Perspectives on the value-growth cycle

Research Signals - July 2019

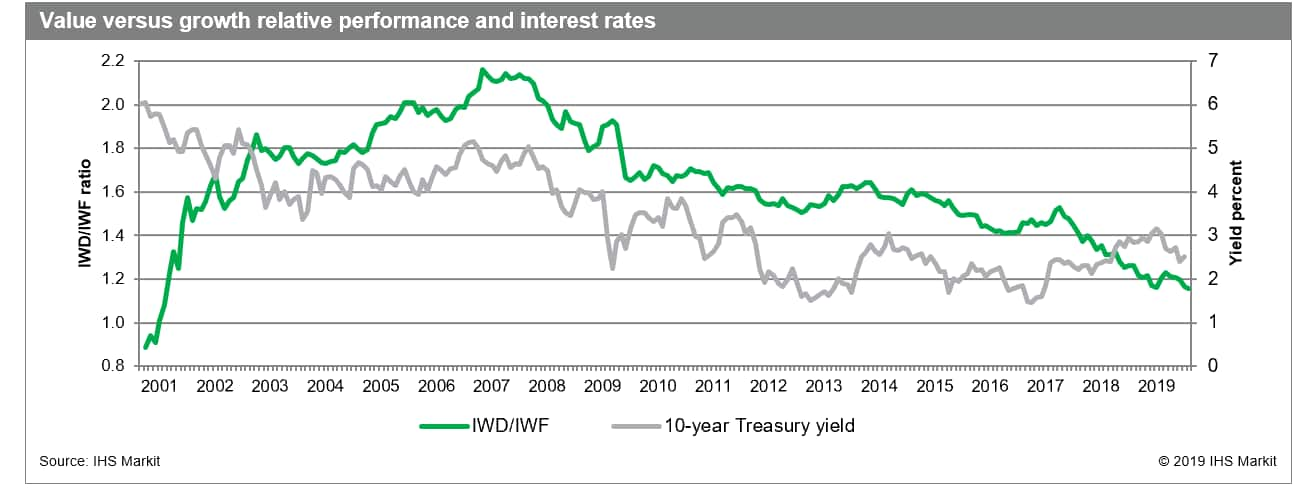

Value investing has been an integral component of many famous investors, including prodigies of the so-called father of value investing, Benjamin Graham. These include Warren Buffett and Charlie Munger, who built the Berkshire Hathaway empire on the concepts of long-term value, John Templeton, who extended value strategies to international markets, and Joel Greenblatt, who developed Magic Formula investing on the principles of value. Eugene Fama and Kenneth French also found that value stocks outperform growth stocks, adding book-to-market values (high minus low or HML) to their original three-factor model. However, value investing has its flaws, including so-called value traps or stocks which trade at low valuations for extended periods of time, and exposure to extended periods of underperformance, most notably during the tech bubble in the late 1990s. Value stocks are currently trading in another period of long-term underperformance for which we add some perspectives.

- Institutional investors show some signs of convergence with retail investors based on recent flows into value and growth stocks

- Stocks favored by our Historical Growth Model are trading at rich earnings multiples relative to those identified by our Deep Value Model

- Our Deep Value Model, designed to identify stocks trading at a steep discount to intrinsic value with a quality overlay, successfully navigated the recent growth cycle compared with a pure value strategy and Greenblatt's Magic Formula

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.