Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 05, 2022

Securities Finance November Snapshot 2022

- Securities finance revenues generated $1.005bln during the month of November

- EMEA equity revenues increase 27% YoY

- Government bond revenues increase 20% YoY

- Corporate bonds record their strongest revenues of 2022 so far

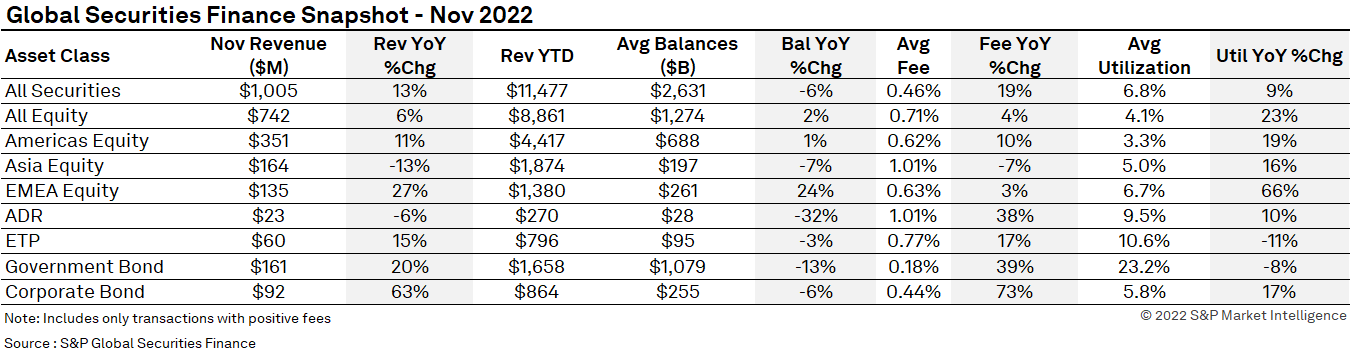

Securities finance revenues continued their strong performance throughout the month of November generating $1.005bln. Revenues for November were 13% higher than during November 2021 with increases seen in fees (+19%) and utilization (+9%). The value of on loan balances was 6% lower however which is not surprising given the fall in market valuations over 2022.

Significant increases in revenues for EMEA equities, government bonds and corporate bonds were seen throughout the month when compared with November 2021. European equities generated $135m making November the third highest revenue generating month of the year so far (May $270m and April $175m). Average fees were 63bps for the month which is an increase of 30% on the month of October. Utilization of EMEA equities remained steady throughout the month at 6.71% (6.7% during October). Americas equities remained the largest contributor to overall equity revenues, contributing just over 47%. Asian equities generated 13% less revenues YoY. Average fees in Asia increased MoM (Nov 101bps, Oct 91bps) but average utilization and on loan balances fell.

Fixed income performed very well throughout the month. Government bonds continued to produce stronger revenues YoY with an increase of 20% to $161m. Government bonds, at the end of November, had generated 13% more revenue in the eleven months of 2022 than the whole of 2021 (2022 rev to end Nov $1.657bln vs $1.466bln entire 2021). Average fees remained at a year high of 18bps which is the same as the two-month previous. November was also a very good month for corporate bonds. The asset class produced the highest revenues of 2022 so far. Revenues increased 7% when compared with October 2022 (Nov $91.5m vs Oct $85.6m). Having grown every month since the start of the year, 2022 is likely to be the best year for corporate bond revenues ever recorded.

Americas Equity

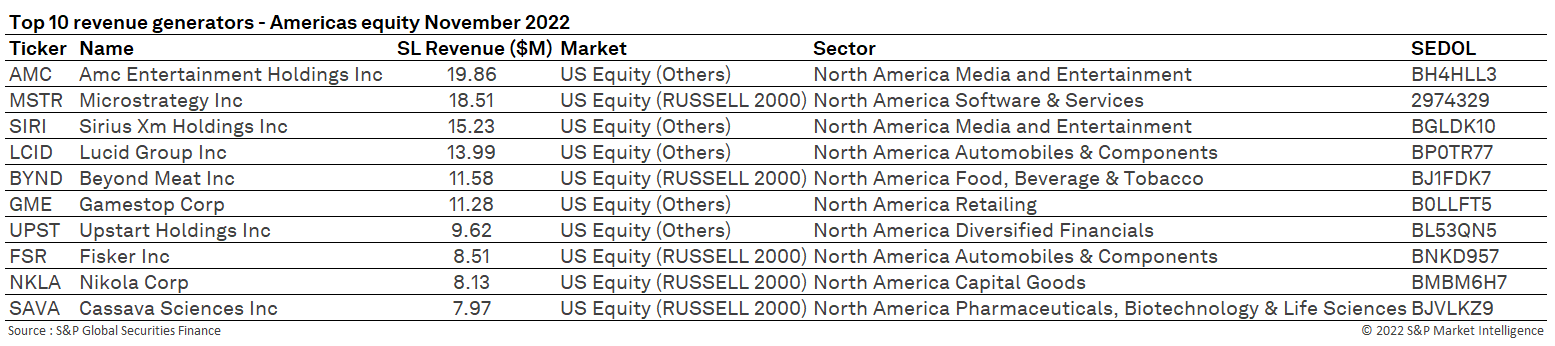

Americas equity generated $351m during the month of November. This was an increase of 11% YoY. Americas equity has performed exceptionally well during 2022. Revenues for the year so far ($4.417bln) are 15% higher than those generated during the entirety of 2021 ($3.8bln). With another month of the year to go and a continuation of some high fee specials, revenues are likely to end significantly higher when compared with last year. This is also reflected in the average fee which crept back over the 60bps mark during November (average fee 62bps). This is an increase of 5% on October and a 10% increase YoY. Despite utilization increasing 19% YoY to 3.3%, it fell when compared with October (Oct utilization 3.48%). Utilization in October was the highest seen during 2022.

The top revenue generating stocks were familiar in name but not in position in the table when compared with previous months of 2022. AMC Entertainment (AMC) retook the top spot during November with $19.86m in revenues. The beleaguered cinema chain reported an increase in net losses during the month along the redundancy of 20% of their personnel. MicroStrategy (MSTR) continued to be affected by the fall in Bitcoin valuations and Sirius Xm Holdings (SIRI) benefited from a rapid increase in fees mid-month which pushed it towards third place. One new stock in the list, Nikola Corp (NKLA), has seen the percentage of its shares outstanding on loan increase throughout the year as the company's stock price has fallen. Utilization in this stock is just below 95% and borrowing fees have risen significantly since mid-October. As with many similar companies in the EV sector, the stock remains under pressure. Nikola was the target of a well-publicized short report that alluded to numerous improprieties taking place within the organization. Ever since the report's publication in 2021, the stock has remained a target from short sellers.

The top ten revenue earners generated $124m over the month which equates to 36% of the total revenues for Americas equities. This is an increase when compared with October.

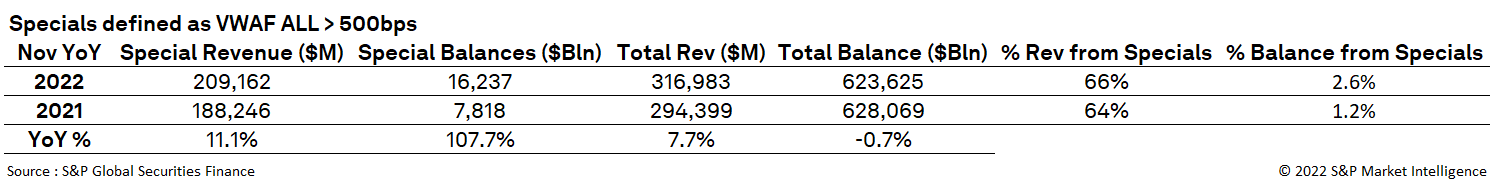

US equity special balances and returns continue to run well above 2021 levels, with specials defined as greater than 500bps annualized fee. November US equity specials revenue of $209m notched the fourth consecutive MoM decline, descending from the YTD peak monthly revenue of $472m seen in July. Average daily US equity specials balances of $18bn YTD throughout November are the highest on record, exceeding the previous record of $17.3bn observed in 2008.

APAC equity

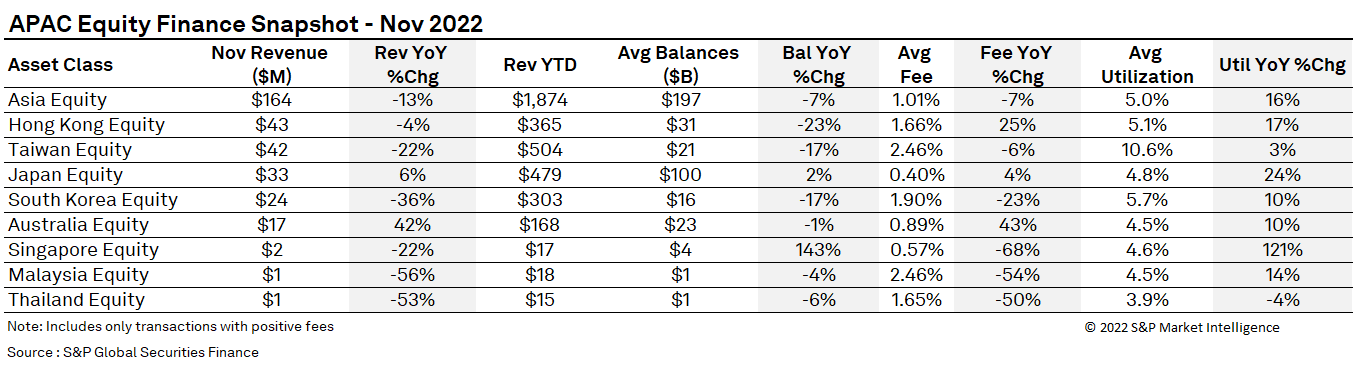

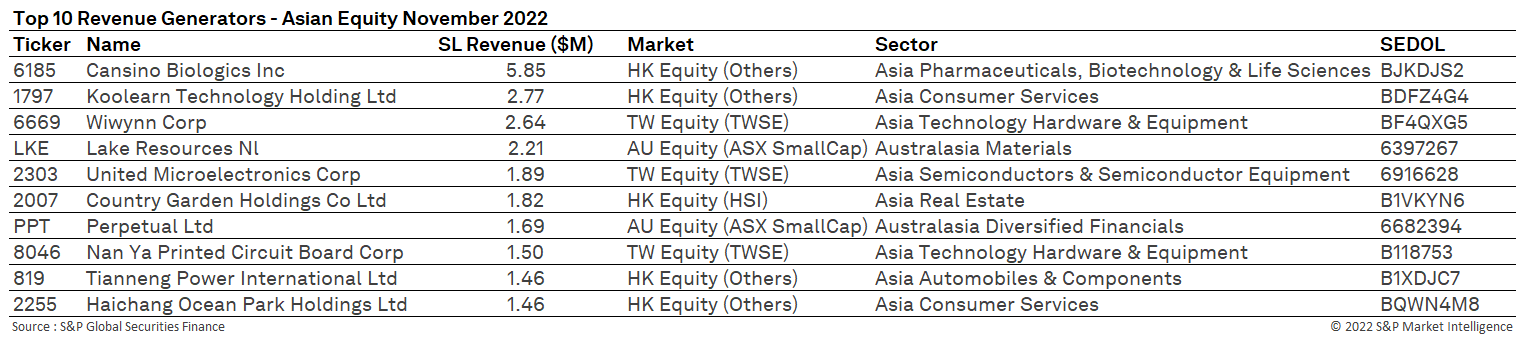

Revenues generated by APAC equities continued to decline over the month of November. The region generated $164m in revenues which was a 13% decrease YoY. Despite the decrease in revenues and the fact that average fees were down 7%, average utilization did increase. Hong Kong generated the most revenues in the region, surpassing Taiwan for the first time this year. Chinese stocks remain volatile given the increase in COVID rates, the slowing economy and the uncertainty surrounding on going lock downs. Hong Kong contributed five of November's top earning stocks. Cansino Biologics was the top revenue generating stock in the region. The company develops the Chinese COVID vaccine. There is little liquidity in this name which has pushed fees higher during October and November.

Taiwan has been the highest revenue generating market of the year so far. Despite this, revenues continue to decline YoY with revenues down 22%, balances down 17% and fees down 6%. When compared with October revenues increased 2%.

As mentioned in previous snapshots, Australia continues to offer opportunities to lenders. Revenues increased by double digit percentage points (+42%) again during November. $168m have been generated from Australian equities in 2022 compared with $113.7 during the whole of 2021. Lake Resources (LKE) continues to be a popular borrow along with Perpetual (PPT) which entered the top ten revenue generators through the month. Perpetual is a financial services company that has been struggling with ongoing costs for several years. It has been the subject of several takeover proposals of late which have been rejected. The percentage of shares outstanding on loan have been increasing in this stock since the Drip in September. Fees started escalating mid-November as the recent spike in the share price started to decline.

Revenues in Japan increased 6% YoY and but declined 47% MoM. Both average fees and revenues have remained steady throughout all months when compared with 2021. Japan remains an important market for the region in terms of revenues and balances. The country has generated the second highest revenues throughout 2022 and average on loan balances in Japan are significantly higher than any other market in the region.

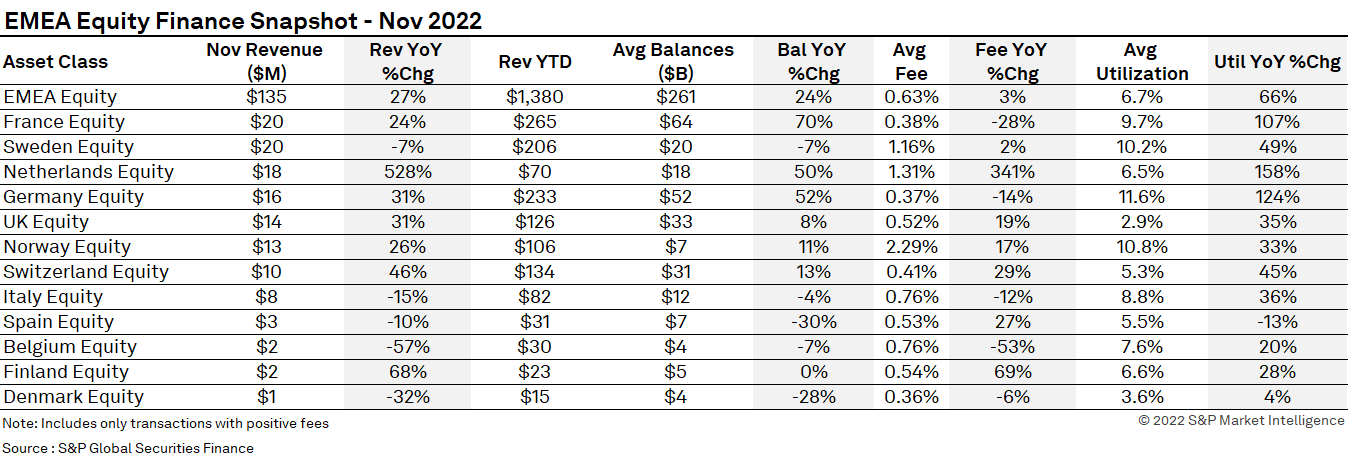

EMEA equity

EMEA equity generated $135m during the month of November. This is 27% more than November 2021 and 37% higher than October 2022. November also saw increases in average balances (+24%), fees (+3%) and utilization (+66%) when compared YoY. Average fees saw a significant uptick over the month. The average fee of 63bps is 3% higher when compared YoY and is significantly higher than both the average fee during October (48bps) and the Q1 (48bps) and Q3 (49bps) averages. Average revenues for November also outpaced the average Q1 ($92m) and Q3 ($98.6m) monthly revenue.

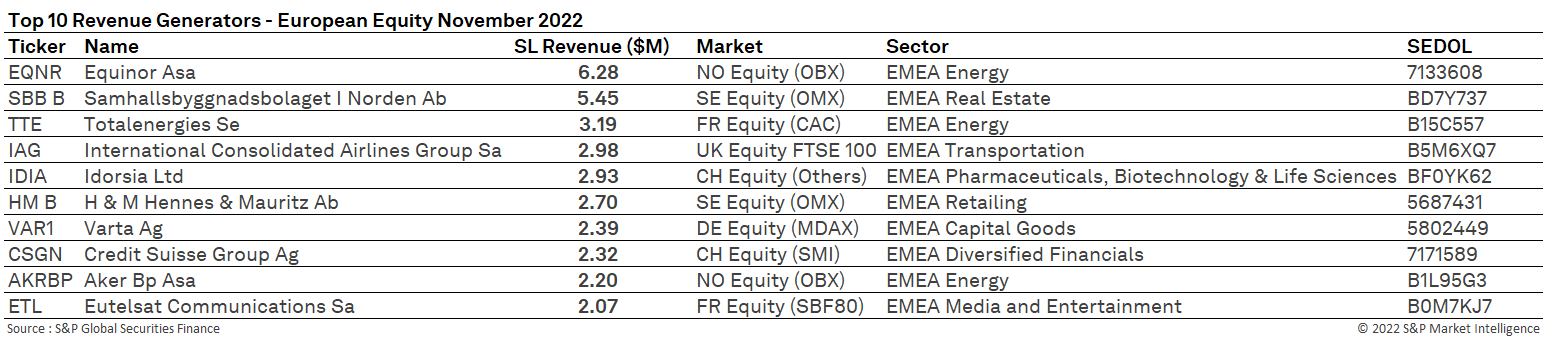

Swedish equities continue to see strong demand. The country has provided numerous opportunities for borrowers over the course of 2022 and has been the highest revenue generating markets in the region over numerous months. In relation to YTD revenues, it is third highest following France and Germany. SBB B has been a very popular borrow over the course of the year. The stock generated the most revenues in November and has earnt $16.3m in revenues for lenders over the year. H&M Hennes and Mauritz Ab has been a popular borrow specifically throughout the month of November. The company paid a dividend during the month, and it is also one of the first major retailers to announce redundancies because of a decline in consumer spending and the impact on profits.

Revenues, average balances, average fees, and average utilization all significantly increased YoY in the Netherlands. The recent dividend in ASML Holdings and elevated fees seen in Cm.com (BFMBLM4) have contributed to this recent spike. Germany, Norway, UK, and Switzerland all experienced double digit increases in revenues over the month. Average balances and utilization also increased across all four countries. All these countries saw at least one special appearing in the top ten revenue generator table over the month. Equinor Asa in Norway benefited from a dividend mid-month, IAG in the UK continues to be a popular borrow as the company faces operational constraints, Varta Ag is an ongoing German special that continues to demand high fees and Credit Suisse and Idorsia continue to be popular shorts amongst borrowers. Specials activity contributed an increasing share of overall revenues for European equities during the month.

November was the second highest revenue generating month of the year for UK equities following October ($14.1m vs $14.5m). Average fees have continued to climb throughout the year in the UK with average fees in January of 29bps (November average fees 51bps). Popular borrows such as IAG (B5M6XQ7), TUI (B11LJN4) and Hammerson Plc (BK7YQK6) have all contributed to these revenues.

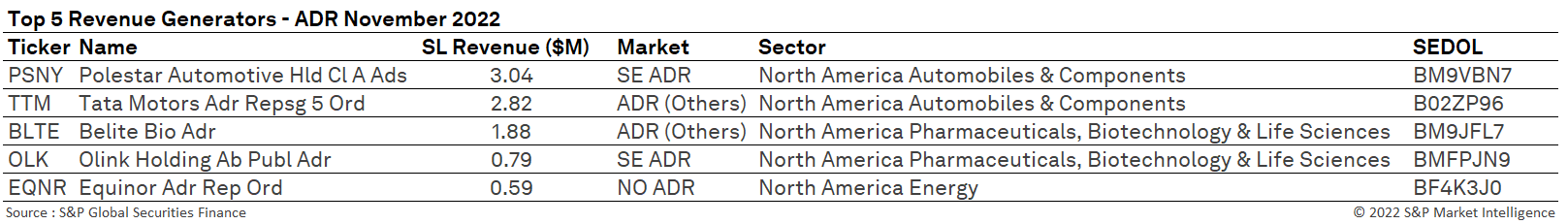

ADRs

ADRs generated $23m in securities finance revenues during the month of November. This was 6% lower than during November 2021. On loan balances were significantly lower YoY (-32%) despite average fees (+38%) and utilization (+10%) increasing over the month. ADRs have faced numerous headwinds this year. The delisting of Chinese based companies from US stock exchanges and the uncertainty that this has created for investors has dented revenues when compared with the most recent years (2022 revs to Nov $270m vs $509m 2021). Average fees of 101bps that were seen in November have also fallen steadily since their peak in August (168bps). They also remain under the 2022 average of 103bps (114bps 2021).

In relation to the top 5 revenue generating ADRs for the month, the only name in the list to change is the addition of Olink Holding Ab (OLK). This is a Swedish life science company that reported a third quarter loss during the month. The EV sector remains well represented by this asset class. Polestar Automotive (PSNY) is the highest revenue generating ADR of the year so far, having generated $38m through to November. Borrow interest and fees increased significantly through the month for Tata Motors (TTM). This stock generated $2.8m during the month, up from $1.6m in October and generating $10.8m YTD.

ETPs

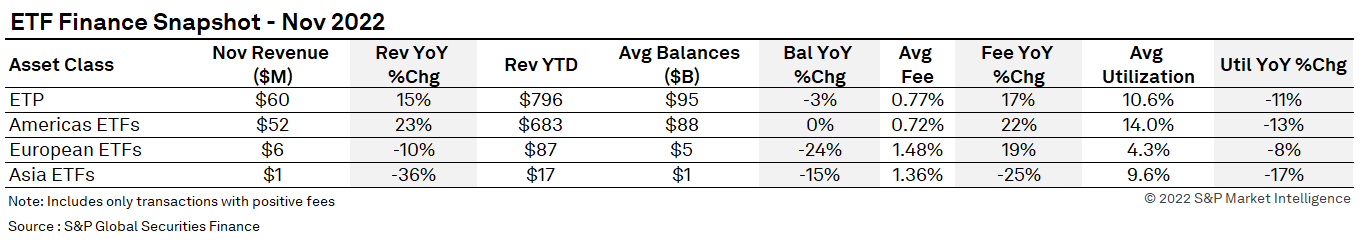

Despite ETP revenues increasing 15% YoY, they declined 14% MoM. Average fees also fell MoM (90bps average fee in October) despite the YoY increase (66bps average fee during November 2021). ETP revenues fell across both Europe and the Americas when compared MoM (Europe -4%, Americas -26%). In Asia there was a 9% increase. Fees declined MoM in both the Americas and Asia (-16% Americas, -5% Asia) but did increase in Europe (+6%). As more positive sounds came from the FED regarding the pace of rate hikes, declines started to be seen in US inflation numbers and equity markets recovered from their lows, it appears logical that revenues and demand for ETFs was softer during the month. The revenues in European ETPs during November were the lowest for any month during 2022 (Previous low October) and those generated in the Americas were the second lowest for 2022 (Previous low August). It was reported during the month that US ETFs drew almost $500bn of inflows despite market conditions which may point to a turnaround in investor sentiment that is reflected in November's securities finance numbers.

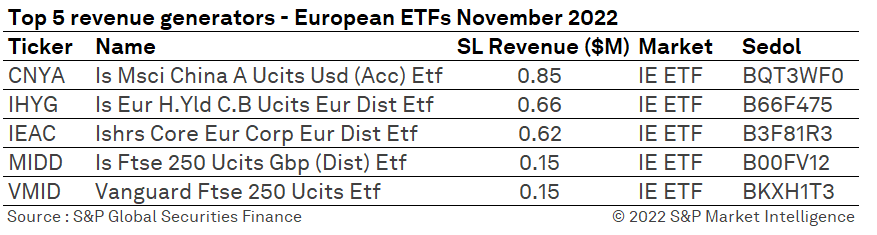

In relation to the top revenue generators there was little change in focus over the month. Emphasis remains on small / mid cap indices and corporate bond proxies. The China MSCI A Ucits ETF continues to top the table in Europe. This stock has generated $13m in revenues over the year. In Europe ETFs replicating the FTSE 250 increased in popularity.

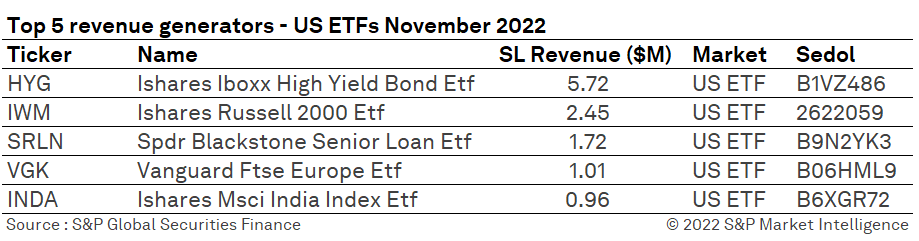

In the Americas, HYG continued to top the table. Revenues in this ETF approximately halved when compared with October, however. The financial press reported over the month that corporate bond funds have started to reverse their outflows as yields have started to stabilize. As in the European names, the mid cap focused Russell 2000 ETF (IWM) moved up the table to second place. This ETF is a common constituent of this list and has generated $27.2m in revenues throughout 2022.

Government Bonds

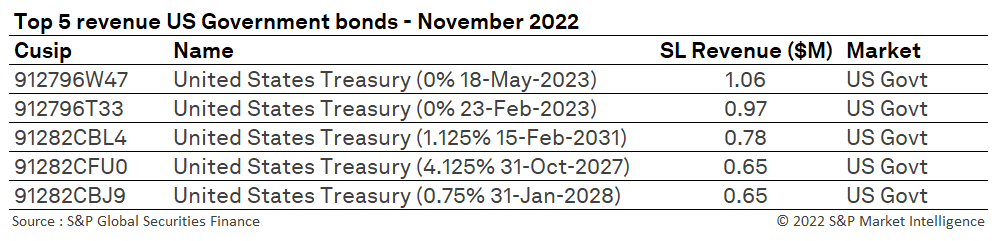

Government bonds continued to grow their revenues YoY. An increase of 20% was seen in November (YoY), with the second highest revenues of the year being recorded (Nov 22 $161m, highest month of 2022 Sep $167.6m). Year to date revenues for government bonds have now surpassed the full year revenues for 2021. November was also the third month in a row where revenues topped $160m. This never happened during 2021 as the highest revenue generating month was December with $150.9m generated. During December 2021 there was a 13% increase in revenues during the year end period. If a similar increase is seen this year (it's expected considering the ongoing volatility and natural drop in year-end liquidity) then government bonds will significantly outperform their 2021 revenues.

Average fees remained steady over the month at 18bps. This is the third month in a row that this level has been maintained. Average fees over 2022 are currently 2bps higher when compared with the same period in 2021. Average balances and average utilization are lower, however.

As we move into the year-end reporting period government bond demand and average fees are expected to increase given the traditional period of lower liquidity. 2022 has had 51 days where the yield swing on US treasuries has surpassed 10bps making it one of the most volatile years for bond trading since the global financial crisis. Yield curve inversion has also been commonplace with both the US treasury and the German bund experiencing widest inversion in 2/10 year yields for 30+ years. The pressure on government bond yields seen throughout 2022 combined with the traditional year end liquidity squeezes will likely make demand for government bonds increase throughout December. Any increase in average fees because of the increase in demand will make 2022 one of the best performing years for government bond revenues.

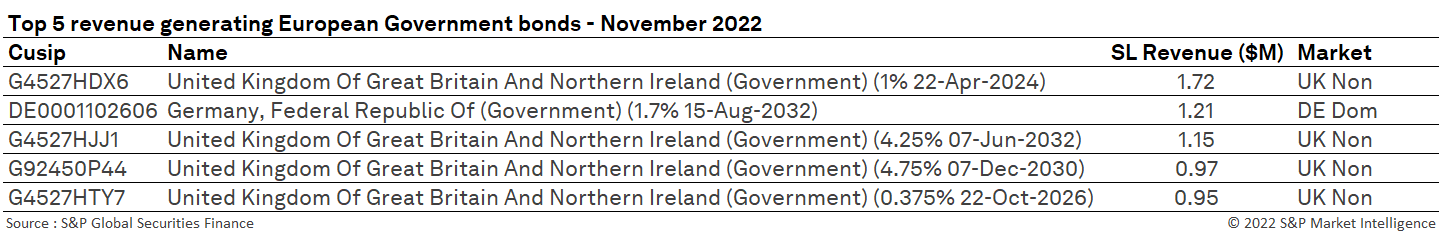

In both Europe and the US, government bonds under 10 years in maturity generated the strongest revenues. Short-dated issues continue to see strong demand as liquidity remains tight. This is also being seen in repo markets. In Europe, Gilts continued to dominate the table.

In the US, softer than expected inflation numbers and talk by the FED of smaller subsequent interest rate increases may have an impact upon how this table looks going into the beginning of 2023. The futures market is currently seeing the federal funds rate peaking between 5% and 5.25%, but the path of inflation could prove these bets wrong in either direction. Whilst the metrics for a recovery in government bond prices appear to be moving in the right direction in the US, the situation remains fragile.

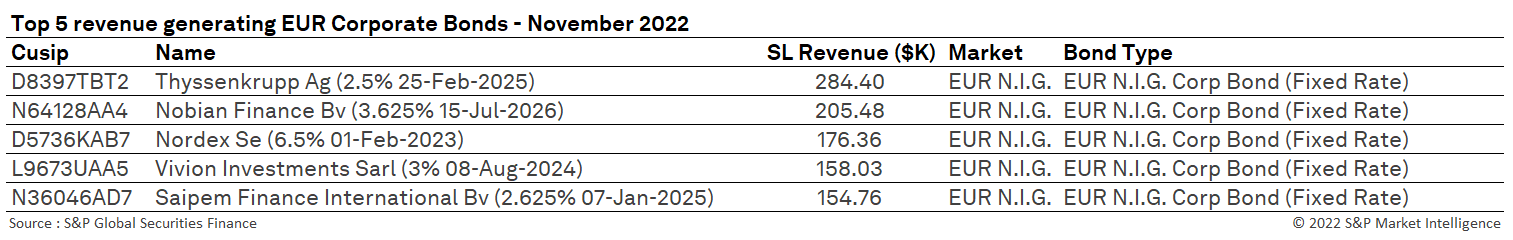

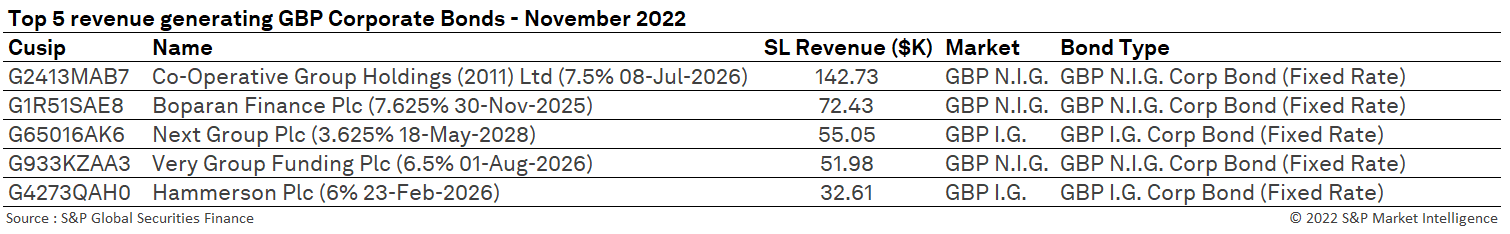

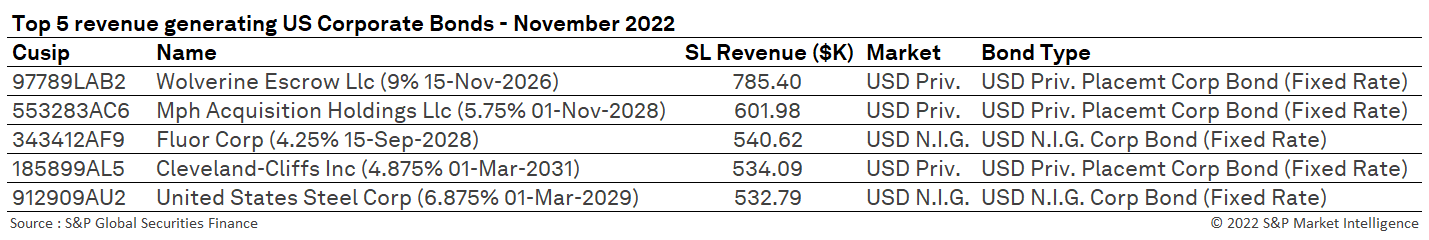

Corporate Bonds

Corporate bonds generated $92m in revenues during November. This is an increase of 63% YoY and it makes November the best performing month of 2022 so far. Average fees over the month also hit a year high at 44bps. Fees have continued to grow throughout 2022 and show no signs of easing. Utilization (+17%) also significantly increased YoY and MoM.

Corporate bonds have experienced a great 2022. Revenues for the year are currently 63% higher than for the entirety of 2021. The speed of interest rate hikes and the threat of looming recessions have generated numerous opportunities for borrowers. Demand has remained widespread as despite the appearance of numerous specials in the market, revenues continue to be generated from a broad range of issues.

Whilst demand for corporate bonds shows little slow down in the securities finance markets, recent reports in the financial press have stated that corporate bond investment credentials may be starting to improve. As yields are now at attractive levels and default rates remain very low, it has been reported that investors are now looking to allocate to this asset class once again. All eyes will be on inflation numbers going forward as this is likely to be the catalyst for further rate rises which has a direct impact on the prices of these bonds.

Notwithstanding any slowdown in corporate bond performance because of this, 2022 will be the year to beat for this asset class going forward.

Conclusion

November was a strong month for securities finance activity. European equities, corporate bonds and government bonds all generated strong returns for investors helping the market generate more than $1bln over the month for the eighth time this year. To put this into context, this only happened on two occasions during 2021.

As 2022 comes to a close, it is clear that despite the ongoing market volatility in both bond and equity markets, significant securities lending opportunities have been present for many asset owners during the year. 2022 is shaping up to be one of the strongest years for securities finance revenues which shows the resilience of the industry and the value that securities lending brings to both asset owners and investment managers.

Please ensure that you register for our upcoming "Securities finance short interest trends 2022" webinar on the 14th / 15th December by clicking HERE. During the 30 minutes discussion we will be reviewing the short interest per asset class over the year and looking into some of the most expensive shorts across numerous markets.

As the December snapshot will not be available until the first week of January, we would like to take the opportunity to thank you all for your support over the past twelve months and we look forward to engaging with you again in the new year.

We wish you all a very happy and peaceful festive and new year period.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-november-snapshot-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-november-snapshot-2022.html&text=Securities+Finance+November+Snapshot+2022+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-november-snapshot-2022.html","enabled":true},{"name":"email","url":"?subject=Securities Finance November Snapshot 2022 | S&P Global&body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-november-snapshot-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+November+Snapshot+2022+%7c+S%26P+Global http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-november-snapshot-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}