IHS Markit Daily Market Update – March 18, 2020

There is a concerted sell-off across both global equity and government bond markets today, with the bond sell-off being particularly fast and furious. Central Banks and governments have unleashed a "shock and awe" campaign of rate cuts, quantitative easing and asset value backstop programs. It hasn't done much to stem the selling as markets continue to search for liquidity and wait for the first sign of a peak in global COVID-19 infections.

Americas

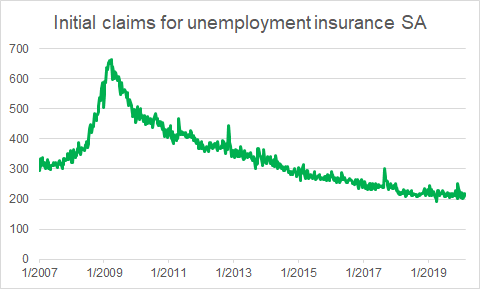

- Many eyes will be on tomorrow's (March 19) 8:30am ET release of the US Initial claims for unemployment insurance for an early assessment of the initial COVID-19 impact on US employment:

2. S&P 500 -8.3% as of 3:30pm ET, having just breached a level 1 trigger (-7%) today at 12:57pm ET that halted trading for 15min. This is the fourth time a trigger (all level 1) has stopped trading since March 9, with most having occurred during the morning. It's worth noting that the next trigger is -13% (level 2), which also triggers a 15min delay, and the last trigger is -20% which halts trading for the remainder of the day (note that level 1 and 2 triggers can only go into effect before 3:25pm ET and level 3 can happen at any time during the trading session).

3. A report from Imperial College London's COVID-19 response team has outlined the potential impact of the coronavirus disease 2019 (COVID-19) pandemic in stark terms. (IHS Markit Life Sciences' Margaret Labban)

a. Assuming an infection rate of R is 2.4 (and in the absence of any Nonpharmaceutical Interventions), the peak in daily mortality rates is anticipated to occur within three months in Great Britain (GB) and the United States around June 2020, with 81% of their populations infected with the COVID-19 virus by that time, totaling 510,000 deaths in the UK and 2.2 million deaths in the US

b. Critical bed capacity would be reached by the second week of April, with demand for intensive care unit (ICU) beds growing to more than 30 times the maximum supply in both countries.

c. Based on this analysis, the UK and the US have to date primarily relied on basic mitigation strategies in their national responses, although various states and cities within the US, for example, have opted to impose more stringent social distancing measures.

4. The Treasury Department is seeking Congressional approval to temporarily backstop money markets given the current stress on the financial sector as part of the broader fiscal package to bolster the economy. The request asks Congress to temporarily suspend restrictions on its Exchange Stabilization Fund so the Treasury can develop guarantee programs for the money-market mutual fund industry. (WSJ)

5. Late yesterday (March 17) and after the close of most financial markets in the United States, the Federal Reserve announced the creation of the Primary Dealer Credit Facility (PDCF) effective 20 March, which will extend credit to the primary dealers from the Federal Reserve similar to that extended to depository institutions (banks) at the Fed's discount window. Collateral type may take many forms of investment-grade securities, including Treasury securities, commercial paper, mortgage-backed securities, collateralized loan obligations, collateralized debt obligations, municipal bonds, other asset backed securities, and a range of equity securities. (IHS Markit's Ken Matheny)

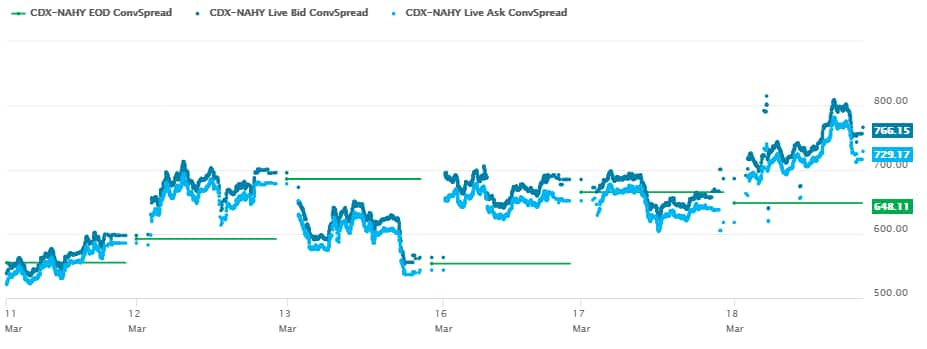

6. CDX NA HY 5yr live spreads are 801bps as of 3:29pm ET, which is a new 8-yr wide, but still far from the worst days of the 2009 when it closed as high as 1894bps:

7. Oil prices hit their lowest levels in 18 years today, being down as low as -24% and almost falling below $20 per barrel at one point of the day; Crude oil -18% / $22.14 per barrel as of 3:26pm ET.

8. This is not simply a glut of oil supply, it's a potential market failure risk. The scale of the oil demand meltdown starting to unfold in the Western Hemisphere is unprecedented, with the demand downside over the next three months likely exceeding 10.0 MMb/d, or 10% of demand. A slowdown of this magnitude is unmanageable in a "cooperative" supply environment, let alone in an all-out supply war. The global oil supply chain will be severely tested in the coming weeks, with a risk that global storage capacity is overwhelmed, forcing prices to fall yet lower to induce immediate supply shut ins. (IHS Markit's Roger Diwan)

9. After strong pressure from the United Auto Workers (UAW) union, Ford, General Motors (GM), and Fiat Chrysler Automobiles (FCA) have each agreed to curb and stagger US production to contain the coronavirus disease 2019 (COVID-19) virus. Separately, the Canadian union has created a task force with FCA, Ford and GM to increase labor protections at plants in Canada. The agreement between US automakers and the UAW came after the union requested all plants be closed for two weeks. (IHS Markit's Stephanie Brinley)

10. 10yr US Treasury bonds are selling off sharply today at +9bps/1.16% yield as of 3:42pm ET (+55bps from Monday's highs), with yields as high at 1.27% at 3pm ET.

Europe/Middle East/Africa

1. The Dutch government announced a package of measures to combat the economic fallout from the COVID-19 outbreak. Contrary to earlier proposals, the measures will not be budget-neutral (funded by cuts in other expenditure categories) but will constitute additional spending to be funded by issuing new debt. Businesses that experience problems in obtaining bank loans and bank guarantees can use the Guarantee Business Financing scheme (GO). The government proposes to increase the GO's guarantee ceiling from EUR400 million to EUR1.5 billion (0.2% of GDP) with the maximum per company increased to EUR150 million. (IHS Markit Economist Daniel Kral)

2. According to an article by the Financial Times, many African governments, including Ghana, Kenya and Rwanda, have sought to get ahead of the disease using strategies that were successful in Asia by announcing school closures, bans on social gatherings and travel restrictions ahead of large influxes of cases. (FT)

3. Major 10yr European govt bonds are significantly weaker across the region today, except for Italy -8bps; Germany +22bps, France +10bps, Spain +17bps, and UK +24bps.

4. European equity markets closed lower across the region; Germany 5.6%, France -5.9%, UK -4.1%, Spain-3.4%, and Italy -1.3%.

Asia-Pacific

1. The Bank of Korea (BOK) has unexpectedly lowered its overnight policy rate by 0.5 percentage point from 1.25% to 0.75%, two weeks before BOK's next scheduled meeting; the reduction follows the US Federal Reserve's sudden rate cut a few days earlier. There is little hard data yet available to show the extent to which the South Korean economy is suffering, but news reports regularly show that much of the economy is contracting: in the retail service sector, customers have disappeared, and many firms have closed their doors. The rate cut will, however, do little to spur demand. Low interest rates would normally encourage spending, especially on cars and homes, but this is unlikely when people are worried about losing their jobs (IHS Markit Economist Dan Ryan)

2. The Philippine government has announced a PHP27.1-billion (USD523.4 million) relief package to fight the coronavirus disease 2019 (COVID-19) virus pandemic, support affected workers and sectors, and soften the adverse economic effect. This came after President Rodrigo Duterte placed the entire island of Luzon under a month-long lockdown. In addition to fiscal measures, IHS Markit forecasts that monetary easing will also be needed to help the economy weather the storm. In addition to the government funds, the government said on 18 March that it will receive a USD100-million loan from the World Bank to enhance its ability to fight the COVID-19 pandemic. This came on top of a USD3-million grant from the Asian Development Bank (ADB) that was secured a few days earlier to help contain the spread of the virus. (IHS Markit Economist Ling-Wei Chung)

3. 10yr Japanese govt bond yields are at the highest level since Dec 2018, closing today at +8bps/0.06% yield.

4. APAC equity markets closed sharply lower today; Australia -6.4%, India -5.6%, Hong Kong -4.2%, China -1.8%, Japan -1.7%, and South Korea -4.9%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.