Municipal Calendar Week of February 21st Presidents Day Holiday

Calendar Week of 02/21/2022

New issue activity will remain subdued over the course of the holiday-shortened week as market players navigate fluctuations in rates coupled with greater volatility across the macro markets. Rising geopolitical tensions fueled by a Russia-Ukraine conflict has sparked concerns among investors, triggering a flight to safety after treasuries rallied into the close of last week. The potential for catastrophic overseas conflict coupled with climbing inflation levels across the nation has shifted investor perception and outlook towards primary market activities. As cash on the sideline expands, investors continue to narrow down purchases of new issue paper during windows of opportunity, a challenging task given the wide fluctuations in benchmarks over the course of the new year. Muni yields bear flattened over the course of last week by 1-9bps, lagging the movement across treasuries with the 10YR ratio settling at 85%, climbing 300bps higher from the week prior as the 30YR remains unchanged at 90%. As credit spreads fluctuate and state and local governments evaluate market conditions, mutual funds have witnessed polarized movements as demand for sub investment grade credits oscillate and cash deployed towards short term durations ascends due to the uncertainty of rate momentum. While the market prepares for a rate hike in March, investors in search of higher returns are set to step up to the plate and take down paper in an effort to ladder their portfolio and mitigate diminished performance driven by rising inflation figures. Looking ahead, market participants will continue to monitor evolving market conditions amidst the lack of new issue supply triggered by greater uncertainty surrounding the trajectory of national economic success, monetary policy and the potential for war in Europe.

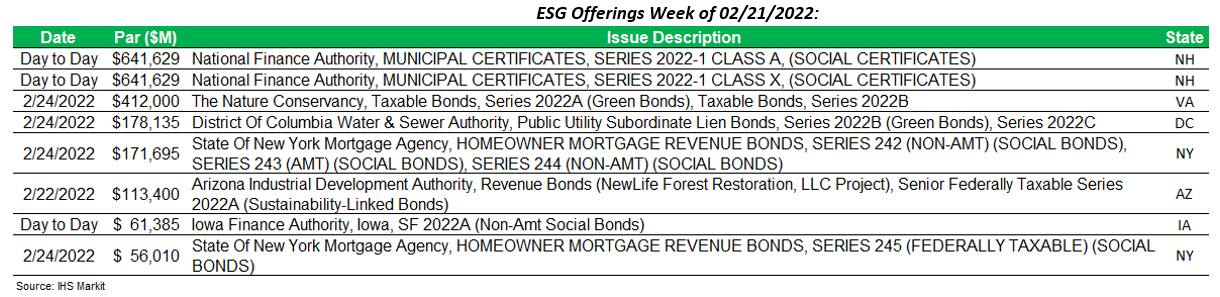

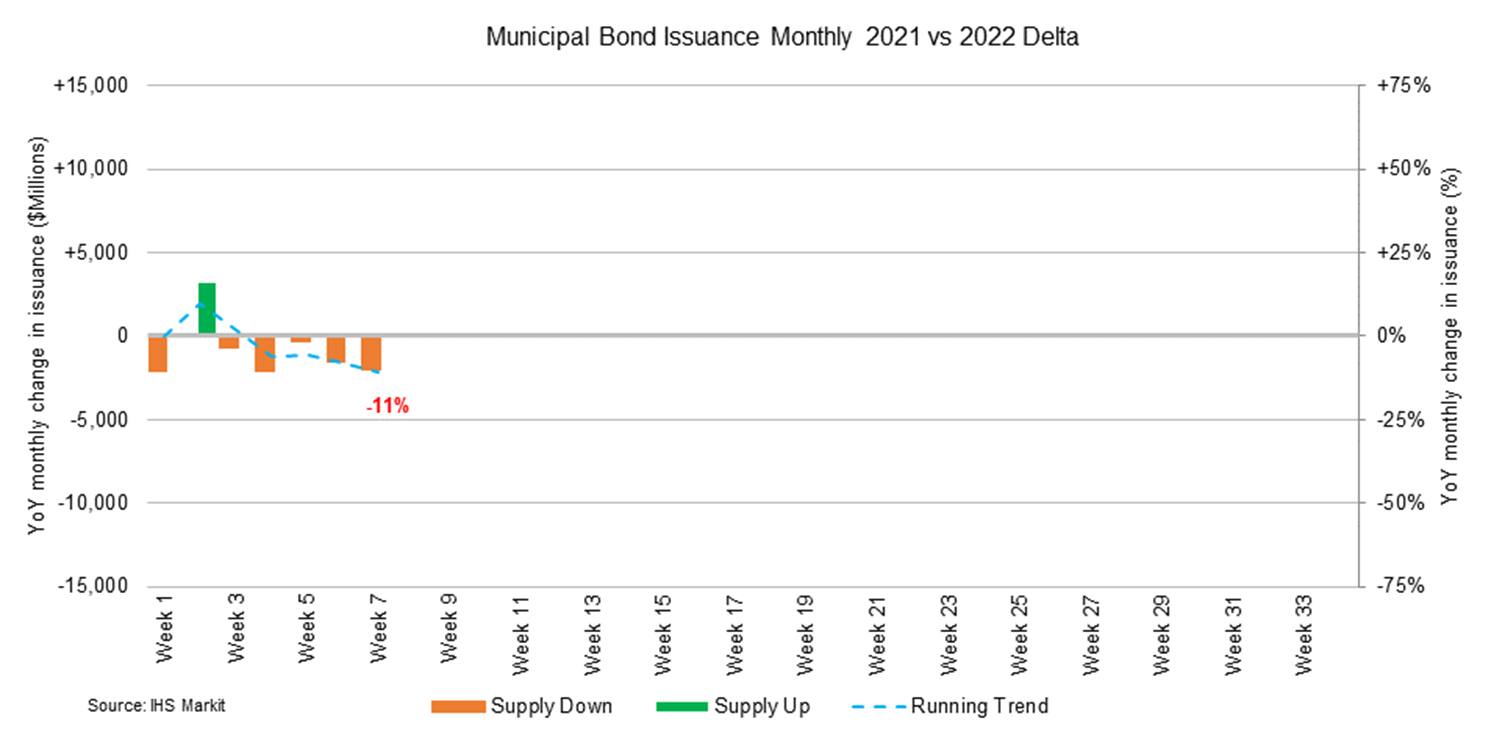

Primary volume was muted ahead of the Presidents Day Holiday weekend with last week's calendar supplying $4.6Bn of deals, with the majority of par size located in the long end of the curve. The University of Washington (Aaa/AA+/-) experienced mixed investor demand, with bumps of 5bps noted in the short end paired with cuts of 5bps across the intermediate range of the scale with the greatest yield housed in the 2041 maturity at 3.35%. The Pennsylvania Housing Finance Agency (Aa1/AA+/-) also tapped into the negotiated arena last week to price $207mm of revenue bonds spanning 10/2022-10/2052 with investor demand suppressing yields across the scale with the 2042 maturity falling +106bps off the interpolated MAC. This week's holiday-shortened calendar will supply $5.4Bn across 172 new issues with $2.4Bn of day-to-day deals as issuers remain on the sideline given the heightened level of volatility across the primary arena and beyond. The Virginia Small Business Financing Authority (Baa1/-/-/BBB+) will lead this week's negotiated calendar to sell $304mm of senior lien revenue and refunding bonds across 06/2038-12/2057, presenting opportunity for sub-investment grade focused investors; selling on Thursday 02/24 with JP Morgan as lead manager. The District of Columbia Water & Sewer Authority (Aa2/AA+/AA) will also tap into the negotiated market to sell a combined $367mm across two tranches with maturities spanning 10/2022-10/2051 with a portion of the bonds carrying a green bond label; selling on Thursday 02/24 and senior managed by Goldman Sachs. This week's competitive calendar will span across 94 new issues for a total of $2Bn, led by the Gwinnett County School District of Georgia (Aaa/AAA/-) auctioning $230mm of general obligation sales tax bonds across three maturities (08/25-08/27) on Thursday 02/24.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.