S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsS&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Forecasting & Planning

Sales Performance & Marketing

Vehicle In Use

Content

Automotive

Forecasting & Planning

Sales Performance & Marketing

Vehicle In Use

Content

Automotive

Associate Director of Industry Analysis & Loyalty Solutions, S&P Global Mobility

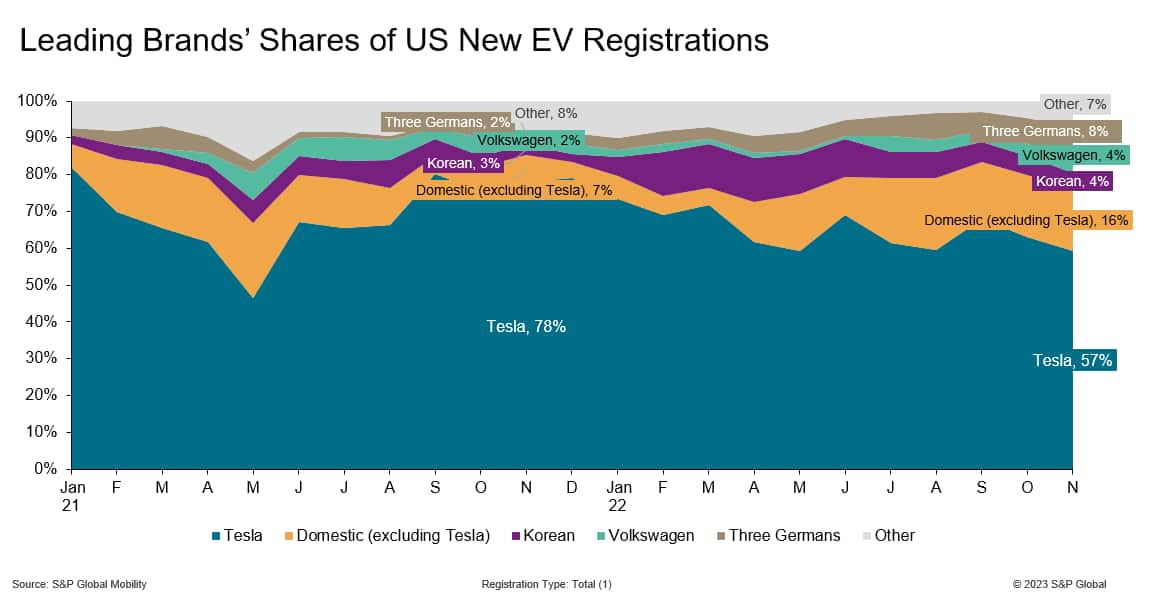

As new electric vehicle brands and models come to market, market shares are changing accordingly. Tesla remains the dominant player, but its share gradually has been declining since the fall of 2021, as shown below. From 77.8% in November 2021, Tesla's EV share has dropped more than 20 percentage points to 57.1% this past November. Put another way, Tesla's one-year decline itself is equal to more than a fifth of the entire US EV market. At the same time, EV shares of non-Tesla domestic brands, the Koreans, Volkswagen, and the three German luxury brands have risen.

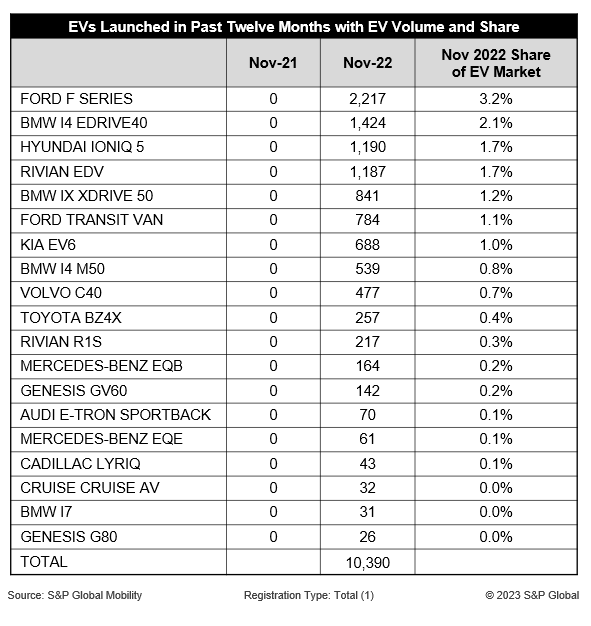

One reason for Tesla's decline is the increase in EV model count. Fifty-one EVs now are available, a 59% increase from 32 models just one year ago. These new models accounted for 10,390 new registrations in November 2022, equal to 15.1 % of the EV market. Four of these new entrants, including the Ford F-Series Lightning, BMW i4 eDrive40, Hyundai Ioniq 5 and Rivian EDV, by themselves had 6,018 deliveries in November or 58% of all new EV model registrations.

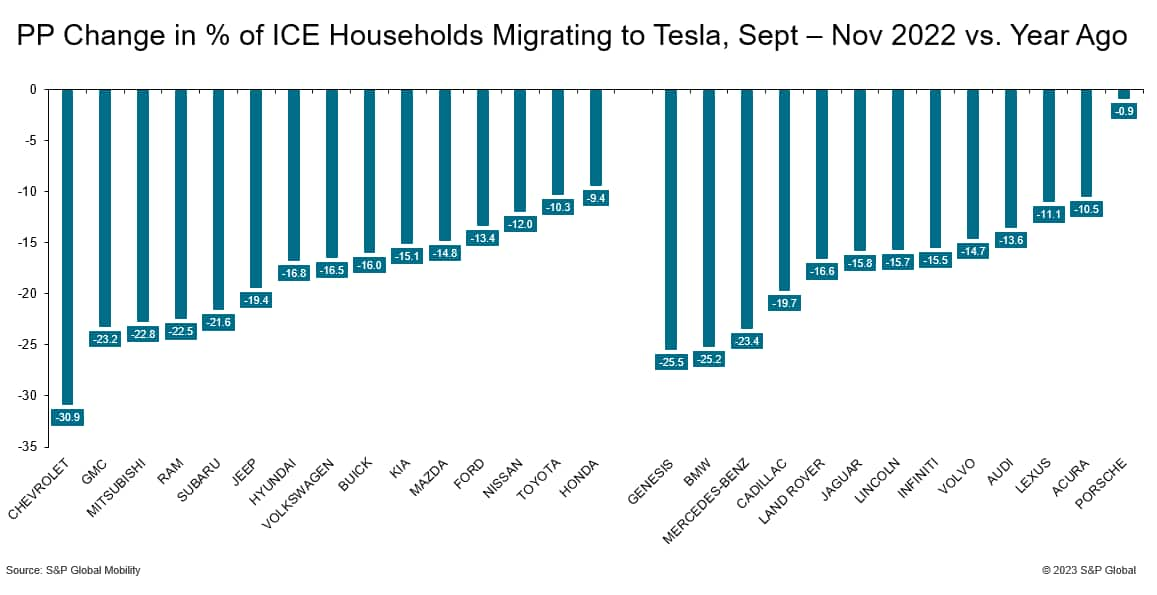

A second - and related - driver of shifting EV brand market shares is the change in migration patterns from ICE (Internal Combustion Engine) to EV. Households with an ICE vehicle in the garage that return to market and acquire an EV are acquiring a Tesla at substantially lower rates than a year ago - this is true for all makes except Porsche, where the decline is marginal. Of the 15 mainstream and 13 luxury brands with significant return to market volumes this past fall, everyone had fewer owners (who acquired an EV) migrating to Tesla versus the year before. The chart below illustrates that the change in movement to Tesla declined by 20 percentage points or more for five of the fifteen mainstream brands and three of the thirteen luxury brands.

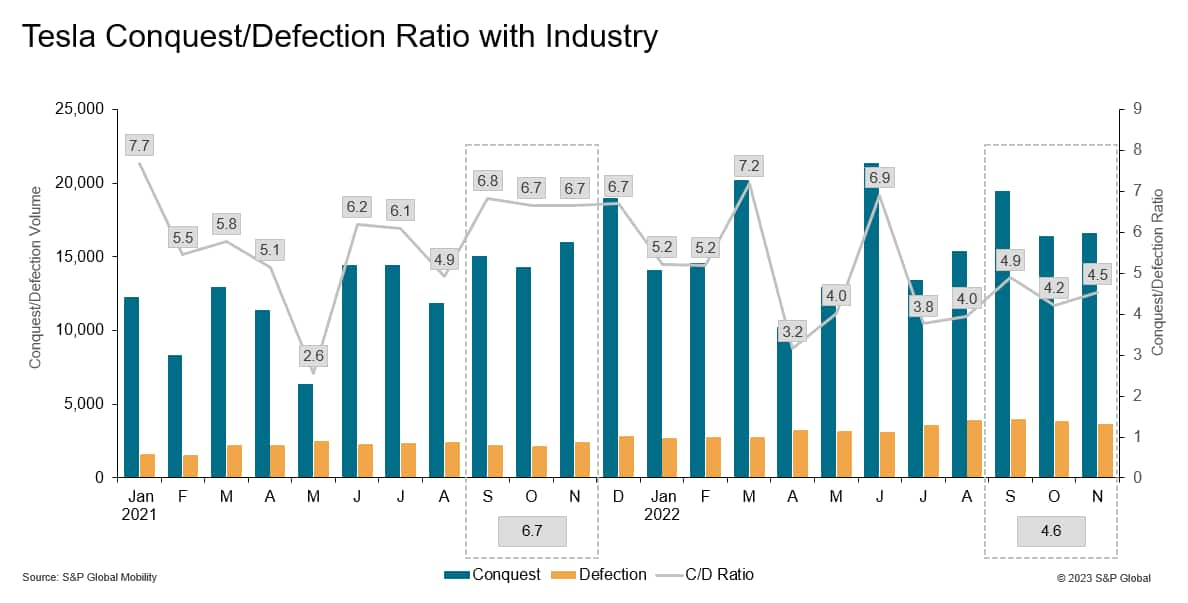

This decline in industry-wide movement to Tesla is supported by S&P Global Mobility conquest and defection data. As shown below, while Tesla's conquest/defection ratio has been erratic, it clearly is down this past fall when compared to a year ago, dropping 2.1 points to 4.6. Lower migration from non-Tesla brands to Tesla, everything else being equal, lowers Tesla conquests which lowers its ratio.

The growth of the US EV market will accelerate as more models arrive. There are 51 models on the market now (with at least one new registration in November), and this will rise to 78 by the end of 2023; then the EV model count will more than double to 160 by the end of 2025. This influx will put downward pressure on EV share for all brands, including Tesla.

Note: All market share calculations are based on total new light-vehicle registrations.

------------------------------------------------------------------------------

Top 10 Industry Trends Report

This automotive insight is part of our monthly Top 10 Industry Trends Report. The report findings are taken from new and used registration and loyalty data.

The December report is now available, incorporating November 2022 CFI and LAT data. To download the report, please click below.

Our Mobility News and Assets Community page features the latest news and research of automotive and mobility industry, visit the page to learn more.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.