IHS Markit Launches New Suite of Global Equity Benchmarks

IHS Markit, a leading index provider, has launched a new set of global equity indices, the EMIX World Indices, to complement its extensive suite of fixed income and credit benchmarks.

With a methodology consistent with the authoritative iBoxx, iTraxx and CDX indices, the EMIX World Indices expand IHS Markit's multi-asset benchmarking expertise, delivering tradable index solutions based on the performance of global equity markets. The EMIX World Indices are designed to serve as efficient vehicles for passive and active portfolio management, smart beta products, ETFs, structured products - and as a basis for enhanced thematic and strategy indices.

EMIX World Overview

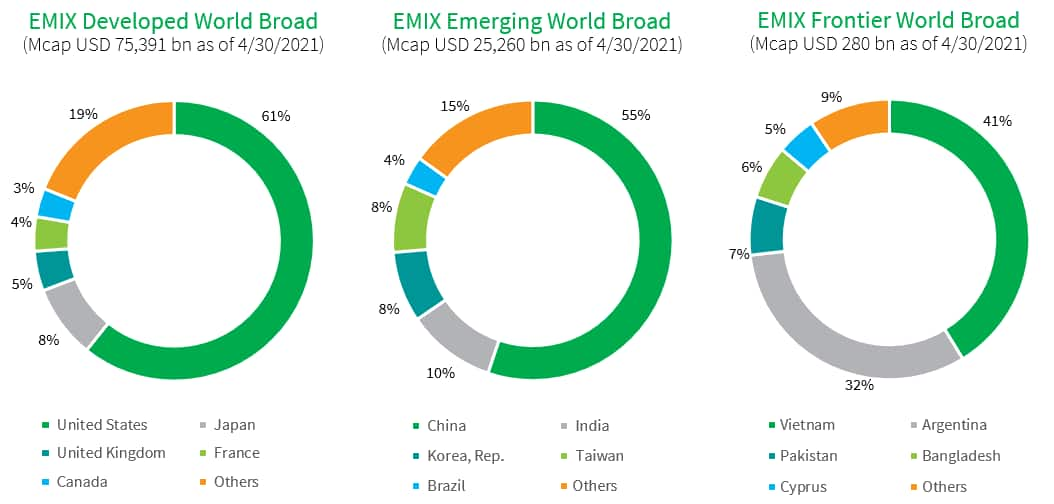

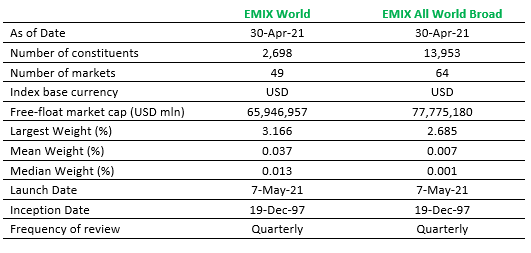

The EMIX World Indices are based on precise and transparent rules, offering comprehensive coverage of the global equity universe, while maintaining minimum standards of investability and liquidity, with non-overlapping size segmentations. The indices cover major and minor exchanges across 70 geographies including Developed, Emerging and Frontier markets and with a standard size segmentation into Large, Mid and Small Cap indices. The headline EMIX World Index is comprised of large and mid-cap companies from developed and emerging markets across the globe, whilst the EMIX All World Broad index additionally covers companies from frontier markets and small-cap companies across developed, emerging and frontier markets. All indices are market-cap weighted and calculated on a daily basis in price, gross and net total returns, with index history available from 1997*. Initially, close to 4,000 sub-indices by market development, size, sector and geographic region are being published. It is envisioned that further index versions (by additional currency, region and industry sector), will be made available using the EMIX index platform**.

All EMIX Indices follow the IHS Markit Industry Classification (IMIC) proprietary schema designed to cover corporations listed on equity markets globally. Each (listed) entity is categorized according to their primary industry exposure, as measured by their core business activity and main source of revenue. IMIC is closely aligned with other global industry sector classifications and standards and the schema used within the iBoxx indices thus providing consistent sector classifications across equity and fixed income instruments, and issuers globally.

EMIX index rules and other methodology documents are available on the EMIX documentation page accessible here.

Further details on the composition of key EMIX indices are provided below.

For more information on IHS Markit's multi-asset indices, visit our product webpage.

_______________________

* Data on the EMIX World Indices is available starting from December 1997, in line with the base date for the main iBoxx corporate bond indices, which will help address investors' demand for centralized multi-asset indices.

** EMIX World Indices leverage a state-of-the-art platform, optimised for operational purposes and the development of custom indices. The index platform is data and methodology agnostic, allowing it to adapt to industry changes including changing regulatory requirements. In addition to the innovations listed above, the new engine provides many other features, such as flexible data consumption, highly automated operation and flexible methodology development that facilitates the design of sophisticated custom indices.