The momentum-value standoff continues

Research Signals - May 2019

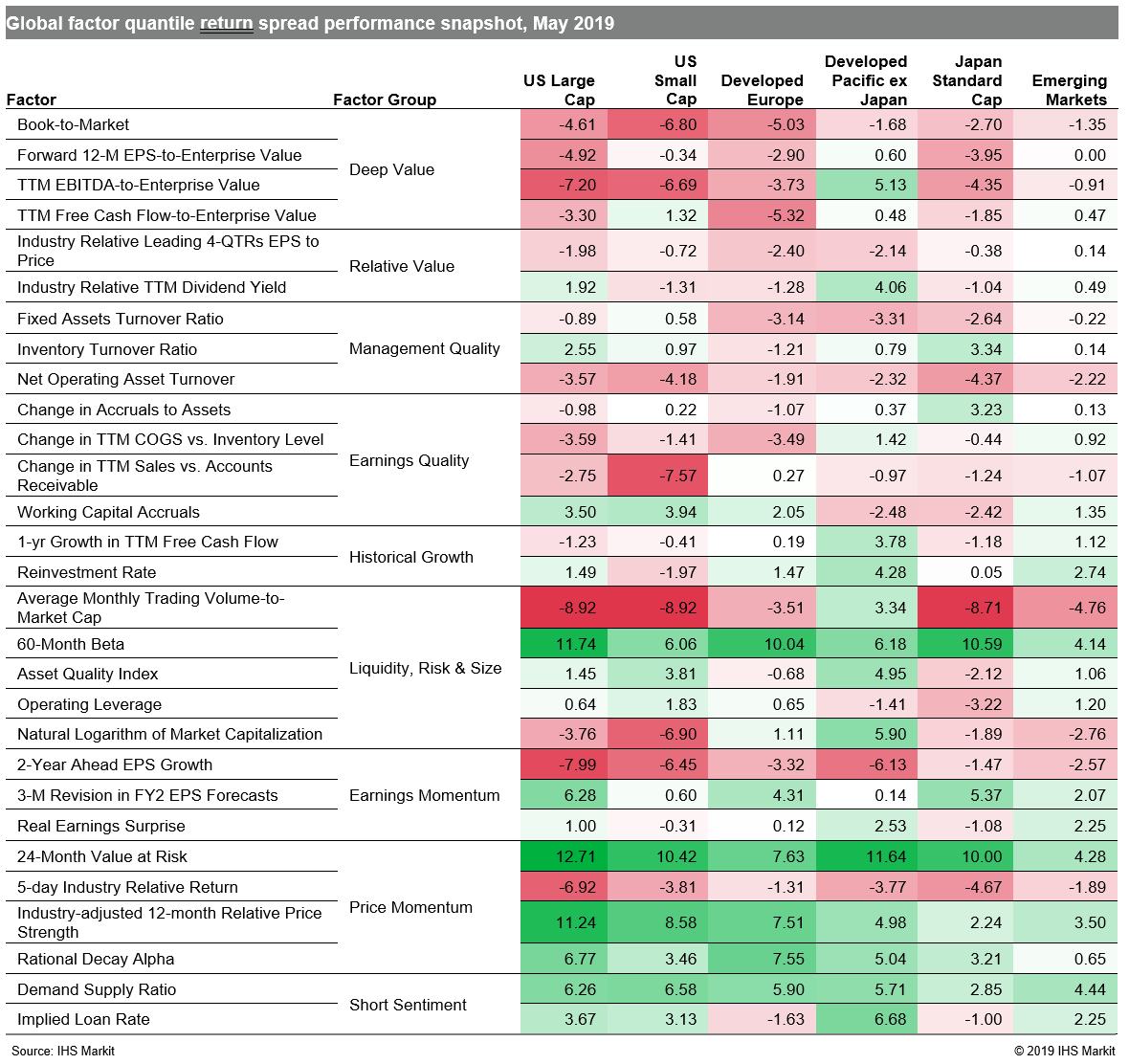

The trade war between value and momentum continued as the standoff between the US and China sent equity markets reeling, with stocks capping their worst month of the year. Factor performance in May reflected momentum's latest salvo on valuation (Table 1). High risk names were the casualties of the war as investors sought out traditional safe havens amid worries about the impact of trade tariffs on global economies. Concerns were reinforced by the J.P.Morgan Global Manufacturing PMI's lowest reading since October 2012, falling into contraction territory as international trade flows weighed on the sector.

- US: High momentum names, gauged by Industry-adjusted 12-month Relative Price Strength, outperformed at the expense of undervalued stocks, captured by TTM EBITDA-to-Enterprise Value

- Developed Europe: Investors reflected trends from other regional equity markets, in addition to signals from securities lending markets favoring stocks with lower short interest, such as Demand Supply Ratio

- Developed Pacific: High beta names strongly underperformed in Japan in May, with an 18.6 percentage point month-on-month swing in 60-Month Beta spread performance

- Emerging markets: 60-Month Beta and Industry-adjusted 12-month Relative Price Strength turned in solid performances last month

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.