UK inflation ticks higher in July

- Consumer price inflation accelerates for first time this year

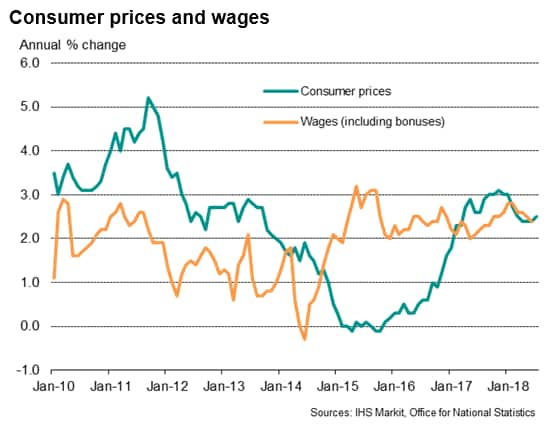

- Inflation outstrips wage growth

- Higher oil and import prices could mean inflation proves sticky in coming months

Consumer price inflation ticked higher to 2.5% in July, according to the Office for National Statistics, up from 2.4% in the prior three months. The rise was the first acceleration in the cost of living seen since last November and goes some way to help vindicate the Bank of England's recent decision to hike interest rates.

The problem that policymakers face is that inflation may prove sticky as the weaker pound raises import prices, but at the same time the economy is showing signs of slowing amid heightened Brexit uncertainly and a broader global slowdown.

The data follow news that wage inflation slowed in the three months to June, meaning the cost of living is once again rising at a faster rate than pay. Total pay growth dropped from 2.6% in the first quarter to 2.4%, while growth of regular pay (excluding bonuses) slipped to 2.7% from 2.9%.

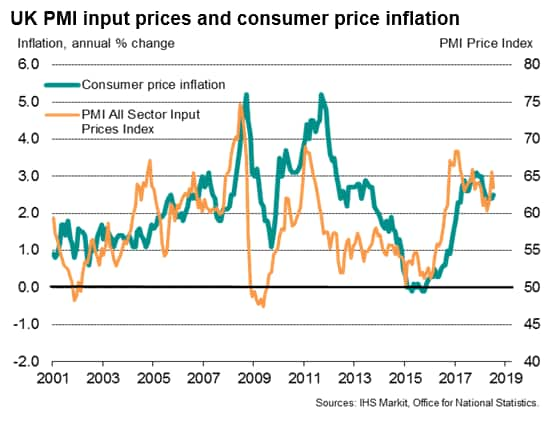

The Bank of England expects inflation to moderate in coming months, but survey data relating to companies' costs and trade prices suggest it could remain stubbornly high.

The PMI survey gauge of average prices charged by companies for their goods and services remained elevated by recent historical standards in July, despite cooling slightly from June, indicative of inflation running at just under 3%.

Higher selling prices reflected the need to pass increased costs on to customers to protect margins, with costs driven up by higher import costs resulting from the weakened pound, as well as higher fuel and other commodity prices, especially oil. Although input cost inflation cooled from June's nine-month peak, the rate of inflation remained worryingly high and above that of all other major developed economies.

The increase in costs signalled by the surveys was corroborated by data from the ONS showing factory raw material prices having risen 10.9% on a year ago in July, the largest rise for over a year.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.