Municipal Calendar Week of December 13th 2021

Calendar Week of 12/13/2021

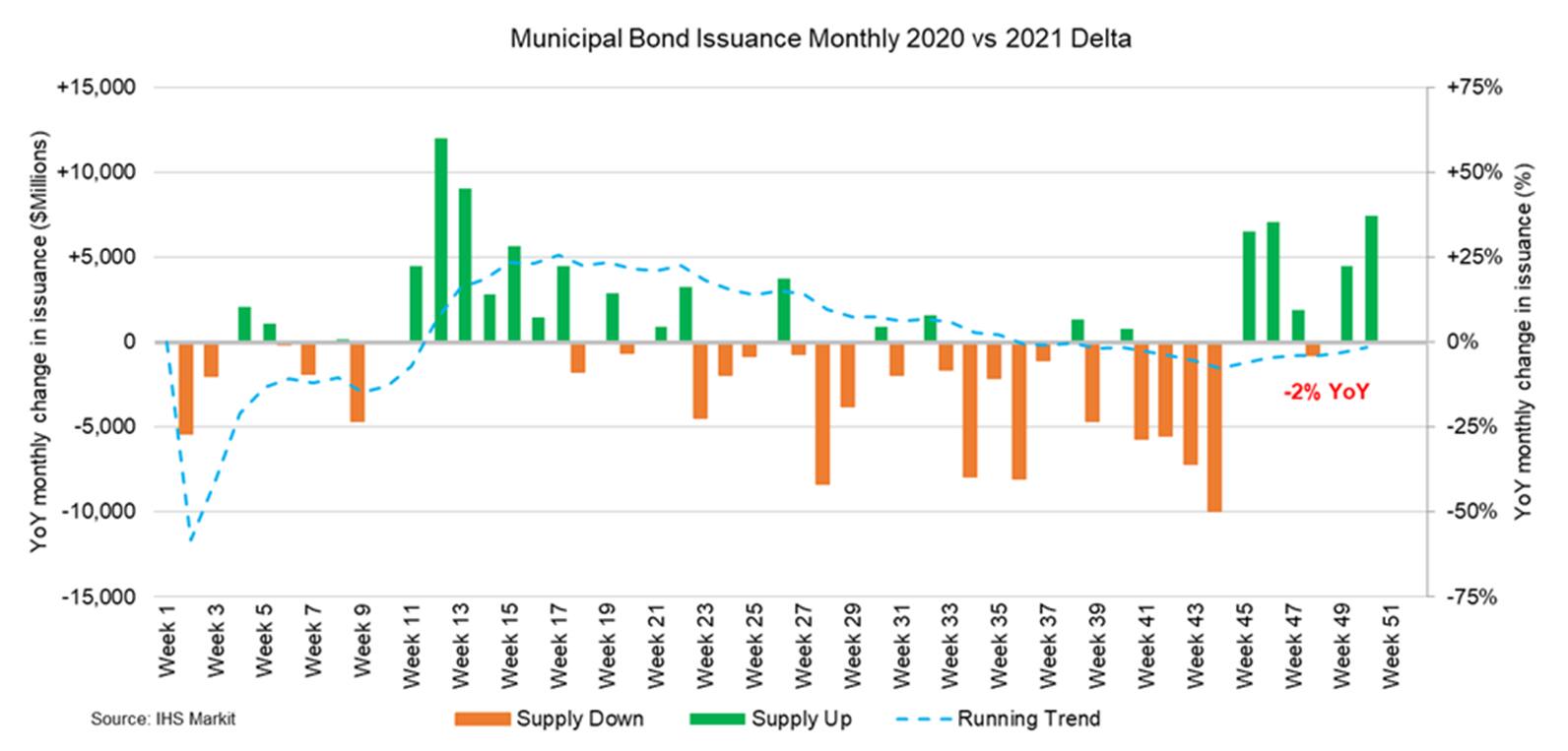

Pricing activity across the primary market peaked over the course of last week after issuers eagerly financed new issue deals ahead of the new year, with a high level of motivation to take advantage of current borrowing levels given recent economic reports. Institutional and retail accounts continue to put cash to work across various state and local credits amidst record levels of inflation after the consumer price index climbed to +6.8%, returning to levels witnessed during the beginning of the 1980s. Surprisingly, last week's economic update fell in-line with overall street projections, resulting in markets rallying into the end of the week as investors feared national inflation levels would surpass 7%+ given the vast amount of economic challenges present across the nation. Given the volatility registered throughout recent months, municipal bonds continue to serve an important role as a safe-haven for investors seeking to house capital outside of US treasuries, which typically undulate with inflation expectations as a result of diminished purchasing power. Following last week's CPI report, treasuries retreated slightly into the close of the week, with investors directing focus towards the upcoming FOMC meeting which is set to take place across two days as the market awaits further guidance on the potential acceleration of asset repurchasing, paired with rate hike projections to combat surging inflation figures into the new year. Muni benchmarks displayed nominal movements over the course of last week despite cross currents across macro markets with cuts of 1bp registered in the short end coupled with no changes in the intermediate and long end of the curve after markets digested the latest economic updates. Muni/UST ratios remained steady following nominal movements in rate activity with the 10YR ratio hovering at 70% and 30YR posting 81% as investors seek opportunistic entry points to deploy capital across various credits in an effort to realize higher yield returns across specified durations. Performance over the course of recent months has been impressive, with three out of the past six weeks posting 25%+ gains as compared to levels registered during 2020, with December performance already peaking at +44% YoY or $30Bn+ of activity witnessed throughout the first two weeks of the month. As the market approaches the final weeks of the year, annual performance is on target to fall several percentage points below last year's historical level of ~$500Bn, highlighting the success and resiliency of the municipal capital markets for all state and local issuers involved.

Demand for muni bonds continues to run high, with state and local governments providing buyside accounts a wide array of new issue par size after last week's calendar supplied $20Bn of new issue paper, marking the largest weekly calendar of the year, and outpacing the weekly average by ~200%. The Golden State Tobacco Securitization Corporation took charge of last week's negotiated calendar, selling a combined $4.2Bn of tobacco settlement bonds with maturities spanning 06/2022-06/2066 after investor interest suppressed yields by ~12bps in the series 2021B-2 tranche, supplying a 3.75% YTM in the long-dated 2066 maturity. The Massachusetts Water Resources Authority (Aa1/AA+/AA+) also tapped into the negotiated arena to price $687mm of green general revenue refunding bonds across 08/2022-08/2044 with noteworthy bumps ranging from 5-15bps with the greatest yield reduction noted in the short end of the curve, with the 2026 maturity facilitating a 1.41% yield, or +15bps off the 5YR UST. This week's calendar is slated to wind down ahead of upcoming Holidays with $8.4Bn pricing across 176 new issues with the State of Connecticut (Aa3/A+/AA-/AA) leading this week's negotiated calendar to sell $800mm of state general obligation bonds presenting a social bond designation, with maturities spanning 01/2023-01/2042, senior managed by Barclays. The New York Liberty Development Corporation (-/A+/A+/-) will also tap into the negotiated arena to price $641mm of revenue refunding bonds with maturities spanning 02/2041-02/2044, with the greatest par size noted in the 2044 maturity ($236mm). This week's competitive calendar will span across 60 new issues for a total of $472mm, led by the City of Gresham, Oregon auctioning $39mm of national guard museum project bonds, spanning across 06/2029-06/2048 and selling on Wednesday 12/15.

Negotiated ESG Offerings Week of 12/13/2021:

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.