Securities Finance Q2 2021

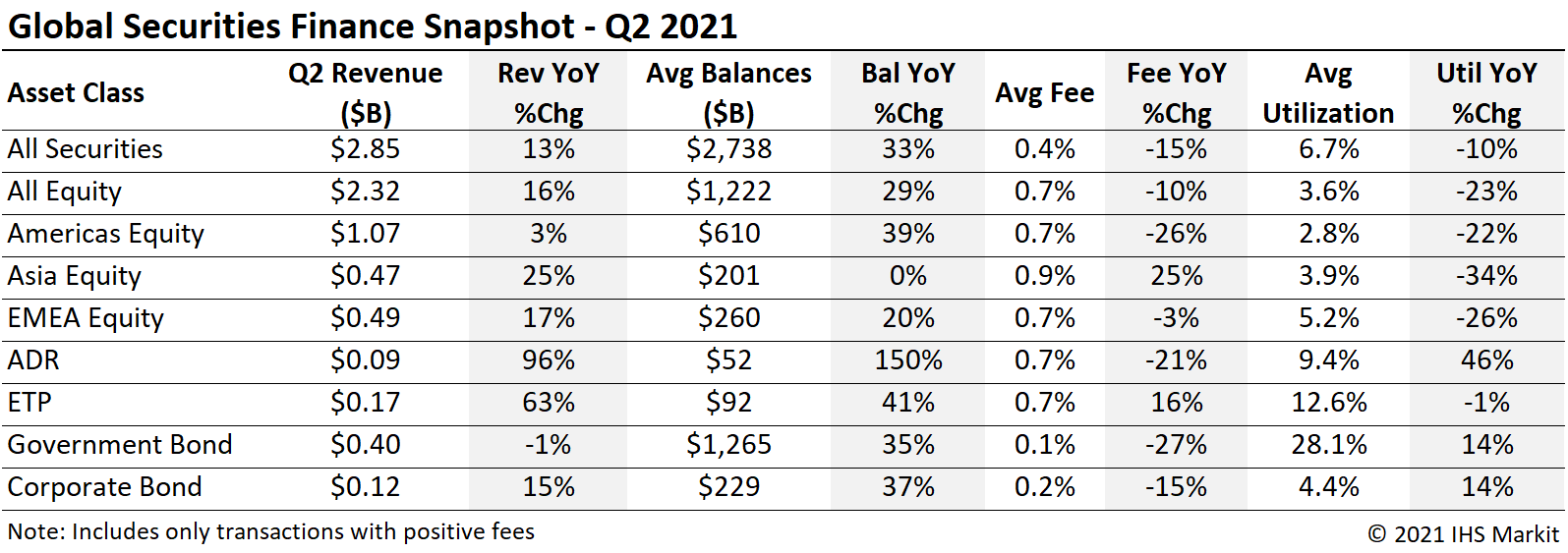

- Q2 revenues increased by 13% YoY

- YoY revenue gains primarily from loan balance recovery

- Emerging markets lead APAC upswing

- ETP lending revenues notch best quarter on record

Global securities finance revenues totaled $2.85B in Q2, a 13% YoY increase. The increasing revenue made Q2 the most revenue generating quarter since Q2 2018. Following the boom/bust Q1 for equity specials, Q2 saw special balances steadily increase, driven by US equities and emerging markets in APAC. Borrow demand for ETFs continues to boost returns, particularly for credit and emerging market products.

Equities:

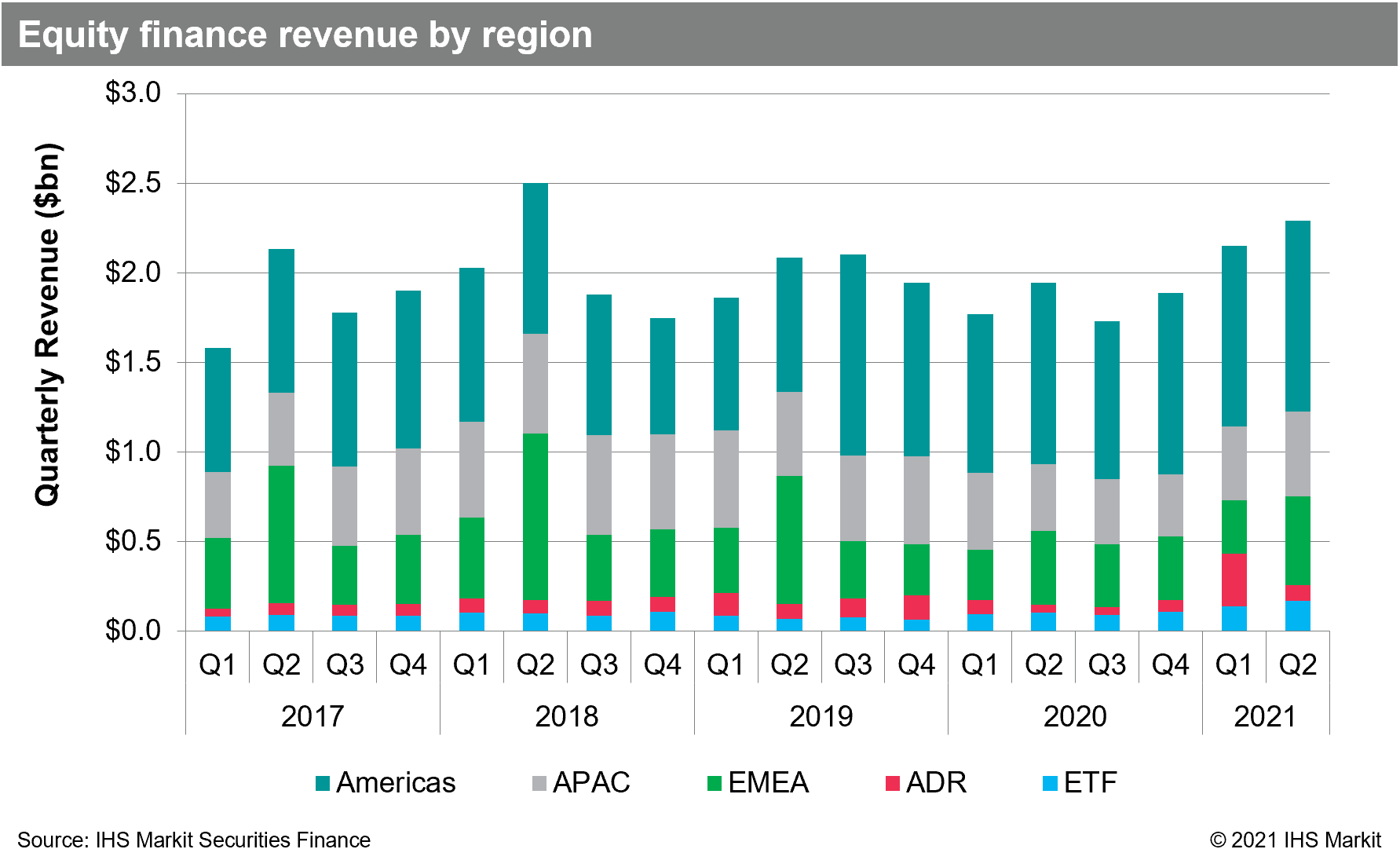

Global equities delivered $2.3b in Q2 revenue, a 16% YoY increase. The 2nd quarter built from a slow start in April, the least revenue generating month YTD, before a strong rebound in returns in May and June. Q2 was the third quarter to see consecutive QoQ revenue growth, starting from the 2020 low-point in revenues observed in Q3. In 2020 a summer slow-down in markets activity, particularly in August, caused equity finance revenues to drop off sharply. Whether 2021 repeats the summer slowdown of 2020 remains to be seen, however some of the Q2 revenue drivers are likely to persist in Q3.

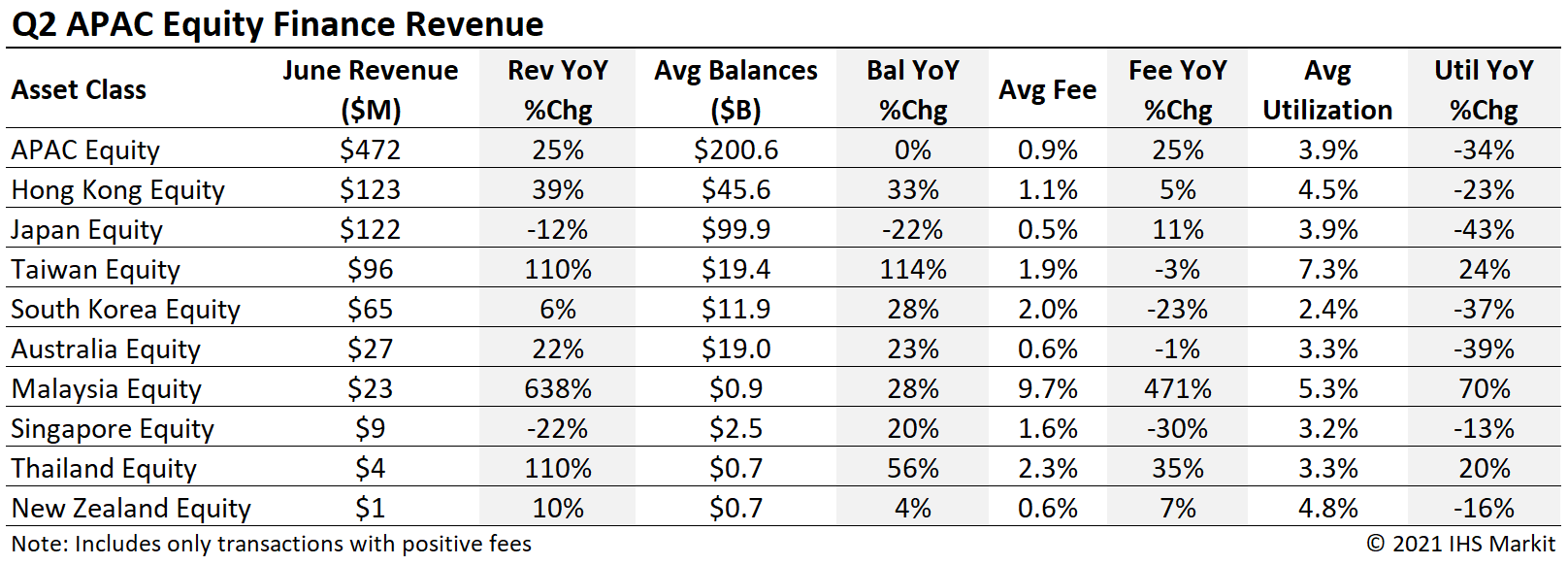

APAC equity revenues of $472m reflect a 25% YoY increase, with each month of Q2 seeing a YoY revenue increase of at least 19%. The upswing was driven by the resumption of short selling in South Korea along with increasing borrow demand in Taiwan and Hong Kong SAR. The revenue growth in the region is partly the result of a light YoY comparison with short sale bans and lower balances coming in the wake of the COVID crash; revenues for Q2 fell 1.4% short of the Q2 2019 return. Hong Kong SAR's equity finance revenues exceeded those of Japan as the most quarterly revenue generating equity market in the region for the first time since Q4 2015.

America's equity finance revenue in Q2 of just over $1b reflect a 3.5% YoY increase and a 5% sequential increase compared with Q1. Notably, June was the most revenue generating month of Q2 and the only month to see a YoY decline in returns, owing to a particularly strong comparison in 2020. The uptrend in revenue within the quarter was driven by both increasing total on-loan balances and an increasing portion of balances with high-fees. US equity finance revenue of $979m reflects a 7.6% YoY increase, while Canada equity revenues of $84m reflects a 29% YoY decline.

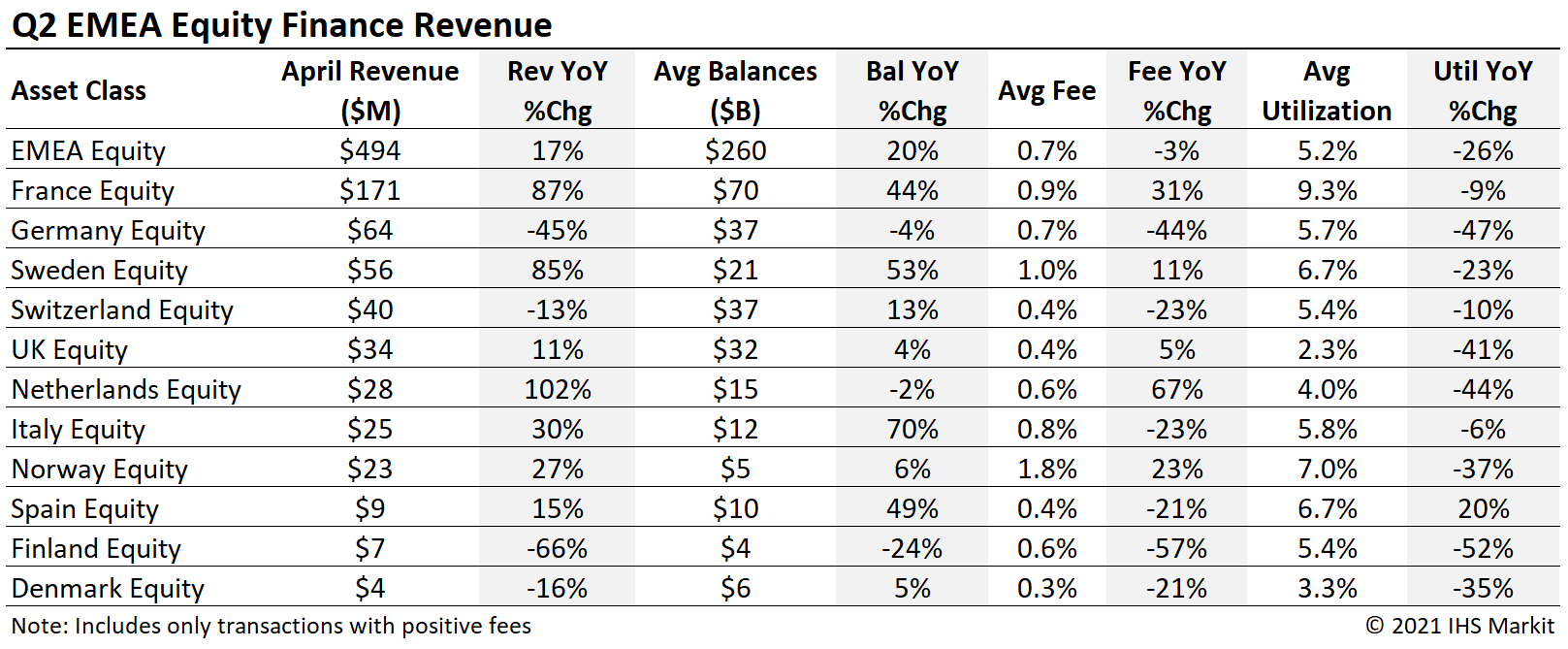

EMEA equity finance revenues of $494m reflect a 17% YoY increase, with June the only month of Q2 to see a YoY revenue decline. The YoY increase was driven by the reinstatement of dividends which had been suspended or reduced in 2020. Q2 revenues declined by 30% compared with Q2 2019. The French equity market delivered the most revenue among EMEA markets in Q2, overtaking the German market which led Q1.

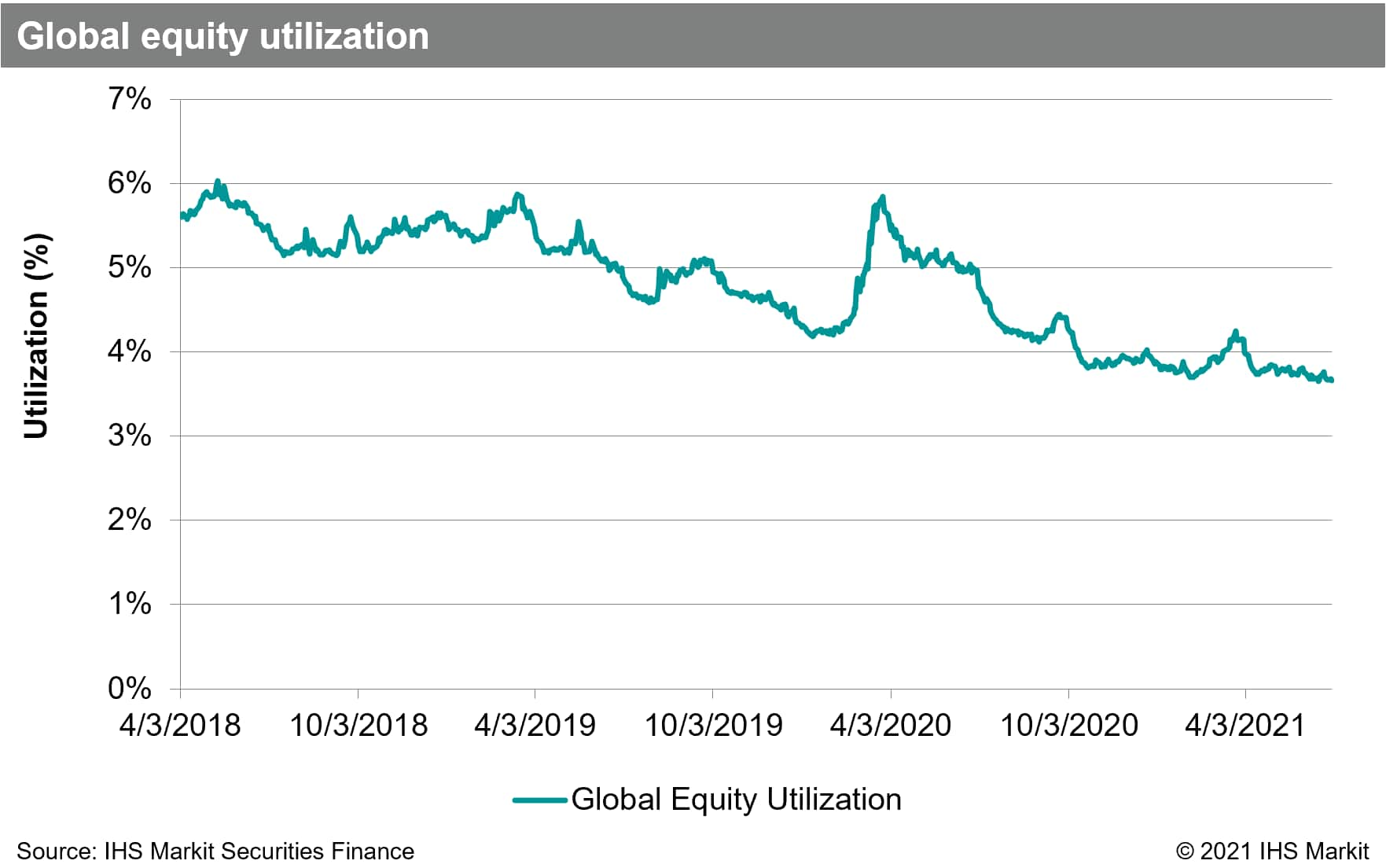

Equity on-loan balances with positive spreads averaged $1.2t in Q2, a 29% YoY increase, largely the result of recovering equity market valuation over the last year. Despite loan balance growth, global equity utilization has resumed a multi-year downtrend, which took a brief pause amid the COVID related sell-off in 2020. The Q2 average global equity utilization of 3.6% is the lowest for any quarter on record.

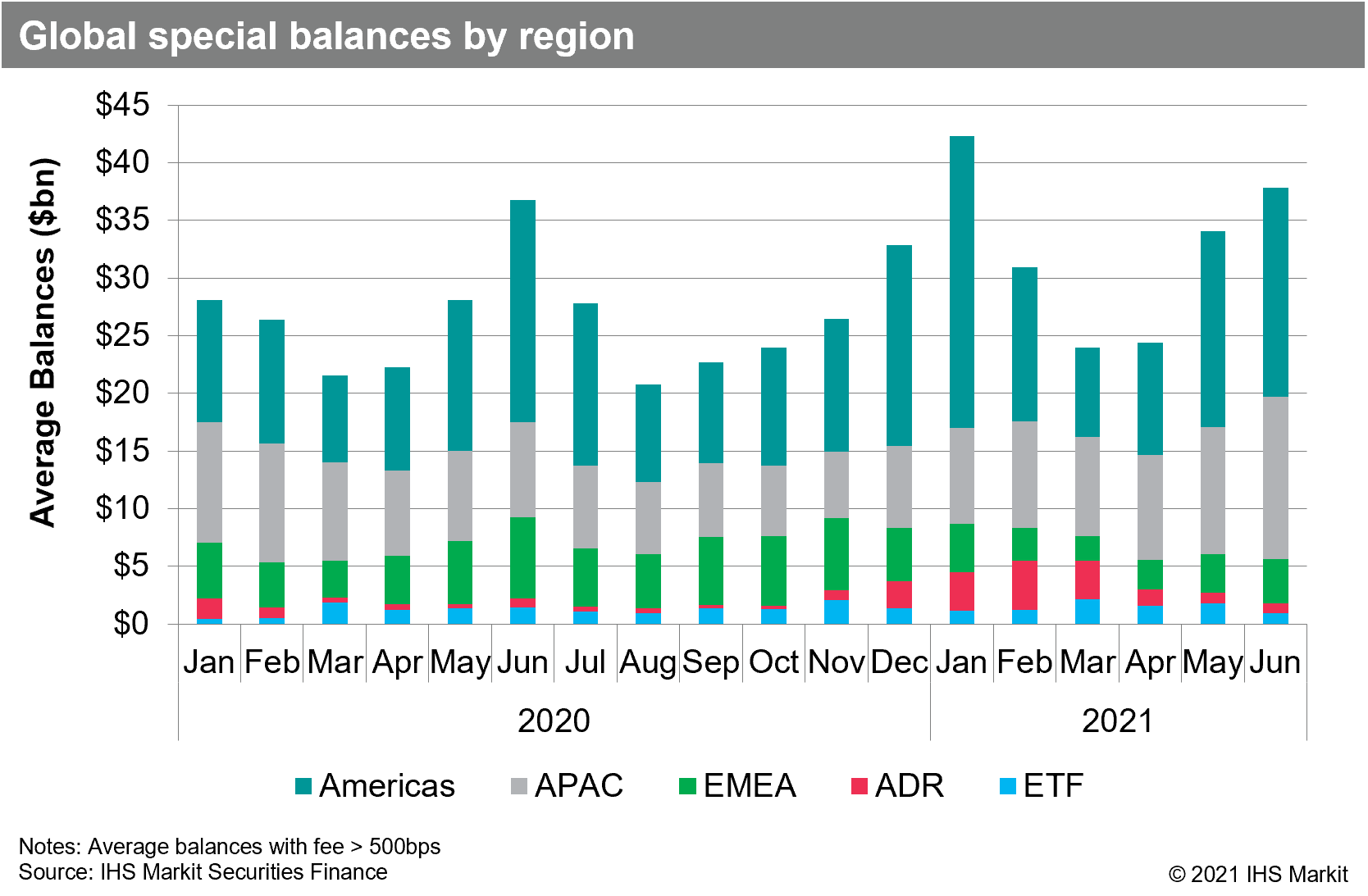

Global equity special balances rebounded in Q2, following the YTD low-point observed in March. APAC equity special balances had the most notable uptick in Q2, owing to reinstatement of short selling in South Korea and a general uptrend in demand for hard to borrow shares in Hong Kong SAR, Taiwan and Malaysia. Average APAC equity special balances averaged $11.4bn in Q2, compared with $8.7b in Q1 and $7.8b in Q2 2020. Americas equity special balances declined by 3% as compared with Q1, but the shortfall was entirely the result of the January short squeeze in hard to borrow shares. EMEA equity special balances declined by 42% YoY, with the shortfall primarily the result of German equity special balances being consistently high in 2020. Specials balances for ADRs surged in late-2020 and early-2021 on the back of outsized borrow demand for Futu Holdings; ADR special balances declined in Q2 following the wrap-up of the Futu trade, though overall borrow demand for depository receipts remains strong.

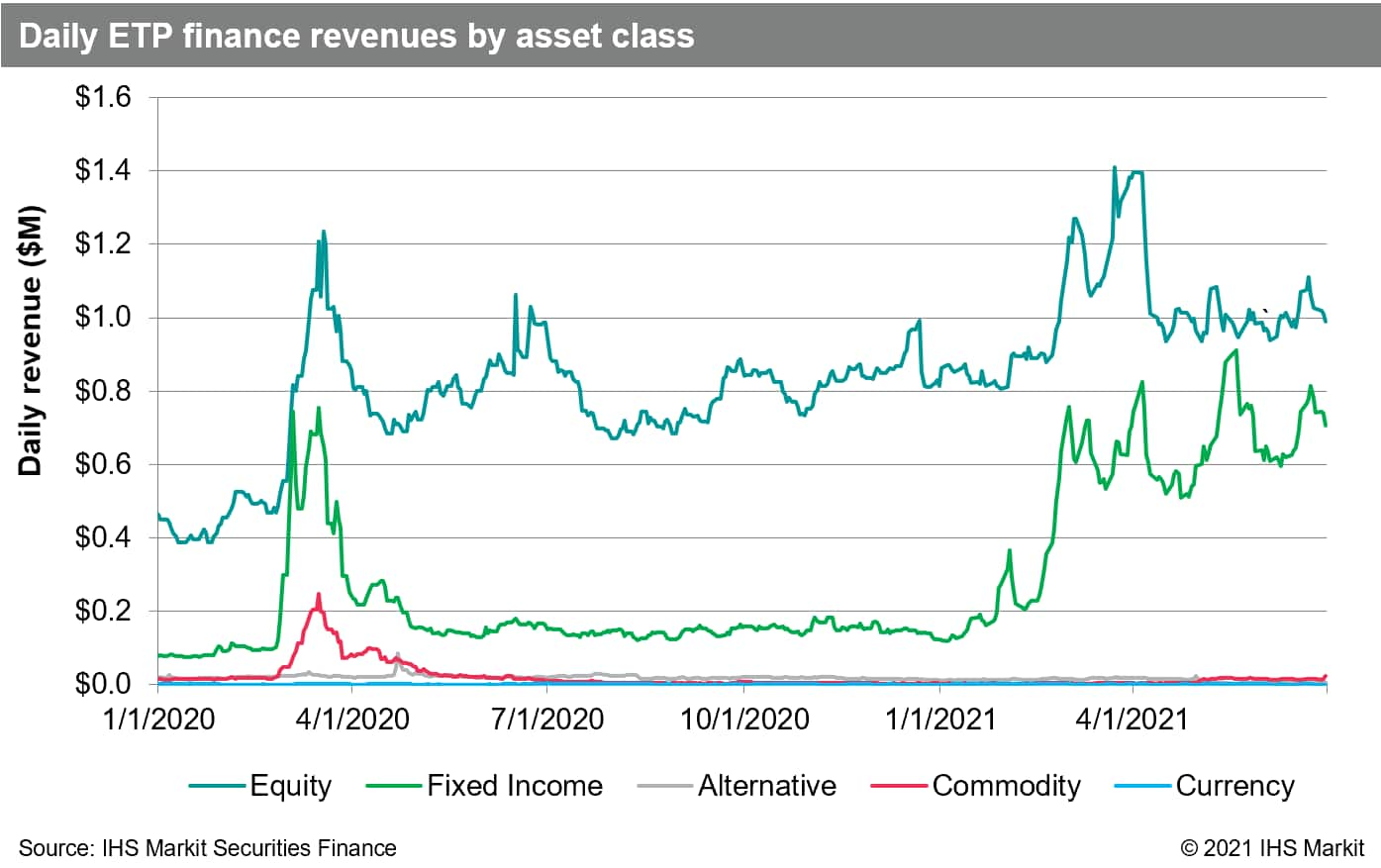

Exchange Traded Products

Global exchange traded product (ETP) revenues totaled $171m for Q2, a 63% YoY increase. Loan balances set a new quarterly average high of $92b, reflecting increased use of the products for hedging. Lendable asset values also set a new all-time quarterly average high of $444bn. Fixed income products generated 39% of Q2 revenues, up from 27% in Q1. US listed products generated 80% of Q2 revenues, up from 74% in Q1. APAC ETP revenues declined by 32% YoY for Q2, but that was partly the result of a strong comp in 2020, revenues only declined slightly compared with Q1. EMEA ETP revenues increased 3% YoY.

Fixed Income

Fee-spread revenues for global sovereign debt totaled $398m for Q2, a 1% YoY decline. Government bond borrow demand remains robust, with $1.26t in positive-fee global balances for Q2 reflecting an 35% YoY increase. The $330bn increase in positive-fee balances is the result of a $247bn YoY increase in total on-loan balances along with $82bn moving from negative to positive fee. Total Q2 government bond lending revenues for agency programs, $408m including reinvestment returns and negative fee trades, declined by 18% YoY. Reinvestment revenue declined by 47% YoY, while fee spread revenues increased by 25% YoY. Following the decline in interest rates during the latter half of Q2, a marginal decline government debt on-loan balances may be the start of an unwind of trades predicated on rate path and yield curve, however, balances remain relatively high historically.

Corporate bond fee spread revenues totaled $121m for Q2, a 15% YoY increase. Corporate bond borrow demand continues to increase with $229b of daily average balances in Q2, a 37% YoY increase and the highest quarterly average since Q3 2008. Total Q2 corporate bond lending revenues for agency programs, $115m including reinvestment returns and negative fee trades, declined by 29% YoY. Q2 reinvestment revenue declined by 59% YoY, while fee spread revenues increased by 19% YoY. While corporate bond loan balances are historically high, there has been a lack of hard to borrow issues; to the extent credit stress increases in the second half of the year, the asset class could get back to delivering stellar lending returns as was the case in 2018, the most revenue generating year for corporate bond lending since 2008.

Conclusion

Global financing revenues for Q2 were in the middle of the range observed over the preceding five years. Global fixed income fee-based returns were the highest since 2018, however the comparison with 2020, excluding the impact of cash reinvestment returns from the 2020 rate cuts. Equity finance revenue had the most revenue generating Q2 since 2018. The upswing in equity revenues was driven by the upswing in APAC specials, div reinstatement in EMEA and IPO/SPAC related demand in US. Taken together, the drivers for equity borrow demand that were anticipated coming into 2021 are largely playing out and delivering returns. Heading into the second half of the year, APAC specials, ETP demand and US SPACs/IPOs appear likely to continue boosting returns. For fixed income the big pictures is greater loan balances and narrower spreads; revenue from rates related trades may decline, though there is a potential for credit risk to drive borrow demand for corporates, which could result in hard to borrow credits becoming a H2 return driver. H1 revenues of $5.5b reflect a 14.3% YoY increase in fee-based revenues.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.