Stocks to watch out for this week

We reveal the stocks that are heavily targeted by short sellers ahead of earnings announcements

- Short sellers up their Axon shorts after the company gets SEC jolt

- ASM and Rec Silicon are two of the high conviction European plays

- Kobe Steel relentlessly targeted by short sellers since the quality scandal broke

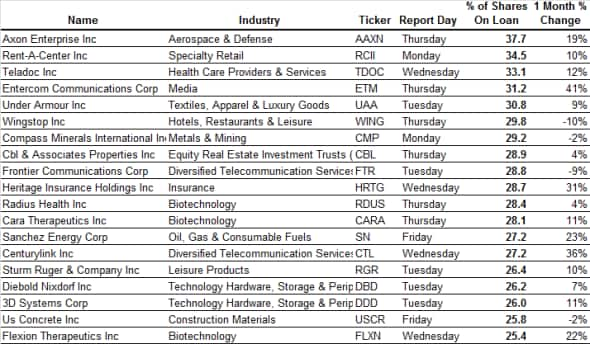

North America

Axon Enterprise will be the most shorted company to announce earnings this week – 38% of its shares outstanding are now out on loan to short sellers. Axon is best known for its iconic Taser stun gun for which it used to be called. The company rebranded under the Axon name to focus attention on the fast growing market for evidence gathering cameras. The high level of shoring activity underscores the skepticism that investors attach to this strategy; the latter market is much more crowded than those for its Taser line.

Although Axon has so far managed to beat analyst expectations, its last earnings failed to satisfy investors and triggered a 10% selloff in shares. Short sellers were given a further boost over the last few weeks when Axon shares fell by a tenth on the news that the SEC singled out the company’s financial disclosures for further scrutiny. This latest development prompted shorts to increase their positions by nearly 19% to the current all-time high.

Short sellers are also taking views on lethal weapons providers this week. Sturm Ruger has more than r a quarter of its shares out on loan, and short sellers took advantage of a brief rally in shares following the tragic events in Las Vegas.

The runner-up on this week’s list of heavily shorted stocks is furniture rental firm Rent-A-Center, which has struggled for the last couple of years as shifting customer tastes eroded a fifth of its revenue, and forced the company to report a loss for two of the last three quarters. The company hoped to put these troubles behind in the spring when it reported better than expected earnings – prompting short sellers to rethink their positions as shares nearly doubled from the February lows. Rent-A-Center’s rally has been temporary, however, and short sellers returned in earnest, increasing the portion of shares out on loan to just under 35%.

Another interesting short play to watch out for is casual dining play Wingstop. Competitor Buffalo Wild Wings announced better than expected earnings last week, forcing shorts to withstand a 20% rally. Wingstop could be even more dangerous for chicken wing shorters since 30% of its shares are on loan to short sellers – this represents more than three times the borrow in Buffalo Wild Wings ahead of earnings.

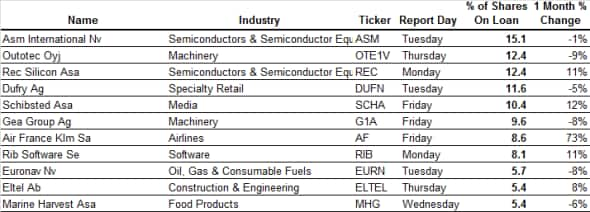

Europe

European short sellers are most convinced about semiconductor equipment manufacturer ASM International heading out of this week’s group of earnings announcements. The company has so far managed to prove short sellers right given that both its earnings have outperformed analyst expectations for each of the last four quarters; however, short sellers have stayed the course since the rally in ASM has taken its forward earnings multiple to a very racy 29X.

Fellow semiconductor play Rec Silicon joins ASM among the top three highly shorted companies announcing earnings this week. Unlike its Dutch peer, Norwegian listed Rec has given short sellers more reasons to cheer; it is expected to report a net loss in each of the four quarters of the year. Anticipation of these poor results have prompted short sellers to increase their positions by a tenth over the last month.

French airline Air France KNL has also been shooting up the short seller agenda, as demand to borrow its shares increased by a massive 70% in the last month. This surge in shorting activity is unlikely to be directionally driven, however, since Air France is in the process of redeeming some convertible bonds which could be driving the demand to borrow its shares from arbitrageurs.

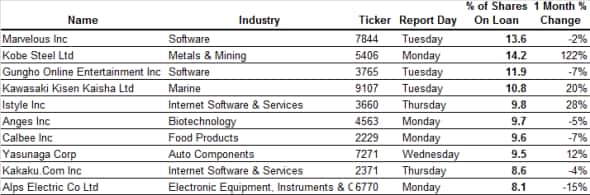

Asia

Online game developer Marvelous is this week’s high conviction Asian short. Short sellers have continued to target the firm over the last 18 months since the hyper competitive nature of its business has eroded a tenth of its annual turnover in this period of time. Shorts were further emboldened the last time Marvelous announced earnings back in July – the below expectation earnings triggered a 40% increase in the demand to borrow shares, which is now at the current 10 month high.

Perhaps the most significant short play among this week’s list is Kobe Steel, which has been embroiled in a quality scandal since its employees falsified quality certificates for material that was used in everything from planes to locomotives. Short sellers haven’t shown the company any pity, and the demand to borrow Kobe Steel has more than doubled in the last four weeks to a new all-time high.

Simon Colvin, Research Analyst at IHS Markit

Posted 31 October 2017

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.