S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsS&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Forecasting & Planning

Sales Performance & Marketing

Vehicle In Use

Content

Automotive

Forecasting & Planning

Sales Performance & Marketing

Vehicle In Use

Content

Automotive

Associate Director, AutoIntelligence, S&P Global Mobility

Summary

The US Environmental Protection Agency (EPA) regulations released on March 20, 2024, seem designed to drive toward a BEV solution, though the agency does describe the rule as "technology agnostic," several elements seem fundamentally designed to encourage the battery electric vehicle solution for zero-emissions vehicles.

New regulations well received

The final ruling has, in general, been well-received by the industry. As noted, it allows for a more gradual ramp-up in BEV compared to the previous base proposal. However, the more gradual ramp also means that in the last two model years, the requirements have a steeper drop. Automakers will need to work toward a more aggressive catch-up in the last two model years.

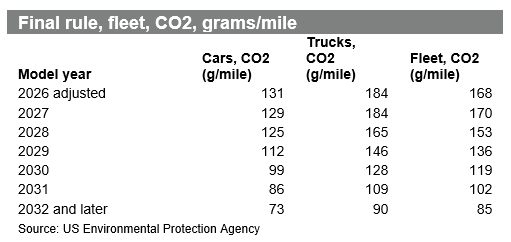

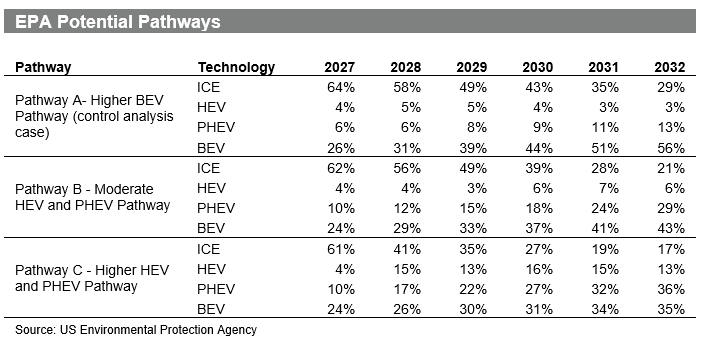

GHG / CO2 implications

The EPA does not mandate what propulsion system is used, though they do estimate what mix of battery electric, plug-in hybrid electric, hybrid electric, or internal combustion engines could meet the target, based on EPA calculations. With the final ruling, the EPA illustrated three primary pathways to reach compliance, demonstrating what kind of mix an automaker might use to reach compliance. These EPA pathways are not directives, and automakers can use a different mix to be compliant, but the pathways presented provide some insight into possibilities.

Under EPA's three potential pathways, the estimated BEV rate to reach compliance varies significantly. Pathway A sees EVs as high as 26% in 2027 model year as one way forward to meeting compliance. Each pathway considers a different mix of full hybrid and plug-in hybrid solutions working with BEV solutions. We found it interesting that the pathway scenarios which the EPA illustrated each incorporated a heavier PHEV penetration than the proposal. In these EPA illustrations, an assumption is made to see HEV at roughly half the 8.6% share it had in January 2024 (according to S&P Global Mobility light-vehicle registrations) in 2027 model year. These illustrative pathways also have PHEV at more than three times penetration in January 2024 (2.5%) as soon as 2027 model year. These are simply illustrations of what the market might look like but are likely indicative of what the EPA expects could be viable. Another element of differentiation for these final rules versus previous rules is that light-duty trucks, which includes most utility vehicles, are challenged to reduce emissions by 51% while passenger cars are expected to see a 44% decline in emissions.

The three pathways that the EPA presented put the US market at between 35% and 56% BEV sales in 2032 model year. This is also a significant change from the April 2023 proposal which could have put BEV penetration in 2032 at 67% of the US light-vehicle market. These pathway illustrations also work to demonstrate it might still be done even if the US market does not reach the 50% BEV sales which President Joe Biden has set as a soft target for 2030 calendar year, while also suggesting that the EPA sees PHEV as the more viable interim solution than its prior analysis suggested. That change could see Stellantis adjust its plans for PHEVs within its new multi-energy platforms, while Mercedes-Benz and BMW offer PHEVs and may have the opportunity to adjust the mix as well. Hyundai Motor Group also may be in a position to further refine its PHEV technology and place more importance there. Toyota has so far put more effort behind HEV, though it does also have robust PHEV technology it could place more emphasis on. Lastly, this could mean Ford and GM take a closer look at PHEVs as a solution to reach compliance if BEVs don't take off as rapidly as planned.

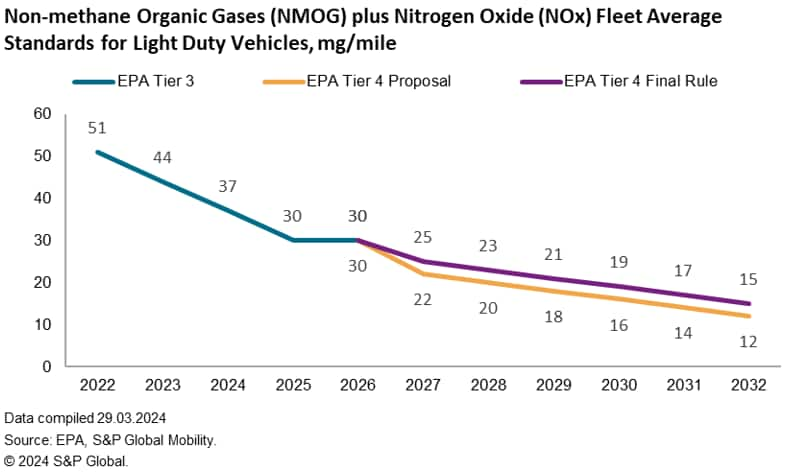

Tier 4: Non-methane organic gases (NMOG) and nitrogen oxide (NOx) standards

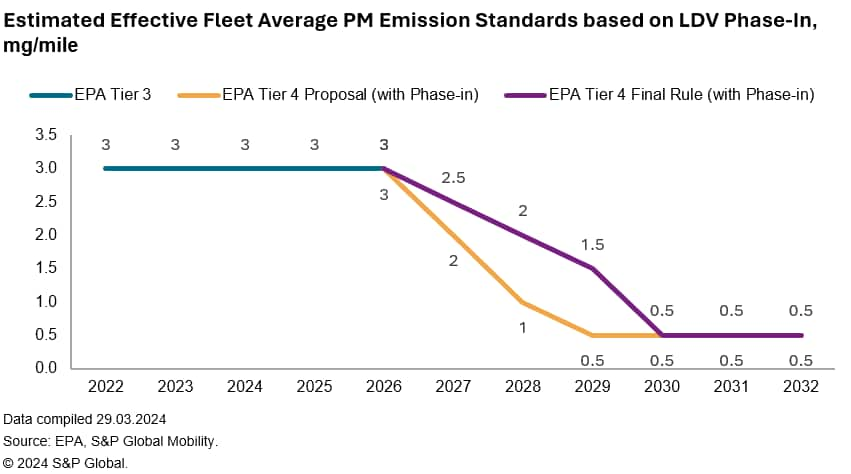

The regulations also address particulate matter and other criteria pollutant emissions in non-methane organic gases (NMOG) and nitrogen oxide (NOx), which are emissions from all internal-combustion engines. These standards must be met by multi-fueled vehicles as well, on each fuel which is used. Here, too, the final rule is less onerous than the proposed rule, though still requires a 50% reduction in these emissions.

With the final ruling, the industry request for PHEVs to receive an adjustment because they can run on electricity only was declined. These standards are required to be met by multi-fueled vehicles on each fuel that is "consumed." For PHEVs, that means that the standards need to be achieved both on electricity alone (charge-depleting operation) and gasoline (charge-sustaining operation). As a result, we expect that PHEVs would not be exempt from meeting these regulations and are likely to also need to include particulate filters. The pressure here has the potential to make PHEVs a more expensive solution than a BEV, in some cases.

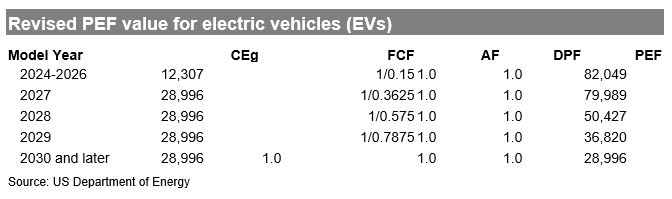

Department of Energy Petroleum-Equivalency Factor

The US Department of Energy (DoE) has issued its final ruling on updating the Petroleum-Equivalent Factor (PEF). This factor is used in the EPA and National Highway Traffic Safety Administration (NHTSA) calculation for determining the impact of EVs on a light-duty automakers compliance with the Corporate Average Fuel Economy (CAFE) standards. This factor essentially determines the extent to which the sale of an EV may offset sales of internal combustion engine vehicles. Vehicles with high eMPG contribute to an automaker's compliance with CAFE standards, administered by NHTSA and aligned with the EPA emissions standards. By reducing the eMPG an automaker can claim for a BEV, it means the automaker cannot use that high eMPG vehicle to functionally offset a low MPG vehicle which is out of compliance. The final rule has been positioned as a win for automakers because it reduces the PEF EV fuel economy rating by 65% beginning in 2030, instead of a 72% reduction starting in 2027 model year, as originally proposed; this could give automakers more time to adjust to the change. However, as with the other regulatory elements announced this week, this change introduces further pressure on automakers to shift to battery electric vehicles as a zero-emissions solution by reducing the ability of BEV to offset multiple ICE sales. The win is in that the factor does not go down as fast as earlier proposed and enables a slightly slower walk to the 2032 targets.

S&P Global Mobility Initial Outlook

Our current February 2024 forecast already factors in a regulatory environment expectation that was less aggressive than the EPA's base proposal from last April. Therefore, it's premature to note if any material powertrain changes will need to be incorporated. Future forecast rounds will be updated to reflect any necessary changes, particularly at a vehicle level.

The final rule has a similar endpoint to the proposed rule, though the 2027 to 2030 model years are less stringent than the EPA's base proposal from April 2023. This has, in general, been well received by industry. The final rule allows for a more gradual ramp up in BEV compared to the previous base proposal. This will allow more time for consumers to adapt to the technology, infrastructure to expand, and efficiency improvements in the legacy ICE powertrain solutions. This is welcome news to S&P Global, as our powertrain forecast had presumed a less aggressive EPA regulation, owing to OEM/dealer/union pushback against the EPA base proposal from April 2023.

Get a free trial of AutoIntelligence

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.