Stocks receive a yearend booster shot

Research Signals - December 2021

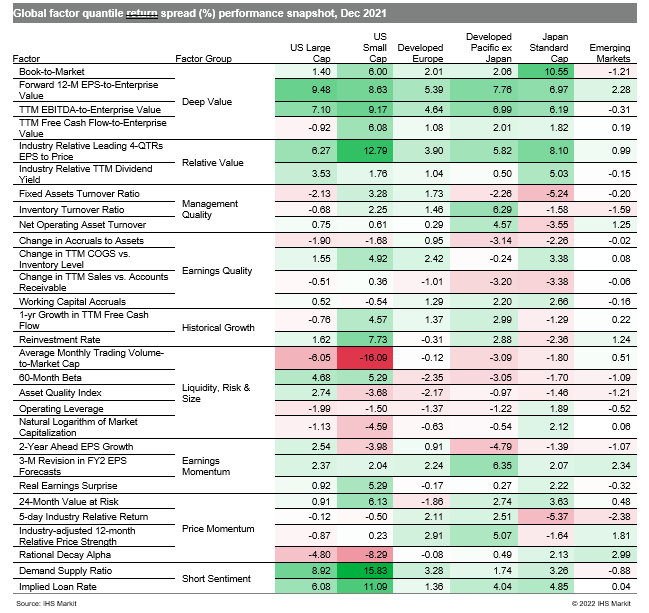

Two years into the pandemic, stocks posted another banner year, particularly in US and European markets, supported by both monetary and fiscal policy and strong corporate earnings. While the robust stock market recovery was unexpected at the beginning of the pandemic, heading into 2022, investors' resolve will be tested by potential economic restrictions from coronavirus variants and inflation. A regime shift in interest rates poses additional risks with many central banks moving toward tighter monetary policy, as value factors continue to fight for domination in several regional markets (Table 1).

- US: Deep Value and Short Sentiment measures outperformed, including TTM EBITDA-to-Enterprise Value and Demand Supply Ratio, respectively

- Developed Europe: Value outperformed growth, as captured respectively by Forward 12-M EPS-to-Enterprise Value and Reinvestment Rate

- Developed Pacific: Book-to-Market was a positive signal in December, though in markets outside Japan, Price Momentum measures such as Industry-adjusted 12-month Relative Price Strength were also highly rewarded

- Emerging markets: Price Momentum measures including Rational Decay Alpha upended Deep Value's two-month run as a key driver

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.