IHS Markit Daily Global Market Summary: 24 March 2020

Global markets started off on a very positive note beginning in APAC, with equity markets higher across every region alongside credit, oil, precious metals, and most agricultural commodities. 10yr benchmark government bonds are generally lower across the world, with the exception 10yr Japanese bonds that ended the day -3bps/0.04% yield.

Americas

- US equity markets started the day sharply higher, with S&P futures trading being halted briefly before the US open after breaching the +5% upside trigger. The S&P 500 was up almost 9% around 12:30pm ET today, but the rally briefly faded and then it regained momentum to close at the high of the day +9.4% on optimism on the passage of the $2 trillion US stimulus package. It's worth noting that the S&P today only modestly exceeded the pre-open futures market highs hit yesterday immediately after the Fed's 8:00am ET announcement that it was expanding its monetary stimulus plans.

- DJIA closed 11.4% today, which is the largest single day increase since 1993. Nasdaq closed 8.1% and Russell 2000 +9.4%.

- Measures to limit the COVID-19 outbreak are hitting US

businesses across the country very hard. Adjusted for seasonal

factors, the IHS Markit Flash Composite PMI Output Index posted

40.5 in March, down from 49.6 in February, the second successive

contraction in output and the steepest slump recorded since

comparable survey data were available in October 2009. (IHS Markit

Economist Chris Williamson)

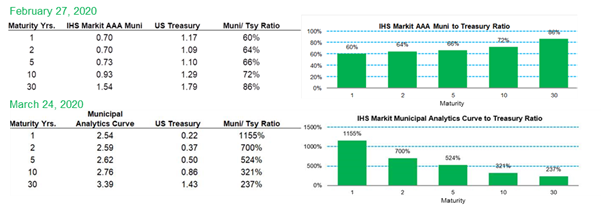

- There is an unprecedented market dislocation occurring in the

tax exempt US municipal bond market. AAA-rated tax exempt municipal

bond yields have historically been lower than their equivalent

maturity US Treasury yield (given the benefit of the tax

exemption), except for times when there is a sharp increase in

supply (or decline in demand), which would result in IHS Markit

Municipal Analytics Curve (MAC) AAA municipal bond/US Treasury

yield ratios becoming greater than 100%. The ratio began to

gradually increase starting Feb 27, but is now multiples of US

Treasury Yields across the curve for the first time:

- Ford is working with 3M Co. and General Electric Co. to produce ventilators to help combat the coronavirus pandemic. (WSJ)

- Chevron, based out of San Ramon, California, is cutting its 2020 capital spending plan by $4 billion, or 20%, in response to rapidly declining market conditions. The biggest cut in spending will be in the Permian Basin, where the company will reduce capital expenditure on its shale operations by around $2 billion. "Given the decline in commodity prices, we are taking actions expected to preserve cash, support our balance sheet strength, lower short-term production, and preserve long-term value," says Chevron chairman and CEO Michael Wirth.

- Central America's manufacturing, textile, and tourism industries will most likely experience an escalation in layoffs and business closures. Central American tourism businesses are reporting cancellations of 70-95% during what is typically its high season, including Holy Week (2-11 April) which could result in a wave of bankruptcies in the sector's small and medium businesses beginning by early April. Costa Rica's resorts, Guatemala's Antigua and Lago Atitlan, and Honduras' Caribbean islands are likely to be particularly affected. (IHS Markit Economist Kari Pries)

- US new home sales fell 4.4% (±14.8%) to a seasonally adjusted annual rate of 765,000 in February from January; this was the second best reading since July 2007. This is a solid report but is best ignored because of the way the Census Bureau handles cancellations—it does not adjust for them. This matters because the current economic distress is likely to lead to many sales agreed in March and previous months not being closed. (IHS Markit Economist Patrick Newport)

- Eli Lilly (US) will delay the launch of most new trials and pause enrolment in most ongoing clinical studies in light of the coronavirus disease 2019 (COVID-19) pandemic. The company will continue clinical trials that have already enrolled patients in order not to "potentially diminish the societal value of the research information", but will be assessing these trial on a case-by-case basis, according to Eli Lilly Chief Medical Officer Tim Garnett. (IHS Markit's Margaret Labban)

- Gold +6.1% and silver +8.5% as of 4:44pm ET.

- Crude oil +3.6%/$24.24 per barrel as of 4:44pm ET.

- Oil policymakers have yet to craft a plausible way to manage the market out of the crisis, sending crude down a messy path of very low prices, severe supply chain stress and shut-ins. The crux of the challenge for oil markets is twofold, the immense size of surplus and the collapsed timeline of prospective builds, severely limiting the runway of the price war. In particular, IHS Markit sees fundamental pressure concentrated over March and April, an eight-week blitz period over which stocks currently stand to build north of 1.0 billion barrels cumulatively - an unprecedented oversupply that will push prices lower. (IHS Markit Energy Advisory Service)

- 10yr US govt bonds closed +5bps/0.83% yield after hovering near +11bps around 1:00pm ET.

Europe/Middle East/ Africa

- According to the World Health Organization (WHO), a staggering 20% of the global population is currently estimated to be in some form of lockdown, with restriction of movement. In Italy, the number of COVID-19 cases continues on an upward trajectory, with 63,927 at the time of writing, up 8.1% compared with 24 hours earlier. The number of COVID-19 deaths in Italy has reached 6,077, more than double that recorded less than a week earlier. Nevertheless, Italian officials were yesterday (23 March) cautiously optimistic that the worst of the outbreak could be coming towards an end as the number of new confirmed cases and the number of newly reported deaths both declined - yesterday saw the smallest increase in cases for five days, according to The Civil Protection Agency, which has been cited by Reuters. (IHS Markit's Sacha Baggili and Janet Beal)

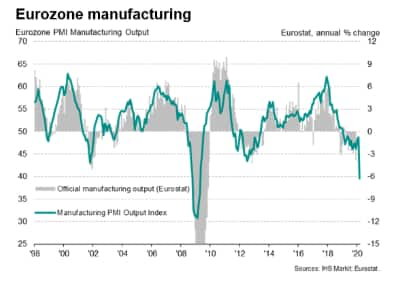

- COVID-19 outbreak has led to the largest collapse in eurozone

business activity ever recorded (IHS Markit Economist Chris

Williamson)

- Flash Eurozone PMI suffers record fall to 31.4 in March as COVID-19 outbreak hits business

- Service sector leads downturn but manufacturing also sees sharpest output fall since 2009

- Steep falls in activity across the region, with 'periphery'

reporting largest downturn

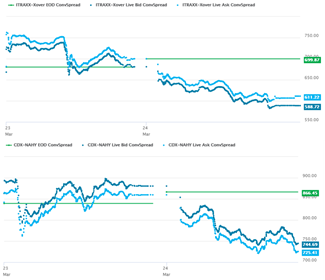

- Both the iTraxx European Xover (-99bps as of 3:31pm ET) and CDX

North America High Yield (-132bps as of 3:30pm ET) CDS indices are

noticeably tighter today - in line with the overall positive tone

of the global markets:

- 10yr European govt bonds were weaker across the region, except for Italy -5bps; Spain +10bps, France +7bps, UK +6bps, and Germany +5bps.

- European equity markets closed significantly higher across the region; Germany +11.0%, UK +9.1%, Italy +8.9%, France +8.4%, and Spain +7.8%.

Asia-Pacific

- Flash Japan PMI at 35.8 in March plunges to the lowest level since the 2011 earthquakes as COVID-19 outbreak hits a wide range of businesses. (IHS Markit Economist Bernard Aw)

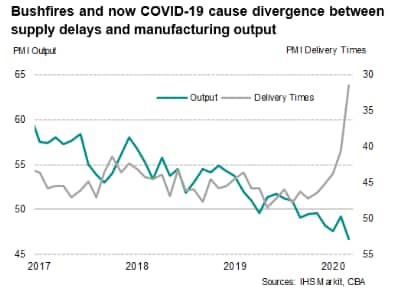

- The Commonwealth Bank Australia Flash PMI, compiled by IHS

Markit and covering both the manufacturing and service sectors,

slumped from 48.3 in February to 40.7 in March, signaling the

steepest contraction of business activity in the near four-year

survey history. The survey findings pointed to the longest

lengthening of suppliers' delivery times on record. Material

shortages due to the COVID-19 situation were by far the most common

reason cited by firms that reported delivery delays. (IHS Markit

Economist Bernard Aw)

- The fallout from COVID-19 outbreak in China will hit auto sales this year. IHS Markit's March forecast update anticipates vehicle demand in China to fall by 42.1% y/y in the first quarter, followed by a 9.5% y/y rebound in the second quarter. For the full year 2020, China's light vehicle sales are forecasted to decline 9.9% to 22.4 million units absent central government incentives to boost consumer demand for autos. (IHS Markit's Abby Chun Tu)

- Japanese conglomerate SoftBank is nearing an investment deal with China's ride-hailing giant Didi Chuxing (DiDi), reports The Information. According to the report, SoftBank will invest USD300 million in DiDi's autonomous vehicle (AV) unit. (IHS Markit's Surabhi Rajpal)

- Major APAC equity markets closed higher across the region; South Korea +8.6%, Japan +7.1%, Australia +4.2%, India +2.6%, and China +2.3%.

You'll frequently see data snaps in these reports from our web-based pricing portal, Price Viewer. Please contact data.delivery@ihsmarkit.com today to ask about complimentary access.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.