Flash Eurozone PMI signals fastest economic growth for 21 years

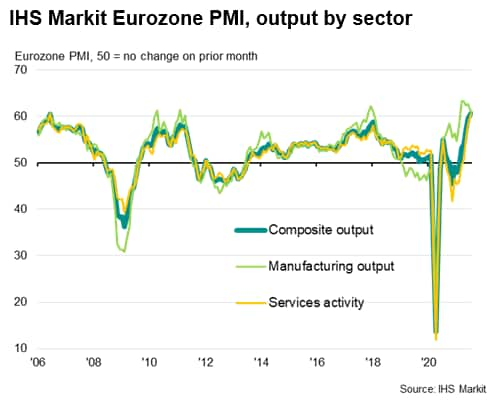

Eurozone business activity grew at the fastest rate for 21 years in July as the economy continued to re-open from COVID-19 restrictions. The strongest rise in service sector activity for 15 years was tempered, however, by a slowing in manufacturing output growth, linked in many cases to worsening supply lines.

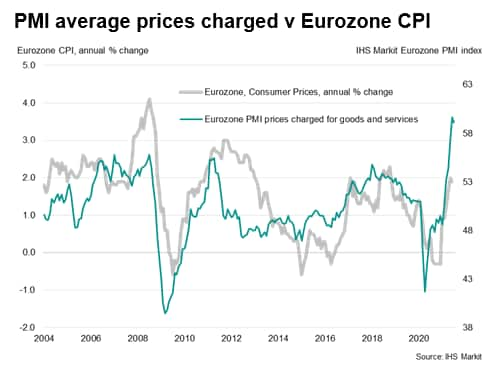

Prices charged for goods and services meanwhile rose at a near unprecedented rate again as demand outstripped supply. Backlogs of work rose at joint-survey record rate amid capacity constraints.

Business confidence meanwhile took a hit from rising concerns over the delta variant, pushing sentiment for the year ahead to a five-month low.

Business activity boosted by opening up of economy

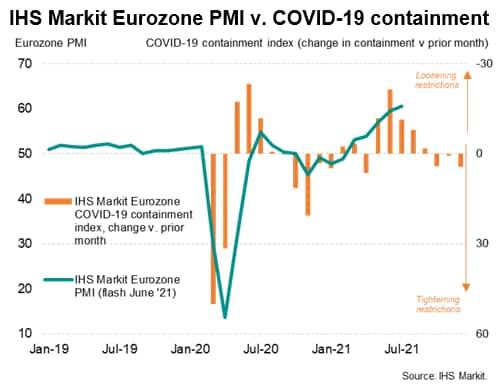

The eurozone is enjoying a summer growth spurt as the loosening of virus-fighting restrictions propelled growth to the fastest for 21 years. The services sector in particular is enjoying the freedom of loosened covid containment measures and improved vaccination rates, especially in relation to hospitality, travel and tourism.

The headline IHS Markit Eurozone Composite PMI® rose from a 15-year high of 59.5 in June to 60.6 in July, its highest since July 2000, according to the preliminary 'flash' reading, which is based on around 85% of typical monthly replies.

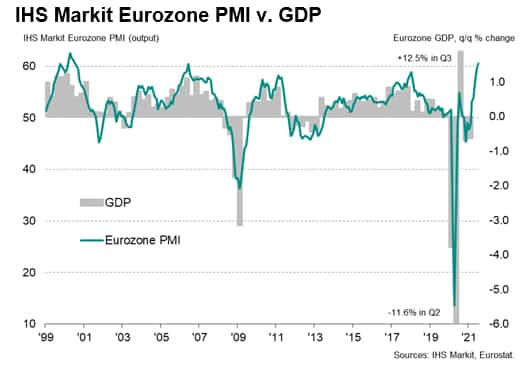

As our chart shows, barring unusual conditions such as those seen during the broad-based economic shutdowns at the height of the pandemic in 2020, the PMI acts as a more reliable indicator of GDP than official first estimates of GDP (see also A PMI-Based Real GDP Tracker for the Euro Area). With the July reading indicating a fourth consecutive month of accelerating business activity, the survey hints strongly at a further acceleration of growth at the start of the third quarter which builds on the economic rebound seen in the second quarter.

This acceleration of growth has coincided with a steady easing of COVID-19 restrictions from a peak in April to the lowest since the pandemic began in July.

The improvement on June's performance was led by the service sector, where growth accelerated to the fastest since June 2006, marking a fourth successive month of rising output. The removal of some pandemic-related travel restrictions notably led to the largest rise in services exports since comparable data were first collected in 2014.

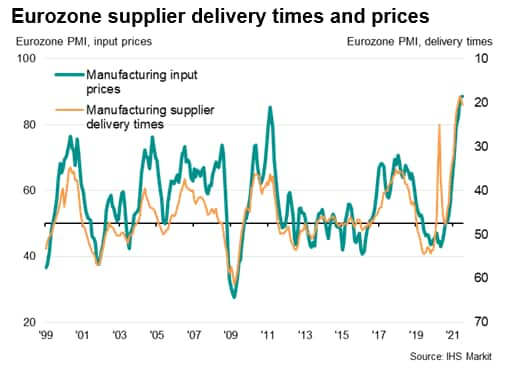

While manufacturing reported a thirteenth successive month of output growth, the rate of expansion slipped to the lowest since February. In many cases, notably in Germany, output was constrained by shortages of inputs. Supplier delivery times - a key barometer of supply chain delays - continued to lengthen at one of the sharpest rates ever recorded by the eurozone PMI survey.

Record rise in selling prices

Supply chain delays therefore remained a major concern for manufacturing, constraining production and pushing firms' costs higher.

These higher costs have led to another near-record increase in average selling prices for goods and services, which is likely to feed through to higher consumer prices in coming months.

Optimism slides

The survey also highlights how the delta variant poses a major risk to the outlook. Not only have rising case numbers led to a slide in business optimism to the lowest since February, further covid waves around the world could lead to further global supply chain delays and hence ever higher prices.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.