Municipal Bonds - April 2019 Highlights

Leveraging our Price Viewer portal, IHS Markit's Tozar Gandhi has highlighted the following April 2019 observations of the Municipal Bonds Market, including a year to date look at the 10 and 30-year Muni AAA, rallies in Puerto Rico General Obligations, PREPA and First Energy bonds, and a view of the Virgin Trains USA Passenger bonds issued at the start of the month.

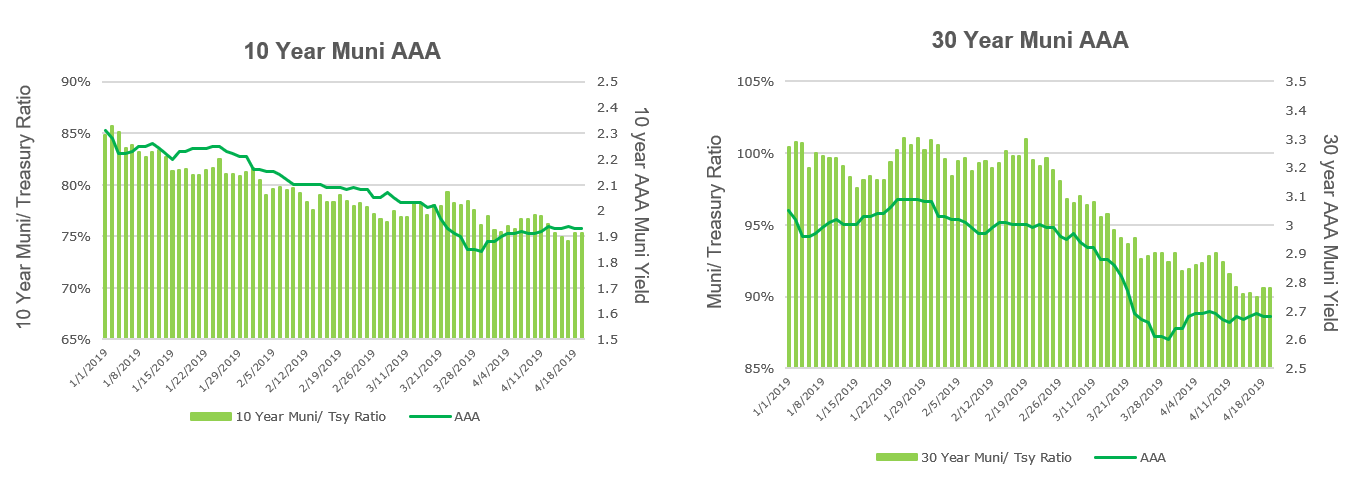

Municipal Bonds YTD

- Municipal bonds continue to rally in 2019

- 10 year AAA yield compressed

- 2.31% on January 1, 2019

- 1.92% on April 22, 2019

- The 10 Year Muni/Treasury Ratio reduced

- 84.86% on January 1, 2019

- 74.13% on April 22, 2019

- 30 year AAA yield compressed

- 3.05% on January 1, 2019

- 2.67% on April 22, 2019

- The 30 Year Muni/Treasury Ratio reduced

- 100.41% on January 1, 2019

- 89.30% on April 22, 2019

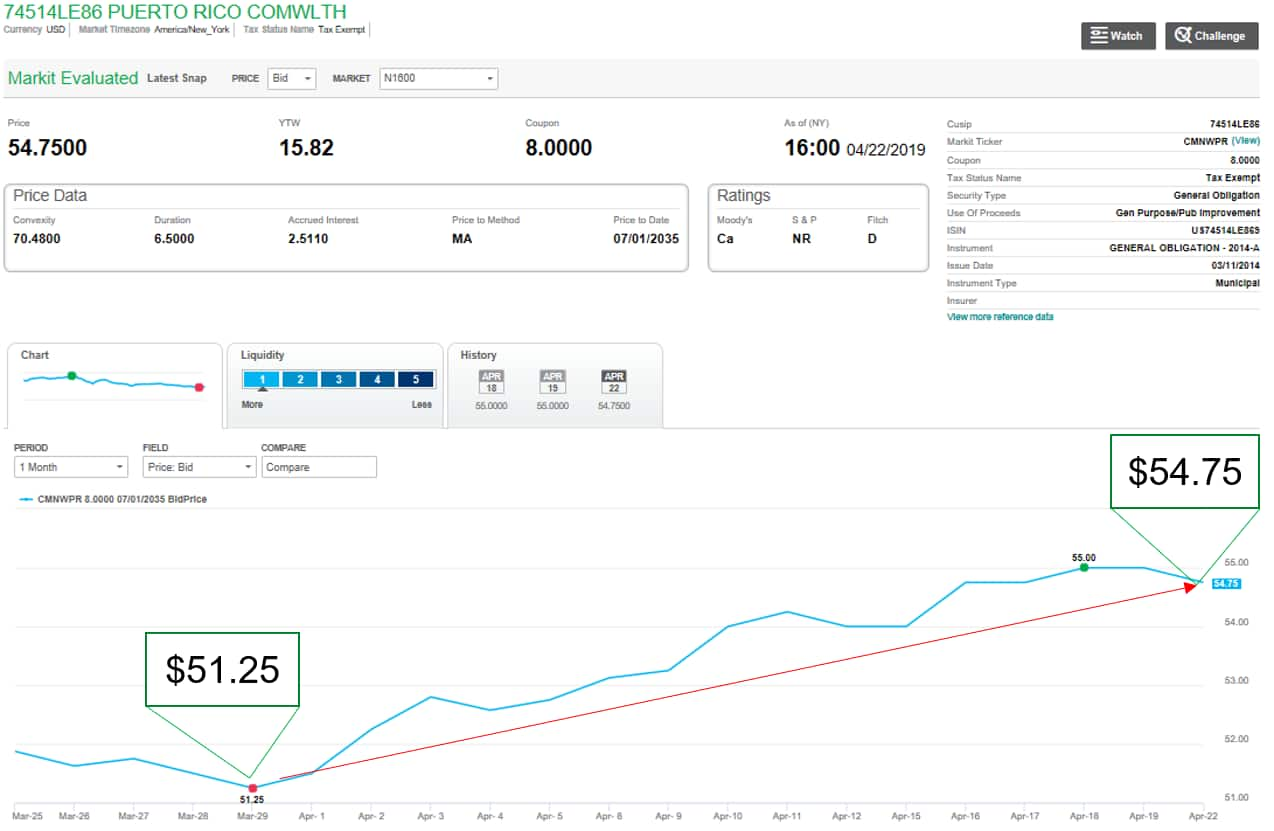

8% Puerto Rico General Obligation bonds due in 2035 rallied in April 2019

- $51.25 on March 29 2019

- $54.75 on April 22 2019

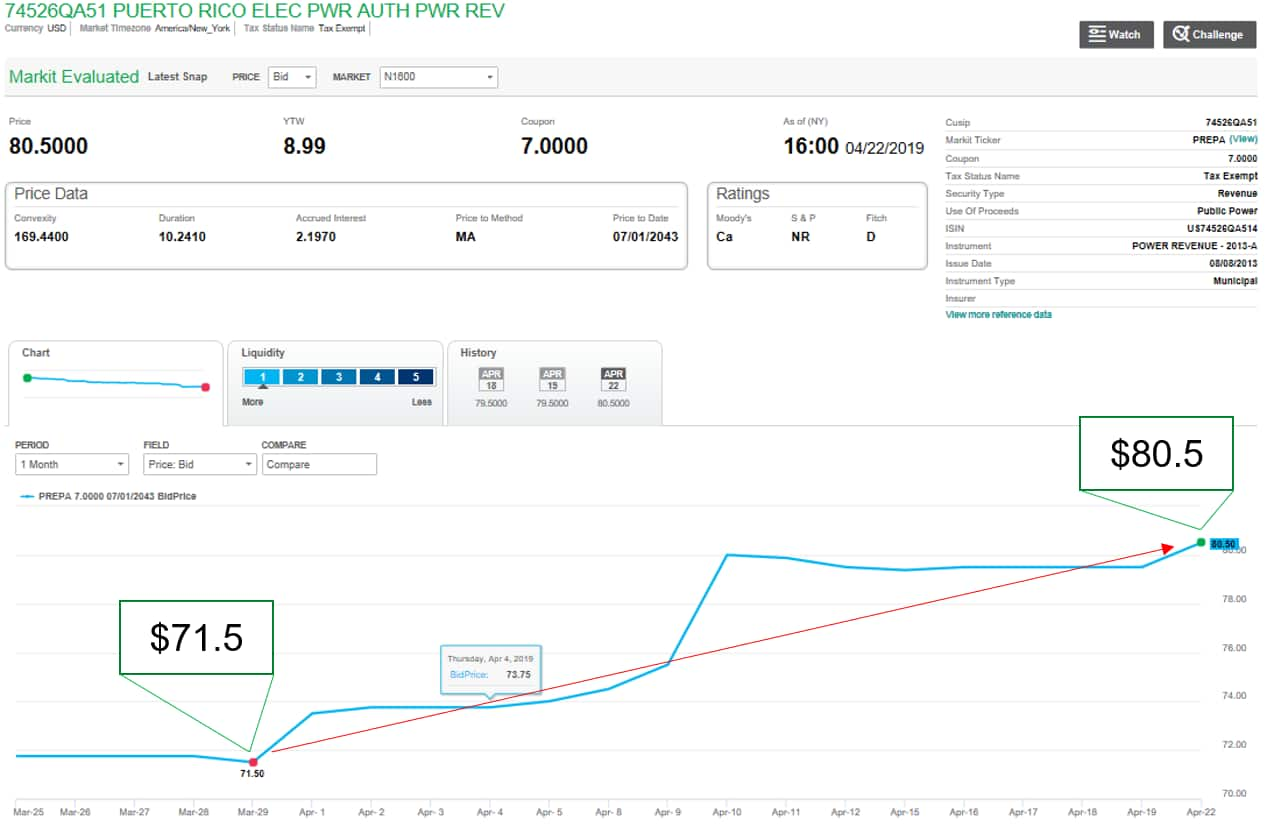

PREPA bonds rally

- $71.5 on March 29 2019

- $80.5 on April 22 2019

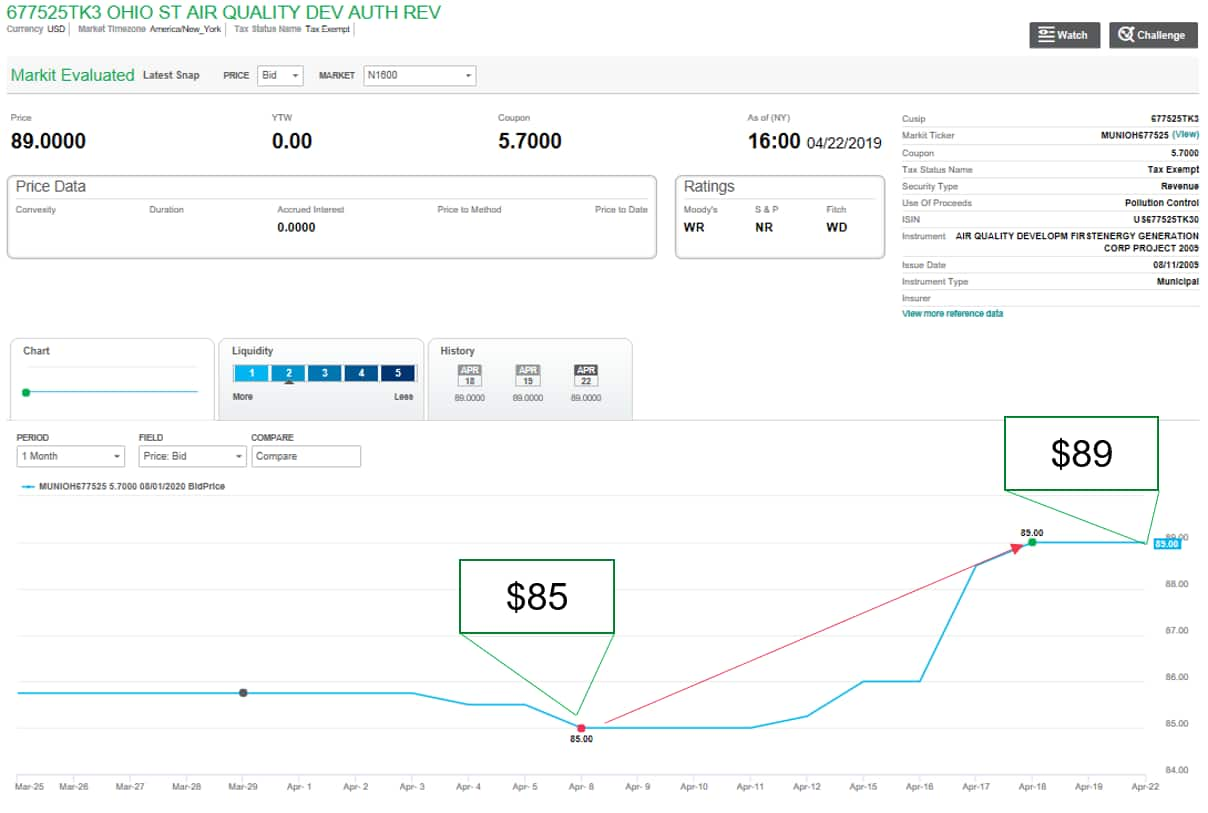

First Energy bonds rally in April 2019

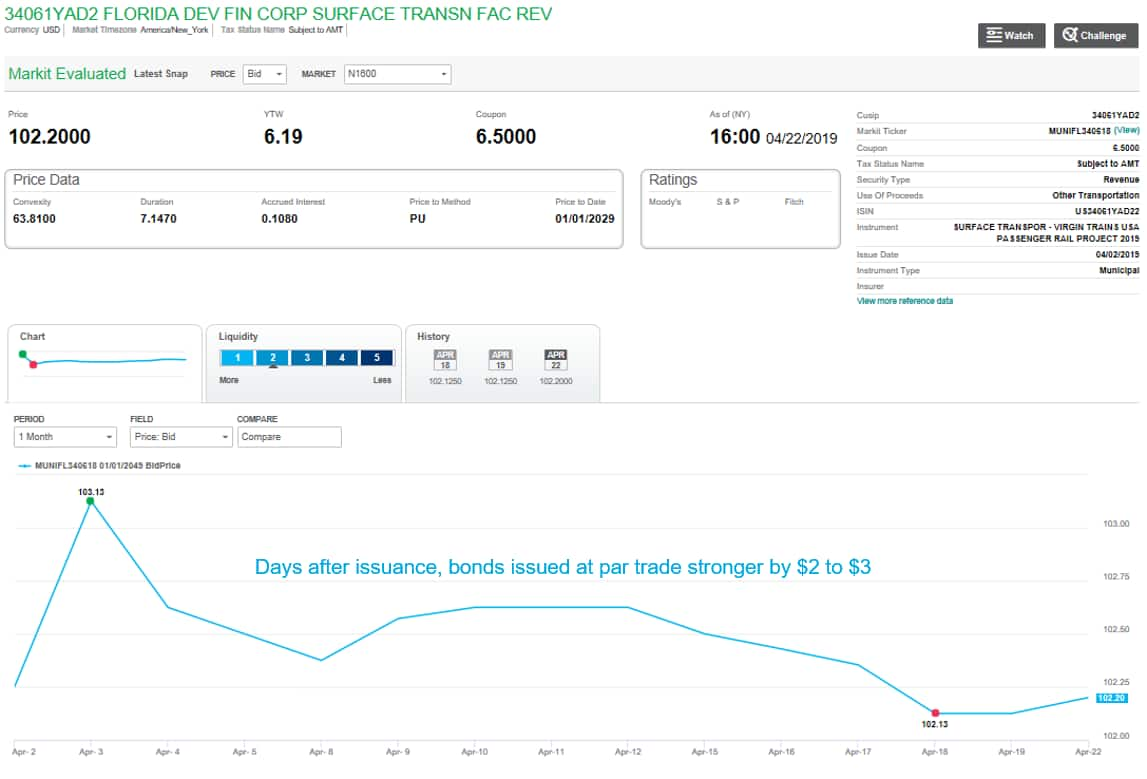

$1.75 billion Virgin Trains USA Passenger bonds issued at the

beginning of April 2019

Municipal Bond Pricing Data

IHS Markit delivers prices for more than 1.1 million municipal bonds daily - including tax-exempt investment grade, high yield and taxable municipal bonds. We source data from our parsing technology and from the Municipal Securities Rule Making Board (MSRB) feed directly into our pricing engine to quickly update municipal bond prices. Our pricing methodology accounts for the financial condition of each state and municipality, uses of proceeds, and issue-level factors that drive price movements, regardless of the credit rating. In addition to tracking bond prices in real time, you receive value-added metrics and liquidity scores. Learn more.