Securities lending helps passive funds gain upper hand

The ability to accept lower quality collateral has helped passive funds generate higher securities lending returns then their actively managed competitors

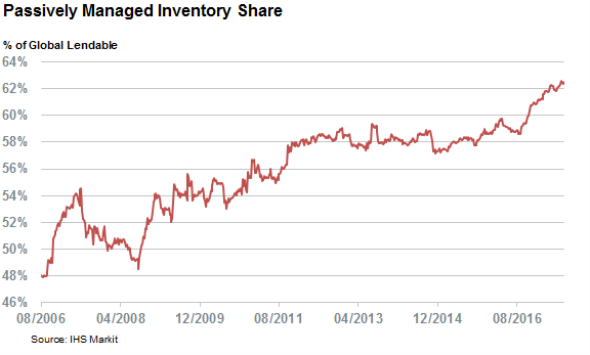

- Passive funds now responsible for over 60% of all securities lending inventory

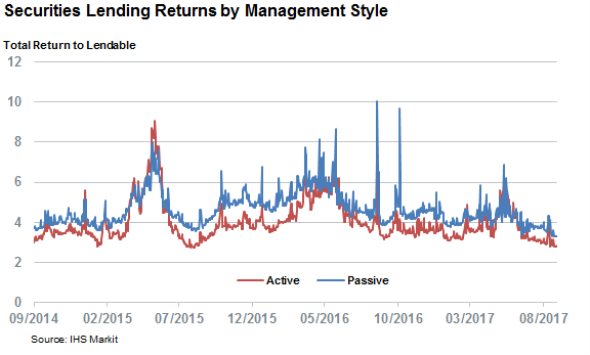

- Passive funds have earned 14% more securities lending revenues since 2014

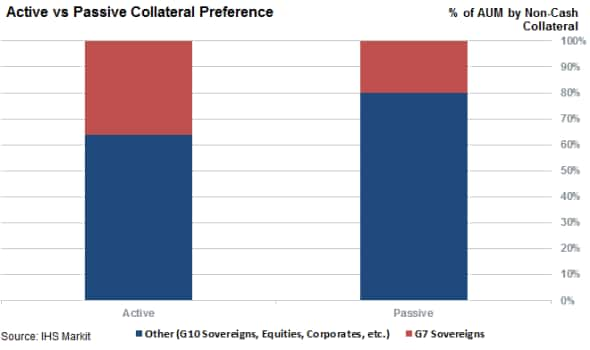

- Active funds are nearly twice as likely to accept only the highest quality non cash collateral

This article was featured in the 3rd edition of the IHS Markit Securities Finance Quarterly Review. Click here if you want to access the full 24 page report.

The term "disruption" is often bandied about, however there is no denying that the asset management industry has felt more than its fair share of disruptive innovation in the years since the financial crisis. Much like more parochial niches such as retail, food distribution or even mattresses, the twin siren songs of improved efficiency and lower cost promised by upstart passive funds have proved too much of a temptation for investors to resist. Spurred on by the desire to cut costs, and the growing realization that the extra costs levied by incumbent fund managers don't guarantee outperformance, the steady trickle of inflows into passive funds has now turned into a deluge.

Money riding this wave of disruption is showing no signs of drying up anytime soon, as it has only taken to mid-August for the global ETF industry to beat its previous full year inflow record.

The $4.3bn now managed by ETFs globally, and the even larger sum allocated to passive fund trackers, is now starting to make waves in the securities lending space. In fact, these funds are now responsible for nearly two thirds of all global securities lendable inventory according to the funds contributing to the Markit Securities Finance database. Not surprisingly, this share has grown significantly over the last decade since passive funds were responsible for less than half of the global inventory before the crisis in 2008.

Astonishingly, these "boring" funds are actually able to generate more revenues in the securities lending market than their actively managed peers. Over the last three years passive funds have earned an average total return of 5.1bps, a full 14% more than the 4.5bps earned by actively managed funds over the same period.

One reason behind this consistent outperformance can be attributed to the willingness of passive funds to be pragmatic when it comes to the type of assets which they are willing to receive as collateral for securities lending transactions.

Our data indicates that 36% of active funds will only accept the highest quality G7 bonds as non-cash collateral. Passively managed funds on the other hand are much less picky when it comes to collateral given that only 20% of these funds by AUM will only lend securities against the highest quality collateral. This means that fully 80% of all passive inventories are available to borrowers with some sort of lower quality collateral such as G10 bonds or equities.

These numbers may not seem drastic at first glance, but chronic industry oversupply means this is very much a buyers' market when it comes to selecting potential counterparties. The advent of derivatives clearing regulation has further fueled this trend as borrowers now have to ration collateral for other activities within their organizations.

Ironically, these collateral shortages have created opportunities in the market, but mainly for lenders who are willing to lend out high quality liquid assets to holders of relatively lower quality collateral.

European sovereign bonds, which is one such asset class, highlights this trend perfectly. The funds which are willing to lend out the asset class against assets other than G7 government bonds have been able to generate an average total return of 4.8bps over the last three years. Pickier G7 only lenders haven't been able to achieve even half these returns over the same period of time mostly due to the fact that the utilization rates achieved by their inventory has been half of those achieved by their less selective peers.

For now, passive investment funds have been better able to capitalize on the collateral shortage given that their willingness to accept more readily available collateral turns them into more attractive potential counterparts. Being able to use ancillary activities, such as securities lending, to drive down the cost of their already inexpensive products is part of the disruptive appeal of passive funds, and the collateral shortage has made a tough competitor even tougher.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.