Benchmark index family for tracking green, social and sustainability bonds

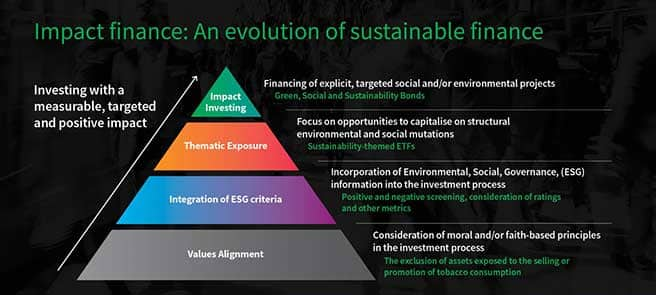

The iBoxx® Global Green, Social & Sustainability Bonds Index is designed to reflect the performance of global Green, Social and Sustainability investment grade and high yield sovereign, sub-sovereign and corporate bonds denominated in EUR, USD, GBP and CAD, whilst upholding minimum standards of investability and liquidity. The index is part of a range of available iBoxx ESG (Environmental, Social, Governance) and sustainability bond indices. Green, Social and Sustainability index supports impact investing. The use of proceeds by issuers of eligible bonds intend to finance qualifying investments that generate measurable societal and/or environmental benefits, rather than more broadly financing an issuers' activities. The index leverages external, independent sustainable data sources from Climate Bonds Initiative (“CBI”) and Environmental Finance to determine ‘Green’, ‘Social’, and ‘Sustainability’ bond classifications. The classification schema is broadly based on the International Capital Market Association’s (ICMA) voluntary principles for self-labelling but also contains other eligible sustainable bonds such as those based on the UN Sustainable Development goals. All bonds need to have a pledge to use the proceeds of the bonds for Green, Social or Sustainability investments to be eligible.Key benefits:

Download Global Green, Social & Sustainability Index Guide

Download Global Green, Social & Sustainability Fact Sheet