EQUITIES COMMENTARY

Jul 06, 2021

Variants in factor performance

Research Signals - June 2021

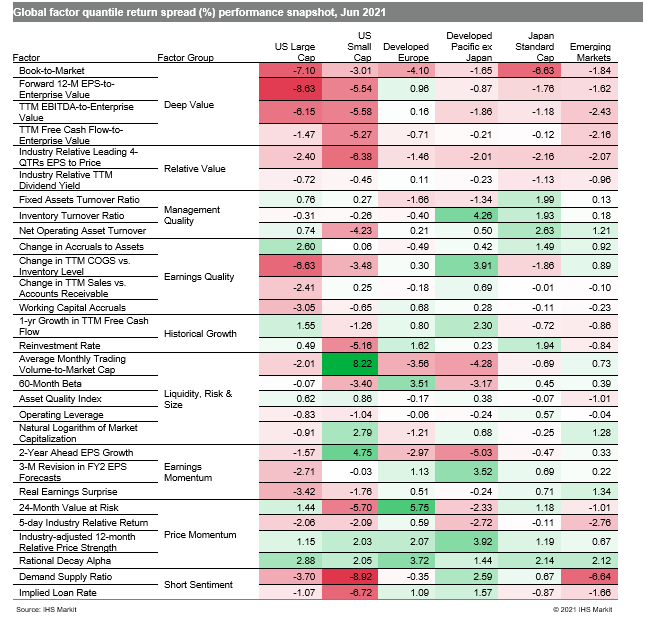

- Investors have mostly shrugged off inflation fears, however, concerns surrounding rising delta variant cases and the potential disruption of the global economic recovery has resulted in variations in major equity market performance, such as that between more restrained Asian stocks and new all-time highs in the US. The continued solid upturn in the J.P.Morgan Global Manufacturing PMI also saw regional variations, with extended strength in the eurozone and the US, while Asia continued to underperform. Investors reacted with variants in monthly factor performance by taking on more risk and exposure to momentum stocks, while shunning previously outperforming deep value shares across many regional markets (Table 1).

- US: Value measures such as Forward 12-M EPS-to-Enterprise Value were particularly weak performers among large caps, while higher risk small cap shares ranked in the bottom decile of 60-Month Beta outperformed

- Developed Europe: Investors tempered their optimism in high momentum shares gauged by Rational Decay Alpha with low risk exposure to names captured by 24-Month Value at Risk

- Developed Pacific: High quality firms were especially rewarded, as represented by Inventory Turnover Ratio

- Emerging markets: Investors took on a renewed interest in high momentum, high risk names, as confirmed by outperformance of Rational Decay Alpha and underperformance of 24-Month Value at Risk, respectively

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvariants-in-factor-performance.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvariants-in-factor-performance.html&text=Variants+in+factor+performance+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvariants-in-factor-performance.html","enabled":true},{"name":"email","url":"?subject=Variants in factor performance | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvariants-in-factor-performance.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Variants+in+factor+performance+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvariants-in-factor-performance.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}