The continued success of the India Model

Research Signals - August 2021

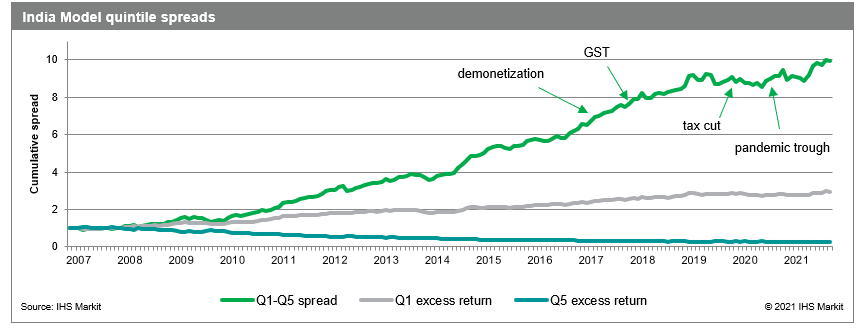

Over the past several years, economic activity in India has been impacted by major events including the double shock of demonetization and the introduction of the goods and services tax (GST) between late 2016 and mid 2017, a significant corporate tax rate cut in September 2019 and, most recently, the COVID-19 pandemic. With these events in mind, we review the Research Signals India model which has proven successful in navigating the uncertainty surrounding these major events.

- Stocks ranked as buy candidates returned a monthly average of 0.62% in excess of the universe from September 2006 through June 2021, while sell rated stocks trailed with an average excess return of -0.73%

- The spread between top and bottom ranked stocks averaged 1.35% per month and was positive in 73% of months, with robustness across cross-sectional rankings

- Stocks which were recently favored by the model include HDFC Bank, Larsen & Toubro and UltraTech Cement, while Adani Enterprises and Reliance Industries was poorly ranked

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.