Daily Global Market Summary - 8 June 2021

Major US, European, and APAC equity indices closed mixed across each region. US and benchmark European government bonds closed sharply higher. European iTraxx and CDX-NA credit indices were close to flat across IG and high yield. The US dollar, natural gas, oil, and copper closed higher, while gold and silver were lower on the day. Markets are eagerly awaiting Thursday's US CPI report to determine if consumer prices have stabilized since last month's much higher than anticipated print.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; Russell 2000 +1.1%, Nasdaq +0.3%, S&P 500 flat, and DJIA -0.1%.

- 10yr US govt bonds closed -3bps/1.54% yield and 30yr bonds -3bps/2.22% yield.

- CDX-NAIG closed flat/50bps and CDX-NAHY flat/283bps.

- A "massive rotation" into corporate bonds from equities may be on the horizon for U.S. pension funds as they become fully funded, according to strategists at Bank of America Corp. Investment gains boosted the funded ratio of the 100 largest corporate plans to 98.8% in May, according to Milliman. That measure of defined benefit pension assets to liabilities has surged from 82% since July 2020, data from the risk management firm show. (Bloomberg)

- DXY US dollar index closed +0.1%/90.08.

- Gold closed -0.2%/$1,894 per troy oz, silver -1.0%/$27.73 per troy oz, and copper +0.6%/$4.56 per pound.

- Crude oil closed +1.2%/$70.05 per barrel and natural gas closed +1.9%/$3.13 per mmbtu.

- The delta variant of coronavirus that first arose in India appears markedly easier to transmit and more virulent than previous mutations, including the alpha strain that emerged last year in the U.K., according to the World Health Organization's weekly update. People infected with the delta variant were 2.6 times more likely to land in the hospital. They were also more likely to spread the virus to others, the WHO said. Two studies suggest COVID vaccines may be less effective against the delta strain, which is now found in 74 countries, up by about a dozen from a week ago. (Bloomberg)

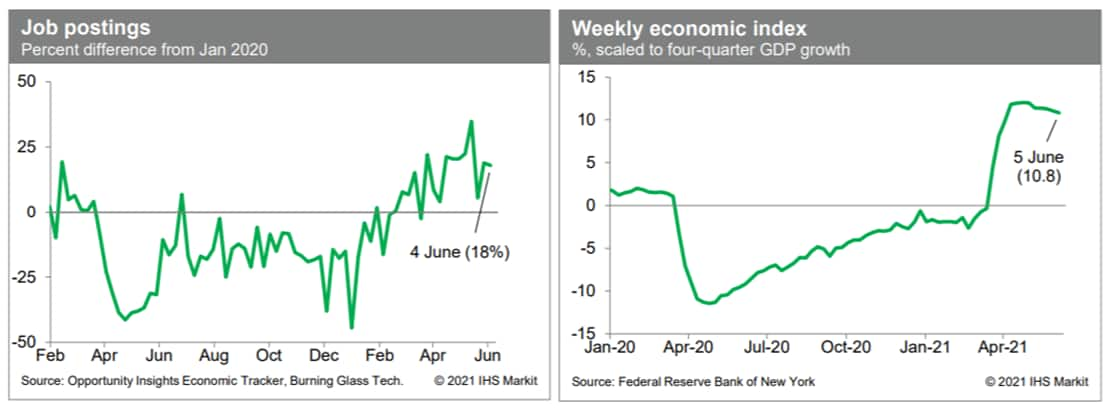

- Job postings last week were down slightly from the prior week,

according to the Opportunity Insights Economic Tracker, but

nevertheless in line with a solid trend that is well above the

January 2020 level. This is suggestive of robust demand for labor.

Meanwhile, the Weekly Economic Index (WEI) has been drifting lower

in recent weeks and, as of last week, stood at 10.8. Factoring in

recent readings and accounting for the historical discrepancy

between the WEI and GDP growth, this suggests GDP growth over the

four quarters ending in the second quarter between 10.0% and 12.6%.

Our latest GDP tracking would put four-quarter GDP growth at 13.4%

in the second quarter. The WEI suggests some downside risk to this

forecast. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

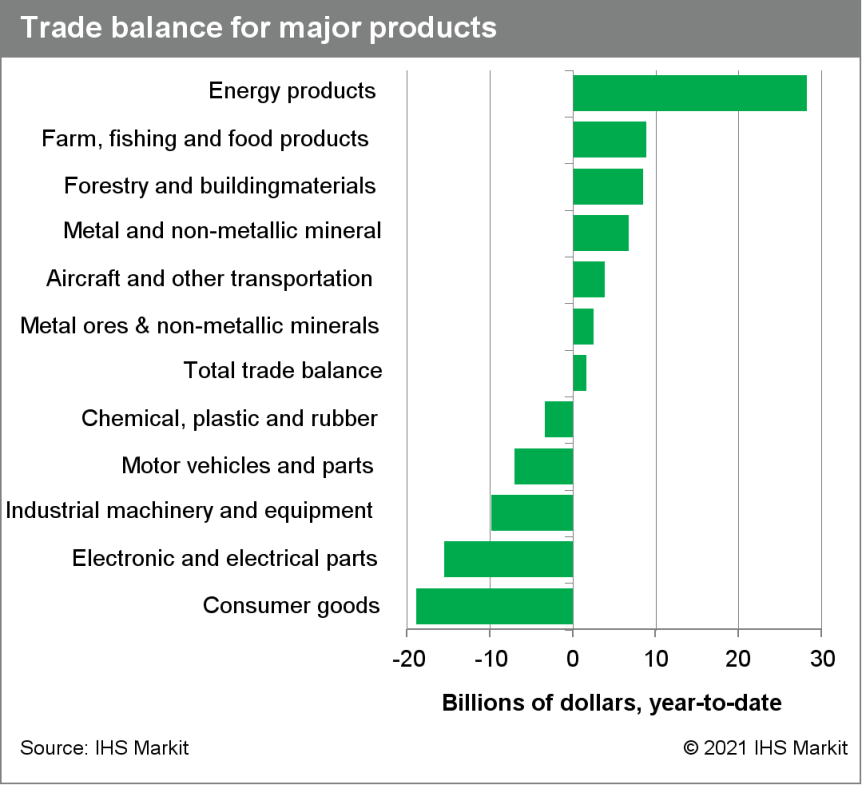

- The US trade deficit (nominal) shrank by $6.1 billion from a

record high to $68.9 billion as imports fell and exports rose. (IHS

Markit Economist Patrick

Newport)

- The $4.6 billion drop in nominal goods imports in April may be payback for the $17.3 billion jump the previous month. Then again, it might be that the seasonal factors, which correct for seasonality in normal times (these are not normal times), are incorrectly apportioning the numbers. A three-month average indicates that goods imports are at a record high and surging, with consumer and capital goods accounting for most of the surge.

- Nominal goods imports (seasonally adjusted) from mainland China dropped by $6.0 billion, more than the total $4.6 billion drop.

- Nominal goods exports are at record highs; real goods exports are finally back to pre-pandemic levels. Exports of civilian aircraft increased by $1.4 billion, the biggest increase in 36 months.

- The following indicators set record highs in April: exports of goods ($145.3 billion), exports of industrial supplies and materials ($52.2 billion), exports of foods, feeds, and beverages ($13.8 billion), imports of foods, feeds, and beverages ($14.5 billion), and imports of capital goods ($63.7 billion).

- Bottom line: a three-month average gives a better read than the latest monthly reading. It shows imports surging to meet strong domestic demand, exports still playing catch up, and the trade deficit at a record high.

- USDA Secretary Tom Vilsack announced the department is investing over $4 billion to bolster the US food supply chain as part of the Biden administration's "Build Back Better" initiative aimed at tackling vulnerabilities and other shortcomings exposed during the COVID-19 pandemic. He said part of the effort may include a second look at recent livestock market regulations to ensure fairness and transparency. The new supply chain investments will be focused on four key areas: food production; food processing; distribution and aggregation; and market opportunities and consumers. Combined with $1 billion in investments in food and nutrition programs announced last week, Vilsack pointed out more than $5 billion will be provided via Build Back Better effort. Plus, he expresses confidence that the USDA spending will attract "billions more" from the private sector. The plan rolled out today (June 8) lacks many specifics, but Vilsack provided a few additional details during a briefing with reporters and said there would be more information in coming weeks and months. (IHS Markit Food and Agricultural Policy's Richard Morrison)

- Tesla CEO Elon Musk has announced in a Twitter post the cancellation of plans for a Plaid+ variant of the updated Model S electric vehicle. In the tweet, Musk wrote, "Plaid+ is canceled. No need, as Plaid is just so good." A second tweet by Musk said of the Plaid variant, "0 to 60mph in under 2 seconds. Quickest production car ever made of any kind. Has to be felt to be believed." In addition, he suggested that deliveries of Model S Plaid would start during the week beginning 7 June, saying, "Model S goes to Plaid speed this week." Other than the Musk posts, Tesla has provided no comment on the change of plans, at the time of writing. A Bloomberg report indicates that the availability of Tesla's new 4680 battery cells could have had an impact on the decision, noting that Musk's posts did not address that potential issue. Earlier, Tesla scheduled a Plaid delivery event for 10 June. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Canada's April merchandise trade balance registered a small

surplus of $593.9 million, while the deficit seen in March was

revised to a wider $1.3 billion. (IHS Markit Economist Evan

Andrade)

- Owing to plummeting motor vehicle and parts trade, nominal exports edged down 1.0% month on month (m/m) to $50.2 billion and nominal imports fell 4.7% m/m to $49.6 billion.

- In real terms, export volumes were down 2.9% m/m, while imports volumes fell 6.2% m/m—the steepest monthly decline in real imports since the onset of the pandemic.

- Canada's energy product trade surplus continued to shrink from

the seven-year high in February and the non-energy products trade

deficit narrowed to $6.2 billion from $8.3 billion the month

prior.

- In a press release, Plains All American announced the signing of an agreement to sell its Pine Prairie and Southern Pines natural gas storage facilities to Hartree Partners for a total cash consideration of $850 million. The transaction is expected to close in the third quarter of 2021. Hartree will acquire nine caverns, along with associated base gas, header pipelines and compression facilities. It has a total working gas capacity of 70 Bcf. Plains said the transaction will help them to exceed their 2021 asset sales target of $750 million, generate additional free cash flow and building momentum to reduce debt and increase investor returns. Plains All American is a publicly traded master limited partnership that owns and operates midstream energy infrastructure and provides logistics services for crude oil, natural gas liquids, and natural gas. It owns an extensive network of pipeline transportation, terminalling, storage, and gathering assets in key crude oil and NGL producing basins and transportation corridors and at major market hubs in the United States and Canada. The company is based in Houston, Texas. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

Europe/Middle East/Africa

- Major European equity indices closed mixed; UK +0.3%, France +0.1%, Italy/Spain -0.1%, and Germany -0.2%.

- 10yr European govt bonds closed sharply higher; Italy -5bps, UK -4bps, and France/Germany/Spain -3bps.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover -1bp/243bps.

- Brent crude closed +1.0%/$72.22 per barrel.

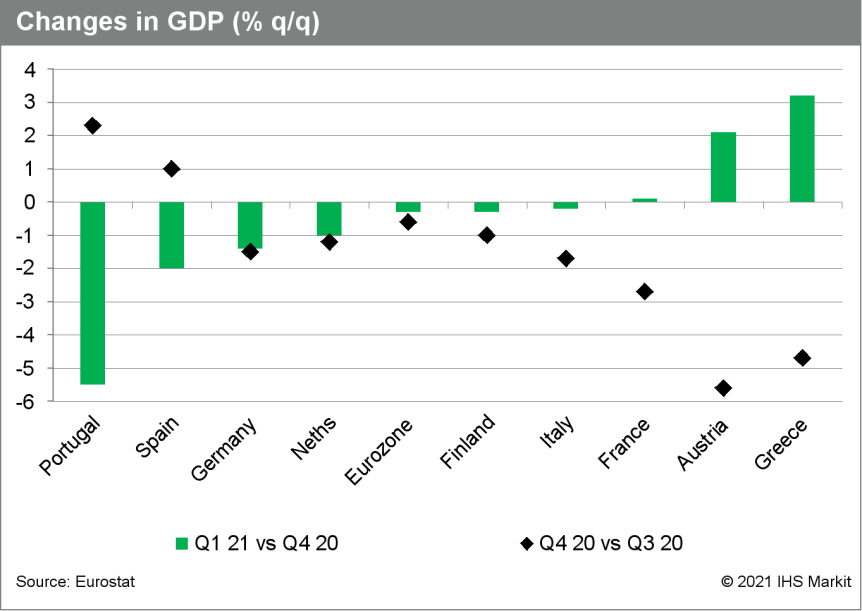

- According to Eurostat's third estimate, eurozone GDP contracted

by 0.3% quarter on quarter (q/q) in the first quarter, half the

previously estimated decline (Eurostat's prior second estimate was

-0.6% q/q). (IHS Markit Economist Ken

Wattret)

- The cumulative decline in GDP in the second COVID-19-driven recession in the fourth quarter of 2020 and the first quarter of 2021 was just 0.9%, therefore, compared with an unprecedented 14.9% collapse during the initial recession, in the first and second quarters of 2020.

- As expected, the initial expenditure breakdown for the first quarter revealed that the key driver of the q/q contraction in GDP was private consumption. It fell by 2.3% q/q, following a somewhat larger 2.9% q/q decline in the fourth quarter of 2020, with both quarters heavily affected by COVID-19 containment measures.

- In contrast, both investment (+0.2% q/q) and exports (1.0% q/q) held up relatively well. Net trade contributed a positive, but modest, 0.1 percentage point to the q/q change in GDP growth in the first quarter.

- Inventories contributed 0.7 percentage point, following a similarly large 0.5 percentage point boost in the fourth quarter of 2020, broadly offsetting the 1.5 percentage point drag in the third quarter of 2020.

- Despite the first quarter's relatively small q/q decline, eurozone GDP is still 5.1% below its pre-pandemic level (the fourth quarter of 2019), with considerable variations evident across expenditure components.

- Private consumption underperformed, at 9.5% below its

pre-pandemic level, reflecting the nature of the COVID-19

restrictions, which have affected consumption of services in

particular. Investment, despite three consecutive q/q increases,

remained 7.7% below its fourth-quarter-2019 level.

- In April, the upswing of German manufacturing orders paused,

and output even suffered a small setback. This can be linked to the

interim retraction of some of the loosening steps enjoyed in March

and to increasing supply chain constraints. Notwithstanding the

anticipated strong rebound of economic activity in May-June as

pandemic-related restrictions were rescinded again, second-quarter

GDP growth will be less buoyant in Germany than among many of its

European peers, which exited strict lockdown conditions at an

earlier stage. (IHS Markit Economist Timo

Klein)

- Seasonally and calendar-adjusted German industrial production excluding construction declined by 0.3% month on month (m/m) in April, another downward correction following an interim rebound in March from January-February declines. The huge base effect of the output plunge in March-April 2020 has raised the year-on-year (y/y) rate to 33.3%, but April's level remains about 6% below that in February 2020 before the pandemic struck.

- Total production, including construction, even declined by 1.0% m/m in April, as a fresh setback for construction (-4.3% m/m) outweighed a rebound in energy output (6.0%) owed to unusually cool weather.

- As was to be expected due to tightened COVID-19 restrictions, consumer goods production was the main dampening force in April, while intermediate and investment goods output was broadly flat. Accordingly, a different split according to industrial branches reveals that the food/beverages/tobacco sector (-5.7% m/m) and motor vehicles (-3.3%) suffered the most, whereas those sectors that rely mostly on external demand, such as machinery/equipment (3.9%) and computers and electrical equipment (3.5% m/m) did quite well. In the case of motor vehicles, the ongoing shortage of computer chips also restrains production for export purposes.

- Automotive supplier Bosch has opened a chip plant located in a semiconductor hub near Dresden (Germany), reports Reuters. The company said that investment in the project stood at around EUR1 billion (USD1.2 billion), of which EUR200 million is state aid received under an EU investment scheme. German Chancellor Angela Merkel and EU Vice-President Margarethe Vestager were present at the online opening ceremony. The new facility will make specialist power-management chips and Application Specific Integrated Circuits (ASICs) for the automotive industry and the industrial IoT (Internet of Things) on 300mm wafers. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- IHS Markit has lowered India's GDP growth forecast to 7.7% for

2021. Countries in sub-Saharan Africa with a strong trade

relationship with India could be exposed to weaker consumer demand

and sustained supply-chain disruptions during the second quarter.

(IHS Markit Economist Thea

Fourie)

- India has a negative trade balance with sub-Saharan Africa, with Indian exports to the region trailing import demand from India. Trade between the two regions ranges from mineral fuels such as oil, gold, and coal to food products dominated by groundnuts, cereal and leguminous vegetables, as well as pharmaceutical products. Benin and Nigeria are the countries most exposed to trade disruptions with India.

- The impact of a second wave of COVID-19 infections on India's economy and subsequent government restrictions became more visible during May. IHS Markit's India Service Purchasing Managers' Index (PMI) trended below the 50-neutral level to 46.4 in May, with the PMI in contraction territory for the first time in eight months. The IHS Markit India Industry PMI slowed to 50.8 over the period, barely remaining above the 50-neutral level.

- India is a large trading partner for many countries in the sub-Saharan African region and weaker demand and supply-chain disruptions would impact on economic activity in these economies during the second quarter. India is Guinea-Bissau's and Nigeria's largest export partner, with exports dominated by cashew nuts and oil respectively. Other countries relying heavily on exports to India include Benin (nuts), Ghana and Burkina Faso (gold), Comoros (vanilla and other spices), Republic of the Congo (oil, wood, copper), Mozambique (coal and leguminous vegetables), and Tanzania (leguminous vegetables).

- The IMF forecasts Botswana's real GDP to expand by 8.3% in

2021, thanks to improvements in global demand for diamonds, the

easing of COVID-19 pandemic-related restrictions on mobility, and

the government's expansionary fiscal stance. The Fund states that

the recovery is expected to be uneven across sectors and largely

dependent on improvements in the domestic and the external

environments. (IHS Markit Economist Archbold

Macheka)

- The IMF cautions that the growth outlook remains subject to high uncertainty, with downside risks emanating primarily from the evolution of the COVID-19 pandemic, availability and deployment of vaccines, and lower-than-expected diamond revenues. A quicker rollout of COVID-19 vaccines domestically and globally could see growth surprising on the upside, "while steadfast implementation of supply side reforms could promote private sector activity and diversify the sources of growth", says the IMF.

- The Fund states that the current-account and fiscal deficits are forecast to narrow in 2021, on the back of the expected improvement in global diamond demand, phasing out of the one-off COVID-related spending, and implementation of revenue-enhancing and expenditure consolidation measures.

- In terms of price pressures, inflation expectations are projected to tick up temporarily in the near term, driven by a rebound in oil prices, hikes in the fuel levy and the value-added tax (VAT) rate, and an increase in administered prices.

- Nairametrics reported on 7 June that the Central Bank of

Nigeria (CBN) would increase the amount of foreign exchange

allocated to banks to meet customers' requests for hard currency.

The increased demand for foreign exchange followed the negative

impact of the COVID-19 virus pandemic on the primary foreign

exchange earner, oil, and the devaluation of the exchange rate.

(IHS Markit Banking Risk's Ronel Oberholzer)

- The CBN Governor, Godwin Emefiele, at a meeting with the Managing Directors of Deposit Money Banks (DMBs), committed the CBN to ensure an "efficient FX market for all legitimate users" after the central bank had reportedly received complaints primarily from retail customers looking to travel or pay tuition and medical fees abroad.

- Although structurally, the banking sector presents a low liquidity risk profile, with an estimated LDR of 54% in 2020, operationally foreign currency liquidity strains increased in 2020 and 2021. Foreign exchange shortages emerged as oil prices fell in 2020, limiting foreign-exchange earnings from oil exports and sparking an outflow of foreign investors. Despite a recovery in oil prices, export earnings have stayed under pressure on production limitations in the oil industry. The resulting risks to the banking sector are twofold and interrelated in Nigeria, namely liquidity constraints and foreign currency risks.

Asia-Pacific

- APAC equity markets closed mixed; Australia +0.2%, Hong Kong flat, India -0.1%, South Korea -0.1%, Japan -0.2%, and Mainland China -0.5%.

- Chinese media reported a new wave of sea freight rate rises in the first week of June. The spot freight rate from Asia to Northern Europe rose by 11% last week, reaching USD10,492 per FEU, a staggering 533% higher than the same period last year, according to the Baltic Freight Index (FBX). The Shanghai Container Freight Index (SCFI), released by the Shanghai Shipping Exchange on 2 June, showed that it rose by 117 points to close at 3,613 points. It advanced again by 3.3% and set a new record, with a year-on-year increase of 157% compared with the same time last year. On June 4, the freight rate from Shanghai to the basic European port market was USD5,887 per TEU; from Shanghai to the Mediterranean basic port market was USD5,952/TEU. Some analysts predict a further rate increase as the global shipping and port industry continue to realign themselves. While China continues to face a shortage of standard and reefer containers, thousands of containers remain stranded in California, The UK's Felixstowe and New Zealand's Auckland. Some important ports' numbers of stranded empty containers are reportedly three times higher than normal. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Great Wall Motors has partnered with Oculii to mass produce Level 3 and Level 4 autonomous vehicles (AVs), according to a company statement. Oculii's artificial intelligence (AI) software allows any radar to increase the resolution of any commodity radar by more than 100X. It offers all-weather, sub-degree horizontal and vertical spatial resolution up to 350 meters around a full 360-degree field of view. Great Wall also announced that it aims to achieve Level 3 automated vehicle operation with redundancy throughout a vehicle in 2021. Great Wall has entered several partnerships on AVs. Last year, Ibeo Automotive System announced that it will supply its solid-state LiDAR, ibeoNEXT, for a new generation of vehicles built by Great Wall from 2022. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese autonomous vehicle (AV) startup Zongmu Technology has raised USD190 million in a Series D round of funding, reports Bloomberg. The investors that participated in the funding round included Xiaomi Corporation, Denso, Fosun Capital Group, Qualcomm Ventures, and a fund backed by Chongqing Changan Automobile. Zongmu conducted the Series D fundraising in three stages and Hubei Xiaomi Changjiang Industrial Investment Fund Management Co led the third phase of the round. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Japan's real GDP for the first quarter of 2021 was revised up

to a contraction of 1.0% quarter on quarter (q/q; or 3.9% q/q

annualized) from a 1.3% q/q (or 5.1% q/q annualized) drop. The

upward revision reflected a larger increase in changes in private

inventories and a softer contraction in public demand. (IHS Markit

Economist Harumi

Taguchi)

- The upward revisions for the increases in changes in private inventories (0.4-percentage-point contribution to change in real GDP; up from 0.3 percentage point) and private capital expenditure (capex; up to -1.2% q/q from -1.4% q/q) were in line with IHS Markit expectations. However, the better-than-expected results stemmed from softer declines in government consumption (-1.1% q/q; up from -1.8% q/q) and public investment (-0.5% q/q; up from -1.1% q/q).

- Capex was revised up marginally, but overall weakness reflected declines in all major components after rises in the previous quarter, particularly for transport equipment (down 8.2% q/q). Disruptions caused by the February earthquake and semiconductor shortages were probably part of the reason behind the contraction. Revisions for private consumption, residential investment, and external demand were marginal.

- Isuzu and Hino are in talks to use the Automated Mapping Platform (AMP) developed by Woven Alpha, according to a company statement. AMP is an open-source platform that enables the creation and sharing of highly accurate maps by combining data gathered from vehicles of participating companies and advanced satellite imagery technology. The company claims that AMP's HD map includes several layers of data information of road objects creating an accurate representation of the road while keeping it updated. Isuzu and Hino will examine the potential application of AMP to make smarter and safer logistics through automated driving and Advanced Driver Assistance System (ADAS) using HD maps. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- India's Minister for Electronics and Information Technology (MEITY) wrote to Twitter on 5 June, saying that the company would face "unintended consequences" should it fail to comply with new information technology (IT) rules. The rules - known as the Intermediary Guidelines and Digital Ethics Code - took effect in May 2021, increasing the liability of "intermediaries" - that is, platforms such as Twitter and Facebook. Platforms with more than 5 million registered users are defined as a "significant social media intermediary", and are liable to higher obligations. Most intermediaries have reportedly complied with the rules, with Twitter issuing a statement on 7 June saying that it was "committed" to doing so within a one-week timeframe. However, legal challenges to various provisions are likely to be brought as intermediaries commence compliance. The rules have broadened the government's administrative reach, allowing it to increase monitoring of user behavior and shared content, with the justification likely to be on law enforcement grounds. Without a specific definition of "public order", the government is likely to frequently require platforms to take down content and/or user pages within 36 hours. (IHS Markit Country Risk's Deepa Kumar)

- Nissan India announced the launch of a subscription service for its vehicle line-up in India in partnership with Orix, a leasing and financial services company, reports Autocar. The service, called the 'Nissan Intelligent Ownership Subscription Plan' can be used to subscribe to the Nissan Magnite and Kicks, or the Datsun Redigo. Nissan offers the service in Delhi NCR, Hyderabad and Chennai, and plans to expand to cities like Mumbai, Pune and Bengaluru. The monthly cost of the service (after payment of a refundable security deposit) includes vehicle insurance, service (including tire and battery replacement), as well as maintenance costs (including scheduled and unscheduled repairs). Nissan is also offering free 24x7 roadside assistance with the service, and customers can choose if they want a car with a white license plate (private registration) or black license plate (commercial registration). Car subscription programs are common to all major automakers in India. Another recent reason for the popularity of subscription services in the country is the need of the commuters to avoid public transport and ride-hailing services during the COVID-19 virus pandemic and the growing preference for personal mobility. (IHS Markit AutoIntelligence's Tarun Thakur)

- The lenders of Punj Lloyd voted to reject a resolution plan for the company undergoing bankruptcy proceedings in India, as they failed to select a bidder for the company within the given timeframe. The consortium of lenders, known as Committee of Creditors (CoC), further recommended the liquidation of the company as it is unable to avoid bankruptcy. In March 2019 the National Company Law Tribunal (NCLT), the bankruptcy proceedings court of India, had initiated proceedings against Punj Lloyd. The bankruptcy resolution process was based on a petition filed by lender ICICI Bank over a default of USD122 million (INR8.54 billion) by Punj Lloyd. Subsequently, more lenders had filed similar default cases against it. Since then, the company had been in moratorium, with a Resolution Professional (RP) appointed by the court to handle the resolution process. NCLT had given an extension until 31 March 2021 for the CoC and the RP to finalize a resolution plan, which ended in failure, with liquidation looking likely. (IHS Markit Upstream Costs and Technology's Amey Khanzode)

- KrisEnergy said the company is unable to pay its debts and will proceed to liquidation. This decision was driven by the company's liabilities which exceed assets and the lower than expected production and cash flow from the Apsara Mini Phase 1A project in offshore Cambodia. KrisEnergy has filed a winding up petition in the Cayman Islands on 4 June 2021 and a hearing date for the petition will subsequently be fixed. Keppel Corporation is the parent company of KrisEnergy with the company's KrisEnergy exposure amounting to SGD423 million (USD320 million). Keppel Corporation said on 8 June 2021 that a USD240 million (SGD318 million) loss will be incurred in its first half 2021 results after estimating recoverable amount of KrisEnergy's net assets. (IHS Markit Upstream Costs and Technology's Kelvin Sam)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.