PUBLICATION

Feb 15, 2022

Malaysian banks bracing for a rebound post 2020’s dividend frugality

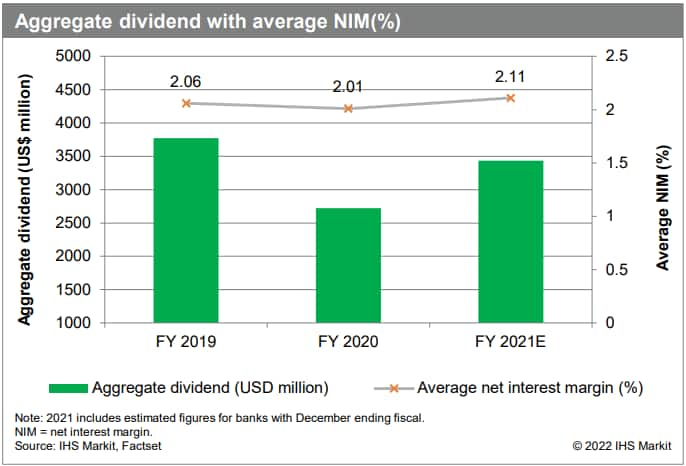

- With FY2021 year-end dividends to be announced in February 2022, IHS Markit expects Malaysian banking sector's aggregate dividends to increase by 26% in FY2021 year on year (y/y) to USD3.43 billion, after a 27.8% plunge in FY2020 due to COVID-19. The dividend payouts are forecast to grow 4.6% y/y in FY2022, supported by strong liquidity and capital buffers.

- However, there is a mixed picture for dividends in FY2021. AMMB Holdings decided to hold dividend payouts until the end of the year owing to cautious capital management, while CIMB Group, is expected to boost its year-end dividend more than threefold compared to last year. Maybank and Public Bank will continue to be the top dividend contributors.

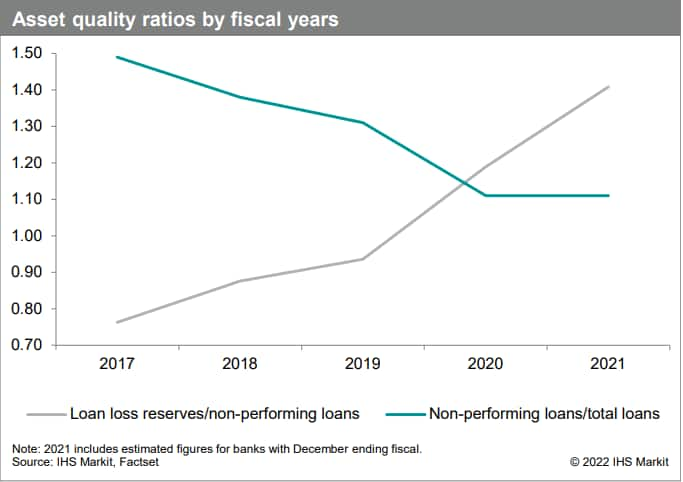

- Malaysian banking sector outlook for 2022 is stable as economic activity is expected to return to pre-pandemic levels, leading to more jobs and higher wages, as well as a gradual increase in interest rates that will help banks improve net interest margins and profitability. However, there are still uncertainties around the COVID-19 pandemic and prolonged supply chain disruptions, as well as natural disaster risks, such as flood.

- The upbeat trend is aligned with the regional sentiment across Southeast Asia. Banks from Thailand, Singapore and Indonesia are poised for steady growth for the new year. Banking dividends for all four markets are expected to rise by 9.25% on average in FY2022.

For more information, please contact dividendsapac@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysian-banks-bracing-for-a-rebound-post-2020s-dividend-frug.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysian-banks-bracing-for-a-rebound-post-2020s-dividend-frug.html&text=Malaysian+banks+bracing+for+a+rebound+post+2020%e2%80%99s+dividend+frugality+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysian-banks-bracing-for-a-rebound-post-2020s-dividend-frug.html","enabled":true},{"name":"email","url":"?subject=Malaysian banks bracing for a rebound post 2020’s dividend frugality | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysian-banks-bracing-for-a-rebound-post-2020s-dividend-frug.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Malaysian+banks+bracing+for+a+rebound+post+2020%e2%80%99s+dividend+frugality+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmalaysian-banks-bracing-for-a-rebound-post-2020s-dividend-frug.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}