Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 18, 2024

Egyptian business activity drops sharply in February amid currency crisis, leading to emergency interest rate hike and floating of pound

Egypt's non-oil economy was greatly impacted by the Red Sea shipping crisis in February, as a sharp drop in traffic through the Suez Canal led to plunging revenues and a considerable shortfall of foreign currency reserves. The Egypt PMI highlighted the extent of the economic impact, as business activity suffered its steepest fall in over a year and inflationary pressures soared amid a weakening currency.

Following the PMI's release, Egypt's monetary policy committee announced emergency measures aimed at combating the currency crisis, including a 600-point increase in interest rates and the floating of the Egyptian pound. The measures ensured the quick approval of a new IMF loan program, which has restored investor confidence.

Red Sea disruptions behind marked fall in non-oil activity in February

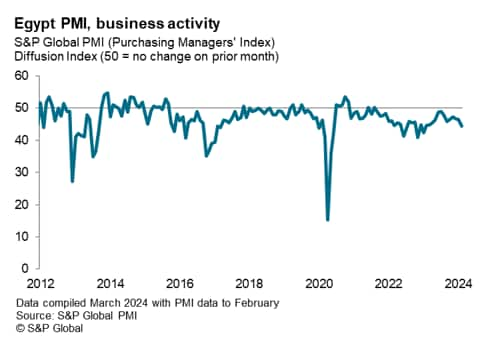

The headline S&P Global Egypt Purchasing Managers' Index™ (PMI®) dropped to 47.1 in February, from 48.1 in January, to indicate a solid decline in the health of the non-oil economy. Business activity was a key area that suffered over the latest survey period, as the data signalled the worst contraction in 13 months.

Companies within the PMI survey highlighted the Red Sea shipping crisis as a key driver of the steep downturn in February. Global freighters have been diverting their shipping routes around Africa rather than passing through the Red Sea and Suez Canal since the start of the year, which has crippled Suez Canal revenues, a contributor to Egyptian non-oil GDP. Government reports suggest that revenues had roughly halved by the end of February compared with the same period in 2023, leading to a fall in sales and economic activity across the non-oil economy.

Foreign currency shortfall leads to rapid increase in purchasing costs

As well as impacting business activity, the sharp fall in Suez Canal revenues tipped Egypt into a wider currency crisis during February, as a shortfall of foreign currency inflows triggered a rise in exchange rates for the Egyptian pound. While the formal rate against the US dollar was, until recently, pegged at approximately 30 pounds, businesses generally traded dollars at local rates which rose to around twice the official rate in February.

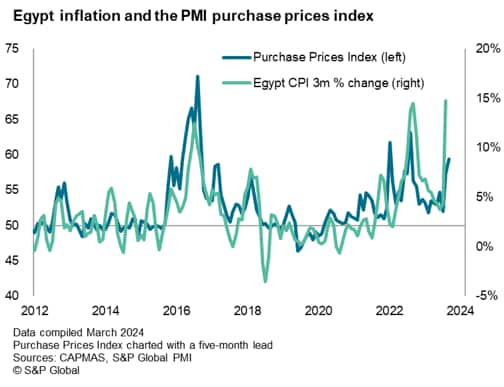

The latest PMI data showed that this led to a marked acceleration in purchase price inflation, driven by rising costs for imported goods purchased with US dollars. Notably, more than a third of the survey panel reported an increase in purchase costs since the prior survey period. The rate of inflation was the sharpest recorded in just over a year and much stronger than the series long-run trend.

The index has tended to correlate well with near-term changes in Egypt's consumer price inflation metric. February was no exception, as CPI rebounded to a five-month high of 35.7% according to official data released after the PMI results.

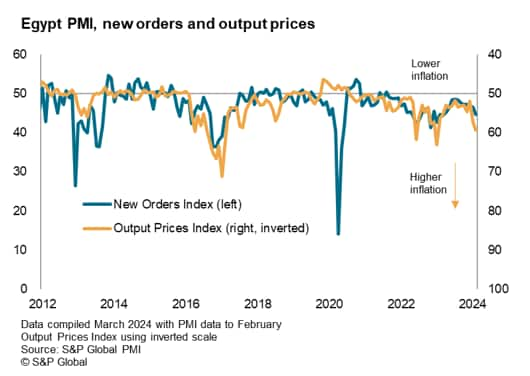

Selling prices rise sharply, client demand slumps

As a result of rising purchase price inflation, Egyptian non-oil companies raised their selling prices at the fastest rate for 13 months in February. The upsurge appeared to dampen client spending power, as new order volumes fell to the greatest degree since early 2023. The output prices index tends to act as a good barometer for sales performances, particularly during periods of high inflation. The latest results suggest that the slump in new order volumes could worsen in the coming months if inflationary pressures are not brought under control.

Emergency policy meeting

On Wednesday 6th March, Egypt's monetary policy committee convened for an emergency meeting in response to the domestic currency crisis and announced the floating of the Egyptian pound on foreign exchange markets. The decision led the pound to plunge from around 30.0 against the US dollar to more than 48.0 per dollar, aligning it with the parallel market rate. Simultaneously, the MPC raised its key interest rate by 6.0% in an attempt to bring down inflation.

The measures were also key conditions for an expanded USD 8 billion IMF loan program which was duly announced later that day, leading Egyptian stock markets to a record high as investor confidence grew. Further reports point to an additional aid package from the European Union aimed at shoring up Egypt's economy.

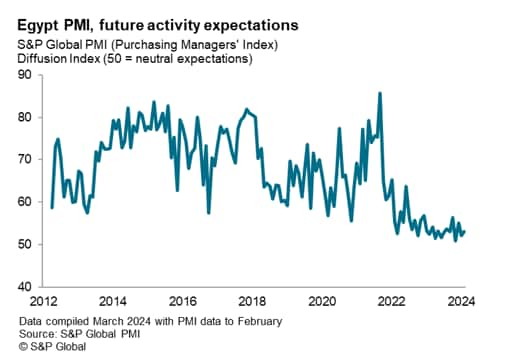

It is yet to be seen whether the emergency policy move will also transform business confidence, which the latest PMI data signals is hovering at record lows. The hike in interest rates would, under normal economic circumstance, point to a worsening of demand levels as firms row back spending and investment. However, if the currency devaluation helps to stabilise market exchange rates and bring down inflation, this has the potential to quickly curb business concerns and support economic conditions.

March PMI data is released on 3rd April and will be the first gauge of how the monetary policy announcements have impacted business activity, confidence and prices in Egypt's non-oil private sector.

Access the Egypt PMI press releases here.

David Owen, Economist, S&P Global Market Intelligence

david.owen@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fegyptian-business-activity-drops-sharply-in-february-amid-currency-crisis-Mar24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fegyptian-business-activity-drops-sharply-in-february-amid-currency-crisis-Mar24.html&text=Egyptian+business+activity+drops+sharply+in+February+amid+currency+crisis%2c+leading+to+emergency+interest+rate+hike+and+floating+of+pound+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fegyptian-business-activity-drops-sharply-in-february-amid-currency-crisis-Mar24.html","enabled":true},{"name":"email","url":"?subject=Egyptian business activity drops sharply in February amid currency crisis, leading to emergency interest rate hike and floating of pound | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fegyptian-business-activity-drops-sharply-in-february-amid-currency-crisis-Mar24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Egyptian+business+activity+drops+sharply+in+February+amid+currency+crisis%2c+leading+to+emergency+interest+rate+hike+and+floating+of+pound+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fegyptian-business-activity-drops-sharply-in-february-amid-currency-crisis-Mar24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}