Subordination (TLAC and MREL) - Preparing for the New German CDS Protocol

It's hard to escape Brexit and the ongoing debate about separation, at least here in the UK. Nonetheless, away from the headlines the EU continues to push forward doggedly with harmonisation in many areas, notably in financial regulation. One such rule that won't make the front pages is the subordination requirement for loss absorbency. On April 4, IHS Markit held a well-attended webinar on this topic and participants were keen to understand the implications for trading in bonds and synthetic credit instruments.

Before we plough into the detail, perhaps we should give a short explanation of the forces driving regulatory change. "Too big to fail" banks are now considered beyond the pale after the plethora of taxpayer-funded bailouts during the financial crisis. But how to resolve banks in an orderly fashion is an issue that goes beyond moral certitude. Regulators need to be able to "bail-in" bondholders without infringing the No Creditor Worse Off (NCWO) principle. Given that senior unsecured bonds are typically pari passu with other liabilities such as depositors and derivative counterparties, an enforced write down of senior debt to recapitalise an ailing bank creates legal obstacles that can derail an orderly resolution.

Subordination

The accompanying regulations - Total Loss Absorbing Capacity (TLAC) for G-SIBs and Minimum Required funds for own funds and Eligible Liabilities (MREL) for EU banks - thus included provisions for avoiding breaches of NCWO. Three forms of debt subordination emerged that enable banks to issue senior debt that counts as loss absorbing capital:

- Structural - senior paper issued by the HoldCo is structurally subordinated to senior debt issued by the OpCo. This approach was taken by UK and Swiss banks and a handful of other banks in various jurisdictions.

- Contractual - a new type of debt, called senior non-preferred, that sits between traditional senior and tier 2 subordinated debt. This route was pioneered by French banks.

- Statutory - passing a national law that subordinates all senior unsecured debt to depositors and other liabilities that were previously pari passu. Germany took this path.

The EU decided to adopt the contractual approach, and all EU member countries were required to pass this directive into law by the end of 2018 (TLAC came into force on 1 Jan 2019). Harmonisation obviously makes sense, particularly in the eurozone where the Single Resolution Mechanism is one of the Banking Union's key pillars. But Germany's incongruous method of subordination posed questions for financial markets, not least in the CDS world.

How to deal with a problem like Germany?

After the emergence of senior non-preferred debt, the CDS industry had to respond, if the product was to remain fit for purpose. After all, investors holding non-preferred paper would hardly want to buy protection on senior CDS if it was referencing a part of the capital structure highly unlikely to absorb losses in a resolution.

So, a new ISDA transaction type was created - "Standard European Senior Non-Preferred Financial Corporate" - that references a supplement recognising three levels of seniority. A new tier - "SNRLAC" - was also formulated to enable trading through a new SRO and pricing at this level of the capital stack. This process began with the French banks and has since rolled out to names such as Santander and Danske Bank. These are all included as index constituents at the SNRLAC level, a process that has gone smoothly.

But there was a wrinkle in the fabric of CDS that needed ironing out. German banks senior CDS had been trading on the standard European financial transaction type and priced off the "SNRFOR" (traditional senior) curve, despite them being economically subordinated (through statute). This meant that anyone comparing a SNRFOR curve from, for example, Deutsche Bank with a French bank's SNRFOR curve, wouldn't be comparing apples with apples. The latter's curve would sit higher up the capital structure due to it being pari passu with depositors etc. - the new SNRLAC curve was taking care of loss absorbency.

This unfortunate situation began to change on 21 July 2018. An amendment to German law allowed for the issuance of both senior preferred and senior non-preferred debt. All senior obligations issued prior to 21 July 2018 rank pari passu with non-preferred issued after the law change. Effectively, this brought Germany law into line with the rest of the EU - harmonisation in action.

From the cash perspective, the way forward was simple: German banks were free to issue new senior preferred as well as senior non-preferred. But matters were a little more convoluted for CDS. As the existing trades (economically subordinated) were on the standard financials transactions type, it muddied the waters for liquidity provision on the senior preferred tier.

Protocol incoming

A legal mechanism was needed to clear the way for all three CDS tiers to be traded on German banks. Such a tool was available in the form of a protocol, already used on previous occasions, including the introduction of the 2014 ISDA definitions.

ISDA proposed in November 2018 that legacy single-name and index senior transactions referencing German banks would be amended via a protocol. This would change the transaction type from Standard European Financial Corporate to Standard European Senior Non-Preferred Financial Corporate. This won't have any economic effect - senior CDS on German banks is already economically non-preferred - but it will provide a legal framework for trading both senior preferred and senior non-preferred.

This all seems relatively simple, if slightly arcane. But the protocol is still to be implemented and market participants have many questions on how the process will evolve. It was these questions that the IHS Markit endeavoured to answer during our client webinar on April 4.

Webinar Summary

First, the protocol timeline. After an initial delay in implementation, the relevant dates are as follows (these are correct at the time of writing):

February 6 - ISDA publishes protocol

Feb 15 - IHS Markit version 2 RED codes for Series 22-30

April 26 - Cut-off date for protocol adherence

April 29 - IHS Markit implements static data changes to RED service

May 11 (Indicative - TBC) - DTCC TIW event processing should be complete and version two of indices commence trading

IHS Markit clearly has a key role in this process. Some of the main points raised during the webinar were:

- Changes to the RED service: Relevant updates - tier

changes for obligations issued prior to July 21; amendments to RED

9 codes and necessary changes to entities; Preferred Obligations

and Standard Reference Obligations; Index XML.

- These changes will enable the smooth functioning of the CDS market and help mitigate operational risk when trading German bank CDS. More details are available to our RED customers.

- Indices: RED also has a crucial role for index trading. Series 22-31 of the Markit iTraxx Europe and iTraxx Senior Financials will be re-versioned to facilitate the protocol.

- MarkitSERV: The DSMatch platform supports the relevant ISDA transaction types for legal confirmation.

- Pricing: Following the protocol implementation and event processing, pricing of all three tiers - senior preferred, senior non-preferred and subordinate - will commence. It's important to note that IHS Markit curves are dependent on observed data, so the distribution of data is largely a function of liquidity provision and contributions from major market makers.

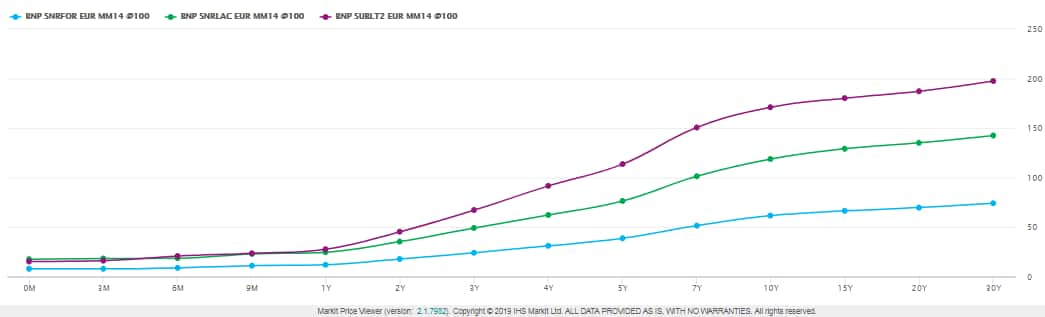

Source: IHS Markit PriceViewer

The Basis Between Tiers on German Banks

Most of the questions received during the webinar were about RED and processing of indices, but there also some interesting queries on pricing. One concerned the basis between tiers on German banks. We have several precedents that allow us to give some insight on what the trading of German CDS will look like in the future. The French banks, as noted above, were early adopters of senior non-preferred debt and names such as BNP have been trading with three tiers since March 2018.

The chart above, taken from the IHSM Price Viewer platform, shows the full-term structure on BNP's three tiers. It is evident that the SNRLAC five-year spread is trading at approximately twice the level of the SNRFOR level, while the SUBLT2 spread is about 60-70% wider than SNRLAC. This is a good guideline but doesn't necessarily tell us where the German banks will trade. Banco Santander's SNRLAC spread is just 62% wider than SNRFOR and the SUBLT2 is around 90% wider than SNRLAC. The relationship between the tiers will be driven by the capital structure of the bank, how much loss absorbing capital it has already raised and how much it is expected to issue in future. Idiosyncratic national implementations of MREL can also play a part.

CDS is adaptable

The CDS instrument has come in for a lot of criticism in recent times, in some cases justified but often not. A perfect, standardised hedging tool for a non-standard cash product such as bonds is never going to be achievable, a point that needs to be reiterated as it is not always understood.

But it is indisputable that the industry has introduced changes that ensure CDS remains fit for purpose. In 2014 new definitions were rolled out that accommodate the new era of sovereign bailouts and bank bail-ins. This work was continued with the implementation of the senior non-preferred transaction type and the SNRLAC pricing tier. The protocol for German banks CDS is an extension of the same theme. End users - whether they are investors using CDS to hedge, take directional views or bank CVA desks managing counterparty credit risk - should now have the necessary tools to conduct their business.