Most shorted ahead of earnings: Carbo Ceramics, Euronav and Monotaro

We reveal how short sellers are positioning themselves in companies announcing earnings in the coming week:

- Carbo Ceramics remains a popular short

- Euronav demand spikes on merger announcement

- Declining demand for most shorted Asian stocks

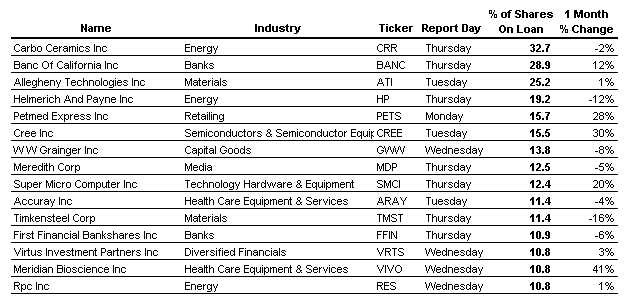

North America

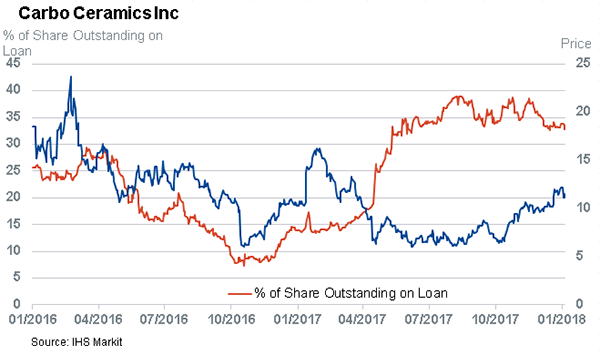

Carbo Ceramics has been a popular short for over a decade, and it’s certainly been a wild ride. The share price peaked at $172 in July 2011, then fell to $63 in September 2012 ─ then moved back up to $150 in July 2014, before descending to a low just over $6 in June 2017.

When Carbo reported worse than consensus Q117 EPS on March 27th, shares plunged more than 26% in a single day, and short sellers reacted by doubling their short positions ahead of Q2 earnings on July 27th. While there was a negative reaction to the firm’s inability to meet expectations and move toward a net profit in Q2 and Q3, the reaction has become more muted.

After the Q3 numbers were reported on October 27th, shares fell more than 4% to $6.6, but they recovered the following day, and have since traded above $11. Short demand has consistently remained between 30-40% of outstanding shares since surging in Q217 ─ but it’s worth noting that demand is currently at the lower end of that range ahead of Q4 reporting on January 25th.

Petmed Express ─ a provider of prescription medicines for dogs and cats ─ has seen a marked increase in short demand over the last month; more than 15% of its shares are currently out on loan. Short sellers are expecting a different result from the firm’s last earnings announcement, which sent shares up 18%. However, contrary to this assumption, IHS Markit Research Signals currently ranks Petmed the highest short squeeze stock.

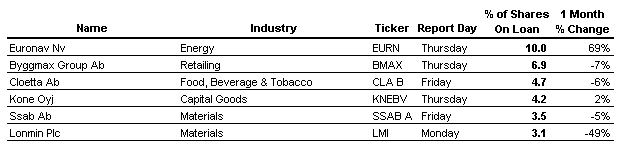

Europe

Short demand for Euronav spiked after the oil tanker firm announced a merger with Gener8 Maritime on December 21st. The increased demand is likely due to arbitrageurs betting that the offer premium to the current Gener8 price will collapse if the merger is finalized.

On the other hand, there was a marked increase in short demand for both firms in the 12 months prior to the announcement. Euronav struggled to turn a profit in a challenging environment for tanker firms, but analysts expect a smaller operating loss in Q4.

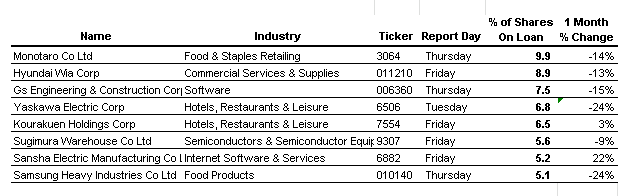

Asia

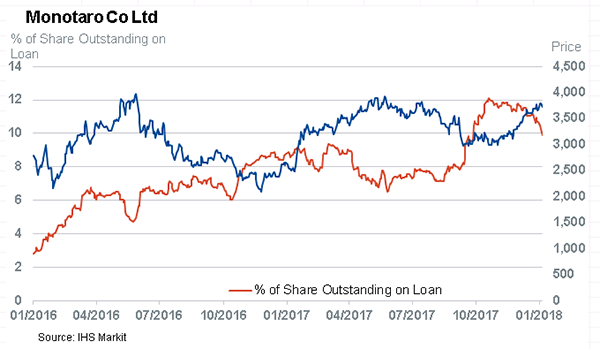

Monotaro, the Japanese e-commerce seller of industrial parts, has had declining short demand ahead of their earnings announcement on January 25th. Short demand remains elevated at 9.9% of outstanding shares, but that’s down from the 52 week high of 12%, which hit after they reported Q3 earnings. Shares have since rallied more than 20% since then, while shorts have trimmed their positions.

The declining demand for Monotaro is emblematic of the short covering themethat we are seeing across the most shorted stocks in Asia with earnings announcements this coming week.

Samuel Pierson, Securities Finance Analyst at IHS Markit

Posted 22 January 2018

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.