The Asian USD High Yield Credit Bond Market

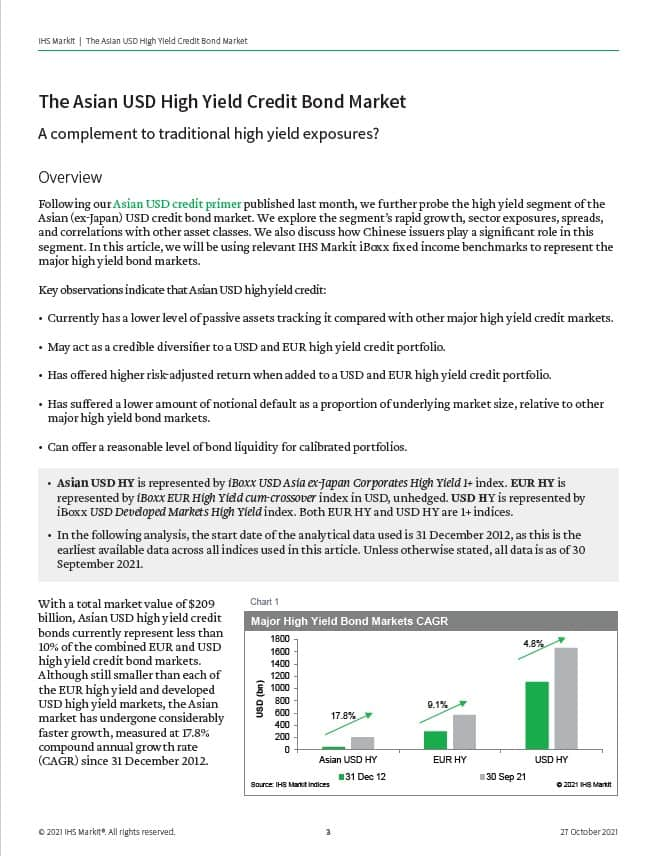

Following our Asian USD credit primer published last month, we further probe the high yield segment of the Asian (ex-Japan) USD credit bond market. We explore the segment's rapid growth, sector exposures, spreads, and correlations with other asset classes. We also discuss how Chinese issuers play a significant role in this segment. In this article, we will be using relevant IHS Markit iBoxx fixed income benchmarks to represent the major high yield bond markets.

Key observations indicate that Asian USD high yield credit:

- Currently has a lower level of passive assets tracking it compared with other major high yield credit markets.

- May act as a credible diversifier to a USD and EUR high yield credit portfolio.

- Has significant exposure to China issued USD bonds by market value.

- Can offer a reasonable level of bond liquidity for calibrated portfolios.

|  |

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.