Muni monthly summary - November 2019

In this month's blog we review how low interest rates have been a big factor in fueling an increase in Taxable muni issuances for refunding Tax Exempt Muni bonds.

- Low interest rates help muni issuers in refund higher coupon tax exempt bonds with proceeds of lower coupon taxable bonds

- There were more than 200 taxable issues in November 2019 totaling more than $11.75 billion of which there were 140 refunding deals for more than $8.75 billion

- The education sector led taxable issuances with 93 deals of which 67 were refunding deals

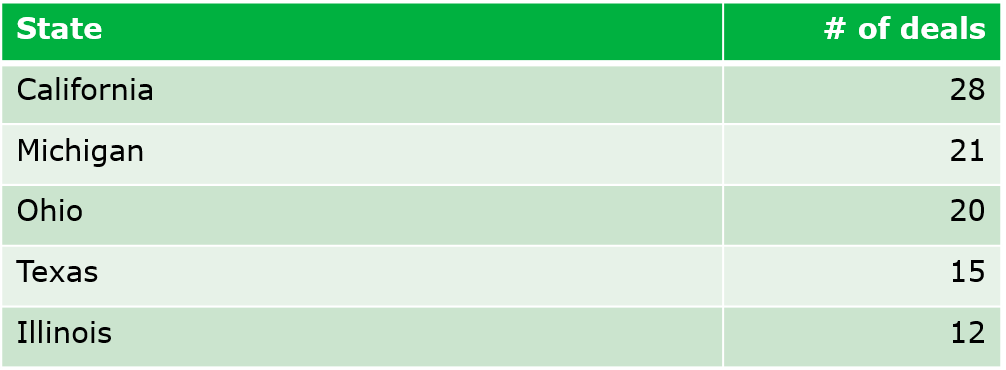

Top 5 states by number of deals were

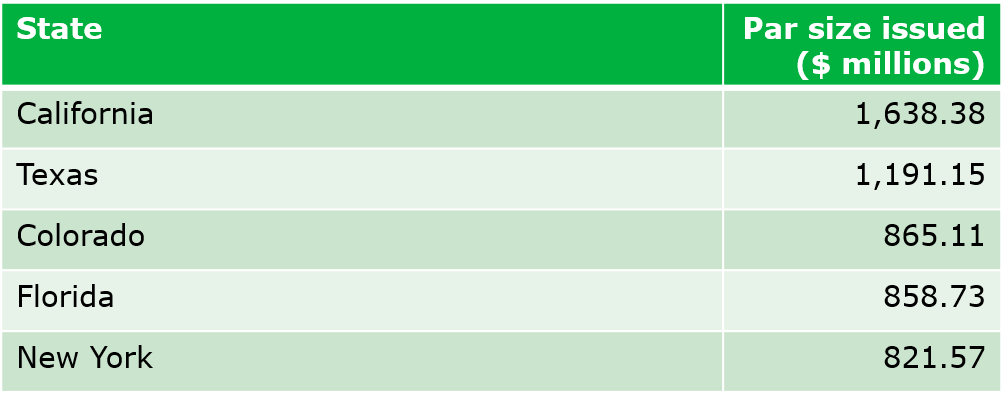

Top 5 states by number of par size issued for refunding were

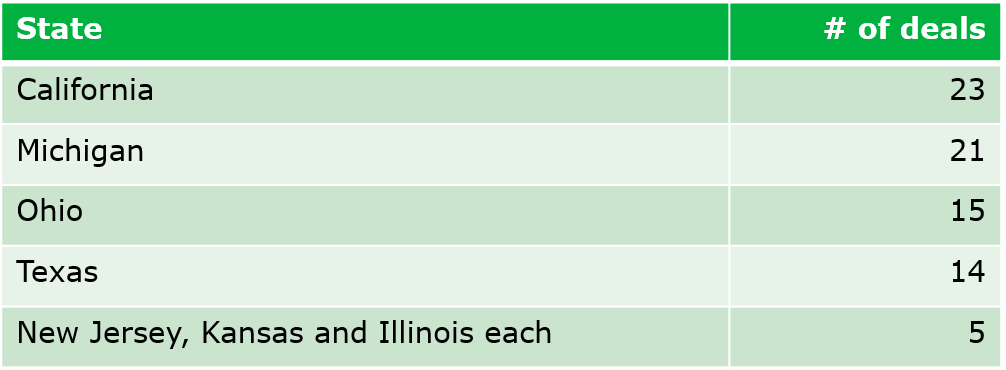

Top 5 states by number of refunding deals were

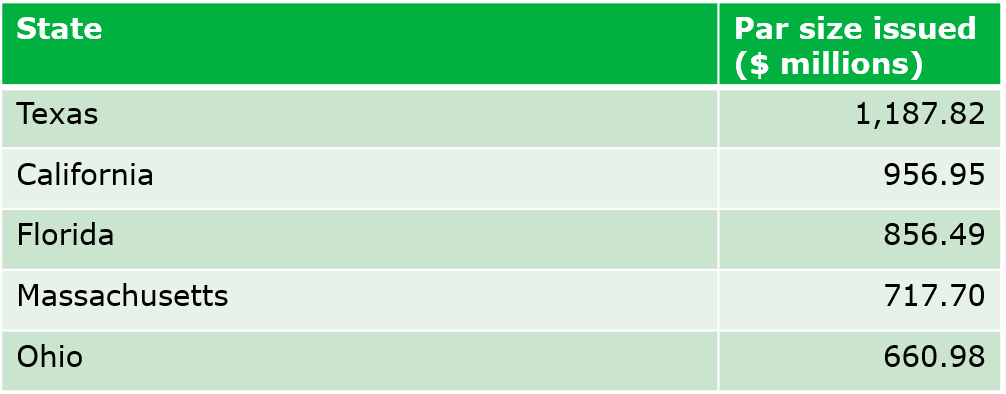

Top 5 states by par size issued for refunding were

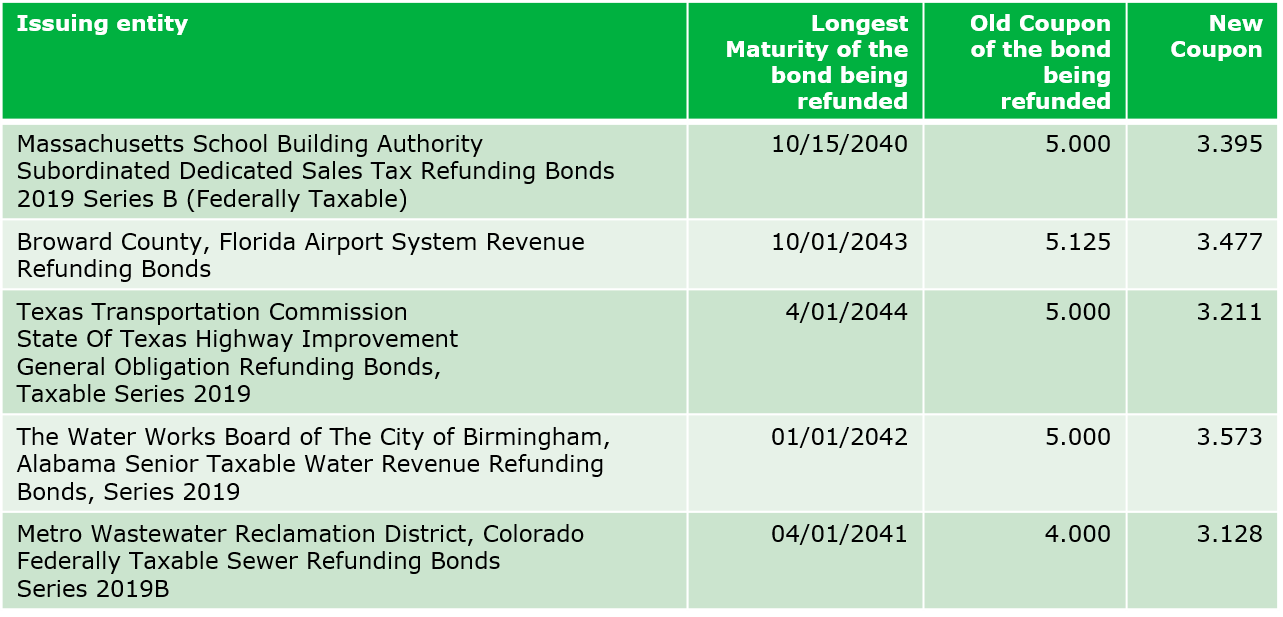

Projected savings for issuers of some of the refunding deal in November 2019

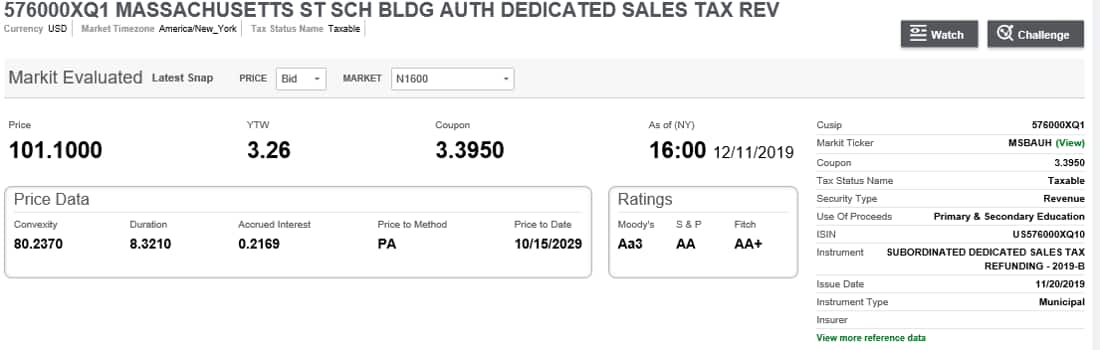

New Issue

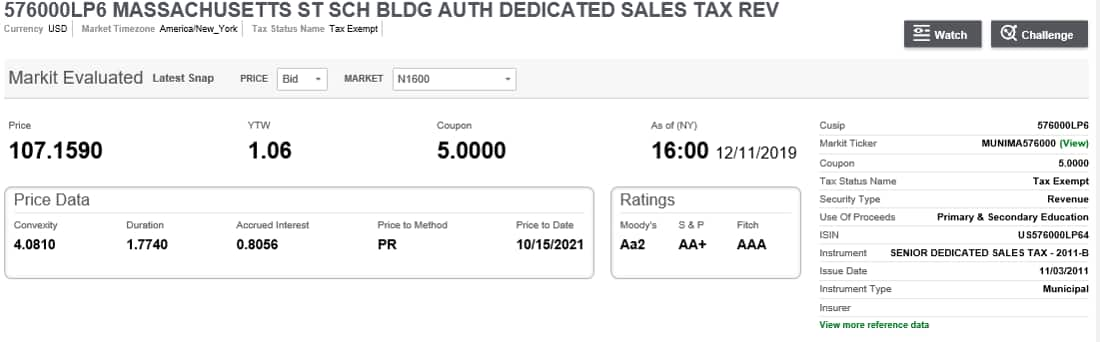

Older issue being refunded

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.