Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 25, 2023

US T-Bills – risk on, risk off

DOWNLOAD PDF VERSION

With a potential debt ceiling clash, uncertainty following the recent banking turmoil, sticky inflation, and hesitation regarding the future direction of interest rates, there is a lot impacting US Treasuries right now.

US treasury investments are the go-to risk free asset for many global investors. The $4.9T market offers global investors a liquid, safe haven, traditionally protecting them from market volatility and credit risk. Despite this, developments surrounding this asset class have sent yields whipsawing over recent months. The problems in the banking sector recently led the US 10-year yield to fall from 3.92% to 3.47% in a matter of days, for example.

US Treasury Bills are the most short-dated treasury investments available to investors. They are perceived to be the safest form of US Treasury investment as the shorter maturity dates are often reflected in more stable prices. Recently, the price on the 3-month bill plummeted, as investor concern regarding the government's ability to raise the debt ceiling increased. As it stands, July is seen as the deadline for the US government to no longer be able to issue any further debt.

Surging investor demand has pushed the one-month T-bill price higher in recent weeks, sending the yield down to 3.313% from 4.675% at the end of March. The one-month bill is considered to be in the "safe zone", where the three-month bill may mature before any agreement to raise the debt ceiling limit is reached.

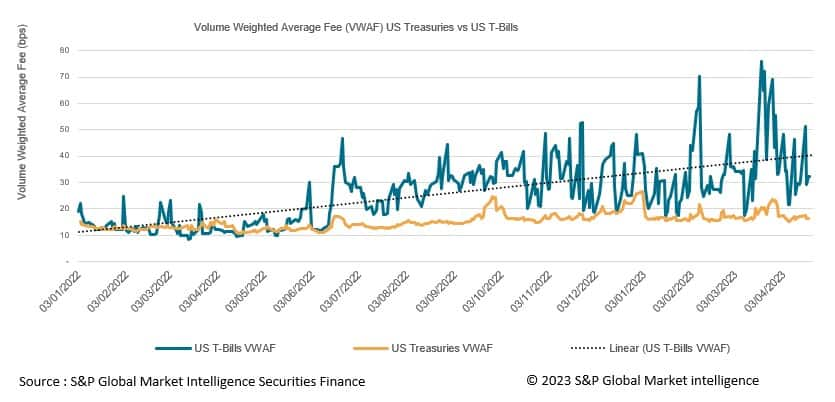

S&P Global Market Intelligence Securities Finance data shows that this volatility is now being reflected in the borrowing fees of these assets as average fees continue to rise.

Repo markets are also starting to react with short-dated treasury bills becoming more expensive week over week. Haircuts currently remain unchanged.

Following the banking turmoil, allocations to USD Money Market funds have swelled to a reported $5.2T as a flight to safety and a desire for higher yields has driven deposits away from traditional bank savings accounts. A lot of this cash has found its way into Money Market funds and has consequently been parked at the Fed's reverse repurchase treasury facility, which borrows cash from Money Market funds on an overnight basis in exchange for US treasuries. The current interest rate on this facility is 4.8% and investors would typically not invest in T-bills with a lower relative yield. Given the rapid inflow of cash into these vehicles however, it is possible that many funds have now reached their $160B limit for the facility which is forcing them to buy ultrashort T-bills instead.

Money Market funds have favored ultrashort T-bills ever since interest rates started moving higher. One month and two-month maturities now count for over 40% of funds' T- bill allocations. This is certainly one of the many reasons why cash reinvestment returns in securities lending programs have not grown as quickly as interest rate increases may have otherwise suggested. Many investors have preferred to stick to the short end of the curve to avoid being caught offside during any future rate rises.

As treasury yields have increased throughout April, following their decline in March, hedge funds have also reportedly been placing some of the biggest ever shorts on benchmark treasuries seen in recent years. Data reported by the Commodity Futures Trading Commission shows that net shorts on 10-year Treasury futures have grown to a record 1.29 million contracts as of the 18th of April. Volatility in Treasury prices is allowing hedge funds to engage in basis trades again by buying specific Treasuries (typically the 10yr) and simultaneously selling their underlying futures contracts where there is a slight differential in pricing.

Along a similar vein, uncertainty regarding the Feds ability to reach its 2% inflation target and the future path of interest rate increases is also enticing hedge funds into a tug of war with the Fed. Hedge funds are reportedly positioning for the central bank to have to keep raising rates for longer, believing that inflation may prove stickier than currently predicted.

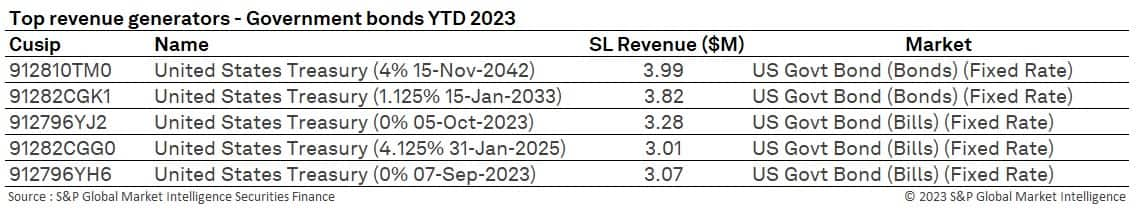

The current political and economic uncertainties surrounding US Treasuries continue to create trading opportunities that have been absent for many years. Further volatility is expected in the coming months as we edge closer to the debt ceiling discussions and towards any change in interest rate policy. Securities finance continues to benefit from this activity as both lending rates and demand for US Treasuries continue to march higher.

For more information on how to access this data set, please contact the sales team at: Global-EquitySalesSpecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-tbills-risk-on-risk-off.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-tbills-risk-on-risk-off.html&text=US+T-Bills+%e2%80%93+risk+on%2c+risk+off+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-tbills-risk-on-risk-off.html","enabled":true},{"name":"email","url":"?subject=US T-Bills – risk on, risk off | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-tbills-risk-on-risk-off.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+T-Bills+%e2%80%93+risk+on%2c+risk+off+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-tbills-risk-on-risk-off.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}