Value factors maintain momentum

Research Signals – December 2017

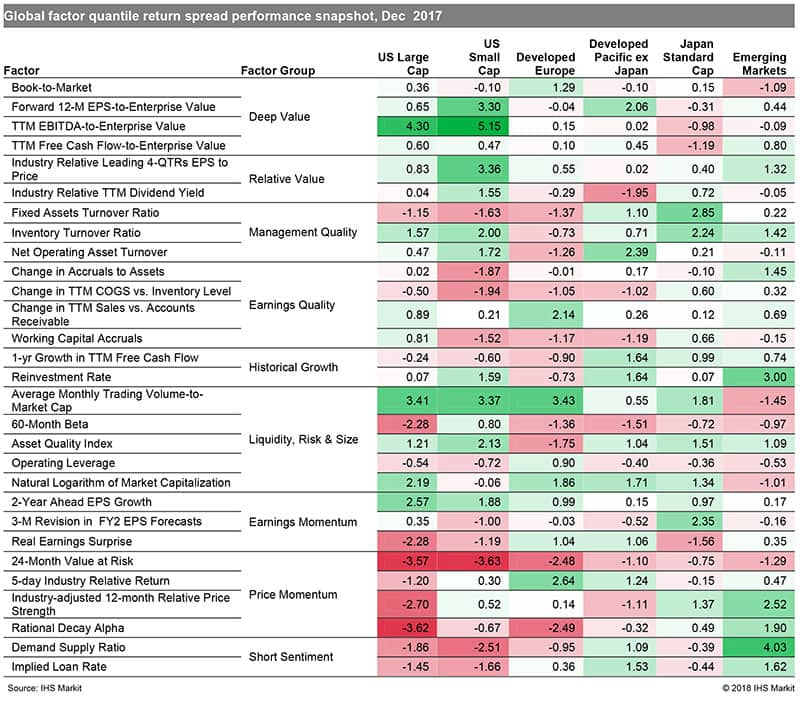

Global stocks had plenty to celebrate at the New Year with their best annual performance since 2009. However, a synchronized global economic recovery, confirmed by the J.P. Morgan Global Manufacturing PMI™ ending 2017 near a seven-year high, did not translate into a consistent pattern of outperformance to price momentum trades across regional markets. Indeed value factors posted another strong month across many developed markets (Table 1).

- US: TTM EBITDA-to-Enterprise Value more than doubled its prior month performance, demonstrating investors continued push toward valuation

- Developed Europe: Momentum in stock prices did not translate into like factor performance, with momentum metrics such as Rational Decay Alpha struggling further in December

- Developed Pacific: Japanese markets remain upbeat heading into the new year, with positive momentum captured by Industry-adjusted 12-month Relative Price Strength

- Emerging markets: Historical growth factors performed strongly for the month, with Reinvestment Rate leading the group

Table 1

Posted 4 January 2018

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.