Factor food for thought

Research Signals - February 2021

2021 started out as a relatively uneventful month of positive momentum in high risk shares, carried over from the end of last year, on optimistic vaccination and economic outlook. However, pressure built up in the final week of January in a battle between day traders and hedge funds, resulting in frenzied trading in GameStop and other heavily shorted stocks, with major indexes erasing their initial gains for the month. Yet, retail investors' uprise could not derail the bull market and stocks continued to make new highs in the early days of February. As the bull market rages on, we take a few snapshots of factor exposures to highlight current market attributes.

- In mid-January 2021, a handful of the most shorted stocks saw a parabolic increase in performance relative to the market, though valuations of a broader set of highly shorted stocks remained comparatively in check

- As the market rebounded from the pandemic lows, investors bid up the valuations of high risk names in addition to those with negative earnings

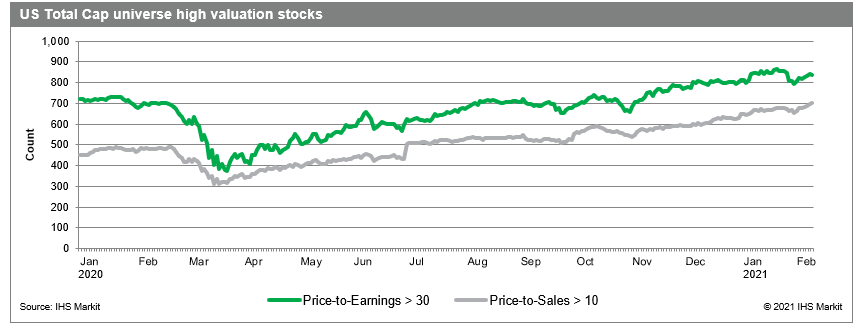

- A notable number of stocks are trading at elevated price-to-earnings and price-to-sales multiples, alongside those trading at 52-week highs

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.