S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsS&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Forecasting & Planning

Sales Performance & Marketing

Vehicle In Use

Content

Automotive

Forecasting & Planning

Sales Performance & Marketing

Vehicle In Use

Content

Automotive

Principal Analyst, Automotive Lightweighting, S&P Global Mobility

Gigacasting is all the rage in automotive manufacturing circles. And while Tesla has mainstreamed the term — involving enormous, high-pressure aluminum die casting machines that punch out vehicle chassis and bodies-in-white — the technology has largely caught on in mainland China. Now other automakers, including Toyota, are eyeing the process.

The rising adoption of aluminum gigacasting modules and structural parts is primarily driven by the need to prevent the continuous increase in vehicle weight, enhance fuel efficiency, and accommodate the growing demand for battery electric vehicles. Done correctly, gigacasting can theoretically slash per-unit manufacturing costs by eliminating the welding of dozens of body parts by casting one single module. But much of the conversation ignores fundamental roadblocks in implementing the technology.

These massive gigacastings (also known as megacastings) carry huge initial startup costs, may have distortion issues in the metal, alter collision-repair capabilities, and require extensive end-of-line inspection scanning. And that is only after ordering a custom-built gargantuan piece of equipment, moving it into place, and figuring out how to efficiently work the temperamental processes.

So why are established industry automakers and suppliers still chasing these big dreams that come with massive headwinds? Do casting experts have enough technical solutions to known operational problems? And looking downstream into the vehicle use-case, can ADAS systems prevent enough crashes to make up for these unrepairable castings?

Simple answer: It's not about the components, it's about the assembly plant. And it's not about material and methodology changes to the underbelly of vehicles, but the creative processes themselves which are under transformation. And it's not about the exact factory implementation, but how an entirely new workflow can be enabled for improved productivity.

When looking at market share of advanced steels, stampers of those components, and conversion rates in adoption scenarios, S&P Global Mobility forecasts 15% to 20% of traditional body-in-white (BIW) stampings in 2030 may be at risk from these gigacastings. Underbody components typically comprise about 50% of a vehicle's BIW shell, and this soft underbelly is the target of gigacasting's focus.

Expertise within suppliers, factory designs, and vehicle configurations are all changing. As a result, the era of transportation is approaching a disruption to the auto industry's backbone: the assembly line.

The assembly line process as we know it stood for 110 years as the uncontested champion of high-volume manufacturing. Components could be sub-assembled offline, lasers might scan each part for dimensional accuracy, and a bolt might even hold all the measurement data from rigorous testing of a powertrain. But the assembly line itself evolved to absorb these improvements. No revolution to assembly efficiency stood to threaten the linear model — until now. Robotics, automation, industry 4.0, and blockchain all have impacts on the efficiency, cadence, and support networks of modern assembly plants.

OEMs are looking towards gigacasting not as a component piece, but as a change to how their entire world functions. The reconfiguration of the dance played behind factory walls will forever change economies within automotive. Whether corner castings or single piece, whether gigacast or gigapress, a change to how vehicles come together is upon the industry. Nodal construction will replace linear, bottlenecks will arise and dissolve, and something altogether new will be born.

Source: S&P Global Mobility

©2023 S&P Global Mobility

Gigacasting and mainland China

The rise of aluminum gigacasting in mainland China's automotive sector, especially for new energy vehicles (NEVs), is driven by weight reduction and efficiency needs. Deciding between outsourced supply chains and in-house production raises sustainability and cost concerns.

According to S&P Global Mobility, production of electric light vehicles in mainland China is expected to reach a total of 19 million units annually by 2030 — firmly establishing the country as a global leader in the EV sector. Now, China looks to exert a substantial influence in gigacasting globally.

Doing this will empower mainland China EV manufacturers to adopt more aluminum material for car-body fabrication and enhance its affordability. Consequently, it can stimulate further growth within the EV market throughout the region.

A recent major shift toward aluminum gigacasting modules and structural parts has been seen with NIO's ET5 and Geely's Zeekr 009 — both featuring single-piece aluminum gigacasting rear floors. Meanwhile, Xpeng's G6 featured not only an aluminum megacasted single-piece front compartment, inclusive of front shock towers and side members, but also a single-piece rear floor. These two modules were separately cast using two sets of LK Group's 7,000-ton press force megacasting machines.

Unlike Tesla's gigacasting production model - characterized by an in-house approach involving substantial greenfield investments in gigacasting facilities adjacent to the final assembly workshop — these automakers outsourced gigacasting to tier 1 suppliers, sparking new collaborations. This shift holds the promise of reaping benefits by distributing responsibility between OEMs and tier 1 suppliers to jointly develop technology while also mitigating the risks associated with substantial upfront investments and potential sensitive patent infringements. That said, challenges like machine availability and technical disputes remain, which could snarl future collaborations.

In the mainland Chinese model, behind the scenes, extensive preparations integrate these substantial outsourced modules from gigacasting into the body assembly line. Over the last several months, several collaborations were announced — including partnerships between Seres and Wencan, Human Horizon EV and Tuopu, and Li Auto with an undisclosed tier 1 supplier, among others.

The growing popularity of the outsourced approach to gigacasting is also evident, as it allows automakers to bypass the substantial upfront investments required to construct their own gigacasting facilities.

A costly gamble?

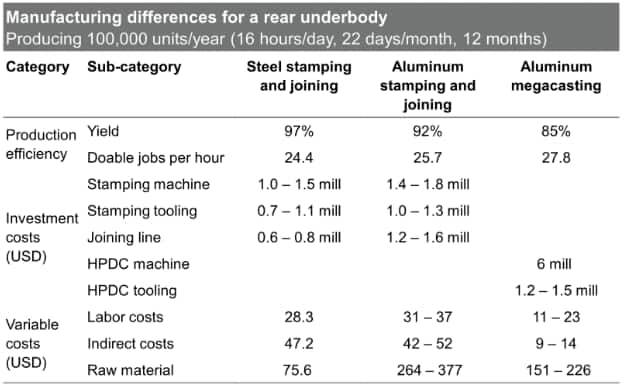

The cost-benefit analysis of gigacasting should be based on achieving a good-enough first-pass yield rate and maintaining a sufficient, yet not excessive, number of orders for the same part. When comparing gigacasting to conventional steel stamping or aluminum-stitching, S&P Global Mobility nonetheless assesses the unit price for a single-piece, gigacasted aluminum rear floor to be valid.

To streamline the production chain and enhance production efficiency, tier 1 gigacasting suppliers have the potential to consolidate orders from original equipment manufacturers (OEMs), thereby avoiding redundant investments in gigacasting machinery. However, the downtime to switch tooling on a gigacasting machine, which often weighs several tons, can range from hours to days — inevitably reducing the utilization rate and productivity.

Based on our previous analysis of a typical 6,000T press force megacasting machine for rear floor module fabrication, its maximum annual capacity is estimated at 100,000 to 150,000 pieces, with cycle time of 120 to 150 seconds per piece, operating 16-20 hours a day for up to 300 working days a year, assuming a 90% yield rate. Frequent tooling changes for different parts on the same gigacasting machine would further reduce these output figures.

For a specific example, Tesla's Gigafactory in Shanghai Lingang is equipped with three or four sets of IDRA's gigapress units, specifically dedicated to casting the one-piece rear floor for the Model Y. The maximum production capacity for this model is estimated to reach up to 600,000 units per year, considering the scale of the gigapress units.

A schematic of a Tesla Model 3 (left) and Model Y body-in-white, comparing traditional vs. gigacast assembly. The Model 3 comprises 171 metal pieces, whereas the new gigacast Model Y rear structure requires just two pieces of metal and 1,600 fewer welds.

Image source: Tesla

However, Tesla opted not to utilize gigapress technology for the all-new Model 3s produced in China, which was unveiled in August. Contrary to previous reports, this model did not feature a one-piece aluminum rear floor, nor did it incorporate a larger single-piece gigacasted underbody.

As such, we assert that only a substantial number of gigacasting machines can effectively sustain the outsourced gigacasting supply chain. Why is that? Considering the maximum output volume is restricted to 150,000 pieces per year, it is evident that the existing capacity cannot support an additional program for Model 3 volumes. The mega-casting stands are fully occupied, and there are no available land resources or plans for further investment to expand the in-house capacity at Tesla's Lingang plant, at least as of now.

Roadblocks to gigacasting

How can OEMs and suppliers integrate gigacasting technology with traditional body shop processes? As Elon Musk has noted, it's more complicated to make the 'machine that makes the machine' than the end product itself.

The production of a gigacasting machine entails an investment of several months, dedicated to both manufacturing and meticulous fine tuning, until the machine achieves a level of reliability and stability suitable for consistent output. These processes are undeniably labor-intensive and demand a substantial infusion of specialized knowledge. Currently, there exists a handful of companies, (including LK Group, Buhler, Yizumi, Haitan and UBE), capable of manufacturing the gigacasting machine. Consequently, the newfound capacity for gigacasting falls short of meeting the escalating demand for electrified vehicles.

There also are issues with production management on the plant floors. Megacasted single piece machines present an opportunity for OEMs to significantly reduce the presence of machines, robots, and manual labor in their traditional car body plants. However, the implementation of two distinct manufacturing systems — the traditional body shop employing stamping and welding processes, and the gigacast model featuring fewer machining processes but necessitating new conveyor systems to handle substantial material volumes — represents a pragmatic compromise at the current juncture.

Which then begs the question of how to profitably renovate or rebuild existing production lines to incorporate outsourced gigacasting components. Such methods remain unproven and, as of now, unjustified. While capable of fabricating a portion of the underbody structural components, gigacasting does not preclude the necessity for all stamping and welding processes in the body shop.

The application of press force in megacasting machines has given rise to considerable debate. Normal high-pressure die-casting of aluminum typically involves press forces of less than 4,000 metric tons.

However, Tesla raised the ante with its groundbreaking innovation in 2019 to use gigacasting to fabricate the rear floor section of the Model Y — using between 6,000 and 9,000 metric tons of force. Tesla also is reportedly close to being able to die cast nearly all of the underbody of an electric vehicle in one piece.

Chinese OEMs are now diligently striving to replicate Tesla's success with gigacasting machines featuring increasingly higher press forces; there are reports of even more formidable 12,000 and 16,000 metric ton machines.

While megacasting the body section may not yield immediate profitability, there is a collective determination within the industry to remain committed until the revolutionary future arrives. While the use of megacasting to produce body parts may require a long-term path to profitable operation, the industry is committed to developing this technology because it has the potential to rethink traditional supply chains and production.

Nevertheless, S&P Global Mobility sees numerous obstacles ahead, including challenges related to the quantity of gigacasting machines, new issues arising in plant floor management, the need to explore alternative technical solutions and more.

Suppliers and OEMs should consider these impediments when evaluating the strategic horizon aligned with these casting questions.

FOR MORE ON VEHICLE MANUFACTURING TECHNOLOGY

FEATURES AND TECHNOLOGY BENCHMARKING

THE LOOMING EV SUPPLIER SHAKEOUT

AUTOMOTIVE PLANNING AND FORECASTING

CHINA AND GIGACASTING (sub req'd)

MEGACASTING AND THE FUTURE (sub req'd)

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.