Fixed Income: Volumes Remain Strong Following Record Year

2020 was a record-breaking year for Fixed Income with over 4,600 deals and $4.3 Tn of issuance run on our IssueNet platform. Over 2,000 of these deals were also run over InvestorAccess. 2021 year to date has continued to see high volumes and deal counts.

Q3 Update

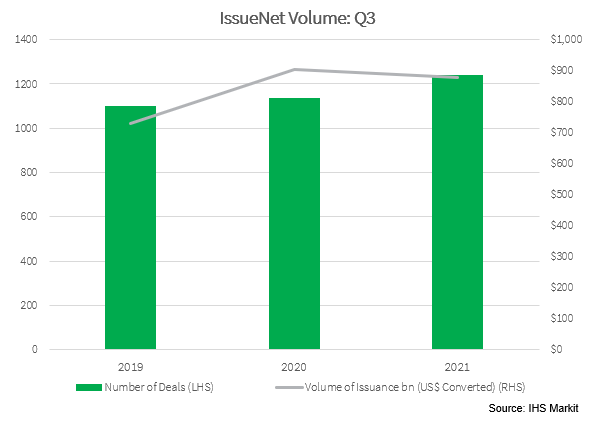

IssueNet, a technology that synchronizes deal and orderbook information between a network of 220+ syndicate banks, continued to see consistent growth in deal numbers, with an increase of 9% in Q3 compared to the same quarter 2020. Although issuance volumes saw a decrease of 3% in the same period, this was in line with overall market activity, which usually sees a lull in the traditionally lighter summer months.

- 1,238 deals run on IssueNet in Q3 2021

- $876.6 Bn USD equivalent in volume run on IssueNet in Q3 2021

Q3 also saw the culmination of a number of major investment projects in the IssueNet platform, including a successful migration to Amazon Web Services, certification for Microsoft Edge browser, and an upgrade to Oracle 19.

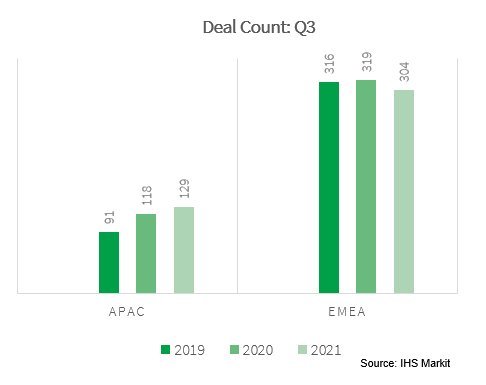

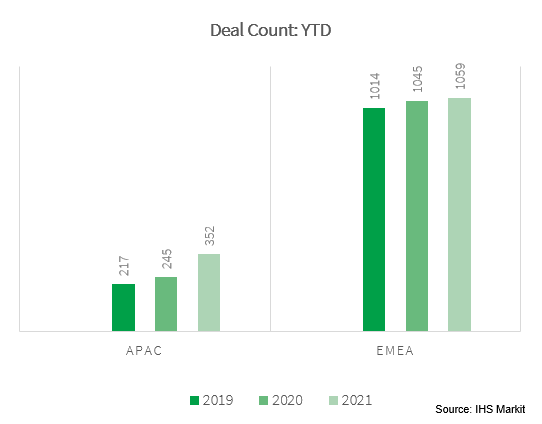

InvestorAccess, a platform that builds upon our fixed income sell-side IssueNet network, brings together investors and banks, integrating the buy side into existing primary workflows while increasing efficiency and reducing risk. Deal counts for the APAC region on InvestorAccess have increased significantly since launch and are up 42% when comparing Q3 2021 with Q3 2019. Deal counts in the EMEA region, where InvestorAccess has been operating for a number of years, remained steady in Q3 2021, dropping slightly by 5% compared to Q3 2020, but in line with the overall decline seen in the EMEA market (as per IGM).1

- 97% of all EMEA investment-grade deals were published to InvestorAccess in August 2021

- 461 deals were published to InvestorAccess in Q3

- $462 Bn USD equivalent was run over InvestorAccess in Q3

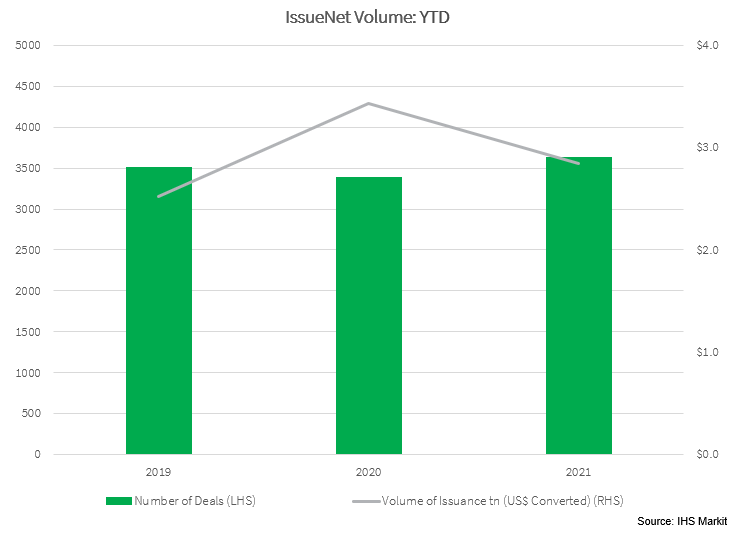

Year-to-Date Update

IssueNet continues to bring major efficiencies to the new issuance process with over 3,600 deals and $2.84 Tn of issuance YTD. The advantages provided by IssueNet are reflected in its global coverage, with the vast majority of deals being run on the platform:

- 96% of EUR deals

- 93% of APAC deals

- 96% of U.S. investment-grade deals

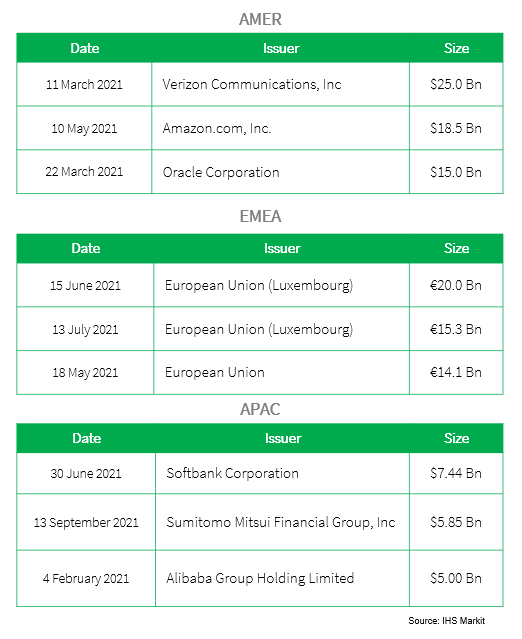

Some of the more notable deals run on IssueNet this year include:

So far in 2021 the InvestorAccess community has expanded to include over 525 buy-side firms that are now able to place orders electronically with the banks. The sell side has also grown, with 57 global banks now publishing deal terms to investors. Rabobank is the latest underwriter to begin accepting electronic orders via InvestorAccess.

This has helped to maintain the consistently high coverage of InvestorAccess, with 94% of all EUR issuance available on InvestorAccess YTD. It has also enabled significant growth in APAC with a 43.6% increase in deal numbers in the region compared to 2020 YTD.

For more information, please visit our product page: https://ihsmarkit.com/products/fixed-income-issuance.html

1 Source: Informa Global Markets