Will index rule changes affect how European credit trades vs North America?

Europe's status as an economic laggard in the post-GFC era is well reported and, indeed, well deserved. Growth has been elusive, despite the concerted efforts on central banks. The comparison with the US is an unfavorable one, a fact that hasn't escaped the notice of President Trump, among others.

The credit markets reflect this trend. Since 2010, when the eurozone debt crisis gathered pace, the Markit iTraxx Europe (Main) has traded consistently wider than the Markit CDX IG, its US investment grade equivalent (there are periods where this is not the case, such as the oil price decline of 2014-2015). This is in a marked contrast to the Great Moderation, when the CDX IG was always wider than Main (though both were crushed to very low levels by the prevailing synthetic bid), and indeed during the GFC and its aftermath, when default rates were far higher in the US than in Europe.

Source: IHS Markit Price Viewer

So it's interesting to note that we are in the midst of one of those atypical times when Europe IG CDS outperforms North America. The iTraxx Main is about 4bps tighter than the CDX IG and has traded inside its counterpart for 15 consecutive days, the longest period since May 2018. Credit in general enjoyed a stellar first half of the year, but in recent weeks the European index has tightened to levels not seen since March 2018.

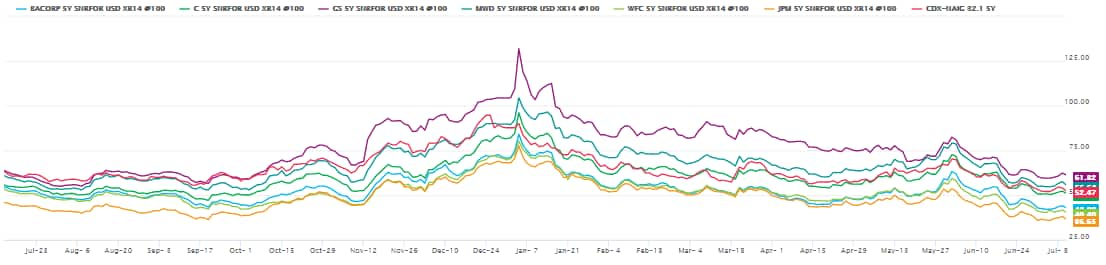

Technical factors aside, the prospect of further easing in monetary policy on both sides of the Atlantic has surely played a major role in the 2019 rally. But we also need to look at the composition of the two IG indices. The iTraxx Main includes banks while the CDX IG excludes them. In the past this has led to the Main underperforming - the policy response to restructuring bank balance sheets was too slow and inadequate in comparison to the emphatic action in the US. But the ECB's introduction of TLTRO 3 is a boon for the region's banks and the markets are expecting further supportive measures. Bank spreads still trade wider than the rest on average but they have rallied strongly in recent weeks.

In this light, the possibility of structural changes to the indices could well have a bearing on how they trade relative to each other. Last week, IHS Markit announced that we are consulting with CDX Index Advisory Committee members regarding the potential inclusion of swap dealers in the CDX IG. A separately traded CDX Financials index is also under consultation. If agreed, this would mark a significant change for the CDX, which includes financials (mainly insurers) but not banks.

Source: IHS Markit Price Viewer

Nonetheless, if implemented the CDX is unlikely to be a carbon copy of the iTraxx Main. The universe of swap dealers that are US names (many are foreign banks operating in the US) and liquid in the CDS market is relatively small. The effect on the index would also probably be different. The average spread of six large US swap dealers (JP Morgan, BAML, Citigroup, Morgan Stanley, Wells Fargo, Goldman Sachs) is around 50bps, roughly in line with the CDX IG index level. As noted above, European banks trade wider than the rest of the corporate IG constituents, hence pushing the index level wider.

Market participants are invited to provide feedback by the end of July, following which we will publish a further announcement on the results of the consultation. We are also taking feedback on a proposal to amend the iTraxx Europe rules. The proposal is to allow sector limits to deviate within bands (a maximum of 20% from current fixed limit) to prioritise liquidity. This could result in a higher number of names from sectors that have stronger liquidity to be included as constituents. We are currently reviewing the results of this feedback and will publish a further announcement.

Market participants should certainly keep abreast of these developments given the importance of the indices. Indeed, some press articles have commented CDS indices could lose their pre-eminence to other instruments such as ETFs and TRS. It should be welcomed that end users have a wider variety of tools to hedge credit risk. But make no mistake, for liquidity and credit risk isolation CDS indices are hard to beat. Demand is going up - as it is in tranches and options referencing the indices - and we expect this trend to continue.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.