Valuation Governance in focus as APRA and ASIC review raises concerns around unlisted asset valuation practices

Introduction

In our 2020 report on " Valuation Considerations for Pension Fund Investments into Private Equity" we discussed the impact of COVID-19 on the valuation of unlisted assets held by superannuation funds. Notably, the heightened market volatility, increased member switching and federal government decision to allow members early access to their superannuation funds raised significant concerns over the liquidity management and valuation best practices adopted by Super funds.

This update presents the recent findings published by APRA and ASIC in Q4 2021 following an extensive review into the conduct of unlisted assets valuation practices. Their reports identified significant gaps and conflict of interests which RSE licensees will need to address in 2022 before the new amendments around valuation governance under Prudential Standard SPS530 comes into effect.

Findings from APRA's superannuation thematic reviews

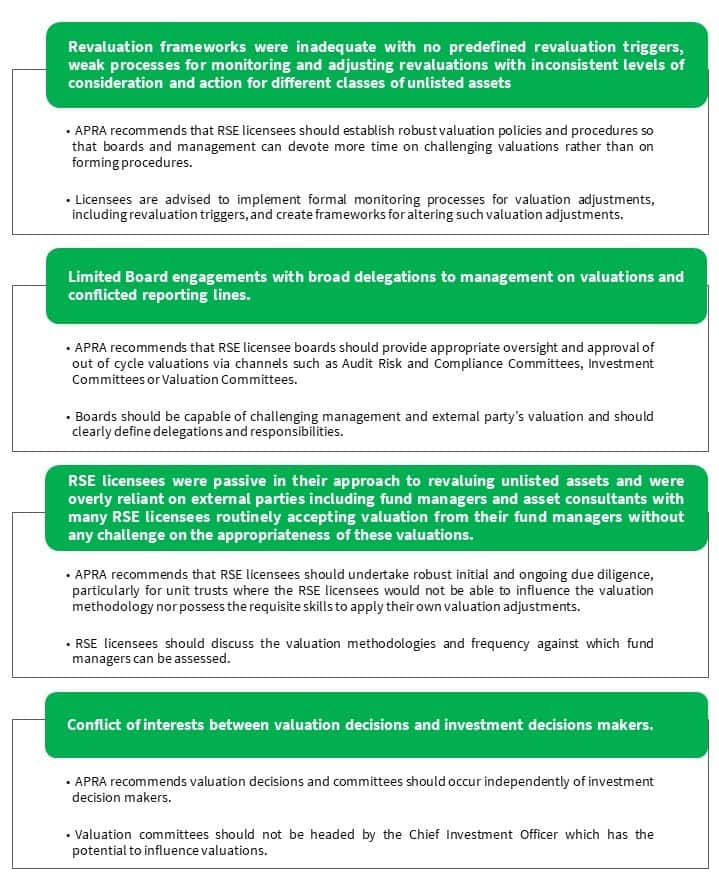

APRA conducted a thematic review of unlisted assets valuation practices from September 2020 to March 2021 by selecting 31 RSE licensees based on their exposure to unlisted assets. The key findings and proposed recommendations from APRA's report are highlighted below:

At the same time, APRA observed some improved valuation practices during this review such as increased regular reporting from monthly/quarterly to daily/weekly, increased frequency of investment committee meetings, adopting out of cycle valuations either by using low point estimates previously provided by independent valuers or asking fund managers or independent valuers to revalue their investments earlier.

Findings from ASIC's superannuation trustees' conflicts of interest policies and compliance review

In October 2021, ASIC also released its findings from the review performed on Super fund trustee's conflict of interest, valuation of unlisted assets, and compliance policies. ASIC's focus was on the alleged switching of director and executive's personal investments out of unlisted assets, thereby unfairly benefiting from their inside knowledge as to the timing of Super fund unlisted assets revaluations compared to public investors. ASIC revealed that there was clear failure on part of Super fund trustees to identify such investment switching as a source of potential conflict with many trustees not having proper mechanisms in place to review this switching activity. Almost half of the trustees (10 of the 23) did not have preventative controls such as trade pre-approvals or switching blackout periods which could have limited executives' ability to switch investment options. Also, there is a significant shortfall in trustee board level engagement with only a few trustees (if any) having detailed policies in place that outline restrictive measures.

Proposed Amendments to include Valuation Governance under APRA Prudential Standard SPS530

To strengthen the valuation governance framework particularly around unlisted assets, APRA has announced the new amendments under Investment Governance Prudential Standard SPS530 outlining the revised Investment Governance framework. One of the major changes proposed under the Standard includes developing and implementing an effective valuation governance framework with board approved valuation policy outlining:

- Roles and responsibilities of the Board with delegated responsibilities for the oversight and management of valuation processes and procedures;

- Key metrics and information that must be reported to the Board;

- Valuation methodology employed for each asset class and sub-asset class including the sources of valuation inputs;

- Circumstances under which independent external valuations are to be obtained;

- Frequency of valuation and circumstances which will trigger interim valuations outside of determined valuation frequency;

- Validation of valuation outputs including any back testing procedures;

- Review process to ensure that valuation policy remains effective;

- Circumstances as to when to accept, reject or reassess valuation of RSE investments to ensure that RSE licensee's valuation remain appropriate.

Currently APRA Prudential Guidelines SPG531 provides guidelines around valuation governance and best practices in relation to asset valuation that may be voluntarily adopted. However, with these proposed amendments to include a Valuation Governance framework under the Investment Governance Standard SPS530, RSE licensees will be required to comply with the requirements from 1 January 2023. The draft amendments are currently open for consultation until February 2022.

In November 2021, the Federal Government also announced the updated Superannuation portfolio holding disclosure regulation which requires superannuation funds to disclose information about the identity, valuation, and weightings of their investments. Under this regulation, superannuation funds must report their holdings by 31 March 2022 and every six months thereafter. The proposed changes are in line with industry best practice valuation guidelines such as International Private Equity and Venture Capital Valuation Guidelines (IPEV) and the Australian Investment Council (AIC) and will help improve transparency and accountability for members.

Key Observations

Based on the above findings and proposed amendments under SPS530, RSE licensees will need to pay special attention to their internal valuation policies which will be used as guiding principles to define the roles and responsibilities of various oversight committees, valuation methodology and key reporting metrics. One of the key considerations for RSE licensees is to establish and maintain independence in the valuation process from deal teams whose remuneration is linked to the investment performance. Industry best practice is to set up an independent valuation committee comprising of members who are not directly involved in investment decisions or valuation of investments and thus, can provide oversight on the overall valuation process and procedures.

<span/>To avoid any potential conflict of interest, RSE licensees can obtain independent valuations or assurance reviews from third-party service providers on internal valuations prepared by independent price verification (IPV) or risk management teams. For internally managed investments, there might be a few practical constraints to strictly enforce segregation of duties between the Valuation and Investment function. Hence a prudent approach is to ensure broad representation from different functions such as Risk, Investment, Finance and Compliance through various committees for providing oversight and assessing the appropriateness of the valuation. However, irrespective of whether valuations are performed internally or externally, RSE trustees need to continuously monitor and review their control environment supporting the valuation process and make appropriate changes, if required, to ensure effective valuation governance arrangements are in place.

RSE licensees are also required to perform in-depth due diligence when selecting third-party fund managers as well as perform periodic reviews on their valuation processes and procedures to ensure consistency with their own valuation practices. RSE licensees need to proactively engage with fund managers to discuss valuation methodology, data/inputs and should establish documented procedures for cases when the valuation provided by fund managers are not considered suitable. Hence, it is also important from the perspective of fund managers who are managing and investing capital on behalf of RSE licensees to start reviewing and aligning their valuation policies and procedures in accordance with these amended standards. To establish such valuation policies, it is important to note that the valuation methodology selected for valuing the private assets might vary depending upon the type of investment strategy such as early stage, growth stage or late stage as the underlying investment risk and return expectation changes. The proposed practice changes will further align the local market here in Australia to North American and European operating models (of words to that effect).

Valuation Considerations for Private Assets

To ensure valuation processes and methodologies remain consistent and valid during periods of heightened volatility, there should be appropriate checks and balances around the suitability of data/inputs utilized in such valuations. A common misconception in private asset valuation is around utilizing par value or cost as an automatic proxy for Fair Value, or utilizing Price of Recent Investment (PRI) as a Valuation Technique for calculating the Fair Value. However, these assumptions are not in line with Fair Value Principles and were severely tested during the height of the pandemic when uncertainty over future cash flows translated into higher required returns and lower asset values.

RSE licensees should also consider that private investments, which often carry a higher degree of risk, uncertainty and/or incomplete information, might not be appropriately valued using standard valuation techniques in all cases. For example, early-stage companies are especially hard to value due to the difficulty of gauging the probability or financial impact of the success or failure of development activities. In such cases alternative valuation techniques such as milestone-based approaches may be necessary.

Consequently, the most appropriate valuation techniques to measure fair value are those based on observable and reliable market data, incorporating market participant assumptions of the potential outcomes. Scenario analysis is one of the commonly used valuation techniques where asset valuation is computed under different scenarios, varying the severity of assumptions for both macroeconomic and asset-specific variables. However, for some valuations risk is not only discrete but sequential, and decision trees can be used to devise the right outcomes at each stage. Unlike scenario analysis and decision trees where investment level valuations are examined under discrete scenarios, simulations allow for more flexibility and provide a way of examining the consequences of continuous risk at the macroeconomic level. Using these valuation techniques can help to improve fair value estimation during periods of uncertainty.

Closing comments

Super funds continue to increase their asset allocation to unlisted assets, especially those with long duration such as infrastructure, property and early-stage companies. As Super funds start looking at risk and return holistically across their public and private investments, it will become paramount to establish and maintain robust valuation governance frameworks and policies to provide fair valuation of unlisted assets to meet regulatory standards, maintain member's equity, manage risk, and attribute performance. With evolving regulations and higher scrutiny, it is imperative that both Super funds trustees and fund managers start reviewing their valuation governance framework quickly before regulators come knocking on their doors.

Posted 12 January 2022 by Mukul Singhal, CFA, CAIA, Director, Private Equity & Debt Services, IHS Markit and Leon Sinclair, Global Head, Private Equity & Debt Services, IHS Markit

For further insights, please refer below to our thought leadership articles published in 2021: