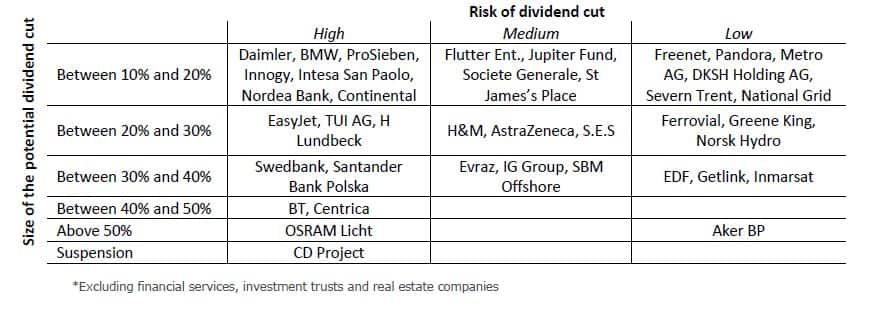

40 European dividends at risk

We forecast 19 European companies will experience dividend cuts, and highlight the following 21 most at risk of reduction in 2019 and beyond

- Among blue chip companies, we project dividend reductions from Centrica, Daimler, BMW, Intesa San Paolo and BT Group

- Companies in the banking, automotive, and utilities and travel & leisure sectors are most exposed

- DKSH Holding, Metro AG, St. James's Place dividends exceed their stated policies or historical norms

This report covers 40 stocks from the Stoxx Europe 600 index* that are at risk of cutting their dividend in the upcoming months due to weak financial ratios or stock-specific headwinds. After highlighting the 19 firms for which we are forecasting a reduction, we will review the 18 firms most at risk of a dividend cut due to weak financial ratios (high leverage, low free cash flow cover and high payout ratio). Lastly, we will list 3 companies for which there is a disconnect between dividend policy and reality.

To access the report, please contact dividendsupport@ihsmarkit.com.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.