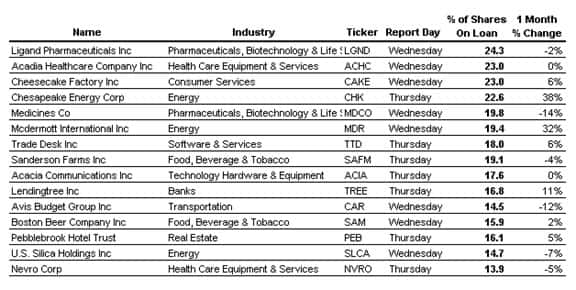

Most shorted ahead of earnings: Ligand Pharma, Chesapeake Energy & Independence Group

We reveal how short sellers are positioning themselves in companies announcing earnings in the coming week:

- Pharma and Energy in sights for US short sellers

- Shorts take another look at Distribuidora Inter de Alimentacion

- Australian firms attract additional short demand

Americas

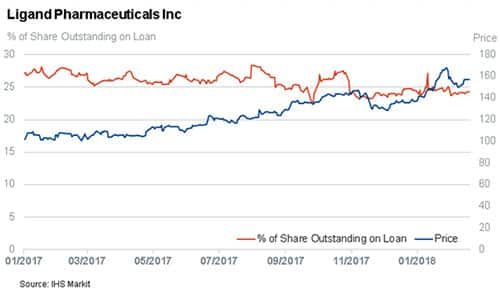

Ligand Pharmaceuticals has long been a short target, with more than 24% of outstanding shares short, however there has been little change in positioning year to date. While the share price increased 48% over the last 12 months, short sellers covered a little on the margins, but the notional short position is up 30% in that time, currently just above $800m.

The largest increase in short demand ahead of earnings is seen in Chesapeake Energy, which saw short demand increase by a third to 22% of outstanding shares. With the stock already down more than 30% year to date, short sellers are betting there’s more profit to be had.

Mimedx Group originally expected to report earnings this week, however they announced they will delay reporting, which sent shares into a tailspin (down more than 30% intraday). With more than 34% of outstanding shares short, this was a most welcome development for a large and vocal contingent of short sellers.

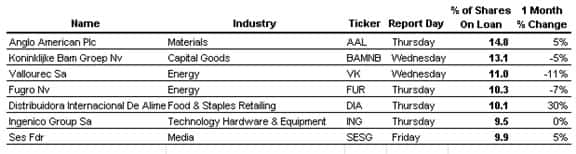

Europe

Short demand for Anglo American has increased nearly seven-fold over the last year, and currently sits just below 15% of outstanding shares. That is largely the result of an arbitrage trade opportunity which was created when London-based billionaire Anil Agarwal issued bonds to fund a 20% stake in Anglo American – so the demand from outright short sellers is far below the disclosed short balances.

Short sellers have taken another look at Distribuidora Inter de Alimentacion, whose shares recently hit a 6-year low. Short demand is currently 10% of shares outstanding, up from 7% at the start of 2018, though still well below the high of 25% observed in July 2017.

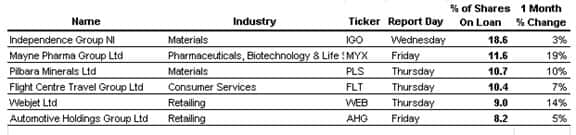

Asia

Australia firms make up all of the region’s firms seeing high short interest ahead of their earnings this week. In fact, all of these firms Down Under have seen an increase in short demand over the last month. Nickel and copper miner Independence Group sees the most short interest among these firms, currently 18.6% of outstanding shares. Short demand has nearly tripled in the last 12 months, from below 5% of shares outstanding at the start of 2017.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.