Muni Monthly Summary - August 2019

Following is Tozar Gandhi's Monthly Municipal Bond Market update for month ending August 2019, featuring contributions from our own Jan Hansen of IHS Markit's Municipal Bond Pricing team. The below views were snapped via our Price Viewer portal.

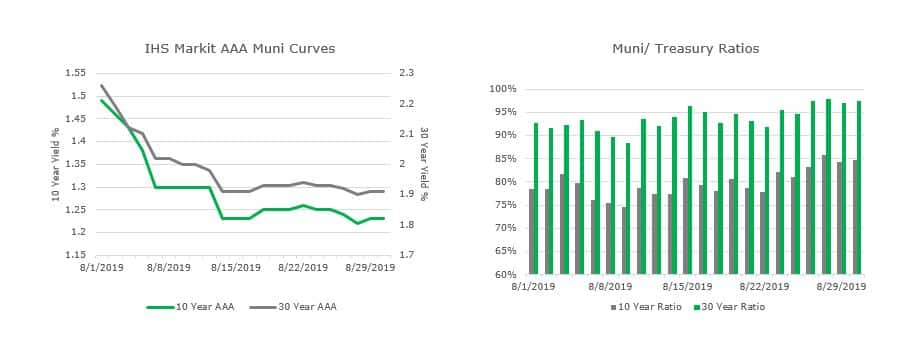

- Muni yields continued to decrease, but not as much as treasury yields

- Muni Treasury Ratios increased during the month

- Taxable municipal spreads widened 8 to 10 bps

- Longer dated bonds performed better than shorter term/ intermediate term bonds

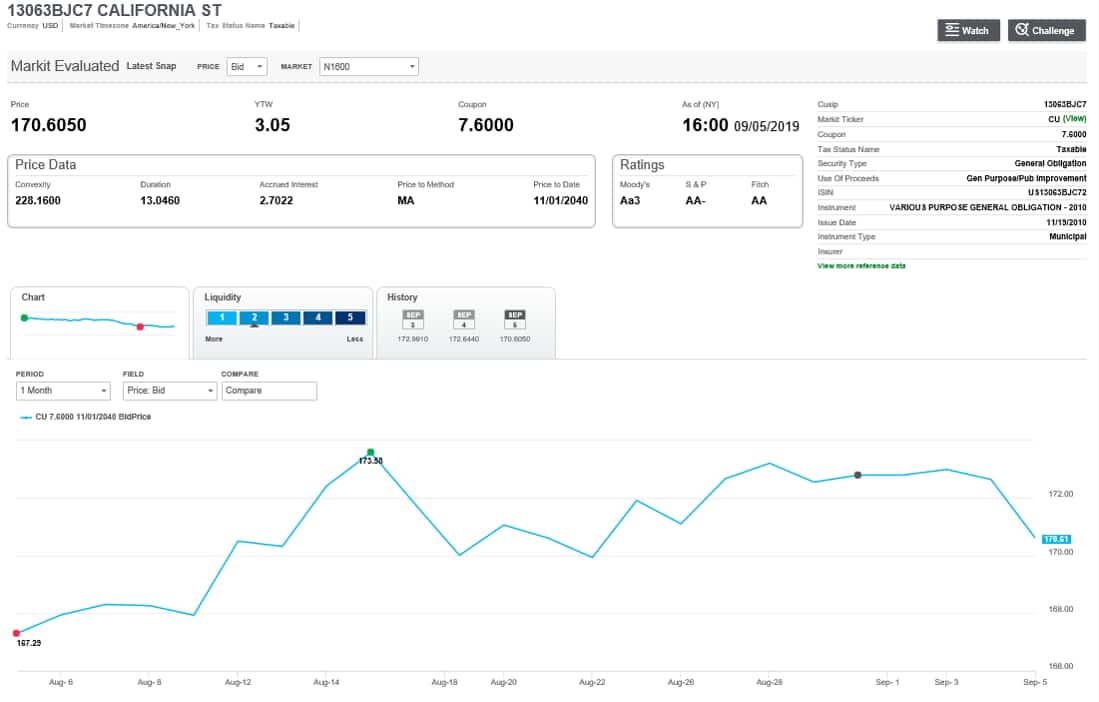

California taxable bond spreads widened

Spread on the bond increased from 85 bps to the 30 Year UST on July 31, 2019 to 99 bps on August 31, 2019. Despite the spread widening of 14 basis points, the bond returned 6.26% on account of coupon income and price appreciation during August 2019.

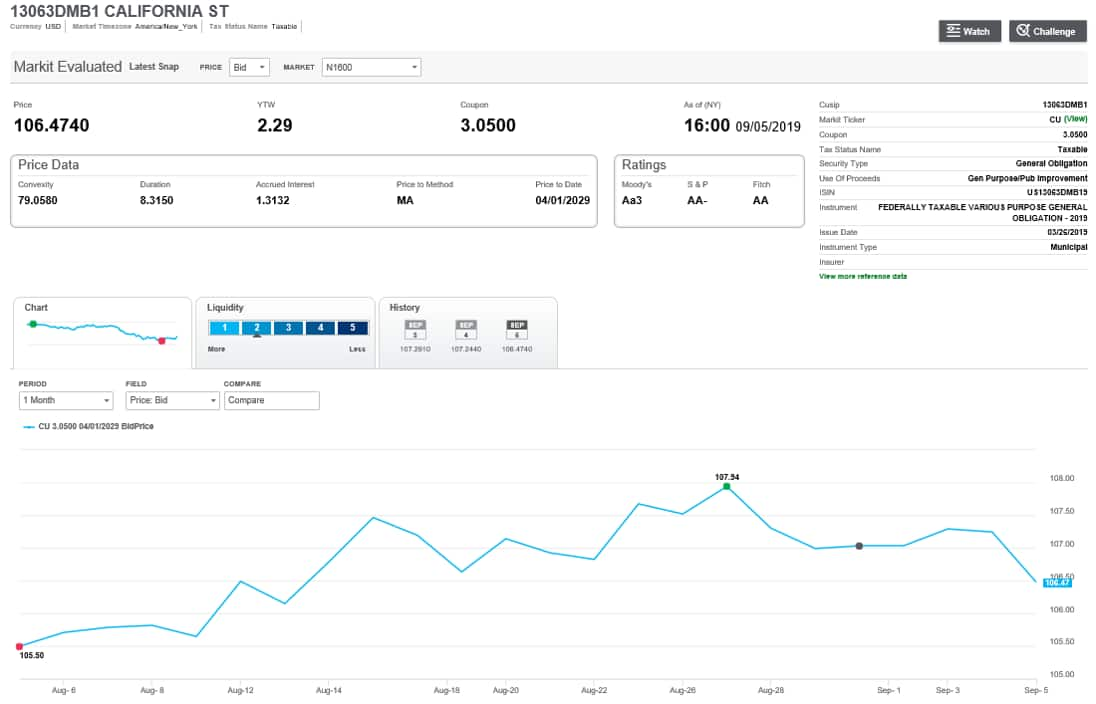

California taxable bond spreads widened

Spread on the bond increased from 59 bps to the 10 Year UST on July 31, 2019 to 73 bps on August 31, 2019. Despite the spread widening of 14 basis points, the bond returned 3.46% on account of coupon income and price appreciation during August 2019.

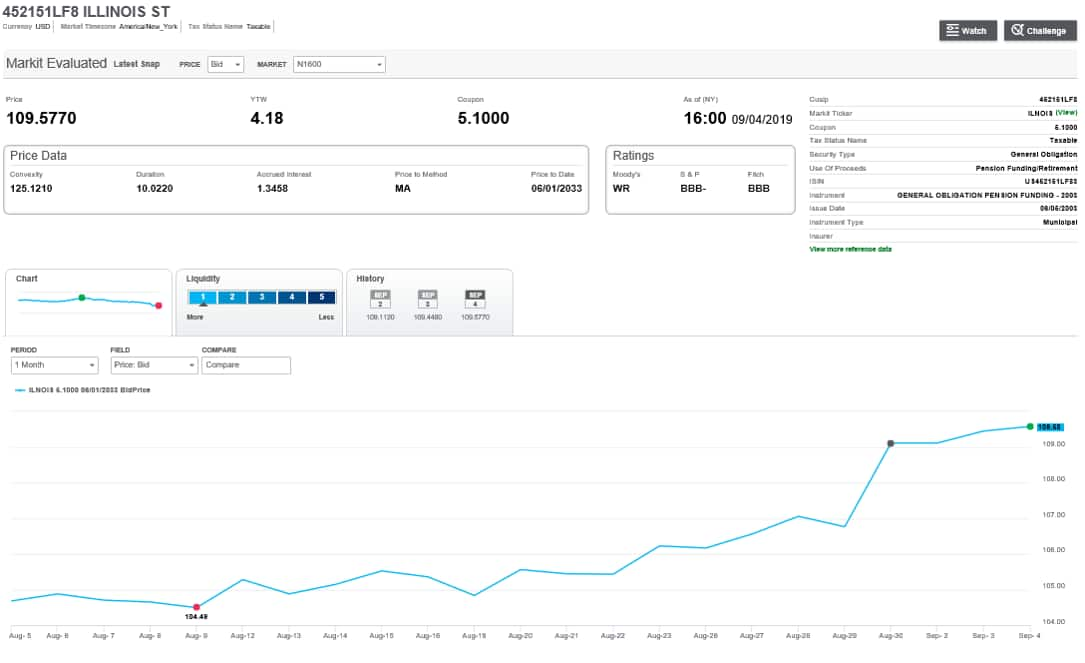

Illinois taxable spreads tightened on account of court ruling

Spread on the bond tightened from 267 bps to the 10 Year UST on July 31, 2019 to 249 bps on August 31, 2019. Along with the spread tightening of 18 basis points, the bond returned 6.11% on account of coupon income and price appreciation during August 2019. Source: Price Viewer

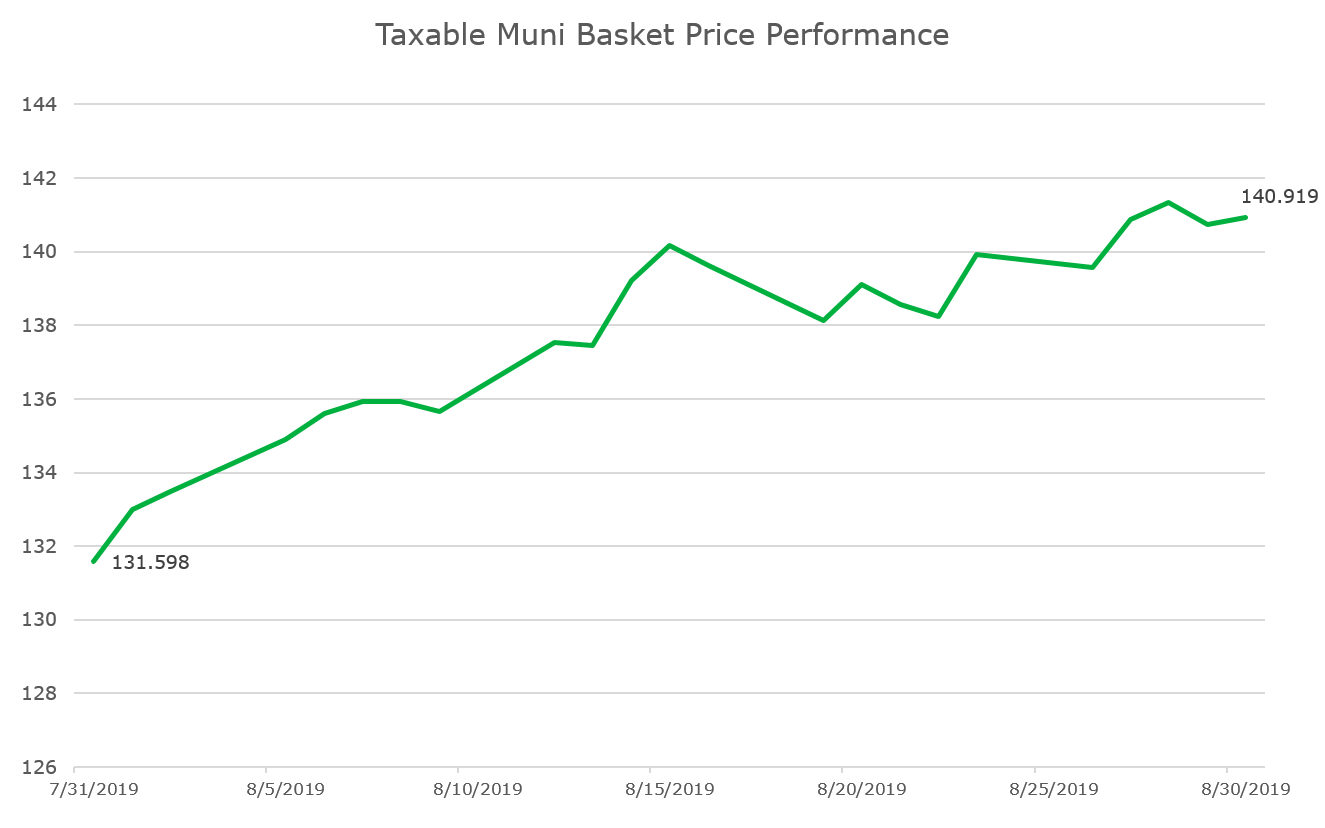

The above chart shows the price performance of a basket of 150 Taxable Municipal bonds for August 2019.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.