Weekly Global Market Summary Highlights: January 10-14, 2022

All major US equity indices closed lower on the week, while European and APAC markets were mixed. US government bonds closed mixed with the curve slightly flatter on the week, while most benchmark European government bonds closed higher week-over-week. European iTraxx closed slightly wider across IG and high yield, while CDX-NA was almost flat week-over-week. The US dollar closed lower on the week, while oil, natural gas, gold, silver, and copper were higher week-over-week.

Americas

All major US equity markets closed lower on the week; Nasdaq -0.3%, S&P 500 -0.3%, Russell 2000 -0.8%, and DJIA -0.9% week-over-week.

10yr US govt bonds closed 1.79% yield and 30yr bonds 2.13% yield, which is +2bps and flat week-over-week, respectively.

DXY US dollar index closed 95.17 (-0.6% WoW).

Gold closed $1,817 per troy oz (+1.1% WoW), silver closed $22.92 per troy oz (+2.3% WoW), and copper closed $4.42 per pound (+0.2% WoW).

Crude Oil closed $83.82 per barrel (+6.2% WoW) and natural gas closed $4.08 per mmbtu (+9.5% WoW).

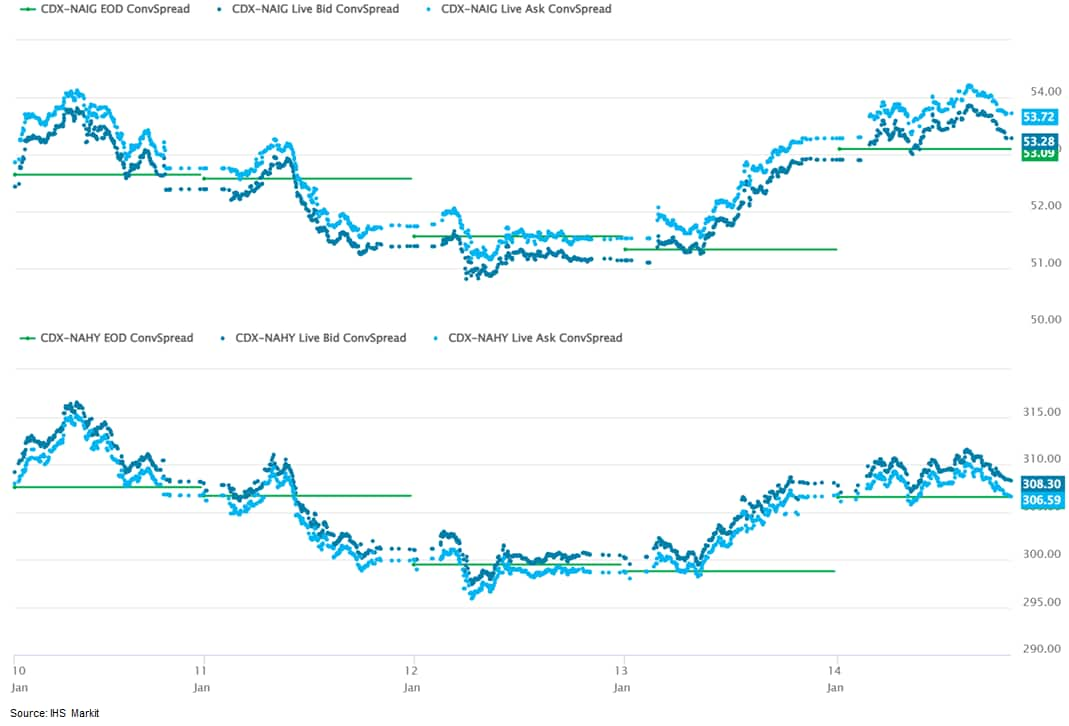

CDX-NAIG closed 54bps and CDX-NAHY 308bps, which is +1bp and

flat week-over-week, respectively.

EMEA

Major European equity indices closed mixed on the week; UK +0.8%, Spain +0.6%, Italy -0.3%, Germany -0.4%, and France -1.1% week-over-week.

Most 10yr European government bonds closed higher on the week except for France +4bps; Italy closed -5bps, UK -3bps, Spain -2bps, and Germany -1bps week-over-week.

Brent Crude closed $86.06 per barrel (+5.3% WoW).

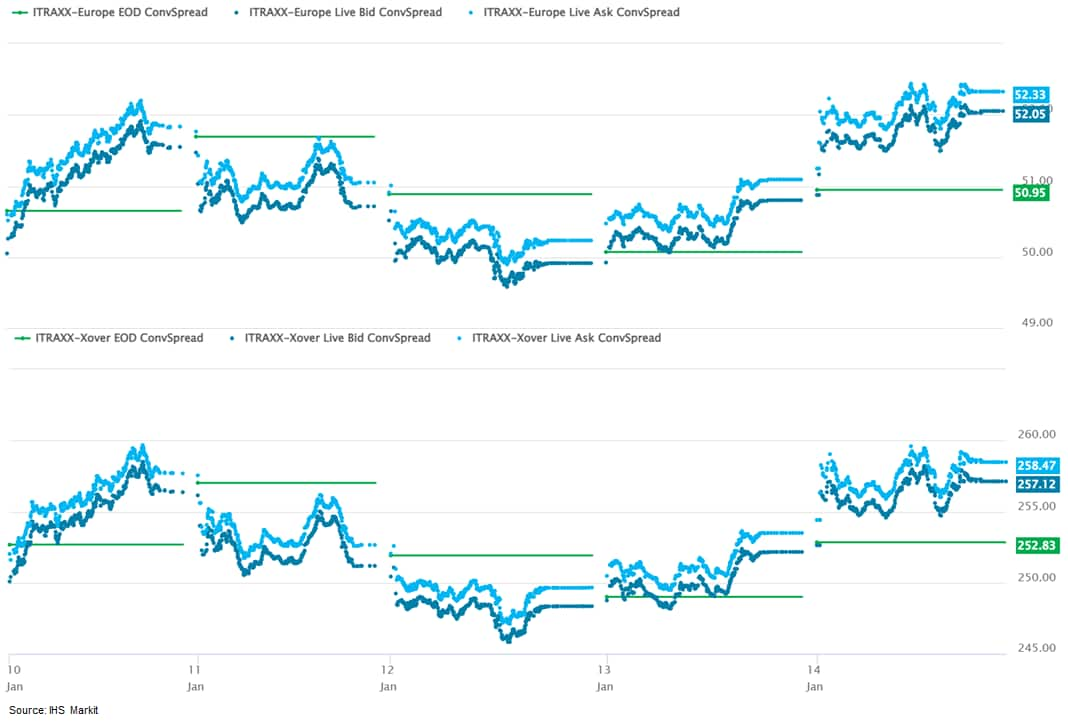

iTraxx-Europe closed 52bps and iTraxx-Xover 258bps, which is

+2bps and +5bps week-over-week, respectively.

APAC

Major APAC equity indices closed mixed on the week; Hong Kong +3.8%, India +2.5%, Australia -0.8%, South Korea -1.1%, Japan -1.2%, and Mainland China -1.6% week-over-week.

Monday, January 10, 2022

- Novel, biodegradable fibers that release antimicrobial

compounds when triggered by bacterial enzymes or critical increases

in relative humidity might lead to food producers' holy grail of

environmentally friendly packaging materials that extend product

shelf life and diminish the risks of food poisoning by combatting

the likes of fungi, E. coli, and Listeria. (IHS Markit Food and

Agricultural Policy's William Schulz)

- The cellulosic nanofibers, which can be deposited as a functional layer of food packaging materials, were developed by researchers at Harvard University's T.H. Chan School of Public Health and the Nanyang Technological University (NTU) in Singapore. They are created with an industrial method known as electrospinning that produces fibers by using electric force to draw charged threads of polymer solutions into tubes.

- The multi-stimuli-responsive fibers the Harvard-NTU team developed consist of cellulose nanocrystals, corn protein zein, and starch. Electrospinning allows incorporation of nature-derived antimicrobial active ingredients (AI) such as thyme oil, citric acid, and nisin, as well as cyclodextrin-inclusion complexes of thyme oil, sorbic acid and nisin. The ingredients all meet FDA's standard of Generally Recognized as Safe (GRAS), researchers say.

- "Food safety and waste have become a major societal challenge of our times with immense public health and economic impact which compromises food security," says Philip Demokritou, a professor of environmental health and co-director of the NTU-Harvard Initiative on Sustainable Nanotechnology. "One of the most efficient ways to enhance food safety and reduce spoilage and waste is to develop efficient, biodegradable, nontoxic food-packaging materials. In this study, we used nature-derived compounds including biopolymers, nontoxic solvents, and nature-inspired antimicrobials and developed scalable systems to synthesize smart antimicrobial materials."

- The packaging industry is the largest and growing consumer of synthetic plastics derived from fossil fuels, Demokritou says, with food packaging plastics accounting for the bulk of plastic waste in the environment.

- The study notes that synthetic, petroleum-based polymers are widely used as food packaging materials because of their low cost, excellent gas barrier, and mechanical properties. But incorporating AIs in these materials has not been successful due to poor antimicrobial performance related to the materials' low surface-to-volume ratio, and "potential negative sensory effects."

- Bloomberg and several news websites in Hong Kong reported on 7

January that mainland Chinese banking regulators, which include the

People's Bank of China (PBOC) and the China Banking and Insurance

Regulatory Commission (CBIRC), have asked banks to increase the

loan amount granted to real estate companies. Furthermore, there

have been reports that banks have been asked to not include lending

towards property project M&A under mainland China's three red

lines policy. However, some banks have refuted this, stating that

they have been asked to continue considering all lending under the

three red lines. (IHS Markit Banking Risk's Angus

Lam)

- Mainland Chinese regulators began to push healthy developers to purchase good-quality housing projects from cash-strapped players in the sector at the end of 2021 (see China: 21 December 2021: Mainland Chinese authorities encourage banks to lend towards property companies' M&A, potentially reducing asset quality deterioration).

- The latest news, although not confirmed by all parties, suggests that it is the first sign of loosening financing for developers by relaxing the M&A finance for healthy developers to purchase from weaker parties. This is the first relaxation since the three red lines were introduced at the start of 2021 (see China: 4 January 2021: Mainland China's central bank further caps lending for real estate to curb financial risk, limited impact on overall banking sector).

- Since the fourth quarter of 2021, banks have improved the loan amount granted to retail customers to purchase properties. According to a press release by the CBIRC on 6 January, mortgage loans had risen by 8.4% year on year in November 2021, with 90% of the loans granted to first-time buyers, suggesting the continuing of the "housing for living, not for flipping" policy.

- IHS Markit assesses that the relaxation of loans for the M&A of property projects is a short-term liquidity solution, while a restructuring of the sector, alongside poor assets, would be likely to be a more long-term outcome. However, since stability is key, it is likely that the regulator will ensure that retail customers are protected adequately by introducing a system to ensure that funds received from home purchasers are used to complete the developments.

- In December 2021, the impact of the semiconductor shortage

continued to constrain sales, production and exports in Mexico; in

the full year, sales improved 6.8% y/y, exports were up 0.9% and

production declined 2.0%. In 2021, Mexican light-vehicle sales

results varied through the year. In 2021, there were market

challenges in the first two months, followed by high y/y

improvements for several months based on comparisons with the weak

results in the corresponding periods of 2020. In the second half of

2021, the semiconductor and other supply chain issues constrained

light-vehicle production, exports, and sales. These issues are

expected to constrain production throughout 2022. With sales and

production constrained in 2021 and 2022, a release of pent-up

demand is expected to bring sales improvements in 2023 and 2024. In

2022, although light-vehicle production is forecast to improve

compared with 2021, it is not expected to reach the pre-pandemic

volume of 2019 until 2023. (IHS Markit AutoIntelligence's Stephanie

Brinley)

- VinFast has announced that 25,000 reservations for its new VF 7

and VF 9 were placed within 48 hours of opening, as well as a

100-unit US corporate order. Separately, VinFast also confirmed it

will work with HERE Navigation and HERE SDK for navigation and a

VinFast mobile application. The VF 8 and VF 9 reservations - 15,237

for the less expensive VF 8 and 9,071 for the larger VF 9 - were

placed from global markets. The company did not provide a breakdown

for how many reservations were in which country. (IHS Markit

AutoIntelligence's Stephanie

Brinley)

- In addition, and separate from the reservations, VinFast announced a corporate order in the US. A company called Artemis DNA has ordered 100 VinFast vehicles; including units of all five of the company's newly announced products, although production timing for three of them is not confirmed. Artemis DNA is a clinical diagnostics laboratory company in the US that aims to have a fully electric vehicle fleet. It expects to take delivery of its first units in the fourth quarter of 2020 and will be VinFast's first corporate customer in the US. Working with HERE Navigation will enable VinFast to leverage a navigation-as-a-service model and enable it to update and upgrade navigation offerings with new features and services throughout the vehicle's lifecycle, which VinFast says lowers costs and improves scalability. VinFast will integrate the HERE SDK (software developer kit) into the VinFast mobile application as well.

- Having previously announced plans to work with Cerence, in January 2022, VinFast announced that it will use Cerence Connected Vehicle Digital Twin (CCVDT) platform for cloud connected in-vehicle technology. Cerence will provide cloud and AI capabilities. With Cerence, VinFast says it will offer extended digital cockpit capabilities and deeper information about the car; possibilities include enabling in-car delivery services; providing electric vehicle (EV) charging network information; reminders to close doors and windows; calendar reminders; driving suggestions; and others.

- TotalEnergies opened late last year the second phase of its

battery energy storage system (BESS) facility in Dunkirk in

northern France, bringing its capacity to 61 MW, the largest site

in the nation and part of a gradual increase in storage nationally.

The project, known as Dunkirk II, adds to the 25 MW capacity of

Dunkirk I, both located at a TotalEnergies oil refinery that's been

repurposed for biofuels production and an LNG import terminal.

Dunkirk II consists of 27 lithium-ion BESS units supplied by Saft

Batteries. (IHS Markit Net-Zero Business Daily's Kevin Adler)

- TotalEnergies has two more BESS properties under development in France that will bring the company's storage capacity to 129 MW countrywide by the end of 2022, the energy major said on 22 December. Those sites are Carling in northeast France (25 MW) and Grandpuits in north-central France (43 MW).

- France lags behind Germany and the UK in battery storage capacity among European nations, with more than 800 MW of capacity, including the addition in 2021 of about 170 MW, according to IHS Markit. (The UK has about 12,000 MW of installed battery storage, and Germany more than 31,000 MW, according to IHS Markit's Energy Storage Geographic Profiles published last year.)

- IHS Markit says that new installations of battery storage systems in France in 2022 could top 200 MW.

- Speaking to Net-Zero Business Daily by email, George Hilton, IHS Markit energy storage senior analyst, said the industry in France is benefiting from new regulations that opened "access to multiple revenue streams" to pay for the installations. Most important among those streams is the long-term capacity auction known as AOLT, which provides generators and storage companies a guaranteed price for energy for seven years.

- AOLT bids were made through the Ministry for the Ecological and Inclusive Transition in February 2020, which yielded winning bids for 253 MW of new storage capacity through 2028.

- RTE is making progress on a major battery storage project of its own, Project RINGO, which will ultimately deploy 100 MW of new storage at three sites. Its initial investment is €80 million ($95 million), the grid operator said when detailing the program in August. Unlike TotalEnergies, RTE is pairing its storage directly with renewable power installations: wind farms in Vingeanne in eastern France; wind and solar sites in Bellac in the west; and solar sites in Ventavon in the southeast. Construction began in April 2021 at Vingeanne, and the first installation could be completed in the first quarter of 2022.

- South Korea's Lotte Chemical has resurrected plans to construct

a $3.95 billion petrochemical project in Indonesia's Banten

Province, the company announced last Friday. Lotte Chemical signed

a memorandum of understanding (MOU) with the Indonesian government,

intending to complete this "Lotte Chemical Indonesia New Ethylene"

(LINE) petrochemical project by 2025, Lotte Chemical said in a

press release. (IHS Markit Chemical Market Advisory Service's Chuan

Ong)

- The Indonesian government is in turn expected to provide incentives such as lower raw material import tariffs, exemptions on construction equipment and facilities, and tax benefits for successful implementation and commercial production.

- This project has was first mooted more than ten years ago. Lotte Group had proposed a plan to invest in a Merak petrochemical project in 2011 after its Chairman met former Indonesia's former President, Susilo Bambang Yudhoyono. It planned to spend $5 billion on a new plant to augment existing facilities in Merak, which were producing 450,000 mt/yr of linear low density polyester (LLDPE) or high density polyethylene (HDPE), and 38,000 mt/yr of biaxially oriented polypropylene (BOPP).

- According to South Korean broadsheet The Korea Economic Daily, Lotte had targeted commercial production by 2016 but suspended plans as talks with the government dragged and Lotte group was caught up by infighting between its Chairman and his sibling. The Chairman was subsequently arrested for a separate bribery case in 2018. A project ground-breaking in December 2018 slated commercial production in 2023, before the project stalled again due to the COVID-19 outbreak.

- Seasonally and calendar-adjusted German industrial production

excluding construction did not correct for October's unexpectedly

large rebound in November, rather remaining broadly flat.

Nevertheless, the latest output level thus remained almost 8% below

its February 2020 pre-pandemic high. (IHS Markit Economist Timo

Klein)

- Total production including construction was slightly weaker in November due to a dip by 0.8% month on month (m/m) of construction output. Energy production declined even more (-4.4% m/m). Since mid-2018, and especially during the pandemic, construction has been a supportive force for overall production, but this was no longer the case during October-November.

- The split by type of good reveals that the production of intermediate and consumer goods each increased by 0.8% m/m while investment goods output slipped slightly (-0.6%), but to a much lesser extent than feared after October's spike by 7.3% m/m. Intermediate goods remain on a sideways path for now, having declined during June-September 2021. Consumer goods production has shown a sideways tendency since September already. The interim loosening of COVID-19 restrictions since May 2021 boosted the recovery for about three months before losing momentum.

- The November breakdown by industrial branch reveals that motor vehicle production managed to strengthen for the third consecutive month in November, approaching the mid-2021 levels seen prior to the major drop in August (-19.6% m/m). This is still about 30% below its pre-pandemic level, however, reflecting ongoing issues with the availability of semiconductors. In other sectors, production of chemicals/pharmaceuticals sector also increased strongly at 4.0% m/m, unwinding its October setback and therefore resuming its outperformance versus industry as a whole observed during August and September. In contrast, machinery and equipment (-3.6% m/m) and the electronic and electric equipment sector (-1.7%) did less well in November, returning to the pronounced weakness seen during August and September.

- Meanwhile, manufacturing orders continue to display even

greater volatility. November's 3.7% m/m rise recoups part of

October's plunge of -5.8% m/m, just like September (1.8%) had

unwound part of the steep fall in August (-8.8%). The net decline

in orders in recent months has corrected for the almost

uninterrupted build-up of demand since May 2020, however, so that

November's orders level is about 7% above that of February 2020,

just before the pandemic took hold. This contrasts with the 8%

shortfall noted above for production ex-construction. In fact,

October's accumulated stock of orders, a separate statistic, was

even 26% higher than in February 2020.

Tuesday, January 11, 2022

- Lithium-ion (Li-ion) battery prices have increased by 10-20% in

the later months of 2021, predominantly for lithium iron phosphate

(LFP) technology, which is the favored technology for grid energy

storage systems. Surging raw materials prices, automotive industry

demand for LFP batteries, and tight, geographically concentrated

LFP supply are all drivers of higher prices. (IHS Markit EnergyView

Climate & Cleantech's Peter

Gardett and Sam

Wilkinson)

- The latest IHS Markit forecasts for battery energy storage capex suggest that average battery module prices in 2022 will be 5% higher than in 2021, contributing to a 3% increase in total battery energy storage system costs. Compared with the previous IHS Markit forecast, these battery prices are 16% and 22% higher, respectively. Prices may decline modestly in 2023, contingent upon scaled-up LFP manufacturing capacity and energy storage system integrators securing supply agreements with LFP suppliers.

- Higher prices alone are not expected to severely impact the near-term outlook for energy storage installations. With electricity and fuel prices all trending upward and displaying unprecedented levels of volatility, battery energy storage remains competitive with the alternative technologies that can help provide the flexibility required to enable high renewable penetrations in the power system.

- The bigger threat to industry growth is the ability of system integrators to procure the required volumes of batteries, meaning that strategic partnerships with multiple vendors will become increasingly important for system integrators to mitigate against supply disruption.

- On January 7, three Community Choice Aggregators (CCAs) -

Central Coast Community Energy, Silicon Valley Clean Energy and

Sonoma Clean Power - announced that they have partnered to jointly

issue a Request for Proposals (RFP) for new clean energy resources.

The RFP seeks proposals from qualified and experienced individuals

or firms to develop non-polluting energy sources to meet the

state's new Mid-Term Reliability procurement mandate in addition to

each CCA's Renewable Portfolio Standard (RPS), greenhouse gas

emission reductions and reliability requirements. The RFP is at:

sonomacleanpower.org/request-for-proposals. Proposals are due by 5

p.m. PT on January 31. The CPUC ordered all load serving entities

in the state, including CCAs, to purchase 11,500 MW of new, clean

resources to come online by 2026. The decision requires the three

CCAs to procure a combined total of more than 600 MW of additional

Net Qualifying Capacity (NQC) to come online before June 1, 2026.

NQC refers to the ability of a power plant to meet the reliability

needs of the grid, particularly during peak, evening hours.

Eligible resources for this RFP include (IHS Markit PointLogic's

Barry Cassell):

- Non-fossil fuel sources such as solar, wind, renewable plus storage hybrids, and demand response.

- Zero-emitting resources available during peak evening hours, such as energy storage.

- Firm-generation resources that are not weather dependent, such as geothermal.

- Long-duration energy storage that is able to discharge over at least an eight-hour period.

- General Motors (GM) and its joint ventures (JVs) delivered 2,891,900 vehicles in China in 2021, down 0.3% year on year (y/y). Retail sales of the Buick brand contracted by 7.8% y/y to 815,900 units last year while sales of the Chevrolet brand slumped by 21.1% y/y to 229,600 units. Cadillac reported growth of only 0.5% y/y last year with sales of 231,800 units. Sales of the Baojun brand have declined by 47.6% in 2021 to 210,800 units. As a highlight in GM's sales report, the Wuling brand's sales rose 28.5% y/y in 2021 to 1,403,800 units. The budget car brand is also the highest-selling brand under GM in the Chinese market. GM's sales stayed flat last year in China thanks to strong performance of the Wuling brand. The Wuling Hongguang Mini EV has outsold an array of electric vehicles (EVs) in China to become the best-selling EV in the market last year. According to GM, its sales approached 450,000 units last year, taking GM's small EV sales to over 750,000 units. Strong market demand for the Wuling Hongguang Mini EV has boosted GM's sales, and partially offset sales declines by the group's other brands, however, the automaker is faced with mounting pressure in the standard-price and premium vehicle market as Chevrolet is clearly losing traction in the market. In the premium EV market, GM has already launched the Cadillac Lyriq. The E-segment premium model, based on GM's Ultium platform, will enable GM to take on rivals such as Tesla, NIO and Audi, in the premium EV segment. Deliveries of the Lyriq are set to begin in mid-2022 in the country. IHS Markit currently expects sales of the Lyriq to stay below 10,000 units in 2022 as the model is currently only available in China as a long-range rear-wheel drive with high selling price of CNY439,700 (USD69,006). (IHS Markit AutoIntelligence's Abby Chun Tu)

- SML Isuzu has temporarily suspended production at its commercial vehicle manufacturing plant located in Shahid Bhagat Singh Nagar district in Punjab (India) for five days until 15 January due to an increase in COVID-19 cases. According to a filing to the Bombay Stock Exchange (BSE), the company said that due to the sudden increase in COVID-19 cases, especially with the highly infectious Omicron variant, resulting in challenges in the supply chain and likely impact on the demand of school buses, and to ensure safety of its employees and optimize inventory, the company has decided to temporarily suspend production. (IHS Markit AutoIntelligence's Isha Sharma)

- Hanwha Total Petrochemical Co., the largest styrene producer in

South Korea, has further reduced the operating rates at its styrene

plants in Daesan, said a source with knowledge of the matter. It on

Jan. 1 decreased the overall operating rates at its two styrene

plants to 70% of capacity, after implementing a run rate cut to

80%-90% in November, the source said. (IHS Markit Chemical Market

Advisory Service's Trisha Huang)

- It plans to keep running its two styrene plants, with a combined capacity of 1.05 million mt/yr, at the current reduced rate in the near term, the source added.

- Ongoing styrene capacity expansion in China has pressured margins for Northeast Asian styrene producers and prompted several to curtail output in late 2021.

- The price spread between spot CFR China styrene to key feedstock spot FOB Korea benzene shrank in December to the smallest in 2021, data compiled by OPIS show.

- Ahead of the early-2022 commissioning of three new styrene units in China with a combined capacity of 1.97 million mt/yr, the styrene/benzene price spread fell to an average of $151/mt in December, down by 32.9% from $225/mt in November, OPIS data show.

- For comparison, the styrene/benzene price spread averaged $284/mt in the first six months of 2021, the data show.

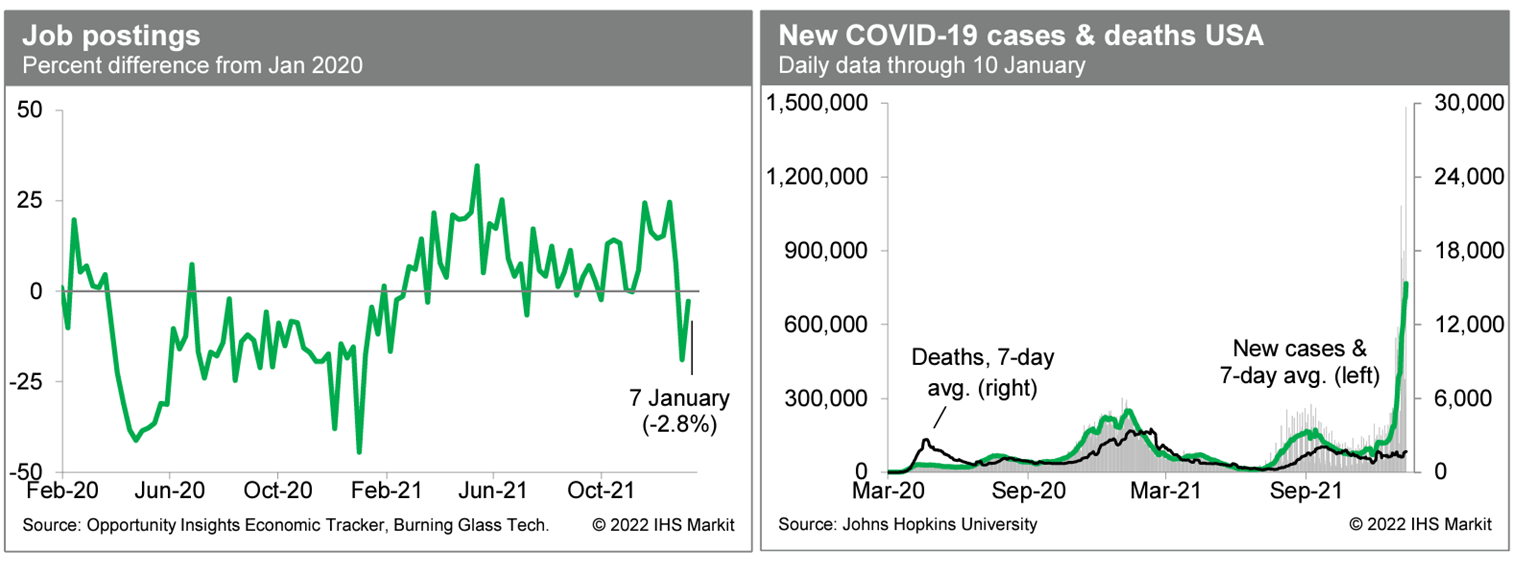

- US job postings rose last week to 2.8% below the January 2020

level, according to the Opportunity Insights Economic Tracker. This

and the prior week's reading are significantly below the prior

trend. The weakness could simply be a temporary lull following the

holidays but could also signal a more fundamental slowing in labor

demand. The next few weekly readings will help to clarify which is

more likely the case. (IHS Markit Economists Ben

Herzon and Lawrence Nelson)

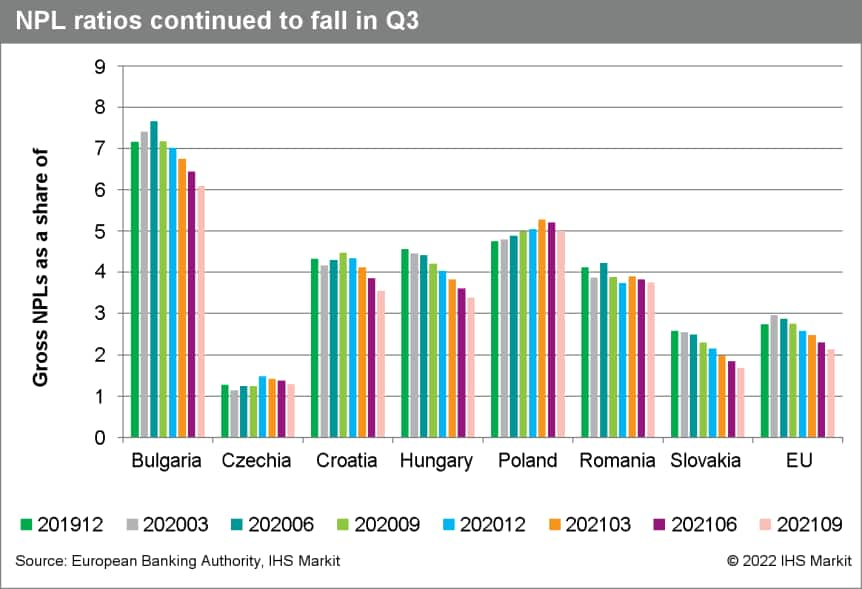

- The European Banking Authority published its latest quarterly

risk dashboard on 10 January 2022. The report indicates stable

impairment and profitability, but the sector continues to face

potential asset quality deterioration from loans previously subject

to forbearance measures, along with growing threats from securities

revaluation and operational risks, notably those relating to cyber

threats and climate risk. This risk dashboard is based on a sample

of 161 European banks (unconsolidated banks, including 30

subsidiaries). (IHS Markit Banking Risk's Risk's Brian

Lawson and Natasha

McSwiggan)

- The stock of non-performing loans (NPLs) of the overall sample has fallen by 5%, permitting the NPL ratio to reach 2.1%. Alongside this, NPL ratios for loans to commercial real estate and small and medium-sized enterprises (SMEs) fell to 5.4% and 5.3%, respectively, compared with 5.9% and 5.7%, respectively, in the second quarter of 2020.

- The share of non-expired and expired EBA-compliant loan moratoria to total loans fell in the third quarter of 2021 in the European Union. Nevertheless, this share remains relatively high in Hungary, Poland, and Croatia at 15.2%, 10.3%, and 9%, respectively. However, the stock of loans benefitting from support is higher than the calculated figures given that the data only reflect EBA-compliant moratoria.

- The average common equity tier-1 capital ratio (on a fully weighted basis) has fallen by 0.1 % to 15.4%, reflecting a small decline in capital and a parallel increase of over 1% in assets. The capital ratio and the tier-1 capital ratio stood at 19.5% and 17%, respectively, a minimal decrease over the quarter. The return on equity for the sample was stable, at 7.7%, a marked improvement compared with the 2.5% return recorded in the third quarter of 2020, with an unchanged net interest margin of 1.24%.

- According to the EBA, increased profitability in the quarter was supported by low impairment, but the net interest margin (NIM) remains at historically low levels. The pre-tax return on assets ratio was 0.49% in the third quarter of 2021, largely unchanged for the third consecutive quarter. Banks aim to increase income from fees and commissions and reduce operating expenses in the coming months.

- Coverage ratios remain low, with only 16.3% of the sample reporting over 55% coverage: 32.5% of banks had below 40% coverage, versus 38.1% in the preceding quarter.

- Market risk remains high. The report highlights "price

corrections and further increased volatility" with the valuation of

securities holdings facing downside risk from high inflation and

central bank tightening. This risk is already affecting the price

of debt securities holdings, exemplified by an increase of around

0.7 percentage points in the yield on 10-year German Bunds from

their 2020 low to just under zero, threatening a move to positive

yields for the first time since May 2019.

Wednesday, January 12, 2022

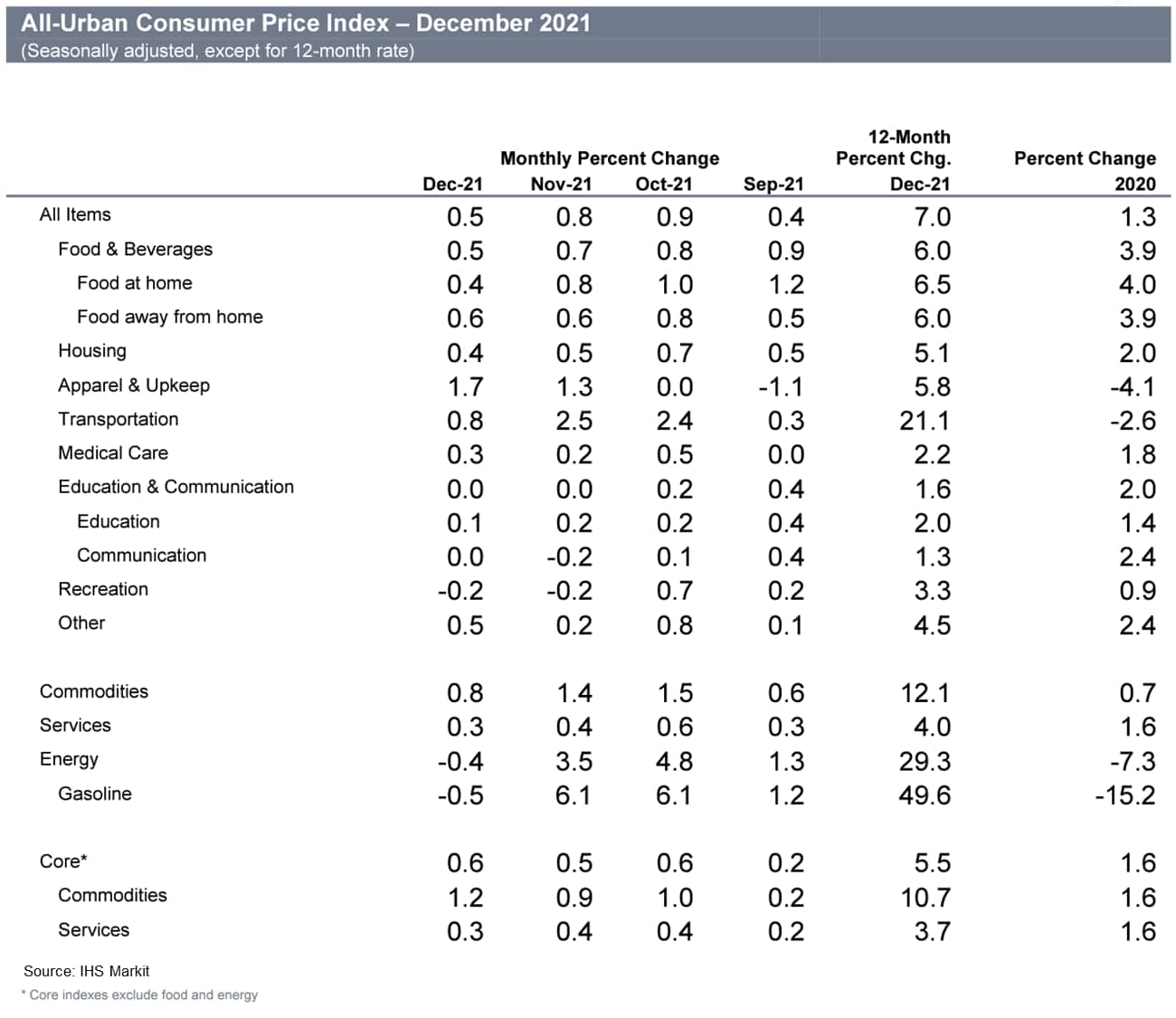

- The US Consumer Price Index (CPI) rose 0.5% in December. The

core CPI, which excludes the direct effects of moves in food and

energy prices, rose 0.6% in December. The CPI for food rose 0.5%

but the CPI for energy declined 0.4%, the first decline since

April. (IHS Markit Economists Ken

Matheny and Juan

Turcios)

- The 12-month change in the overall CPI climbed to 7.0%, the highest in nearly four decades. The 12-month change in the core CPI rose to 5.5%, the highest in more than 30 years.

- The rise in consumer prices continued to be broad-based in December. Among notable increases were those for apparel (1.7%), airline fares (2.7%), used vehicles (3.5%), and new vehicles (1.0%).

- The price of new vehicles is up 12.3% since March while used-car prices are up 39.0% since March. Supply chain bottlenecks have hampered vehicle production, resulting in lean inventories and higher prices. Limited availability of new vehicles for sale continues to spill over into strong demand and extraordinary price increases for used vehicles.

- Rent inflation has accelerated in response to low vacancies and surging home prices. Owners' equivalent rent (OER) and rent of primary residence (RPR) each rose 0.4% in December, similar to recent increases but up sharply from increases during approximately the first year of the pandemic. Twelve-month changes for OER (3.8%) and RPR (3.3%) are up from 2.0% and 1.8%, respectively, as of April.

- The combination of high inflation and tight labor markets

supports our expectation that the Federal Reserve will tighten

monetary policy several times over the course of 2022, including a

first hike in interest rates at the March policy meeting.

- Net capital outflows from Turkey continued during November

2021, fueled by hugely negative real interest rates. The current

account slipped back into deficit in November, although it remained

better than year-earlier levels. In 2022, it will be difficult for

Turkey to recapture net capital inflows. Although the

current-account deficit may re-widen, any such worsening will be

modest. (IHS Markit Economist Andrew

Birch)

- Although they moderated somewhat from October, net capital outflows from Turkey remained significant in November 2021. According to data from the Central Bank of the Republic of Turkey (Türkiye Cumhuriyet Merkez Bankası: TCMB), the country lost USD1.446 billion in net foreign portfolio investment in November. Hugely negative real interest rates and international investor doubts regarding Turkish monetary policy fueled the outflows.

- Meanwhile, following three consecutive months of surplus, the current account fell back into deficit in November. The USD2.681-billion gap, however, remained lower than it had been a year earlier. Seasonal merchandise trade factors contributed heavily to the resumed deficit in November.

- However, USD1.2 billion in fresh service imports in November also contributed to the overall deterioration in the current-account deficit. During the month, travel and transport imports - reflective of substantial new merchandise imports - drove up overall service imports. Additionally, there was a sharp rise in insurance and pension, financial services, and government service imports in November compared with earlier in the year.

- Global securities finance revenues totaled $870m in December, a

4% YoY decline. December saw the lowest global equity revenue for

this quarter which can be attributed to the dwindling EMEA and

Americas equity revenues. The general uptrend in borrow demand for

global ETPs and ADRs remained intact in December. In this note

we'll discuss the drivers of December revenue. (IHS Markit

Securities Finance's Paul

Wilson)

- Waste management company Veolia has announced the opening of a recycling facility for electric vehicle (EV) battery packs. According to a statement, the new site located in Minworth, near Birmingham (United Kingdom), will "initially discharge and dismantle batteries before the mechanical and chemical separation recycling processes will be completed". The company has added that the facility will have the capacity to process 20% of the UK's end-of-life EV batteries by 2024. Although there is an intention to use EV batteries in second-life applications such as energy storage, in many instances there will be a point where many of these batteries are no longer useable in these roles. Recycling batteries can not only enable the reuse of many of the key materials that go into a lithium-ion cell but can also reduce the carbon footprint and resource impact that a new battery cell can have. Indeed, Veolia's statement notes that an estimated 500,000 gallons of water are required to extract one ton of lithium using this type of mining, and that so-called "urban mining" can cut "greenhouse gas emissions from battery production by up to 50%". The announcement also coincides with a report in the Financial Times (FT) that suggests that battery costs will rise in 2022 following a sharp decline in the supplies of lithium and other raw materials as output has failed to keep up with demands of the wider market. (IHS Markit AutoIntelligence's Ian Fletcher)

- China's auto market will continue to play a central role in accelerating the global auto industry's transition to electrification over the next few years, IHS Markit's latest forecasts show. Latest data from China Passenger Car Association (CPCA) indicate that retail sales of passenger new energy vehicles (NEVs), including battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs), reached 475,000 units in China in December 2021, taking the country's full-year passenger NEV sales to a record of 2.99 million units. NEV production in the country is expected to reach more than 4 million units this year and increase to 5.5 million units in 2023, according to IHS Markit's latest forecasts. Of this total, BEV production is expected to increase 23% to around 3.2 million units in 2022, before growing further to 4.43 million units in 2023. The projections take into account factors such as an increase in NEV models, cheaper battery prices, the wider availability of public EV charging stations and automakers' continual efforts to speed up new car deliveries. The penetration rate of NEVs reached 22.6% in December 2021 in the Chinese passenger vehicle market, according to CPCA data. Chinese OEMs have outperformed their joint venture (JV) counterparts to lead sales growth in the NEV segment. This is in part thanks to Chinese OEMs' early involvement in the NEV sector and their ability to respond quickly to consumer demand changes. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Aptiv has announced the USD4.3-billion acquisition of Wind River, a company that provides intelligent-edge software, including for automotive applications. According to Aptiv's statement, the acquisition is an all-cash deal and Wind River achieved revenues of approximately USD400 million in 2021. In the statement, Kevin Clark, president of Aptiv, said, "The automotive industry is undergoing its largest transformation in over a century, as connected, software-defined vehicles increasingly become critical elements of the broader intelligent ecosystem. Fully capitalizing on this opportunity requires comprehensive solutions that enable software to be developed faster, deployed seamlessly and optimized throughout the vehicle lifecycle by leveraging data-driven insights. These same needs are driving the growth of the intelligent edge across multiple end markets. With Aptiv and Wind River's synergistic technologies and decades of experience delivering safety-critical systems, we will accelerate this journey to a software-defined future of the automotive industry. In addition, we are committed to further strengthening Wind River's competitive position in the multiple industries it serves. We look forward to welcoming the world class Wind River team to the Aptiv family as we continue to develop a safer, greener and more connected world." Aptiv expects the acquisition to enable it to expand into other high-value industries, and plans to combine Wind River Studio with its SVA Platform to extend its position in automotive software solutions. (IHS Markit AutoIntelligence's Stephanie Brinley)

Thursday, January 13, 2022

- Solar power will account for nearly half of US generation

capacity installations in 2022, more than natural gas and wind

power combined, according to the US Energy Information

Administration (EIA). Based on surveys of utilities and independent

power producers, EIA said it expects 46.1 GW of utility-scale

generating capacity to be added to the US power grid in 2022, of

which 21.5 GW (46%) will be solar. Natural gas will contribute 9.6

GW (21%), wind 7.6 GW (17%), and 5.1 GW (11%) will come from the

fast-emerging category of battery power. (IHS Markit Net-Zero

Business Daily's Kevin Adler)

- When 2.2 GW of nuclear power is included from two units coming onstream at Southern Company's Vogtle Electric Generating Plant in Georgia, carbon-free power will account for nearly 80% of US installations in 2022, marking a significant step towards the country's goal of transitioning to only clean energy production by 2035.

- Growth can be further accelerated by supportive federal policy, Hensley said. "This growth can be accelerated with the passage of the Build Back Better Act coupled with the infrastructure package—putting the country in a better position to meet climate targets and deliver clean energy to Americans," he said.

- "Wind, solar, and battery storage have been the top choice for new power capacity for six of the last seven years in the US," said John Hensley, vice president for research and analytics at The American Clean Power Association, a US trade group. "Falling costs, improving efficiency, and customer demand support the strong growth this industry is experiencing, and we expect those drivers to continue shaping the energy transition underway," he added.

- Build Back Better is the Biden administration's $1.75-trillion spending plan that would include about $550 billion in incentives and loans for a wide range of renewable energy, from electric vehicle tax breaks to investments in transmission lines to extensions of tax credits for new wind and solar projects. The bill has been held up in the US Senate for several months due to objections raised about its overall price tag by US Senator Joe Manchin, Democrat-West Virginia, and is likely to be subject to significant modifications if it is passed at all.

- Plastic is key to present and future sustainability goals,

US-based trade group the Plastics Industry Association said in a

statement late last week. The trade group rejected findings in a

report by advocacy group Beyond Plastics, cited in The Atlantic,

claiming plastics production could have greater emissions than

coal-fired power plants by the end of this decade, which it said

ignores context. (IHS Markit Chemical Market Advisory Service's

Chuan Ong)

- The Plastics Industry said that an increasing prevalence of natural gas and other renewable energy sources cut US coal dependence by 50% from 2011 to 2021.

- It said plastics are widely used across the economy and hence account for higher emissions, and cannot be compared to coal, or to lesser utilized materials like glass. "Substituting all plastic bottlers with glass would create carbon dioxide emission equivalent to 22 large coal-fired power plants," the group said, quoting a research paper by the Imperial College London.

- The trade group also said that moving away from plastics calls for materials with more emissions-intensive production processes, adding that aluminum production has 30% more emissions than plastics, while iron, steel, and concrete's production emissions can exceed plastics' by up to 200%.

- Life-cycle assessment (LCA), a way of assessing environmental impacts associated with all life cycle stages of a product, also showed sustainability gains in plastics, the trade group said.

- Citing a study published on its own portal, the group said plastics are the most environmentally beneficial material compared to alternatives. It said plastic straws have over 60% less global warming potential, using 50% less energy during production than alternatives, and said similar figures apply for both plastic bags and plastic packaging.

- South Korea's SK Geo Centric (SKGC) has signed an agreement

with US recycling company PureCycle to construct Asia's first

recycled polypropylene (PP) plant, according to a PureCycle press

statement late Monday. SKGC and PureCycle signed a non-binding head

of agreement (HOA), or term sheet, after agreeing to key terms to a

joint venture that will be further negotiated. (IHS Markit Chemical

Market Advisory Service's Chuan Ong)

- This recycled PP plant will be built in Ulsan, South Korea, with expected completion by end-2024. It is projected to have an annual PP capacity of 60,000 mt/year.

- PureCycle said that PP is commonly combined with other materials and additives, limiting traditional mechanical recycling from separating contaminants to produce "like-new" recycled plastic. Contaminated food storage containers, colored detergent bottles, and automotive interior plastic are mostly incinerated because they are difficult to recycle.

- Its technology can be used for commercial production to recycle these into ultra-pure recycled (UPR), it said.

- According to PureCycle, the cooperation with SKGC extends beyond a joint venture to recycle plastic waste and provide South Korea with UPR, but also to develop consumer products.

- PureCycle states that it is the world's only company with Procter & Gamble's solvent-based purification technology to separate contaminants, odors, and colors from PP plastic waste, to convert it to UPR, plastic suitable for any PP market.

- The company had also signed a memorandum of understanding on Sep. 13 last year with Japan's Mitsui & Co. to develop and run a similar facility in Japan. Project details remain unclear.

- SKGC, a petrochemical subsidiary of SK Innovation, had announced on Jul. 8 last year its plans to invest KRW 600 billion ($506 million) in South Korea's largest plastic waste recycling factory in Ulsan, which can process 184,000 mt of trash a year, about 60% of the country's total plastic waste.

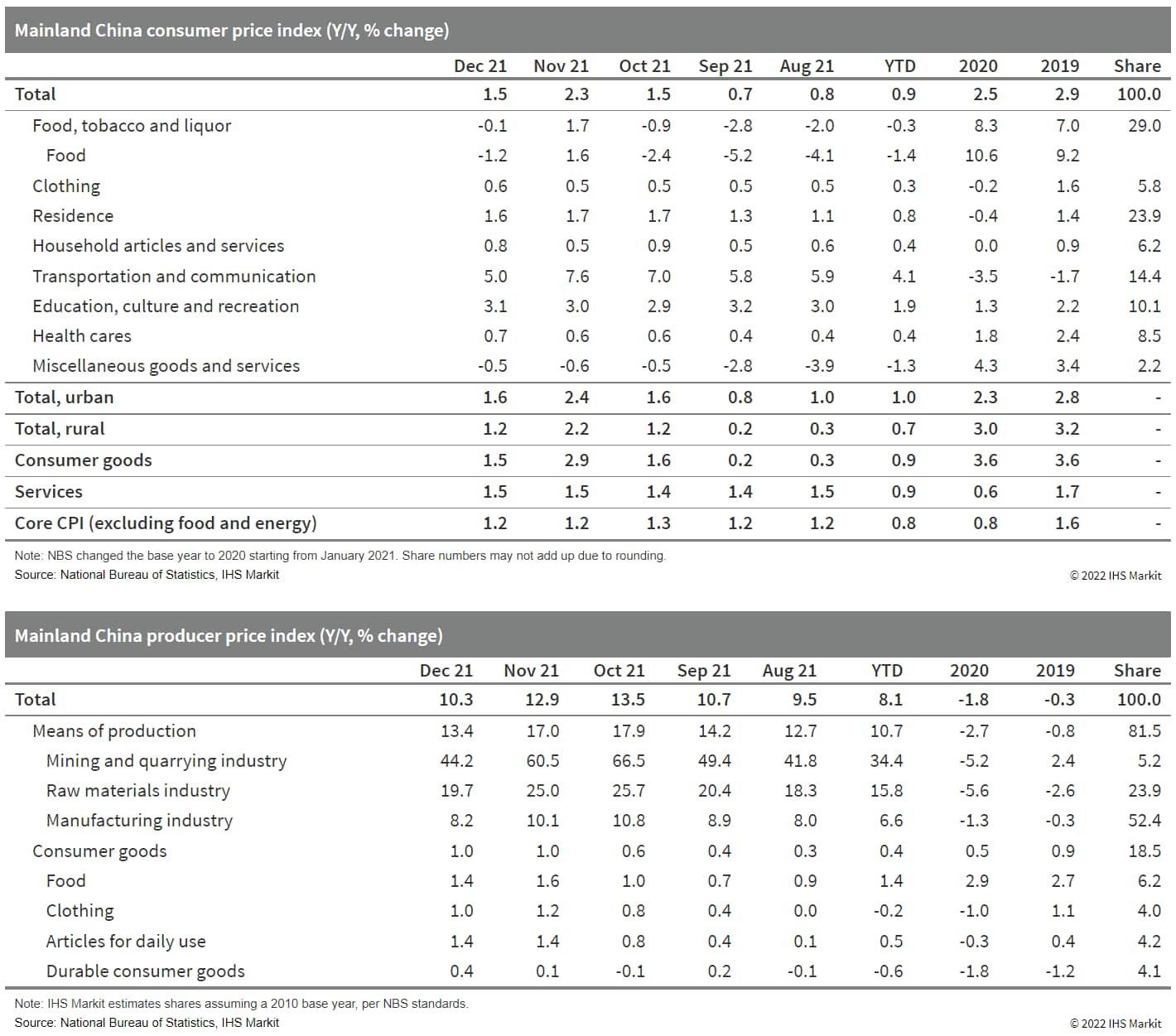

- Mainland China's consumer price index (CPI) increased by 1.5%

year on year (y/y) in December 2021, down by 0.8 percentage point

from the November reading, according to the National Bureau of

Statistics (NBS). Month-on-month (m/m) CPI declined by 0.3%,

falling into deflation territory from the 0.4% m/m inflation in

November. (IHS Markit Economist Lei Yi)

- The disinflation of headline CPI in December was largely driven by the weakened food and fuel prices. Compared with an increase of 1.6% y/y in November, food prices fell by 1.2% in December, as pork price deflation widened slightly by 4.0 percentage points to 36.7% y/y while fresh vegetable price inflation eased by 20 percentage points to 10.6% y/y thanks to ramped-up supply. Regarding the non-food components, vehicle fuel price inflation came in at 22.5% y/y, lower by 13.2 percentage points from the month before; while service price inflation held up at 1.5% y/y, unchanged from the November reading. Excluding the volatile food and energy components, core CPI stayed at 1.2% y/y in December.

- The producer price index (PPI) continued to report double-digit gains of 10.3% y/y in December; still, this represented a second month of moderation from the October high of 13.5% y/y thanks to authorities' interventions. Month-on-month PPI registered deflation of 1.2%, down by 1.2 percentage points from November.

- Retreating commodity prices—crude oil and coal in

particular—contributed to the month-on-month PPI deflation in

December. Prices of oil-related sectors including petroleum

extraction and fuel and chemical product manufacturing re-deflated

month on month; while the coal mining and dressing sector

registered a wider price deflation of 8.3% m/m in December compared

with 4.9% m/m in the prior month. Energy-intensive sectors like

non-ferrous and ferrous metal smelting and pressing continued to

log month-on-month price deflation in December. On the other hand,

owing to the government allowing for a wider coal-fired power

tariff fluctuation range, prices of the power and heat production

and supply sector continued to recover, with m/m inflation inching

up consecutively since September and reaching 3.0% m/m in

December.

- US producer prices for final demand increased 0.2% in December

and rose 9.7% from a year earlier. The overall increase was the

smallest since November 2020, but it was an anomaly rather than a

fundamental shift. Energy goods, up over 31.4% in the past 12

months, sagged by 3.3% as Omicron variant fears hit the crude oil

market. Food prices cooled by 0.6% but that decline was less than

half of the November gain and monthly moves in food prices are as

reliable as a $2 watch. Core goods prices rose 0.5%. (IHS Markit

Economist Mike Montgomery)

- Final demand prices for services grew 0.5% in December but the November gain was revised 0.2 percentage point higher. Transportation and warehousing prices climbed 1.7% with airfares and air freight rates causing the outsized gain. The other services complex scored a 0.2% gain with car rental prices sagging.

- The decline in energy prices was purely temporary. As of 13 January, Brent crude spot prices were just under $85/barrel, above both the October and November prices and more than $10 higher than in December. The 3.3% December energy blip will end up a total quirk as the drop was founded almost exclusively on fears that the Omicron variant would crimp demand for oil. Those fears have proven exaggerated.

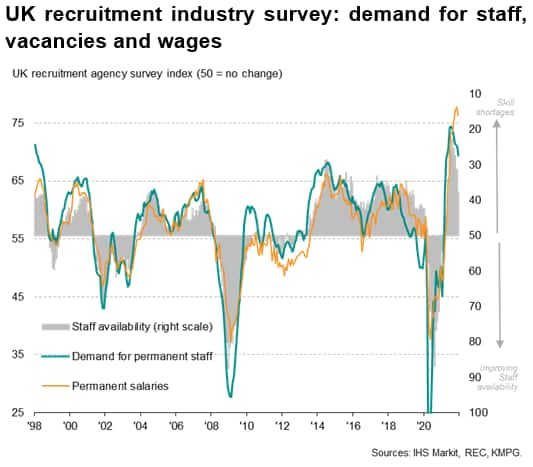

- UK recruitment agencies reported a further strong rise in the

number of people placed in permanent jobs in December, the rate of

hiring running close to the record highs seen in prior recent

months. The survey data, compiled by IHS Markit for the REC and

KPMG, suggest that companies continued to take on impressive

numbers of staff despite the rising spread of Covid-19 amid the

emergence of the Omicron variant. (IHS Markit Economist Chris

Williamson)

- Demand for staff from employers reportedly also continued to rise at a rate not seen over the two decades prior to the pandemic, albeit with the rate of growth of demand cooling further from July's recent peak to run at the lowest since April. This latest cooling will in part have reflected lower economic activity in December arising from the omicron spread. Note that business activity, as measured by the PMI, grew at the slowest rate since the lockdowns at the start of the year.

- At the same time, staff availability continued to deteriorate at a rate rarely exceeded in the recruitment survey's 24-year history, albeit below the rate of deterioration seen in mid-2021.

- Average starting salaries and average pay for temp/contract staff rose steeply again in December. For permanent salaries, only in October and November 2021 had the recruitment industry survey ever recorded a stronger rate of wage inflation than that seen in December.

- Such a lack of available staff is not surprising. The latest

available official data show that the number of unfilled vacancies

had risen to 1.2 million in the three months to October, while

unemployment was down to 1.4 million; an implied record low ratio

of job seekers to vacancies, pointing to a tight labor market which

is conducive of course to high wage growth.

- Electric vehicle (EV) startup Lucid Motors is in talks on beginning production in Saudi Arabia by 2025 or 2026, following the company starting production of the Lucid Air sedan in the United States in 2021, according to media reports. During an interview on the Bloomberg television channel, Lucid chairman Andrew Liveris said, "Now that we are successfully producing and selling cars in the US, our attention is turning to this factory here [in Saudi Arabia]." According to a Bloomberg report, the executive was speaking at a Bloomberg mining conference in Riyadh, Saudi Arabia. Liveris said that the outstanding details to be resolved include ownership percentages for Lucid and the partners on the project. A site near the city of Jeddah is a potential location for the proposed plant, as is a site in the city of Neom, reports Bloomberg. Liveris also reportedly commented on the supply chain issues continuing to affect the auto industry, saying, "We'll have a lot more to say to the market about the sorts of things we're seeing in the supply chain. Yes, we're experiencing supply chain issues." Previous reports have indicated that Lucid has been in talks with Saudi Arabia's sovereign wealth fund, the Public Investment Fund. Lucid began production of the Air sedan in September 2021 and made the first deliveries in October. IHS Markit forecasts, prior to reports of the potential second production facility, showed Lucid's production reaching 94,000 units per year in 2028. (IHS Markit AutoIntelligence's Stephanie Brinley)

Friday, January 14, 2022

- China's authorities have introduced new lockdown and testing protocols after cases of the Omicron variant of the COVID-19 virus were found in the port city of Tianjin. The result has included new production disruptions for both Toyota and Volkswagen (VW). At the time of writing, the measures and their impact are limited to the Tianjin area. According to Reuters, the city began testing its 14 million residents on 12 January 2022. VW Group reportedly has shut down its VW-FAW plant, as well as a components plant in the city because of recent COVID-19 cases at those sites. Reuters reports a VW spokesperson as saying, "Due to the recent COVID-19 outbreaks both the FAW-VW vehicle plant and VW Automatic Transmission Tianjin component factory have been shut down since Monday. Both plants have conducted COVID-19 testing twice for all employees this week and are waiting for the results. We hope to resume production very soon and catch up with lost production. The top priority remains the health and well-being of our employees." The report also states that operations at Toyota's joint-venture plant in Tianjin have been halted since 11 January due to the impact on suppliers of mandatory COVID-19 testing of city residents. "We plan to resume operations as soon as the government's instructions and the safety and security of the local community and suppliers are confirmed and assured," Toyota reportedly said. Great Wall also has a plant in the city, but the Reuters report does not indicate if its output has been affected. At the time of writing, the length of the shutdowns is not certain. This will likely be determined by the test results and how fast the Omicron variant spreads and how many COVID-19 cases are discovered. In Tianjin, VW produces the Chinese-market VW Tayron and Tayron X, as well as the Audi Q3 and Q3 Sportback. In 2022, Toyota's local facilities will produce the Corolla, Allion, IZOA, and Vios. Later this year, several new products are forecast to be added (Corolla Cross, bZ3, bZ4X, and Sienna); it is not clear if the disruption will slow the production of the new models. (IHS Markit AutoIntelligence's Stephanie Brinley)

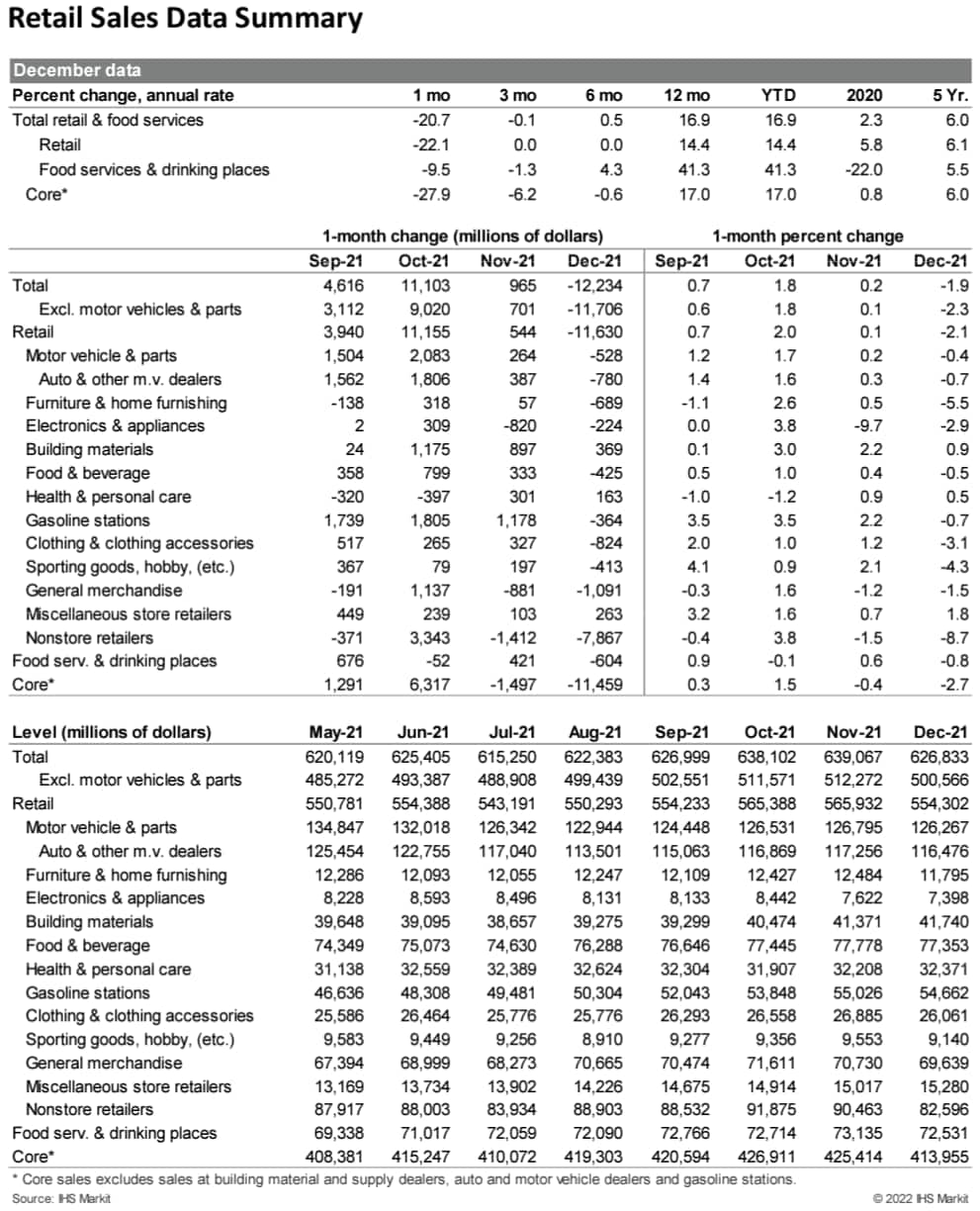

- Total US retail trade and food services sales declined 1.9% in

December, a weaker reading than both the consensus and IHS Markit

analysts had expected. Nonautomotive sales declined 2.3%, while

core sales fell 2.7. (IHS Markit Economists Kathleen

Navin and William Magee)

- The weakness in December was likely due, at least in part, to early holiday shopping, as news reports of supply-chain issues and delays in shipping shifted sales forward into October and November.

- Indeed, nearly two-thirds of the decline in total retail sales in December was accounted for by sales at nonstore retailers, which fell 8.7% on the month and would be particularly sensitive to shipping delays. The same thing happened last year, and sales rebounded sharply in January.

- Sales for food services and drinking places declined 0.8% in December. The weakness in dining out is consistent with recent soft readings from the OpenTable data as would-be diners became more cautious given Omicron concerns. We look for a further decline in dining out in January as virus concerns have intensified.

- A positive note in this month's report was continued strength in retail sales at building materials stores, which rose 0.9% in December following upward revisions to both October and November. Recent strength in this sector likely reflects unseasonably warm weather in many parts of the country during that time.

- Overall, IHS Markit analysts view the weakness in today's

report as temporary, as most fundamentals, including wages and net

worth, remain supportive of consumer spending in the near term.

- The US University of Michigan Consumer Sentiment Index fell 1.8

points to 68.8 in the preliminary January reading—trending

towards the 10-year low recorded in November (67.4). The decline

was driven by worsening views on both the present situation and the

future. The present situation index fell 1.0 point to 73.2, and the

expectations index declined 2.4 points to 65.9. (IHS Markit

Economists Akshat Goel and William Magee)

- While the Omicron-induced surge in COVID-19 infections pulled down sentiment, the escalating inflation appears to be the foremost source of drag. At 7.0%, the 12-month increase in the consumer price index (CPI) in December was the highest in nearly 4 decades. The median expected one-year inflation rate in the University of Michigan survey edged higher 0.1 percentage point to 4.9%, its highest level since 2008.

- Households in the bottom half of the income distribution were most affected by higher consumer prices. The index of sentiment for households earning below $100,000 per year declined 6.6 points, while that for households earning over $100,000 per year rose 4.1 points.

- The index of buying conditions for automobiles fell by 11.0 points in January as high prices and limited inventories continue to be a drag on buying sentiment. The price of new vehicles is up 12.3% since March 2021 while used car prices are up 39.0% since March 2021.

- Consumer sentiment remains shaky and the recent trend underscores the downside risks related to a prolonged period of above-trend inflation. However, inflation risks are balanced by the expectation for strong job and wage growth in the coming months, which should continue to support solid growth of consumer spending. IHS Markit analysts expect that sentiment will track spending more closely as inflation subsides, although these may not align until 2023.

- Thailand's Indorama Ventures Public Company Limited (IVL) is

planning to buy Vietnamese polyethylene terephthalate (PET)

convertor Ngoc Nghia Industry Service Trading Joint Stock Company

(NN), IVL said in a press statement this week. The Thai company

said it is in the process of acquiring shares in NN, the Thai

company said on Jan. 10. (IHS Markit Chemical Market Advisory

Service's Chuan Ong)

- IVL said that NN is a leading PET converter in Vietnam having established relationships with major brands. NN has four manufacturing sites in Northern and Southern Vietnam, with a total production capacity of approximately 5.5 billion units of PET preforms, bottles and closures, equivalent to a PET conversion of 76,000 mt/year.

- According to IVL, as NN provides PET packaging products to multinational and Vietnamese brands in beverage and non-beverage industries, and has local market exposure and understanding, this acquisition will strengthen IVL's packaging business in Asia-Pacific high-growth markets.

- IVL wants to expand its footprint in Vietnam, which it expects to become ASEAN's main production hub for the Asia-Pacific region. Its domestic PET packaging market is projected to grow alongside rising consumption and improving living standards, therefore benefitting IVL's largest business segment, Combined PET, said IVL's D K Agarwal.

- IVL will make a tender offer to acquire all of NN's shares through affiliated Indorama Netherlands B.V.

- This transaction is expected to be completed by the first half of 2022.

- The PET bottle chip sector is the second-largest consumer of purified terephthalic acid (PTA) and monoethylene glycol (MEG), and is a crucial downstream user of paraxylene (PX).

- Enbridge Gas announced on January 13 it has launched a

"first-of-its-kind" hydrogen blending facility in North America,

serving the Markham community. The company said it had partnered

with Cummins Inc and was supported by the Canadian Gas Association

(CGA), Sustainable Development Technology Canada (SDTC) and NGIF

Capital Corporation in deploying the facility, which blends

hydrogen into delivered natural gas and thereby, reduces the carbon

footprint. Enbridge said the CAN$52.2 million joint venture was a

pilot project involving modifications to the Markham Power-to-Gas

facility. That facility was built four years ago as part of another

Enbridge-Cummins joint venture. Enbridge listed some key facts

about the project (IHS Markit PointLogic's Annalisa Kraft):

- Through this pilot project, Enbridge Gas will initially provide a maximum hydrogen blended content of up to two percent by volume of the natural gas supplied to approximately 3,600 customers in Markham, Ontario in Q3-2021, eliminating up to 117 tons of CO2 annually from the atmosphere.

- The pilot project will not impact the standard market cost of natural gas.

- The hydrogen-blending project construction cost was $5.2M.

- The Markham Power-to-Gas facility was commissioned in 2018 through a partnership between Enbridge Gas and Cummins Inc. (which acquired Hydrogenics in 2019) with support from the Province of Ontario. Since then, the facility has provided regulation services to the IESO to help balance electricity supply and demand and ensure system reliability.

- The plant has also proven its potential as a solution to the challenge of storing the province's surplus electrical energy using Enbridge's existing natural gas pipeline infrastructure or in the form of pure hydrogen, which can later be reconverted back to electricity.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.