Institutional ownership data: Quantitative research results

Research Signals - June 2021

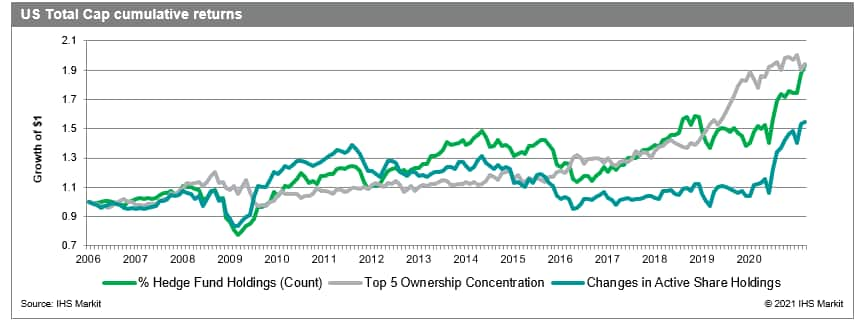

IHS Markit's Equity Point-in-Time Ownership data provides daily insights into global institutional and fund owned security positions, flow of funds and activity globally across developed and emerging markets. Ownership is sourced from 13Fs, global mutual funds, daily ETF holdings, annual reports, and major stakeholder exchange announcements for equity securities. We combine our Research Signals team's quantitative research capability with key elements of this proprietary data, specifically looking for factors that are drivers of stock price performance. In total, we introduce 17 factors capturing ownership concentration, changes in holdings, institutional and hedge fund holdings and liquidity flow ratios.

- Our research reveals varying effects of institutional ownership on stock returns across regions; for example, we find Hedge fund holdings was a positive signal across most developed and emerging markets, along with greater institutional ownership, particularly in the US and emerging Asia

- Closer inspection of rank correlations between three main ownership factors and key drivers from the Research Signals factor library suggests low commonality in general, with the exception of measures of large cap, high volume stocks with low borrowing costs in the securities lending market, demonstrating the uniqueness of the signals

- Using the ownership factors as an overlay with our Value Momentum Analyst Model, we demonstrate additional monthly alpha across developed markets in the US (9.1 bps), Europe (20.0 bps) and Pacific (5.0) regions

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.