Value shares profited from the stock market rebound

Research Signals - October 2022

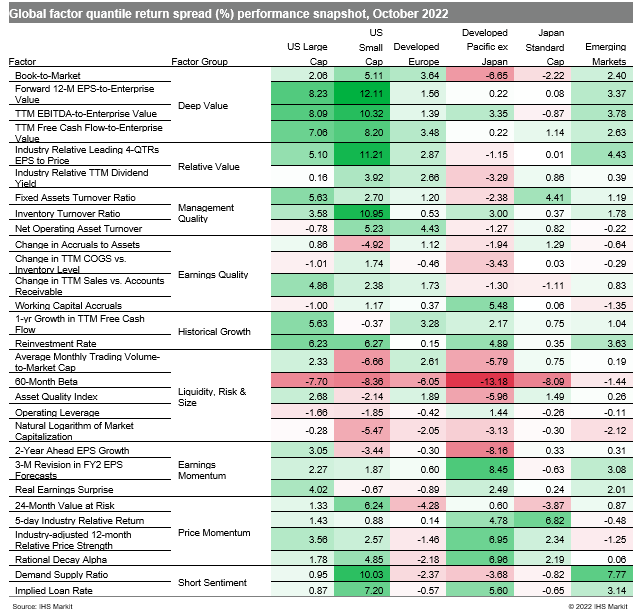

Investors' hopes rose that central banks would ease off future rate hikes on increasing concerns about slowing global economic activity, as confirmed by the manufacturing sector's second consecutive month in contraction territory, according to the J.P.Morgan Global Manufacturing PMI™. In turn, most equity markets around the globe staged a rebound in October, led by the US, with value factors the beneficiaries across many of our coverage regions (Table 1).

- US: Deep Value factors enjoyed a strong bounce last month, as demonstrated by Forward 12-M EPS-to-Enterprise Value

- Developed Europe: Investors moved out on the risk curve, dragging down performance of 60-Month Beta

- Developed Pacific: Strong performance from Price Momentum measures such as Industry-adjusted 12-month Relative Price Strength extended into October in markets outside Japan

- Emerging markets: Large cap shares were favored last month, as captured by performance of Natural Logarithm of Market Capitalization

Table 1

IHS Markit provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.