Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 19, 2023

Basel III Endgame - Or the Prologue to a New Game?

by Mark Findlay

With the highly anticipated NPR publication from the FDIC, OCC and FRB finally now made available last month, the US has set out its stall on how to ensure alignment of the implementation rules already established with other regulators around the world, that will follow the recommendations from BCBS in the so-called Basel III endgame (see "Basel III: Finalising post-crisis reforms").

Despite there were being no great surprises in the publication for many US based institutions, it has not escaped attention that the US regulators have also included certain provisions in their proposed rulemaking, that are applicable to smaller firms, motivated no doubt by the market turmoil earlier this year, due to unrealised losses in non-trading portfolios.

Whilst it's worth noting that the proposal is open to comments until 30th November 2023, so there is still room for some adjustments in the final rule, the implementation timing is set against remarkably different macroeconomic risk factors and global market conditions, than when the regulation reform started, and indeed, when many other regulators published their implementation recommendations of the rules.

Further to this more complicated and volatile setting then, is the question of how this may impact institutions now captured by these endgame rules, in a rising/higher interest rate and credit spread market for the foreseeable near-term?

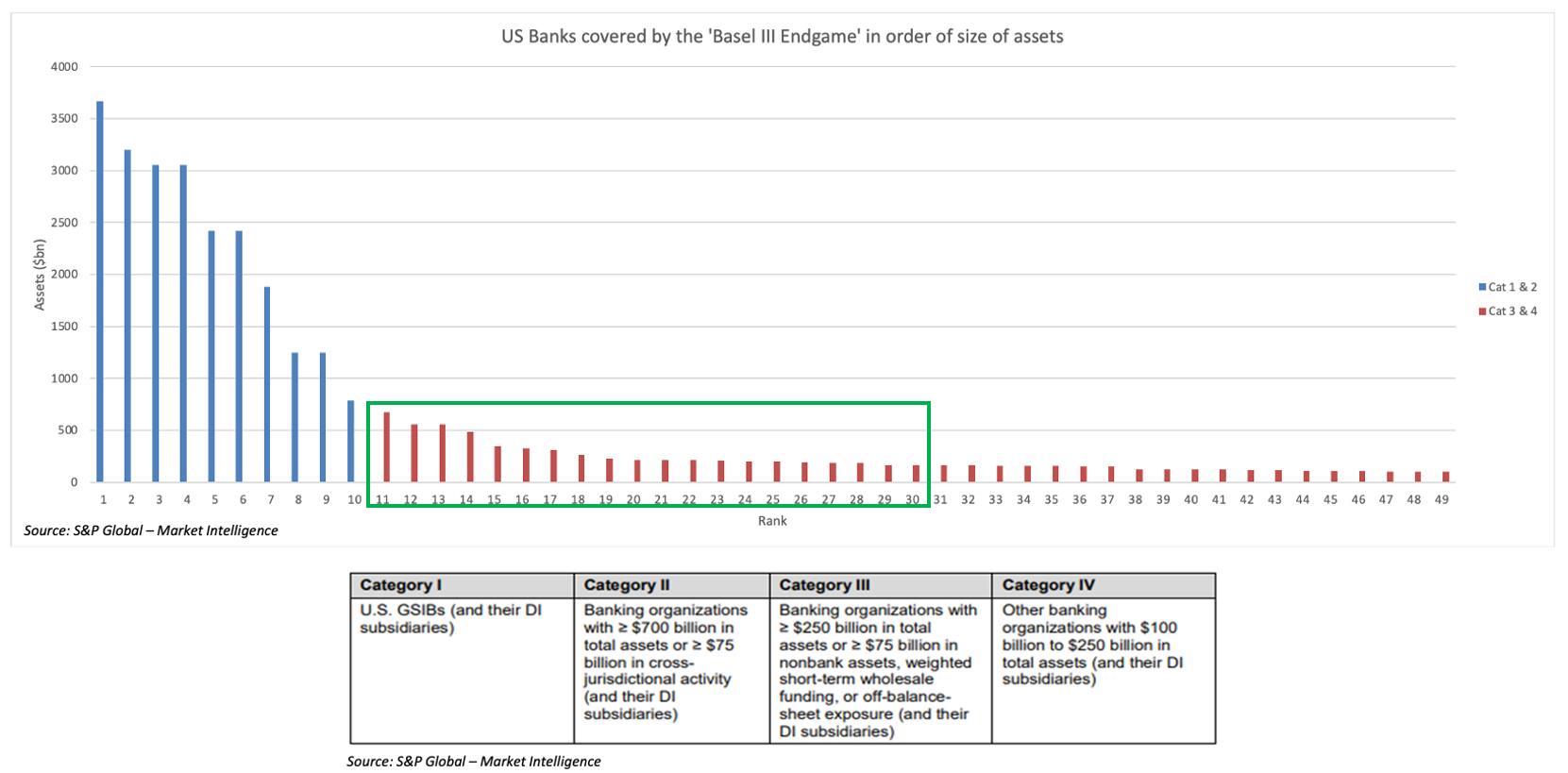

Having analysed the data using our leading risk and capital analytics modelling solutions to apply the regulatory rules, especially focused on the ranked institutions additionally highlighted above in the green boxed range, we estimate market risk RWA's (Risk Weighted Assets) increases of these smaller institutions being 'amplified' under these market dynamics. We expect this to be especially pronounced for institutions who carry a larger proportion of exposures on their rates and credit trading books and that are entering the end point of their trade maturity profile, especially in relation to derivatives use.

This will likely continue to increase RWA capital in many cases, by more than 20% relative to today. The direction of travel here is clear, with much smaller banks as well as shadow banking firms perhaps being required to comply with these wider reaching risk and capital requirements in the medium term. This will likely signal a round of further risk modelling mitigations or re-evaluation of asset allocation on the balance sheets of these institutions.

We support customers who rely on us to help manage improvements in the robustness and accuracy of risk and capital framework. Customers leveraging best in class solutions for performance, risk modelling and with unrivalled depth of market data coverage. This, combined with our cutting-edge cloud-based technology enables us to offer unsurpassed scalability and flexibility in our solutions to constantly adapt quickly to meet these emerging requirements today.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasel-iii-endgame-or-the-prologue-to-a-new-game-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasel-iii-endgame-or-the-prologue-to-a-new-game-.html&text=Basel+III+Endgame+-+Or+the+Prologue+to+a+New+Game%3f++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasel-iii-endgame-or-the-prologue-to-a-new-game-.html","enabled":true},{"name":"email","url":"?subject=Basel III Endgame - Or the Prologue to a New Game? | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasel-iii-endgame-or-the-prologue-to-a-new-game-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Basel+III+Endgame+-+Or+the+Prologue+to+a+New+Game%3f++%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbasel-iii-endgame-or-the-prologue-to-a-new-game-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}