Securities Finance 2019 Year in Review

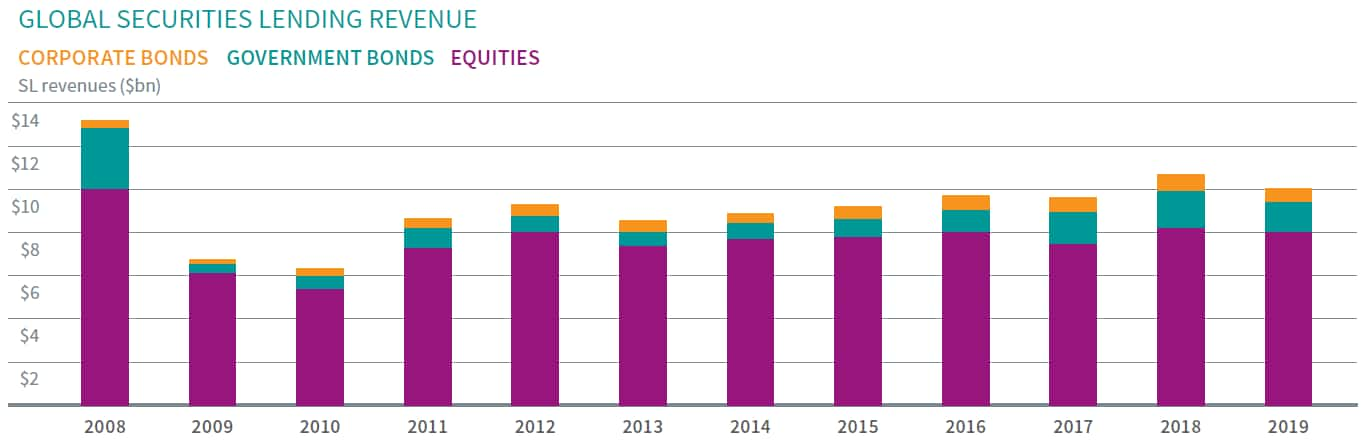

Global revenue falls 6.3% to $10.1 billion

- 2019 delivers second highest annual revenue in the last decade

- In North America, equity specials shine in 2nd half of year

- Fee compression weakens global fixed income revenues

It is neither the best nor the worst of times for securities lending, which means there is the opportunity for movement in either direction as we look ahead to 2020. Before we turn the page, however, we review the year that was 2019. At the end of 2018, things looked rather bleak for capital markets and securities lending revenues were soft given the decline in asset values which reduced loan balances. That makes Q4 2018 a relatively easy YoY comp, which Q4 2019 improved on by 3.8% with $2.4bn in revenues. That put the total for 2019 at $10.1bn, a decline of 6.3% relative to 2018. While the yearly revenue comparison is less favourable, the underperformance was primarily concentrated in the first half of the year.

Read further in the full version

of review (link below)

Read further in the full version

of review (link below)

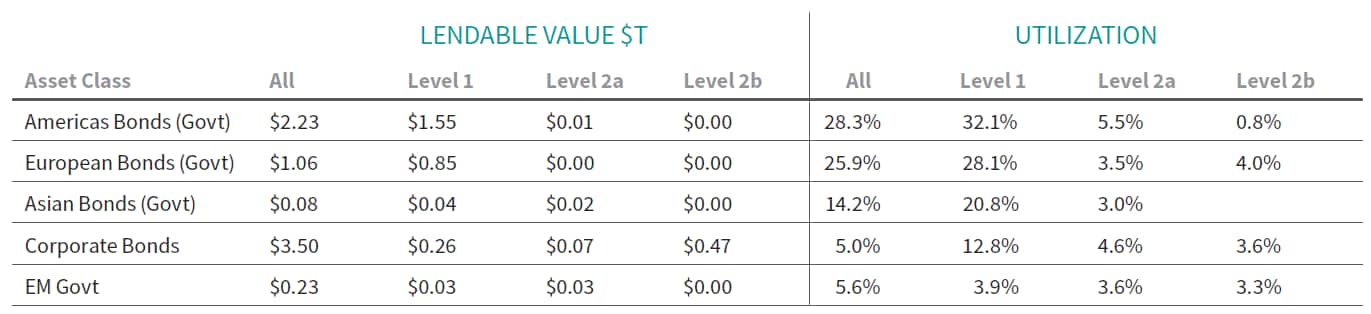

HQLA classifications for securities finance

Leveraging a new dataset for lendable asset evaluation

- Classifying global fixed income securities by HQLA status

- Utilization broken out by collateral eligibility

- New characteristics for securities lending performance attribution

A key aspect of the BIS Basel III regulation is the Liquidity Coverage Ratio (LCR) which requires banks to hold enough High-Quality Liquid Assets (HQLA) to "survive a period of significant liquidity stress" lasting 30 calendar days. To maintain compliance banks must test assets for HQLA status and maintain 100% of their estimated 30 net cash outflow arising from a stress scenario. As a result, the classification of securities between the three categories of HQLA has taken on great significance for the banking industry.

To support independent review, the Portfolio Valuations & Reference Team (PVR) team at IHS Markit has created a model to classify fixed income securities based on a variety of fundamental and market-based characteristics. While the model inputs are proprietary and only available to PVR clients, Securities Finance clients have been granted complimentary access to the output classifications.