iTraxx Series 32 Lifts Off

The iTraxx Europe and iTraxx Crossover indices started trading on September 20, 2019. The iTraxx indices are one of the most liquid fixed income derivates to gain or hedge exposure to the European investment grade and high yield credit markets. Given the transparent rules-based approach and constantly adapting to the evolving credit markets, these highly liquid indices also provide valuable insights into the credit markets.

iTraxx Europe Series 32

Following the recent index rule change, the iTraxx Europe index moved from fixed sector weights to fixed sector weight bands. The rule change allows all index sector weights, except Financials, to deviate by a maximum of 20% from the current sector weights. This establishes greater priority on including names with higher liquidity, while still maintaining the broad sector structure of the index.

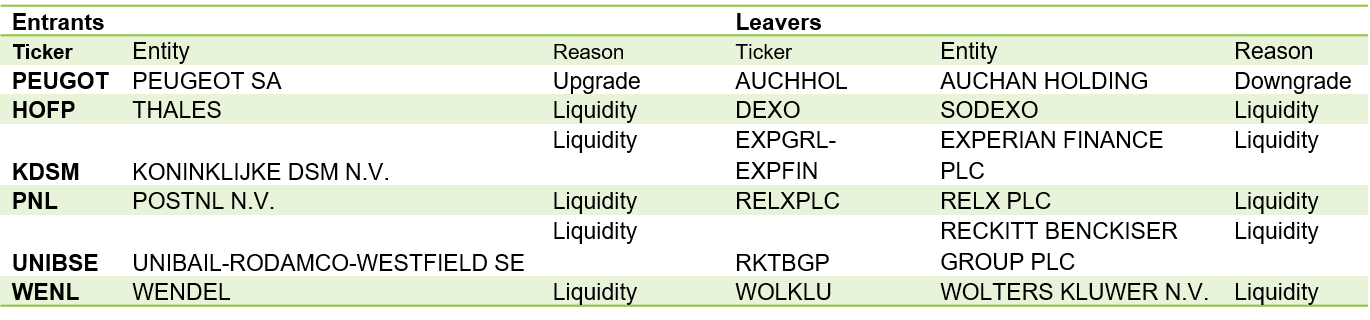

The Series 32 roll resulted in six constituent changes. Second to Financials, Autos & Industrials is the most liquid sector in the European investment grade CDS market. Due to the new feature of flexible sector weights, Series 32 saw five new entrants in the index added to the Autos & Industrials sector. From a liquidity perspective, the total average weekly notional traded of the five entrants is USD 123 million, compared to USD 35 million of the corresponding leavers (as per DTCC data). In addition, there was also the replacement of AUCHHOL with PEUGOT due to rating downgrade and upgrade respectively.

As a result of the rule change, the iTraxx Europe index will now consist of names with superior liquidity. With steady liquidity of the underlying constituents, the iTraxx Europe Series 32 will continue to be a strong instrument to track credit markets.

Summary of changes - iTraxx Europe Series 32 vs. Series 31

iTraxx Crossover Series 32

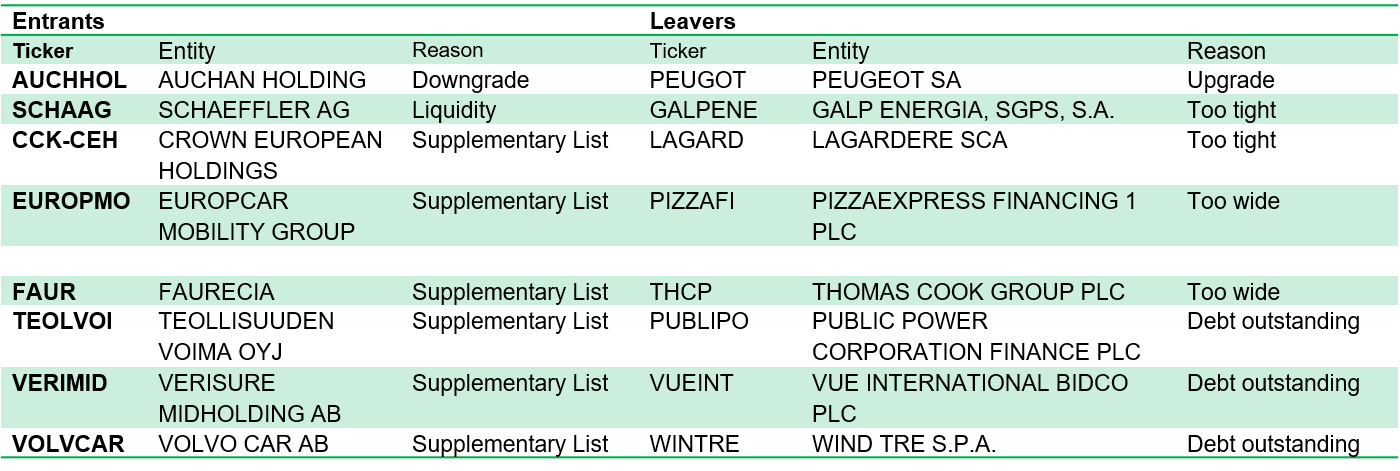

The iTraxx Crossover index noted several changes for various reasons. They are described as follows:

Trading too tight:

For unrated names, the iTraxx Crossover index stipulates a minimum spread cut-off of one and a half times the average spread of the forthcoming iTraxx Non-Financials index. Given the strong credit quality represented by the iTraxx Europe Non-Financials Series 32, the spread cut off was at 75 basis points, relatively tighter compared to 93 basis points and 99 basis points in the last two rolls respectively. This resulted in the exclusion of GALPENE and LAGARD which trade tighter than the said threshold.

Trading too wide:

The iTraxx Crossover index saw the exclusion of two distressed names PIZZAFI and THCP. The names were trading close to 69 points and 79 points upfronts respectively. As per the index rules, for an entity to be eligible for index inclusion, it must have an upfront no more than 50 points corresponding to a 500 basis points coupon.

Debt outstanding:

Three entities, namely PUBLIPO, VUEINT, and WINTRE, were dropped from iTraxx Crossover Series 32 as they no longer satisfy the minimum debt outstanding criteria. For an entity to be included in either iTraxx Europe or iTraxx Crossover, it must guarantee debt equivalent of at least EUR 100 million.

Supplementary List:

Six of the replacement entities for the exclusions noted above were chosen from the Supplementary List, which contains the largest debt issuers in the European High Yield market. The entities in the Supplementary List are names that currently do not trade in the CDS market. It may be interesting to note that more than half of the current iTraxx Crossover constituents were added via the Supplementary List over the years. Given the significant debt outstanding of the names chosen from the Supplementary List for index inclusion, we believe the six names included this roll could be valuable additions to the High Yield CDS market.

Summary of Changes - iTraxx Crossover Series 32 vs. Series 31

Post contributed by Srichandra Masabathula. For more information, visit ihsmarkit.com/products/markit-itraxx.html

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.