‘Safety trades’ in the technology sector

Research Signals - March 2022

The technology sector was the clear winner during the speculative mania coming off the March 2020 market bottom, as stock market cowboys bid up meme stocks and the most expensive growth shares. In a turn of events at the start of 2022, though, signs of higher inflation and the prospects for several rounds of Federal Reserve interest rate hikes and quantitative tightening weighed on long duration assets, particularly the technology sector, dragging down the broader market with it. However, we highlight some perhaps overlooked safe havens within this segment of the market during the tech selloff.

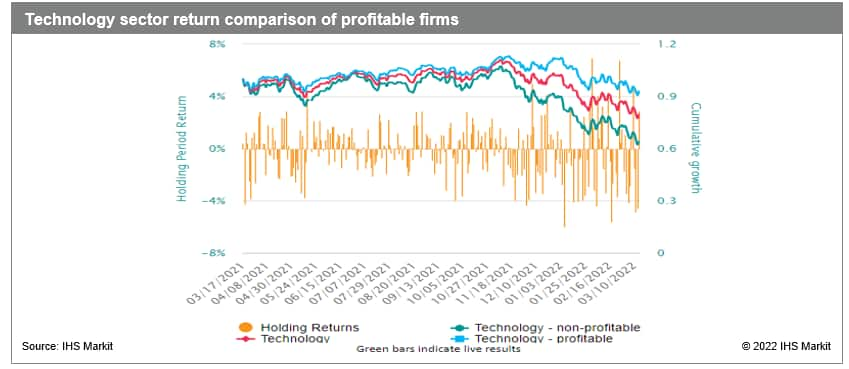

- While investors were mostly agnostic to profitability during the tech run up in 2021, profitable firms weathered the ensuing downturn more effectively than the broader sector and to a greater extent relative to nonprofitable firms

- High quality technology firms scoring in the top 20% of Return on Invested Capital universe rankings have outperformed the sector by 14.6 percent points over the past year

- Value investing's return to favor in the second half of 2021 eventually carried over to the technology sector, as shares with attractive TTM Free Cash Flow-to-Enterprise Value outpaced the sector in the openings months of 2022

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.