Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 10, 2024

Competitive pricing helps to drive business activity growth in Kuwait, but for how much longer?

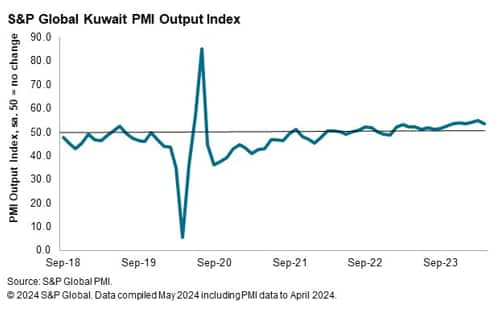

The newly launched S&P Global Kuwait PMI is showing the non-oil private sector experiencing its best run of growth since the survey began in 2018. Output has risen in 15 consecutive months through to April, with survey respondents often highlighting the positive impact of competitive pricing on their sales volumes. The extent to which this price restraint is sustainable given sharply rising input costs will be key to the economy's future growth prospects.

Kuwait output up solidly again in April

The S&P Global Kuwait PMI pointed to a fifteenth consecutive monthly increase in business activity in the non-oil private sector during April. This is comfortably the best spell of growth since the survey began in 2018 and reflects the ability of companies in Kuwait to secure new orders. New business was up solidly again at the start of the second quarter, albeit to a lesser extent than seen in March.

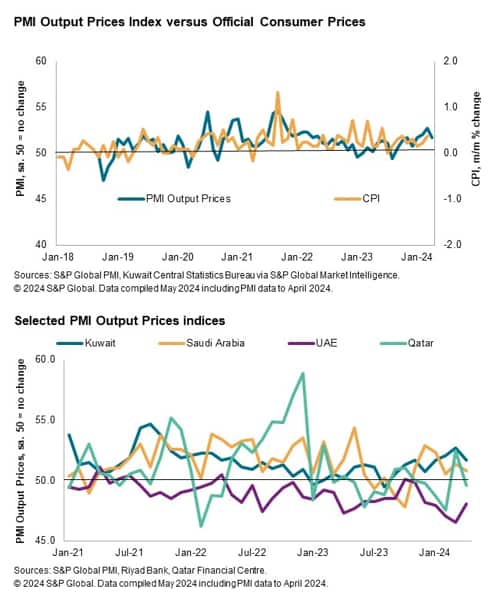

Central to the success firms have had in securing new business have been competitive pricing and discounting, with companies regularly citing these factors as supporting growth. Advertising has also been a key driver of rising new orders. Reports of limited selling price increases tally with the Output Prices Index from the PMI survey which has pointed to a sustained period of relatively muted rises in selling prices, consistent with official data on consumer prices. The picture in Kuwait is also similar to that seen in a number of other economies in the region.

Sharp cost increases put pressure on margins for Kuwaiti businesses

The ability of firms in Kuwait to maintain competitive pricing strategies has been thrown into question in recent months, however, as cost pressures have ramped up. Overall input prices rose at the fastest pace in almost four years during March, with the rate of inflation remaining elevated in April.

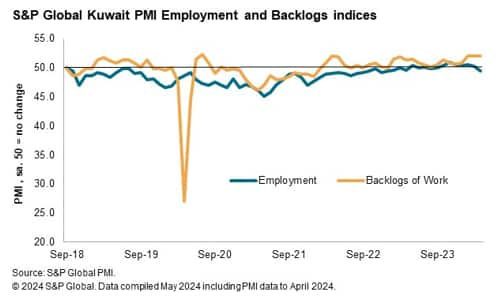

A reluctance to raise selling prices too quickly has meant that firms have looked to try to limit their cost bases instead. In April, this took the form of a reduction in employment, with staffing levels down for the first time in eight months. This decrease in workforce capacity acted to limit the volume of output and therefore contributed to a further build-up of backlogs of work as companies found it difficult to complete projects on time. Moreover, the latest rise was again among the largest on record.

Currently, business confidence appears to be holding up well, but if cost inflation remains marked in the months ahead firms will likely be pushed to raise their own selling prices more quickly to fund improvements to capacity, providing a key test of the strength of demand.

Access the full press release here.

Andrew Harker, Economics Director, S&P Global Market Intelligence

Tel: +44 134 432 8196

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcompetitive-pricing-helps-to-drive-business-activity-growth-in-kuwait-May24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcompetitive-pricing-helps-to-drive-business-activity-growth-in-kuwait-May24.html&text=Competitive+pricing+helps+to+drive+business+activity+growth+in+Kuwait%2c+but+for+how+much+longer%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcompetitive-pricing-helps-to-drive-business-activity-growth-in-kuwait-May24.html","enabled":true},{"name":"email","url":"?subject=Competitive pricing helps to drive business activity growth in Kuwait, but for how much longer? | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcompetitive-pricing-helps-to-drive-business-activity-growth-in-kuwait-May24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Competitive+pricing+helps+to+drive+business+activity+growth+in+Kuwait%2c+but+for+how+much+longer%3f+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcompetitive-pricing-helps-to-drive-business-activity-growth-in-kuwait-May24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}