The end of a bull market era

Research Signals - March 2020

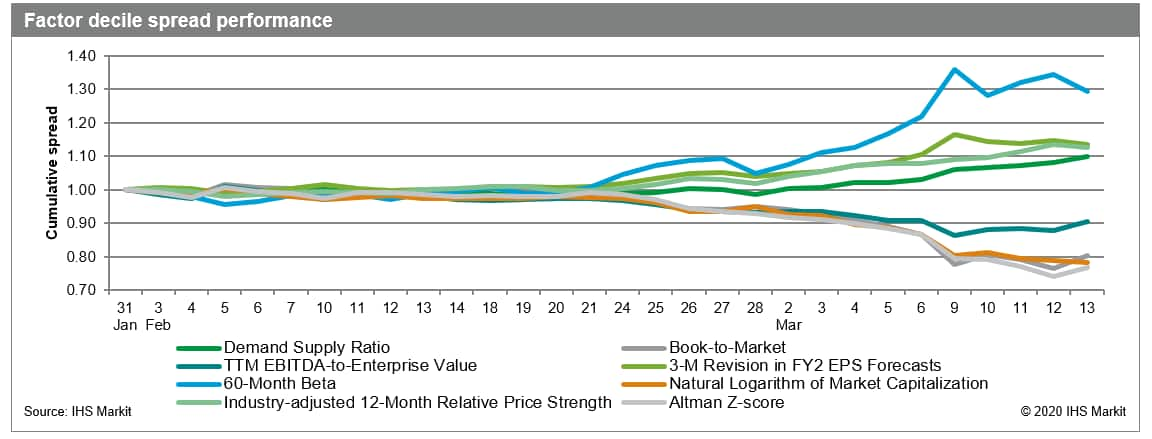

Adding to coronavirus fears, a collapse in oil prices last week catapulted market volatility to levels not seen since the financial crisis. We have produced special reports looking at daily factor and style model performance during this market tumult, beginning with the initial bounce in volatility at the end of February that subsequently spilled over into early March. With key benchmarks continuing to see drastic day-to-day and intraday spikes and drawdowns and as the near 11-year bull market run officially ended in a sharp 16-trading-day sell-off, we extend our performance review into mid-March in the US, as well as month-to-date results from non-US regions.

- High bankruptcy risk and small cap firms continued to lag in US markets last week, while the least shorted shares outperformed low beta stocks

- Our Historical Growth Model continued to outpace other style models since January; however, value models surpassed all other styles as the week progressed

- In Developed Europe and Developed Pacific markets, low beta bested other styles and value continued to suffer, while emerging markets disfavored high risk stocks and highly shorted shares

Figure 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.