-December. According to the latest data, the cumulative number of COVID-19 cases totaled 1,812 in Xi'an as of 6 January, with most of these cases confirmed in the past two weeks. (IHS Markit AutoIntelligence's Abby Chun Tu)

- China saw another pilot carbon sequestration project

commissioned recently, but experts suggest a regulatory framework

and more financial incentives are required for large-scale

development. In a statement, state-owned energy major Sinopec said

it put a carbon capture, utilization, and storage (CCUS) facility

with an annual capacity of 200,000 metric tons (mt) into operation

in Jiangsu province 27 December. (IHS Markit Net-Zero Business

Daily's Max Lin)

- The project will capture CO2 from the tail gas of a coal-to-hydrogen plant at Sinopec's Nanjing petrochemical complex for use in enhanced oil recovery at the Huadong and Jiangsu fields.

- "This marks the completion of our first demonstration project in the Yangtze River Delta region," Sinopec said.

- China, the world's largest GHG emitter, says CCUS will play an important role in its long-term decarbonization pathway in several policy documents.

- IHS Markit estimated that 23 projects with a total carbon capture capacity of 4 million mt/year were operational in China as of September. However, 15 of them were small pilot projects with a capacity of less than 400,000 mt/year each.

- Paola Perez Pena, a clean energy technology principal research analyst at IHS Markit, said China currently remains focused on research and development (R&D) for carbon sequestration projects rather than commercialization.

- "Mainland China has [become] the region with the most operational CCUS pilots globally, however supporting policies for commercial CCUS are still needed to incentivize large-scale projects," Perez Pena told Net-Zero Business Daily.

- "China is not prioritizing [the technology] as a solution on emissions abatement, but rather as an economical option that can increase oil production with side benefits like CO2 emissions reduction," she added.

- China's smaller purified terephthalic acid (PTA) plants will

face tough times ahead as they are outmuscled by larger, new PTA

units, said a source from a downstream polyethylene terephthalate

(PET) plant today. Relatively smaller PTA units will only be able

to consider running opportunistically, when production margins

widen significantly, according to the PET source. (IHS Markit

Chemical Market Advisory Service's Chuan Ong)

- The PET source believes that these uncompetitive plants may have the option of integrating their production -- streamlined producers with inefficient units can still compete by adding value along the entire production chain.

- Some of these plants have shut for extended maintenance but never restarted. Others were taken off-stream indefinitely, said one market analyst.

- "These include Ningbo Union King Polyester Materials (Ningbo Liwan), Urumqi Petrochemical, Hanbang Petrochemical, Shishi Jialong Petrochemical, Sinopec Tianjin, Sinopec Yangzi Petrochemical, as well as Chongqing Pengwei Petrochemical," said the analyst.

- Major producer Zhejiang Yisheng Petrochemical shut two 650,000 mt/yr PTA lines in Ningbo, OPIS reported in 2021. Yisheng blamed poor margins behind its decision, seeing no future upside.

- Dongfeng Honda, the joint venture (JV) between Dongfeng Motor Group and Honda, said it will build a new plant in China for new energy vehicle (NEV) production. The new plant, located in Wuhan, will have capacity for 120,000 units per annum (upa) when it is completed in 2024. The new plant in Wuhan will lay the foundation for Honda to accelerate its transition to electrification. Hybrid models have already accounted for 15% of Honda's Chinese sales in 2021. According to a company statement, a total of 233,801 Honda-branded hybrid vehicles were sold in the market last year, up 16% year on year (y/y). Both of Honda's JV, Dongfeng Honda and GAC Honda, see opportunities to hit new sales records in 2022 as Honda's hybrid product lines and all-new launches like the Integra and Breeze gain traction in China. In the NEV market, Honda has planned a series of electric vehicles (EVs) for China under its commitment to have a fully electrified product portfolio in China by 2030. By the end of 2025, the automaker will introduce 10 new Honda-branded EVs in China under its e:N series. (IHS Markit AutoIntelligence's Abby Chun Tu)

- BW Ideol has signed an agreement with Japan's largest utility company JERA, and France's state-owned investment company ADEME Investissement. Under the agreement, an investment company will be created for the purpose of financing the co-development of floating offshore wind projects over the next five years using BW Ideol's patented floating wind concept. BW Ideol will own 51% of the new entity, JERA and ADEME each holding 24.5%, (IHS Markit Upstream Costs and Technology's Melvin Leong)

- South Korean car-sharing startup SoCar has filed for an initial

public offering (IPO), reports TechCrunch. Details such as the

number of shares to be offered in the IPO and the price range have

not yet been determined. According to the report, SoCar is expected

to reach valuation of about USD2.5 billion after the listing in the

first half of this year. The company will use the IPO proceeds to

make additional acquisitions and advance its technology. SoCar is

the largest car-sharing company in South Korea with more than

12,000 vehicles and 4.5 million registered users. In 2018, SoCar

acquired VCNC, a mobile messaging app platform, to operate a

van-hailing service Tada, which was suspended in 2020 because of

South Korea's revised law. It plans to launch a transportation

super app this year that will provide all-in-one mobility services.

SoCar aims to increase its fleet size to 50,000 by 2027 and replace

all its vehicles with all-electric, hydrogen-powered, and other

environmentally friendly models by 2030. The company's previous

investors include SK Holdings, Bain Capital, Premier Partners,

SoftBank Ventures Asia, Altos Ventures, KB Investment, Stonebridge

Ventures, LB Private Equity, SG Private Equity, and more. (IHS

Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.