Forecast dividend yield strategy outperforms - Hong Kong SAR

Executive summary

• Using S&P Global Market Intelligence estimates, dividend factors constructed based on high forecast dividend yield (HFDY) outperforms Hong Kong SAR's benchmark by 2.43% annualized over the past decade. HFDY is also better versus trailing dividend yield metrics (HTDY) by 0.67% annualized over the same period.

• HFDY presents better risk-adjusted return at 0.22 (Sharpe Ratio 10 years) and 0.28 (Sortino Ratio 10 years), compared with 0.17 and 0.22 for HTDY.

• Over the past decade, forecast dividend yield proved to be a defensive cushion of share price drops with a higher information coefficient (IC) during bear months.

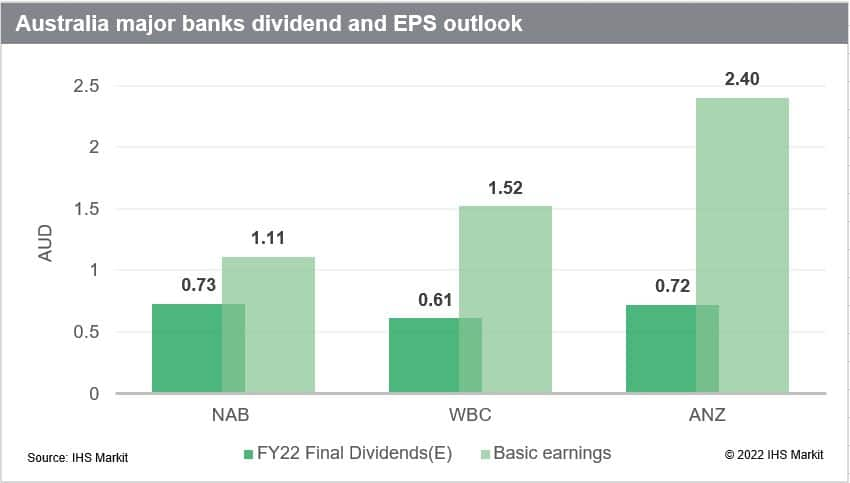

• HFDY provides exposure to typical high-yielding sectors. Over the past 10 years, the top sector— Financials—had an average exposure of 36.1%, representing a 10.6% active exposure compared with the benchmark. Compared with yield strategies, dividend factor constructed based on high forecast dividend growth (HFDG) exhibits better sector diversification, but underperforms overall.

• Dividend Forecasting service, supported by fundamental bottom-up approach adds key values to generating more meaningful dividend yields in forward-looking trading strategies, based on our case studies.

For more information, please contact dividendsapac@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.