IHS Markit Fair Value Case Study - Q4 2020

IHS Markit Fair Value Case Study Q4 2020

January 2021

IHS Markit Fair Value in review

When market quotations are not readily available, such as when a foreign security's primary market is closed, many funds switch to fair value pricing. Using fair value pricing ensures that investors in the fund benefit from the most accurate share price possible. IHS Markit provides an independent fair value service that calculates the best estimate of stock and bond prices outside of active trading hours. The following case study provides an analysis of fair value results for the last quarter of 2020 for countries from the three widely accepted market types: developed, emerging, and frontier.

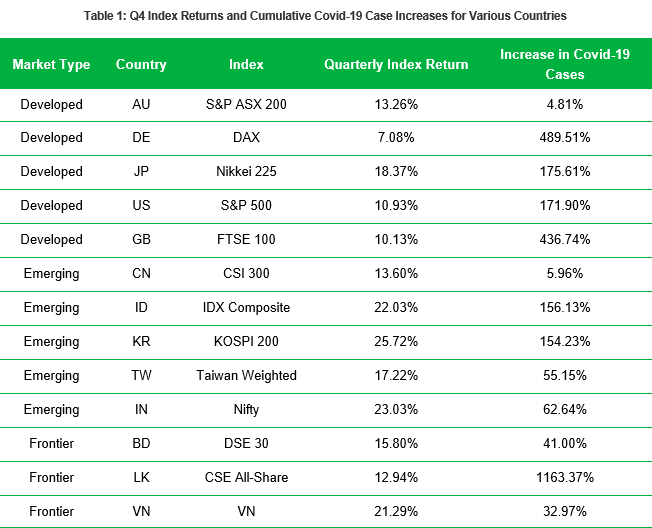

2020: From Beginning to End

Beginning with the Shanghai, Shenzhen, and Hong Kong stock exchanges during the Chinese Lunar New Year in February, the volatility of 2020 arrived with force and did not relent. The S&P Futures finished with 103 100+bps movement days in 2020 (15 in Q4), compared to 43 in 2019. Markets around the world swung wildly in March and April, resulting in trillions of dollars of losses by mid-spring. By summertime in the Northern Hemisphere, new cases and death rates slowed. Aggressive monetary policy by central banks coupled with stimulus bills passed by many governments lead to losses quickly reversing into new highs. Although there was significantly increased volatility for the rest of the year, the bull market continued into Q3 and Q4. The chart below shows the quarterly returns for various markets indices sorted by development level. As depicted, the second wave of Covid-19 had little effect on stock exchanges of all types. The Covid-19 statistics are cumulative cases, meaning that over half of the regions had caseloads in Q4 that at least doubled that of the previous three quarters. Despite these staggering numbers, only one index had a quarterly return of under 10%.

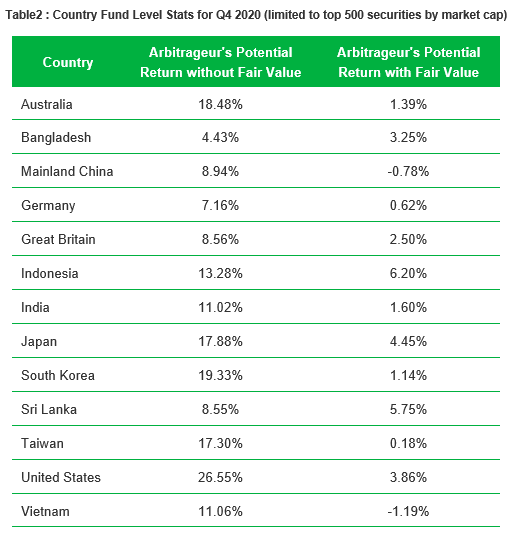

The table below displays IHS Markit's Fair Value performance for the final quarter of 2020. IHS Markit's patent pending stepwise regression model optimizes a combination of global, sector, ADR, country, and currency factors to estimate equity prices outside of normal trading hours. The primary function of equity fair value is to provide these fair valuations to funds where applicable at the time of NAV calculation. In the table below, the valuation point for securities in all countries besides the US is New York 4:00PM. The primary valuation point for US securities is London 12:00PM.

Table 2 shows two fundamental fair value statistics at the country fund level for Q4 2020. Arbitrageur's Potential Return without fair value is the return that could be gained if the arbitrageur trades and the fund use local closing prices. Arbitrageurs Potential Return with fair value is the return that could be gained if the arbitrageur trades and the fund make fair value adjustments. The purpose of comparing these two statistics is to show how effectively the fair valuations were in capturing overnight movement. The specific formulas for these statistics are in the appendix.

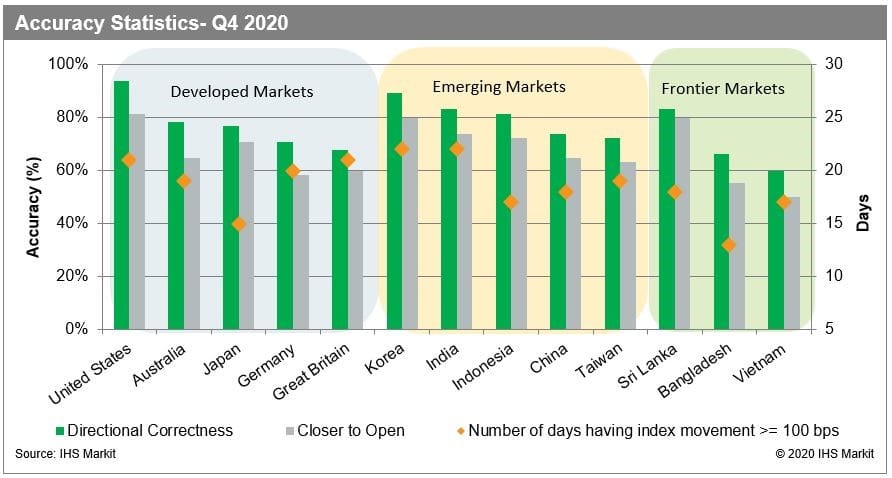

In addition to the Potential Arbitrage Return statistics, two of the main metrics used in fair value are directional correctness and closer to open. Chart 1 displays the directional correctness and closer to open metrics at the country level for Q4 2020. The statistics are grouped by market type and plotted against the number of days the country's index moved more than 100 bps.

Q4 2020 Highlights: US & International Securities

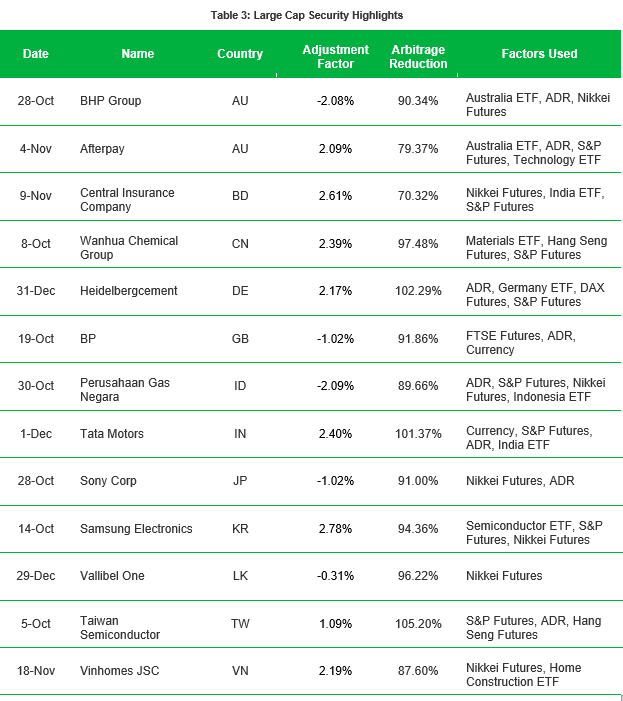

As in the tables displaying overall performance, IHS Markit fair value captured movement with precision at the security level. Table 3 highlights the diverse sets of factors used to capture large portions of large overnight movements in international equities.

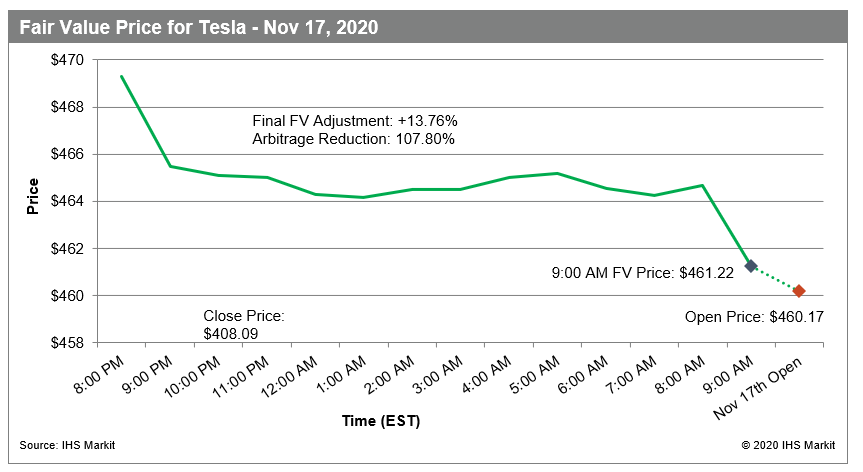

While 4:00 PM New York and 12:00 London are the main valuation points, IHS Markit Fair Value publishes hourly batches to ensure coverage for thousands of securities where applicable 20 hours a day. Chart 2 highlights performance for a major US firm on an hour over hour basis, culminating in a final valuation right before US markets open at 9:30 AM New York time.

On the afternoon of Monday, November 16th S&P Dow Jones Indices announced that Tesla would be joining the S&P Index on December 21st after posting five consecutive profitable quarters. The announcement sent investors into a frenzy in after hours trading. Chart 2 shows the hourly fair value adjustments in response to the Tesla news.

IHS Markit's Fair Value service helps clients meet their regulatory and compliance requirements by providing daily fair value adjustment factors and prices for over 150,000 equity and fixed income securities. We provide security-level as well as aggregate-level fair value adjustment factors across global hourly snaps with the ability to add custom snap times tailored to client requests. To learn more, please visit: ihsmarkit.com/products/pricing-data-fair-value.html or contact: MK-FixedIncomePricingBusinessDevelopment@ihsmarkit.com

Appendix

Actual Overnight Return: The return of a security from its last close to its next open, regardless of how long the time gap may be.

Directional Correctness: Occurs when a fair value price is in the same direction (+, -) as the actual overnight return of the underlying security. The values present in the document are the proportion of securities within a group that were directionally correct.

Closer to Open: Whether a fair value price is closer to the next day open than the previous close. The values present in the document are the proportion of securities within a group that were closer to open.

Arbitrage Reduction: The amount of the movement in the underlying security that we captured using our Fair Value price. These values can be positive or negative, with 100% being full capture. For tables 1 and 2, the values are the average arbitrage reduction across the group.

Potential Arbitrageur's Return = (〖Open〗_(t+1)-〖Close〗_t)/〖Close〗_t ∙Market.Direction

Potential Arbitrageur's Return with Fair Value = (〖Open〗_(t+1)-〖FairValue〗_t)/〖Close〗_t ∙Market.Direction